Many investors have jumped with both feet into the ETF market. Their fees are generally lower than many mutual funds, and most of them do a good job providing returns similar to a target index.

Very few investors are aware of ETN’s, or exchange traded notes. ETN’s are similar on the surface to ETF’s, yet dynamically different in other ways.

Taxation of ETF’s and ETN’s can be different. The risk between ETF’s and ETN’s is different. The underlying investments held in ETF’s and ETN’s are very likely different (there’s little overlap in the asset classes they’re tracking).

Since what you don’t know can hurt you, I’ll break down ETF and ETN differences in this post.

What is an ETF / exchange traded fund?

Similar to mutual funds in many ways, an ETF – or exchange traded fund – owns a basket of investment securities. Ticker SPY for example, is an ETF which invests in all of the stocks in the S&P 500. Ticker AGG is an ETF which owns a representative section of all the investment grade bonds in the United States.

Both SPY and AGG (and other ETF’s) are exchange traded funds which try to mirror their underlying index. ETF managers attempt to replicate the index as close as possible. The securities they own and the yield or return those securities produce should be identical to the index they mimic.

Another major difference between mutual funds and ETF’s is the management style. While passive index funds have become quite popular lately, mutual funds are actively managed for the most part.

Actively managed mutual funds engage a manager – or team of managers – to pick and choose stocks and bonds in an effort to beat the benchmark index. They also engage in market timing strategies, which statistically fail most of the time.

Exchange traded funds don’t generally actively trade their portfolios. They may re-shuffle once in a while to mimic their benchmark index, but generally trade more sparingly. Once or twice a year is about as often as you’ll see an ETF manager trade in the portfolio.

While some actively managed funds will always beat the benchmark index (statistics and luck), very few do. None of them do it consistently over long periods of time. Mutual funds from Dimensional Fund Advisors are passively managed however, and have illustrated some success and consistency in beating the benchmark indexes.

Tracking error is the degree to which an exchange traded fund fails to replicate the index. For example, if the S&P 500 earns 5% and pays a dividend of 1%, ticker SPY should earn 5% and pay a dividend of 1%. If SPY earns 4% and has a .5% dividend yield, the managers will have to answer for the large degree of tracking error.

Granted, there are costs (expense ratio) associated with managing an ETF. The costs assure you that your ETF will never perfectly match the index performance. Still, tracking error is death to an exchange traded fund manager. ETF investors expect to mirror the index as close as possible.

ETF’s are also very different from mutual funds in how they trade. Mutual funds price once per day after the bond or stock market closes, usually by 5pm EST.

ETF’s on the other hand price during the day. They trade just like a stock on the exchange. The price is bid up and sold down by investors while the market is actually open.

Since they price during the day, ETF’s will sometimes experience a premium or discount to their NAV. NAV is the Net Asset Value. It’s the liquidation value if the manager was to sell all securities in the mutual fund or ETF.

If the ETF NAV is $1 and investors are aggressively bidding it up, you may end up paying $1.05 for assets which will sell at $1 in a perfect world. Conversely, if an ETF NAV is $1 and the assets are worth $0.95 you may sell your shares for less than the true value of the portfolio.

Flash crash

ETF’s are notorious for the flash crash. On May 6 of 2010, the markets went haywire for a few hours. ETF investors who had stop orders in found their shares were automatically liquidated at horribly low prices.

The markets rebounded immediately because the selloff was a technical fluke. Some investors suffered massive losses. If they had owned mutual fund shares they would not have experienced the same situation.

That being said, long term investors may still consider ETF’s viable investment options. Long term investors don’t place stop orders on their positions, rather they buy and hold.

What is an ETN / exchange traded note

Similar to mutual funds and exchange traded funds, an exchange traded note mimics a basket of securities. Ticker AMJ is a JP Morgan oil and gas limited partnership exchange traded note. Within the AMJ ETN, you’ll find several oil and gas companies which generally distributed K1’s for tax purposes.

One benefit of an exchange traded note, is rather than deal with the notoriously late K1 distributions you’ll simply get a 1099. This makes filing your taxes much quicker and easier, while still generally experiencing the performance of the Alerian oil and gas services index (ticker AMZ).

The big difference is exchange traded notes are senior, unsecured, unsubordinated debt obligations. In the AMJ example, JP Morgan Chase issued the note. JP Morgan Chase owes the investor whatever the performance of the underlying index is.

ETF’s own the underlying securities. SPY for example owns the S&P 500 stocks. ETN’s are a promise by the issuing bank to pay you based the underlying index performance. Exchange traded notes do not own the underlying investments.

Exchange traded notes have the additional risk of the issuing bank. This is where ETF’s and ETN’s are dynamically different. In the case of AMJ, if JP Morgan Chase goes under, so does your investment!

Most of the banks issuing ETN’s are large and stable. JP Morgan Chase for example, isn’t exactly a community bank. Nonetheless, there is the additional risk that the issuer cannot pay you.

Another difference between exchange traded funds and exchange traded notes is the fees. ETF’s typically have very low management fees. ETN’s however cost quite a bit more across the board.

