This video covering the decision to do a 401k rollover to IRA or not is part of our Wealth Summit series. I interviewed John Frisch, CFP who is the President of Alliant Wealth Advisors, a fee-only NAPFA registered financial advisor firm in Virginia.

John is also an expert in 401k and other retirement plans, and he goes into detail on the most important factors when deciding whether to keep your 401k in the plan when you retire or do a 401k rollover to IRA.

Greg: Hello Wealth Masters! My name is Greg Phelps and I am your host to the Wealth Summit!

Our mission here at the Summit is simple. We want to educate and empower you with actionable tools, tips, and tactics to help you grow, protect, and maximize your personal wealth.

Today I’ve got a real hot button topic that we’re seeing a lot in the news about. Today and I’ve got a very special guest, Jon Frisch.

John Frisch is going to help us determine whether you should keep your old 401k or 403b in the current plan as it is, or consider some of the deciding factors that might prompt you to do a 401k rollover to IRA.

So without further adieu, John, are you ready to help us master our wealth?

John: I will do my best!

Greg: All right, so a little bit about John. John Frisch has over 30 years of experience in the financial services industry.

He’s a CPA, a Personal Financial Specialist (PFS), a CERTIFIED FINANCIAL PLANNER™ (CFP®), and an Accredited Investment Fiduciary® (AIF®).

He serves clients nationwide. John is president of Alliant Wealth Advisors, which was founded in 1995 to provide comprehensive fiduciary wealth management for families and 401k retirement plan consulting for businesses.

So, John, that’s just a real brief bio. Go ahead take just a quick second and fill in any blanks I may have left.

John: I think you pretty much have it. I think the one thing that we haven’t mentioned so far as an addition to a family wealth division, we serve individual and family clients. We also do a lot of work with corporations, businesses, and their 401k plans, so I think that is going to help us as we go through this topic of doing a 401k rollover together.

Greg: Okay, great! And so you know, as I mentioned in the opening real briefly this is kind of a hot button topic because as we’ve seen on the news for probably I guess five/six years now, the Department of Labor fiduciary rule is finally implemented in whatever form—you know—that we have, and so this is a really, really critical component that every financial advisor has to get right with their clients. In all honesty, every client needs to get right if they’re going to make this decision with their financial advisor or on their own.

So John, go ahead and, why don’t you just get us started with some factors that we need to be thinking about when deciding whether to keep your 401k or 403b plan or to roll it into an IRA.

John: Yeah sure. It’s, you know, it’s this topic itself. I agree is important and you’re right Greg the fiduciary rule is required.

If you work—as a family or individual—if you work with a financial advisor they now have to be very thoughtful about this decision regarding whether to leave your account at the 401k or roll it into an IRA.

For individuals that don’t have their own financial advisor, they’ve got to make that decision themselves. There are some factors that have to be considered!

For example, you may have access to—and we’re going to go spend a little more detail on each of these issues—but let me just go through the factors quickly here.

401k Rollover to IRA Factors

401k Investment Quality

Investment quality is first. Your plan may have access to funds and investment managers that you will never get if you rollover to an IRA.

401k Access To Professional Investment Advisors

Some 401ks—and this is not that common today—but it’s definitely a trend and it’s getting more popular . . . some 401ks are providing professional investment management access to their employees and the participants in the plan.

So if you have access to that—at say—you know “no charge” or a nominal charge, if you leave then you’re going to have to replace that somehow with a fee by hiring somebody. So you want to keep that in mind.

Greg: Yes sir! Quick (and I don’t want to interrupt you) but I just want to ask a question.

So just so I understand are you saying that in my 401k it’s possible I could have a professional financial advisor actually manage that for me for a nominal fee or a small fee?

John: Yeah, it’s becoming more popular. The employers are starting to understand and realize that they need to help their employees make better investment decisions.

These 401k plans are self-directed (meaning you the 401k plan participant must make the investment decisions), and the employer could put great investments into that fund lineup.

But if the employee doesn’t know what to do with those funds they may not have very good investment experience. So the more thoughtful employers are starting to give access to tools that you might hear the term “managed accounts.”

