At some point, everyone wonders “How much do I need to retire?” Undoubtedly, some think about it more than others.

Like so many financial topics, there’s no black-and-white fixed number that you must reach in order to retire. $1,000,000 may be enough for some . . . but not nearly enough money for others. In fact, there is an infinite number of individual factors that affect how much you need to retire.

Here are the 5 most critical aspects of planning for retirement you need to consider, however, bear in mind they’re just the tip of the iceberg:

- How much do you want to spend in retirement?

- How much retirement income will you have from streams like pensions and Social Security?

- What type of investment returns will your retirement plan earn?

- How many years will you spend retired?

- Calculating your “target retirement number”?

For reference, when I say “How much do I need to retire?” I’m specifically referring to your “target number.” Your target number is the amount you need in savings and investment (considering tax implications as well) to fill-the-gap in any retirement income shortfall you may have.

The best way to figure out how much you need to retire is to analyze your retirement expense expectations, your retirement income streams, any shortfall between income and expenses, and over how long you’ll have that shortfall.

Finally, your income “sources” (savings and investment accounts) will hopefully provide some amount of growth from investment. This growth helps offset the shortfall in retirement income and reduces your “target retirement number.”

I’ll start with the 4 basic factors which affect how much you need to retire, then summarize the “target retirement number” calculations in the 5th step.

1. How much will you spend in retirement?

There are several variables in retirement spending. You need to consider all of them.

For example:

- Your debt burden (and when and how it changes)

- Where you live and the cost of living

- Your desired lifestyle

- Current and future healthcare needs

- and more!

I created a handy retirement budget worksheet calculator here. You can enter your annual retirement expense estimates OR monthly amounts and calculate how much you’ll need to retire.

Keep in mind, however, many of these expenses will only be relevant in certain years or for certain timeframes. For example, you may travel heavily in your 60’s but not in your 70’s, or you may buy a car with cash every 6 years. Those are atypical expenses, unlike food and housing which remains a relative constant throughout retirement.

Retirement should be fun! You shouldn’t have to live in a state of eternal frugality . . . that’s my personal opinion of course. I’ve worked with a small number of retired couples who were so desperate to retire early they chose to live a very meager retirement lifestyle – and they were perfectly happy doing so!

I don’t envision ever retiring because I love what I do! But, if I were to retire I certainly wouldn’t want it to be boring. I’d far rather enjoy some fun and excitement, giving back and doing more than when I had to work.

Is there a hobby you want to start? Do you want to travel? Maybe splurge on multi-generational family vacations?

Consider these typical retirement stages and how your spending is affected:

Retirement Stage 1: A sense of adventure (and often the highest expense stage). You’ll likely be active with travel and hobbies, and those things cost money!

Retirement Stage 2: Adventure desire satisfied, need to settle in and some may return to work (or volunteer work) for fun. You’re likely not spending quite as much money, and possibly even earning money.

Retirement Stage 3: Rest stage while spending time with friends and family moreso than buying “things” or traveling.

Also, do you want to spend every last penny or do you want to leave assets to your family, friends, or charities? Is there a legacy you feel compelled to plan for?

All of these factors obviously affect your target number and only you know what kind of life you want to live, what your plans are, and how much you are going to need in retirement.

So, the very first step is calculating your retirement budget. While it won’t be perfectly accurate because of those atypical expenses, err on the conservative side and break those expenses down into a yearly number for the purposes of this exercise.

2. Add up retirement income streams and sources

Here’s where it starts to get a little confusing. You will have retirement income streams and retirement income sources. Some of those streams and sources may be taxable when received, others may be tax-free. The critical part is knowing how they map out together over your retirement lifetime.

PRO TIP: The present value of your retirement income streams can possibly be considered as “safe” or “guaranteed” when determining your overall retirement asset allocation. This may allow you to invest your income sources more aggressively.

Retirement income “streams” are set in place when you retire

To simplify things a bit, I’m referring to income streams as those things distributing regular and ongoing retirement income and have no liquidation value. Retirement income streams won’t show up on any statement per se, but they will show up in your bank account as a regular deposit when you receive them.

Here are some examples of retirement income streams:

- Pension income – It starts when you retire and changes at your death when it goes to zero . . . or a spousal benefit (often a reduced amount) kicks in. It typically will have some regular increase for inflation, but not always.

