Award-Winning DIY Retirement Planning Software

Are You A "Do-It-Yourself" Kind Of Person?

This retirement planning software may be perfect for you!

If you scour the internet for award-winning retirement financial planning software you’re likely to find a number of financial planning spreadsheets, tools and calculators. While they may be DIY, none of them are as robust or comprehensive as MoneyGuidePro which is the leading favorite among professional financial planners.

Now you can use the very same software professional CERTIFIED FINANCIAL PLANNER™’s use for their own clients through RetireWire MoneyGuide. It’s is a video-guided financial planning experience created by the CERTIFIED FINANCIAL PLANNER™’s at MoneyGuidePro.

***PLEASE NOTE: Access to this software is limited to 14 days.

Have You Ever Wondered...

If that sounds like you, the RetireWire MoneyGuide is the solution for the DIY investor who really needs a comprehensive financial plan but doesn’t want the “sales pitch”!

What can this software do for me?

The RetireWire MoneyGuide immersive planning experience will help you:

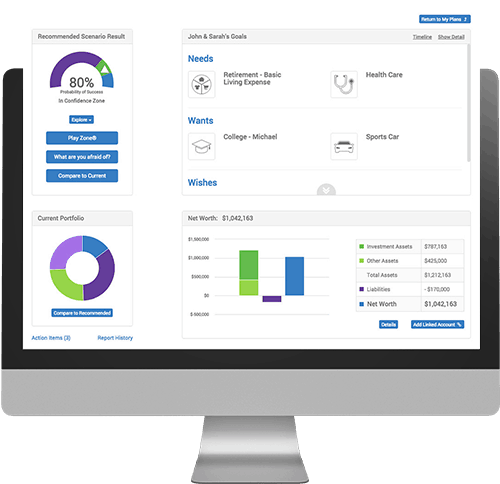

Identify your financial and retirement goals

The RetireWire MoneyGuide will help you define what type of retirement you want and what type of retirement you need. The software then helps you prioritize those things from most to least important and create a plan which matches your income and assets to your expected expenses and liabilities. Ultimately the goal is to help you achieve everything you’ve dreamed within your financial constraints.

Explore Your Retirement Options

The software shows you in a split second what happens if you save more or less, invest differently, or retire earlier or later among dozens of other retirement variables. It’s your retirement, after all, you should choose between the trade-offs to design your perfect retirement financial plan.

Stress-Test Your Personal Financial Plan

The software gives you the tools to see what happens if investment returns are more or less than expected, if Social Security is reduced, or if you have unexpected long-term care expenses. There’s simply no substitute for the “money confidence” the stress-testing process provides you!

How The Retirement Planning Software works

Sign up! The fee is $49 for your online financial planning experience

STEP 2

Schedule your financial planning experience online at your convenience

STEP 3

Create your plan at your scheduled time

STEP 4

Call us if you need us!

***PLEASE NOTE: Access to this software is limited to 14 days from when you first log in.

What's A Lab?

A Lab is a guided online experience that helps you create a customized financial plan focused on your expectations, concerns, and goals. It gives you a chance to think about how you want to live in retirement, what’s most important to you and how much money you will need to reach your goals. Completing a Lab is a valuable experience that can help you better prepare for retirement.

Control and Choices

You can choose when to participate in a Lab and go at your own pace. You may ask questions during the Lab via chat or email as available. Choose a Lab depending on where you are in life. Are you 10 years from retirement? More than 10 years from retirement? Already retired? We have a Lab that can help you. At the end of the Lab, you can choose to have your plan reviewed by an advisor or continue to work on your plan alone.

Who is an ideal lab participant?

If you are interested in creating a plan for your retirement, a Lab is for you. It’s also a great way to help you feel prepared when meeting with a financial advisor.