It’s basically what the name implies. Somebody is managing that account for the participant, and fees range. We do this for our clients, and in our program, there are no fees.

In other programs, I’ve seen a half a percent or 1 percent. You might say “Well that’s too expensive” but, you know, that money manager is probably going to do way better than what you’re paying.

So it’s something to consider and you’re going to lose that access if you leave the 401k.

Another thing is simply the matter of possibly having access to an individual financial advisor to literally call, talk to, sometimes actually meet with. That’s part of the service level. That’s all for the 401k plans, and sometimes the employees aren’t even aware that they have access to an advisor for no additional charge!

Greg: All right. Thanks for clearing that up for me! Okay, so didn’t mean to interrupt so let’s go ahead and get back to your list.

401k Investment Fees

John: Oh, okay. Well, we were on the fees—these are important. So I’m just going to say fees for a little bit.

401k Consolidation of Accounts

Consolidation of accounts. I mean people collect investments. Sometimes I’ve seen it–people come in to meet me and over the years they’ve worked at various employers and they’ve collected 401k accounts at the last three employers and have a couple of IRAs.

Sometimes it makes a lot of sense to consolidate all those accounts.

401k Creditor Protection

Creditor protection . . . we’ll talk about that.

Age 55 401k Distributions

There’s an advantage to the 401k, and that’s age 55+ distributions. We’ll talk about this also, but if you’re age 55+ you can take money out of your 401k without a penalty, whereas with an IRA you cannot do that.

If you try to take the money out of an IRA you’d have to wait till age 59 and a half.

401k Loans

With 401k’s you the ability to take money out in the form of what’s called a loan. An IRA does not do that.

So if you move out of the 401k you’re going to lose that ability.

401k Distributions

The last thing I want to talk about is not really a decision point, but if you do take money out of the 401k (or IRA for that matter) and you don’t roll it into another IRA or another 401k.

In other words, you put it in your bank account to spend it—this creates tax consequences!

I’m just going to use this today as an opportunity to make sure everyone’s aware of those tax consequences because I think sometimes people make a mistake simply because they’re not familiar with the rules.

Greg: Okay. Alright great! So John tell us a little bit about specifically, you know, what are some scenarios we are actually referring to?

John: Yeah. Now exactly, so if this is a situation where if you are . . . you’ve left an employer and you had a 401k account and either you’ve left to go to a new job or you’ve left because you’ve retired, that you have that account at that former employer or you have multiple accounts at multiple former employers.

This is definitely the topic for you. But also I would encourage anyone that’s getting close to retirement to start giving this some thought—because it does take some thought—and then you’ll know what you’re going to do some financial planning before their retirement date.

Greg: Okay. Alright great! So anybody out there who’s listening to this interview . . . If you have an old 401k at a former employer an old 403b, or if you’re thinking about leaving your current employer and moving to a new one—or perhaps even retiring—you’ve got these decisions to make.

So we’re talking specifically to you in this decision-making process, and John I’m going to kind of tee you up here. How do we compare the various 401k options available to us?

401k Options

John: Yeah, there you do have a few choices. I mean obviously one is simply to leave your 401k or you know, I keep saying 401k and I want to preface because I’m also talking about 403b plans . . . I’m talking about 457 plans . . . Basically, any sort of company retirement plan . . . 401k is just the most prevalent.

So that’s, I mean all of the above when I say 401k. Leave your 401k plan where it is is one of your options.

You can roll that 401k into an IRA without tax consequence. You can probably (if you have gone on to another employer), you can probably roll your 401k into your new employers 401k if they offer a 401k obviously, but also the other thing you need to consider is that the employer may not allow rollover into their 401k—they may not want to administer that—so you have to double-check that before you try to do that.

So maybe that’s not an option for you. I mean the fourth and the final option that we all have available is we can just cash it in—you know—and put it in her checking account and buy a boat.

Not my recommendation by the way!

Greg: We’re going to steer you away from that one Wealth Masters because that’s really not what you want to be doing.