- Social Security – It may not start right away (if you’re delaying your credits to get the maximum amount) but will end at death, however, your spouse will keep the higher of your Social Security benefit OR theirs

- Annuity income – This can be structured in a variety of ways, from your life to your joint life (with a spouse) to a period certain, and it may have or not have an increase for inflation over time

Retirement income “sources” fluctuate in value and usage over time

Retirement income sources are “chunks of money” you can access when you need cash to live on. These sources of retirement funding are critical and will form the foundation of your “target retirement number” when you’re calculating “How much do I need to retire?”

Here are some examples of retirement income sources:

- IRAs

- 401ks

- Savings accounts

- Brokerage accounts

- Mutual fund accounts

- Cash-value life insurance

- Gold & other metals in a safe which can be liquidated

These sources are critical because you may draw heavily on them as an “income source” from age 60 to 70 to delay your Social Security benefit for a higher amount. You may also have years with atypical higher expenses and similar years with atypical lower expenses forcing bigger or smaller draws on these sources.

Basically, you need these sources to backfill your retirement income needs.

Taxes are also critical to your retirement income planning

Your retirement income sources and streams may be taxable, or tax-free in the case of the Roth type of account. They may even be partially taxable if you’ve made after-tax non-deductible contributions to a pre-tax account.

Since taxes are such a huge expense for most retirees, It’s important to understand the taxation of both retirement income streams and sources. Taxes will have a dramatic effect on your ultimate retirement planning success or failure.

Taxable retirement income streams and sources

There are a variety of retirement income streams and sources potentially at your disposal when you reach retirement. These income streams and sources are typically broken into taxable (meaning you’ll owe taxes as you receive them) and tax-free.

The reason they must be broken down is you have to account for Uncle Sam’s cut of your retirement income. Overlooking taxes will undoubtedly lead to disastrous financial consequences.

These are both retirement income streams and sources which trigger income tax obligations on the retiree to some extent:

Taxable Retirement Income Streams

- Pension income

- Social Security income (depending on your income level)

- Annuity income (may be proportionately taxable depending on how the annuity was funded)

- Dividends, capital gains, and interest of taxable investment accounts

Taxable Retirement Income Sources

- Distributions from pre-tax retirement accounts (ie. 401(k)s and 403(b)s)

- Sale of investment properties or other assets with capital gains

Tax-free retirement income streams and sources

These retirement income streams and sources won’t trigger income tax obligations:

Tax-free Retirement Income Streams

- Scheduled income streams from a home equity conversion mortgage (reverse mortgage)

Tax-free Retirement Income Sources

- Withdrawals from Roth IRA are typically 100% tax-free if you follow the Roth IRA rules

- Life insurance policy loans (however you incur interest as a borrower)

- Health Savings Account Distributions (tax-free if you follow the HSA rules)

- After-tax contributions in accounts like a 401(k) (these should be converted to a Roth IRA)

Except for the Health Savings Account, the hardest-hitting tax-free account is a Roth IRA. Not only are you able to invest after-tax deposits, but it is also a great vehicle to build your savings habit. Ask your financial advisor or CPA if a Roth conversion may be a beneficial strategy for you prior to—or during—retirement. This would allow you to make tax-free withdrawals in retirement!

Pro Tip: For tax-deferred accounts such as a 401(k), make sure you understand how required minimum distributions work. Required Minimum Distributions always come FIRST, and failing to take a distribution will incur a nasty 50% tax penalty!

The important thing is you’ll need to know how to use your retirement income sources wisely! The goal here is to pay the minimum possible amount in taxes over your retirement (even if it means paying a little more in taxes early in retirement.) Every tax dollar saved is a guaranteed dollar earned unlike investing where you assume the risk for an investment return.

Coordinating a retirement income plan to include all potential income streams and sources will benefit you tremendously in the long run. We call this “retirement income distribution planning“, and it’s perhaps the most fiscally valuable thing you could implement over your retirement!

So your retirement income streams may be predictable, but your retirement income sources will be likely come in the form of irregular draws or distributions. Add in the various taxes you’ll owe, consumer inflation, the fact that medical expenses inflate faster, and portfolio returns vary, and you’ll likely agree that creating a retirement income plan Is challenging at best!

3. How hard will your money work for you in retirement?

The harder your money works FOR you, the better off you’ll be, right? NOT ALWAYS!

It seems simple on the surface . . . get a higher return and your worries will fade away. It’s not the case, however.

To get a higher return you’ll need to take more risk. There is no “free lunch” when it comes to investing. There is no “secret sauce” that can get you max returns with little risk. It doesn’t exist, stop fooling yourself by believing the money media! Their goal is to sell ads, not solve your retirement problems.

What your money does for you is truly dependent on how you deploy it.

