Are YOU WONDERING

Can I Retire Yet?

Do you worry about:

Then you came to the right place! RetireWire is dedicated to bringing you financial and retirement planning tips, tools, tactics and strategies to help you retire rich and fearless!

Ready... SET... RETIRE!

How I Can Help You Achieve Financial Peace

GET READY

1. How To Prepare For Retirement

The first step in preparing for retirement is getting ready by arming yourself with basic retirement, tax, estate, investing, credit, debt and insurance knowledge. These financial factors all play into step two—the retirement planning phase.

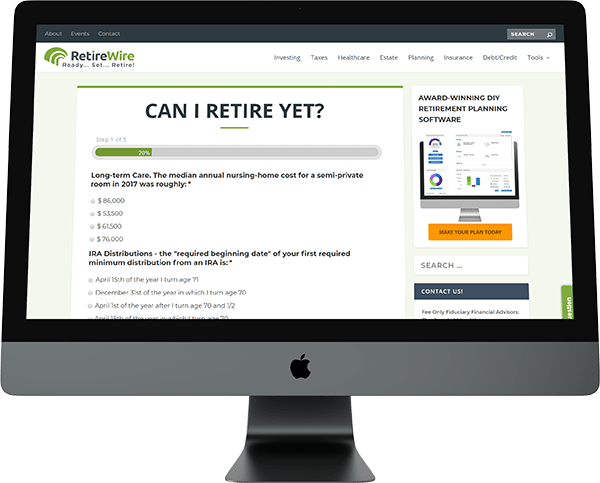

GET SET

2. Can I Retire Yet?

The second step in preparing for retirement is getting set by building a comprehensive retirement plan using the knowledge you've gained. Ben Franklin once said "If you fail to plan, you're planning to fail!" This is the MOST important step.

RETIRE!

3. Ready To Retire Now?

The third step in preparing for retirement is to "practice retirement" BEFORE you actually retire! It sounds weird I know, but practicing retirement will help ensure you're plan is solid . . . and I'll teach you how!

TESTIMONIALS

What People Say About Me

FROM THE BLOG

The Latest From My Blog

My most recent articles on investing, taxes, healthcare, and anything related to your financial freedom.

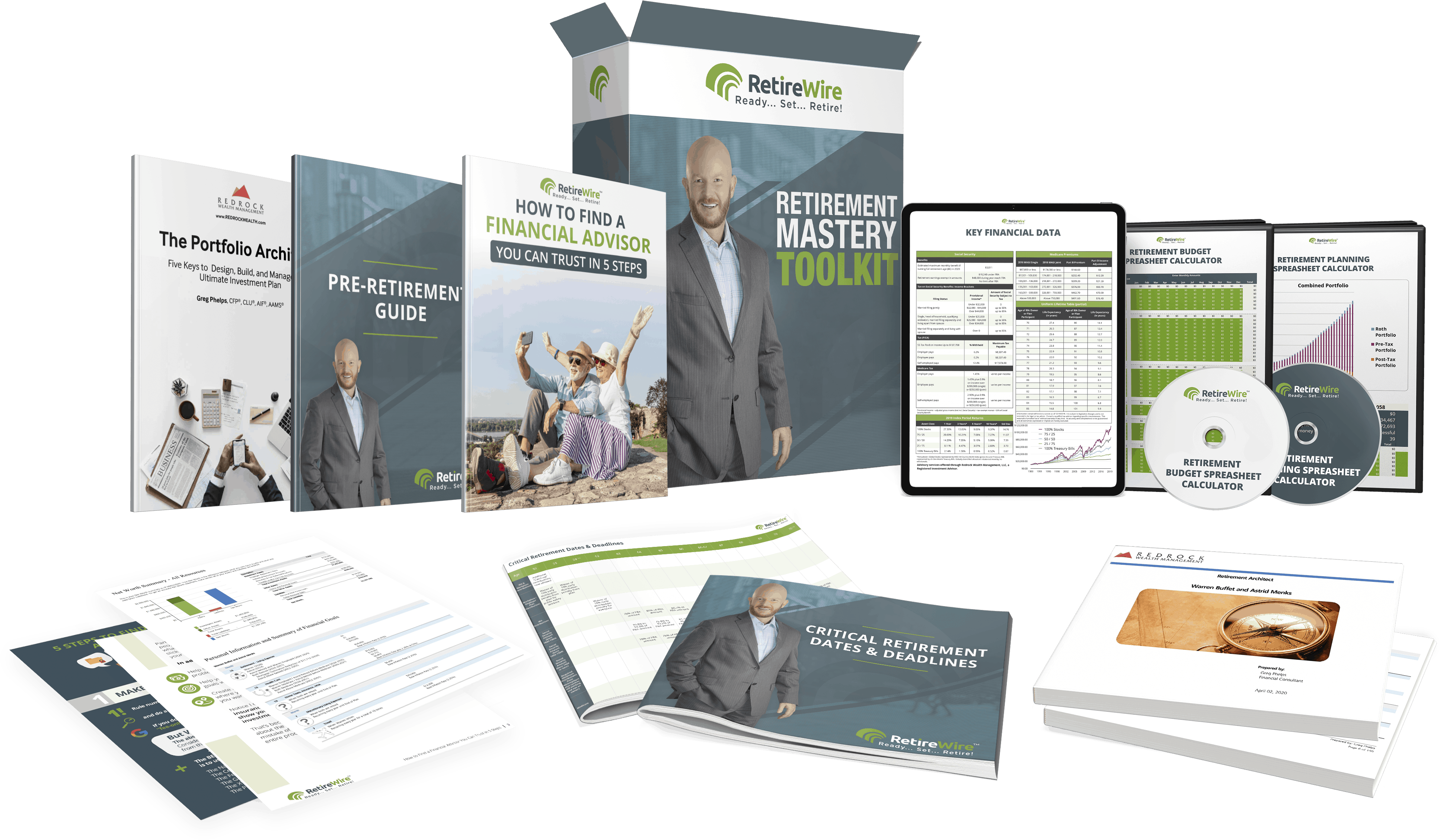

GET THESE FREE RESOURCES

My Free Retirement Mastery Toolkit Will Help You Live Your Dream Retirement

These free tools will help you build your dream retirement plan AND live it with confidence!

Need more help?

Getting Started Is Easier Than You Think

My firm Redrock Wealth Management is a fiduciary financial advisor firm providing comprehensive custom-tailored retirement planning solutions.

STEP 1

Answer A Few Questions

Tell us a bit more about yourself and your retirement planning needs and concerns.

STEP 2

Download A Proposal

Our customized proposal process will explain how we can help and our fees for doing so.

STEP 3

Schedule A FREE Money Strategy Session

Let’s chat! Our best fiduciary financial advisors will help you retire rich and fearless!

About Me

Hi, I'm Greg Phelps

My name is Greg Phelps, President of Redrock Wealth Management and publisher of RetireWire.

In my two decades plus career in financial services, I’ve seen first hand the stress and anxiety the decision to retire causes people. It’s easy to see why after all, because once you retire you can’t earn it again!