So the options really are you leave the 401k alone, you leave the 403(b) alone or 457 plan alone in the current state where it’s at. You keep it there, that gives you some different options.

Or you consider rolling that into an IRA, which is more of a self-directed approach or self-directed with the help of a professional financial advisor. Hopefully, those are really the two main things, right?

So except I guess also rolling it into the new employers 401k if you’re going to go to a new employer and if that 401k plan allows for it.

John: Yeah, exactly. So those are my options.

Greg: What are the most important factors that I need to be considering with those options available?

401k Rollover to IRA Consideration Factors

John: Yeah, so in other words, some of these factors are going to carry more weight than others, so I think the big four or five as follows.

Clearly the quality of the investment options in the 401k versus what you could get if you left the 401k and rolled into an IRA. That’s always going to be a biggie! And here are some things you can think about to make that evaluation properly.

How many investment options do you have access to in the 401k? So if you told me you only have five investment options, I would probably tell you right away there’s no chance you can (in my opinion) properly diversify that account. You could do much better in the IRA where you have access to 10,000 investments or more, you know, for that matter.

Do you have access to what’s called institutional funds? Remember you’re in a 401k and your assets are combined with all the other employees. You may have a very large 401k and your employer’s been able to go out and negotiate very low-cost institutional funds that you will not—as an individual inside and IRA—ever have access to.

So you’ve got to be careful with that if you see the mutual fund name followed by the last letter “I” that usually stands for institutional, and that’s usually a good sign that you’ve got a good mutual fund in there. You can’t get if you leave.

If you see there’s a particular fund company that I’m—you know—in favor of it’s called Dimensional Fund Advisors and they’re the eighth largest mutual fund company in the U.S.

Dimensional Fund Advisors

Probably you haven’t heard of them because they don’t advertise. They just sell to institutions.

It’s not that easy to find them for one, but I’m just going to tell you if you do find the DFA funds in a 401k it’s very—like highly—unlikely you’ll get them inside an IRA. So factor that in because they’re a good mutual fund group.

If the fund lineup is made up of what I call “proprietary funds” that’s sort of a red flag that you know, if you’re, I’m going to just to pick one, but let’s just say, it’s an American Funds 401k and all the funds you have to pick from a from are American Funds.

American Funds has some great funds, but when all your investment options are with the exact same mutual fund company be it American Funds or Fidelity—whoever—they’re not necessarily good at everything. So that means when you’re going to be limited, you’re probably going to have access to good mutual funds but you’re going to be stuck with some bad funds.

So that’s probably a clue that you can do a better job in an IRA instead of the 401k. And then the last thing to do is, of course, look at the performance of the funds.

Greg: And how do you do that?

John: The easy way to do that is there’s a disclosure that you receive once a year. You probably toss it. I’d encourage you to keep it!

It’s probably up on your participant site and the government requires your employer to show you the performance of on each fund on a 1, 5, and 10-year basis and compare it to an index (or what’s called a benchmark).

If you see your funds in the 401k underperforming by 2% a year, probably you’d do better in the IRA. But if you see those funds performing about the same as the indexes indices, I think you probably have some pretty good quality funds.

If you’re expecting your funds outperform the index perhaps maybe you’re asking a little bit too much. It’s not impossible, but you probably have some good funds if they’re about the same level of performance as the indices.

If you’re going to 401k rollover into an IRA, where is your IRA? if it’s in a mutual fund company, it’s probably very limited to the funds available by that fund company. So it’s probably that your 401k is probably a better option.

If you’re in a brokerage account and that could be—who knows—TD Ameritrade, Charles Schwab, Fidelity, whatever, and you have access to the 10,000 funds then you’re going to have a lot more to pick from, and probably get the better quality fund.

The second topic that is really important—we already talked about it though—is the availability of professional investment management. So if you do, you have access to managed accounts and model portfolios.

Individual access to a financial advisor—and I’m not really talking about a 1-800 number with a call center where you talk to a different person every single time—I mean somebody you can form a relationship with. You’re going to give that up if you leave the 401k and more and more plans are offering that today. I think the trend is that more and more will in the future. So look into that.