The three factors of retirement investing

There are three factors which (should) determine how you invest your retirement income “sources”:

- Risk tolerance – This is simply how much volatility you can stomach day in and day out. The short-minded investor has a serious issue with risk tolerance, whereas longer-minded investors tend to be more comfortable with short-term volatility. This is typically discovered using a risk tolerance quiz but is only one of three critical things to consider.

- Risk capacity – This is honestly the most difficult thing to assess. Your risk capacity effectively asks “How much volatility can your retirement plan withstand without seriously changing your life?” Your plan may be razor-thin (meaning you have lofty financial goals) and you can’t withstand substantial risk. Conversely, your plan may be flush with cash and you can afford to endure a lot of risk and volatility.

- Risk required – Finally, there’s the amount of return you may need to accomplish your retirement goals. This is your “risk required.” If your goals are so meager you may not need to take a lot of investment risk . . . that’s one thing. If your retirement goals too lofty you may need to take substantial risks (or reduce your goals.)

Risk tolerance is assessed through a questionnaire that gauges how you feel about volatility. The other two—risk capacity and risk required—can only be determined with a comprehensive retirement plan.

The silent retirement killer . . . inflation

If your retirement investment portfolio is earning 4% you may barely keep pace with inflation. That can be a problem . . . especially if you live too long!

If it’s invested more aggressively it could either a) throw you seriously off course in a bad market, or b) help you enjoy more retirement and maybe leave a substantial legacy behind.

The truth is you need an investment return that will accomplish your retirement goals. That return does need to factor in inflationary pressures along the way.

While you can factor in a 2% inflation rate, historically it’s closer to 3% and has even reached the low teens! Inflation weakens your purchasing power over time. Check out this table to look at historical inflation rates for the U.S. We have seen years with much higher inflation than we’ve recently experienced.

What will your investments earn in retirement?

There’s no easy answer . . . no one can predict the future. We don’t know what the economy, interest rates, global politics or the stock market will do.

In lieu of knowing we have no choice but to make an educated guess. That guess should be put in the context of inflation plus the return of investing.

For example, if you choose to assume a 3% inflation rate, what rate above 3% do you need to achieve to accomplish your retirement goals?

For most retirees in today’s market and economic environment, an investment return of 2% to 4% above inflation is a good—reasonable—target. If inflation stays low at 2%, a total return of 4% to 6% is a good bogey. If inflation is pegged at 3% you may target 5% to 7%.

Let’s assume inflation averages 3% over the foreseeable (meaning long-term) future. More conservative investors with low-risk capacity and risk required factors should focus on 4% to 6% total return. Those more aggressive investors with higher risk capacity and/or risk required factors should focus on 5% to 7% total return.

Keep in mind, you’re investing for a retirement LIFETIME! Those numbers should assume you’ll be invested for the next 30 or so years of your life!

4. How long will you spend in retirement?

If we knew when we’d die we could easily create a perfect retirement plan. Unfortunately (or fortunately depending on how you look at it) we don’t know how long we’ll be around.

The average life expectancy in the United States is about 78. That doesn’t mean you can rely on living to 78 however, it’s just the average.

In reality, you’ll live longer or shorter most likely, and there are several other factors that affect your life expectancy.

- Do you smoke?

- How do you eat? Do you exercise? Are you generally healthy?

- How long to your nearest relatives live? How were their health (or lack thereof) habits?

But it’s not all about YOU either!

Most importantly, what’s your spousal situation? You likely need to plan for two lifetimes in retirement after all, not just one (unless you’re single).

Ask those very same questions about your spouse. How is their health and family longevity? Do they smoke . . . or do they exercise and eat healthily?

I use some powerful retirement planning software to help dial in these numbers/ages. It gives us a better sense of how long you’ll need to plan for in retirement.

This, in turn, helps us dial in your “target retirement number” because we know generally how many years to plan for.