Since exchange traded notes are essentially a bond, they also have a maturity date. This is different from mutual funds and exchange traded funds which can go on indefinitely.

ETN holders can hold the note until maturity or buy and sell them actively on the open exchanges where they trade alongside ETF’s.

ETF and ETN tax treatment

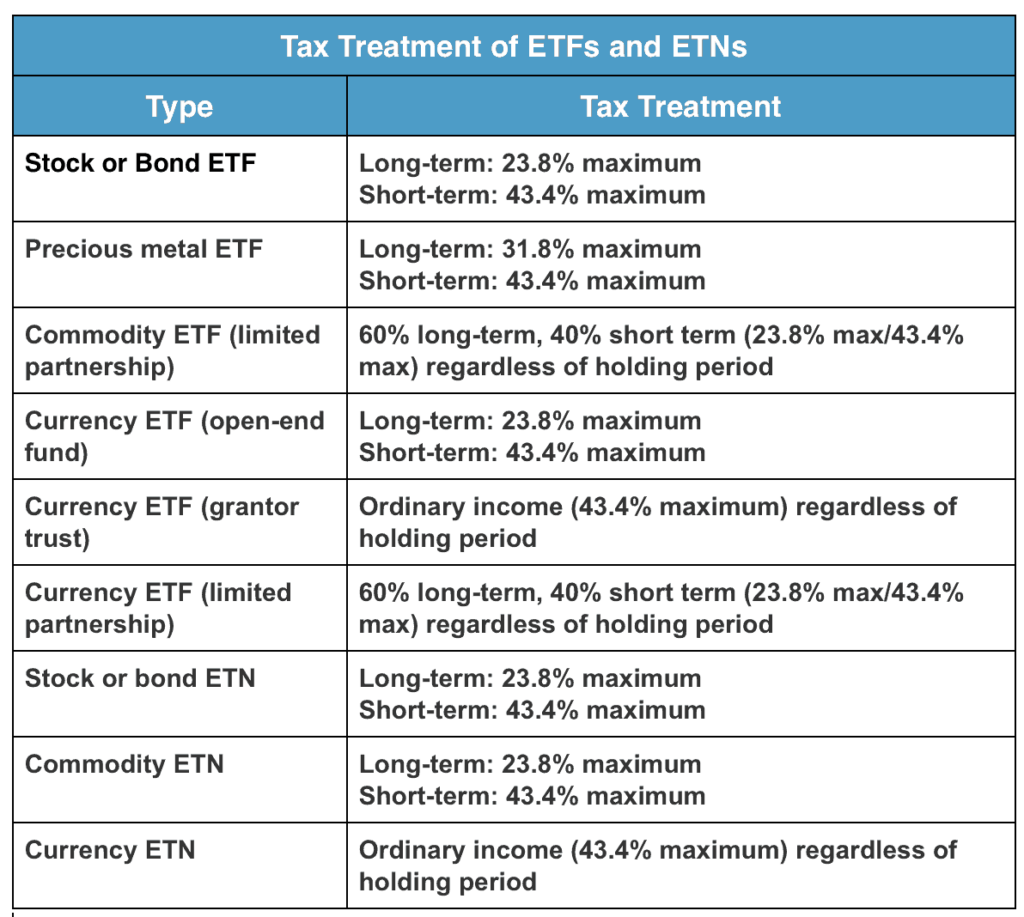

While ETF’s and ETN’s are similar, they tend to be taxed differently depending on the investments they hold. For example, stock and bond ETF’s are treated the same as the stocks and bonds held within the fund.

Stock ETF’s are fairly tax efficient because they don’t distribute large amounts of capital gains. Bond ETF’s usually pass interest payments to their fund holders monthly, sometimes quarterly or semi-annually.

Dividend and interest payments from ETF’s are reported annually on your 1099. Again, stock and bond ETF’s and ETN’s are taxed at long term and short term capital gain rates.

ETF’s which invest in commodities such as gold or oil are a different animal. Since they can’t buy the commodities themselves to hold, they purchase futures contracts.

Shareholder income from commodity ETFs are reported annually on a K-1. Some investors tend to be skeptical about K-1s due to their complexity or long filing times, but they accomplish the same goal as the 1099.

The most interesting part about commodity ETF’s is they are not taxed differently based on how long the investment is held. Usually, investments held for longer than 12 months are taxed at long term gains rates (currently a max of 23.8%).

Conversely, investments held for under 12 months are taxed at short term capital gains rates (currently a max of 43.4%). Commodity ETF’s are always taxed at 60% long term and 40% short term gain rates regardless the time frame the investment has been held.

ETF and ETN differences in summary

There are definitely some major differences in ETF’s and ETN’s. Most investors will never notice the differences however.

The biggest differences are between mutual funds and ETF’s/ETN’s. Mutual funds have much less in common with ETF’s/ETN’s than ETF’s/ETN’s do with each other.

It’s best to focus on the asset class you need exposure to first, ultra-low fees and expenses second, and the vehicle you use to gain that investment exposure last. Don’t get hung up on investing in ETF’s just because you’re neighbor is!