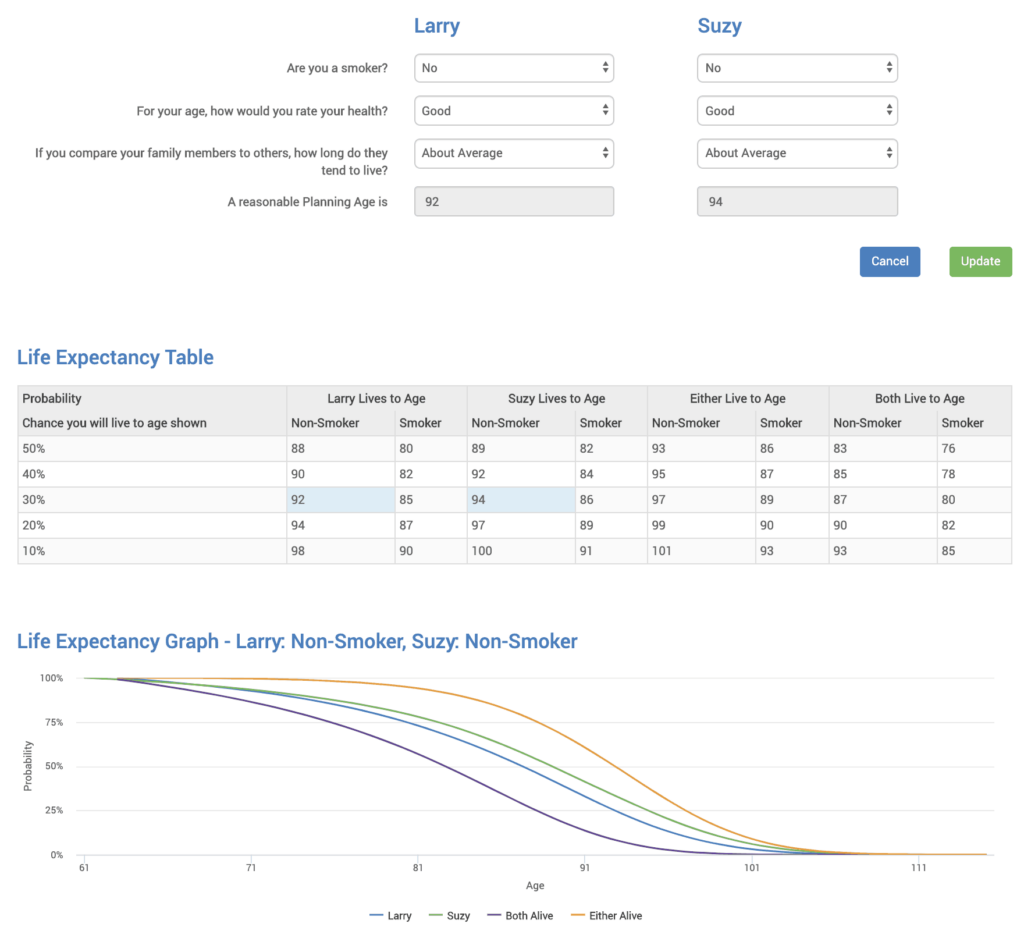

Here’s a sample longevity scenario for reference. Larry and Suzy are 62 and 64 and plan on retiring shortly at 66 and 65. Both are in good health with average family longevity and neither of them smoke. A good planning age for them is 92 and 94 respectively:

Retirement lifetime probability changes for married couples

Notice that there’s a 50% chance either of them will live to age 93? This is critical planning information!

While Larry has a 50% chance of living to age 88, and Suzy has a 50% chance of living to age 89, the odds that one of them will live to age 93 is 50%!

Do you want to plan until age 88, 89, or 93? Or even longer for a safety net? Do you want to risk leaving your spouse destitute?

I highly encourage people to plan for the longest period in retirement that’s remotely reasonable. In this case, there’s a 20% chance either Larry or Suzy will live until age 99.

I’d rather plan for it and NOT need it . . . than NEED it and not plan for it!

Greg Phelps, CFP®, CLU®, AIF®, AAMS®

If you’re retiring at 65 and planning for one of you living until age 99 that’s a whopping 34 years your savings and investments need to last!

99 is a long time to plan for most people retiring in their mid 60’s, but it’s prudent, reasonable, and appropriate. I don’t want to be the guy who dies at 88 while my wife lives to 100 and she ran out of money at age 93!

Our boys don’t want that either I’m sure!

It gets trickier unfortunately

While one of you may live into your late 90’s, that person likely won’t spend as much as both of you did together. This makes retirement planning calculations even more important.

For example, when you die your surviving spouse will need less food in the fridge, the clothing bill will drop, entertainment will be less expensive, you’ll probably sell one of your vehicles which means less gas, insurance, and maintenance as well.

Roughly speaking the surviving spouse will spend about 20% less alone than you will as a couple. Why not 50% less? Your property taxes, utilities, gifts for friends and family won’t likely change at all. 20% less is a reasonable assumption of how much your expenses will drop, but like anything else, everyone is unique in this as well.

5. Calculating your “how much do I need to retire” target number

The very first thing you need to do is figure out your retirement income shortfall. That is the difference between your retirement expenses and your guaranteed retirement income streams. The difference will be made up of distributions from your income sources . . . and don’t forget to include your tax obligations!

Let’s assume your retirement expenses are $100,000 per year. This is a very simplistic assumption because you’ll have atypical expenses periodically throughout retirement and you’ll have various inflationary pressures along the way. But let’s just assume $100,000 per year in today’s dollars.

Now let’s assume you have retirement income streams from pensions and Social Security totaling $60,000 per year net of tax (meaning if you’re paying 15% in taxes your total income streams are almost $71,000 to net you $60,000). Again, this is overly simplistic because you may defer claiming Social Security (which is generally a wise decision but not always). Additionally, your pension income may not have inflationary increases.

Now you’ve got a shortfall of $40,000 per year ($100,000 – $60,000). You’ll need to draw from your retirement income sources to make up that $40,000.

The 4% Rule

The 4% rule (also known as the safe withdrawal rate) is a guideline that helps you determine how much to withdraw each year from their retirement account(s). The 4% rule was developed by Bill Bengen in the mid 90’s as a “rule of thumb for portfolio distributions.

The 4% rule effectively says that with a moderate 60% stock and 40% bond portfolio you should be able to distribute 4% per year and never run out of money in retirement. He proved his hypothesis by backtesting this to the 1970s.

What is lesser known is that more than 2/3 of the time this strategy ended up leaving the retiree with more than double the portfolio they started with! It’s also little known that a withdrawal rate of 6.6% ended up failing about half of the time (OUCH!)

It assumes that once you have a certain amount of money accumulated, the interest generated by that money will provide the needed income (by withdrawing 4% annually) without the retiree having to cut into the principal amount.

Of course, your portfolio may have returns of 10% on the year, and -2% the next. But the average should hopefully cover the 4% and keep your portfolio growing with Inflation.

So withdrawing 4% is generally considered reasonable for most retirees, however, the older you are the number can increase because your life expectancy decreases.

Also, pay special attention to portfolio allocation. We’re talking specifically about a 60% stock and 40% bond allocation. If you’re invested less aggressively your returns and volatility will be lower. 4% may or may not work!

If you’re invested more aggressively your returns may be higher but your volatility will be higher as well! 4% may or may not work here either! In this case, your sequence of returns risk may easily derail your retirement dreams!

Although this rule refers to withdrawal rates, it can be used to determine how much your target number is if 4% is to be withdrawn each year. Here’s how:

- I have a $40,000 per year shortfall

- $40,000 divided by 4% = $1,000,000

Again, that’s overly simplistic. If that $1,000,000 retirement income source is all pre-tax (IRA/401k, etc.) you’ve still got to pay Uncle Sam his fair share.

Add in taxes you’ll owe eventually

Income taxes in retirement will vary widely over time based on far too many factors to discuss in this article. However, we’re just trying to gauge your “target retirement number” using generally accepted rules of thumb.

Understanding we’re just estimating your target number, you should adjust the 4% rule to gross-up for taxes owed. This is FAR from perfect, but we’re just estimating – I cannot emphasize this enough!

Hence, if you need $1,000,000 in “retirement income sources” and you expect your lifetime tax rate to be .15%:

- If it’s all pre-tax (IRA, 401k, etc.) gross $1,000,000 up by 15% which equals $1,176,470 (1M divided by .85) to get your target retirement number . . . basically this answers the question “How much do I need to retire?” In this case, you would need $1,176,470.

- If half of it is pre-tax and half is tax-free (Roth IRA etc.) you would need to gross-up only $500,000 ($500,000 divided by .85 = $588,235) and add in the Roth account for a total of $1,088,235. That would be your target retirement number.

Determining how much you need to retire in summary

You should realize that determining your target number isn’t a static process, it’s dynamic. Things are going to change and it will be in your best interest to revisit your portfolio often and be proactive in case any adjustments are needed in your retirement plan or retirement investment portfolio.

Be wary of under and overestimating retirement income and expenses

Many people underestimate costs and overestimate income which paints a false picture of their “retirement readiness.” Be conservative with your numbers, because if you can hash out a reliable and well-thought-out plan with conservative figures, you will have a greater chance of hitting a more reliable target number.

It may take some investigating, reading, and digging around to determine your target number, but something tells me that if you are reading this, it’s going to be a fun adventure!

No matter what your age is, completing this exercise can help you clarify your future retirement. Of course, navigating all the expenses and account options can be overwhelming, so when you’re ready to stop worrying about retirement drop us a note! We can help.

How much you need to retire depends on 5 things. 1) estimating how long you’ll live in retirement, 2) estimating your retirement expenses, 3) estimating your retirement income streams and sources, 4) estimating how hard your money will work for you in retirement, and 5) calculating your target retirement number.