The third thing—this is really important—but it only applies to folks that are age 55 to 59 and a half. If you leave your 401k at age 56 and the plan allows you can take money out if it’s a situation where you need it.

Maybe you’ve retired early and you want it to take some money out you put in your checking account so that you can live off it, if you were to take that money and roll that 401k into an IRA and then take the money out at age 56 you would be subject to a 10% penalty because you’re taking the money out prior to age 59 and a half.

In a 401k they (the government) actually reduce that age 55. So between the ages of 55 and 59 and a half, you can actually take money out of a 401k and avoid the 10% penalty.

There is one thing you need to consider, you cannot have 401k accounts at prior employers. So if you’re thinking of the strategy it’s very simple to roll prior 401ks into your brand-new 401k before you retire. Then you can start taking distributions out as early as age 55 without the penalty. So you can only have one 401k, you cannot have old ones.

Greg: Yeah, that’s right. You could possibly take the old ones if the new one doesn’t accept the rollover and roll those out into an IRA. Then at least you’ve got the current one that you could take the distribution. That’s another strategy.

John: Yeah, that’s exactly right Greg, and you just have at the end of the day you only have one for your current 401k.

Greg: And I guess before we move on to the last one, the only other thing that I would add to that John—and you probably have some experience with this —but a few years back didn’t they change the rules from 55 to 50 only for public safety workers? Firemen, police officers, and so forth? I believe they need to check into that because it could be a 50 to 59 and a half thing if you’re a public safety worker.

John: Yeah, and to be clear Greg, I’m not clear on that. So, you know, I wouldn’t want to state that to the Wealth Masters out there. If you are a public safety worker, firefighter or police, just double-check into those rules.

I did write a blog on that on retirewire.com. If you want to just go there and hit the search bar and put in public safety worker you’ll be able to find that.

John: If you’re saying it’s true, it’s true!

401k Fees vs. IRA Fees

Greg: Thanks for your confidence! All right, so all right moving onto two fees then yeah see, I mean obviously fees! Here’s your challenge as a participant in a 401k plan—or frankly—a lot of times in an IRA.

It can be very difficult to determine what the fees are. Now I mentioned a little bit earlier there’s a disclosure of the government’s requiring the employers to give the employees now once a year. In that one has the table of the investment performance versus benchmarking. It also has to have another table in there, and that’s with the fees for the investment products.

Greg: Is that the 408(b)(2)?

John: Good question though. There were actually two disclosures. Now two new disclosures.

The one you’re referencing—the408(b)(2)—is the disclosure from the service provider. So, you know, if your employer’s using Voya, Principle, or Merrill Lynch that company has to tell your employer what the fees are. The rule that we’re referring to is 404(a)(5).

So now the employer knows what the fees are from the 408(b)(2) disclosure, they have to! Now they have to tell the employees what the fees are.

I will tell you, unfortunately, that some of these disclosures, they’re harder to read . . . they’re really hard! They aren’t for me to read you know, so,

Greg: And you and I do this every day! I look at—you know—hundreds.

John: It’s so it’s so yeah, you know, I caution you that it may be a little difficult to figure out what your fees are. But remember again that there’s a, there’s some decent chance that your fees with your 401k plan could be very low, especially if you’re in a large plan that had a lot of buying power. If your employer’s really looking out for you they’ll negotiate really good low 401k plan fees.

And then you lose that (low-cost 401k mutual fund fees) if you leave that plan. You will go into an IRA and now you don’t have that buying power anymore.

And so you’re going to be buying where you could maybe you could buy institutional mutual funds that were very low cost in the 401k. And you go in the IRA, now you’re a retail investor and you’re going to be paying retail classes of—you know—share classes that can be a lot higher cost! And so you have to be aware of that, and then you know, if you had access to professional investment management in the 401k.

Now, if you don’t have professional money management in the IRA and you want it you’ve got to hire somebody! And if your accounts aren’t that large, then, you know, they may charge you a higher fee—you know—to make it worth their time.

So, you know, I really think a lot of times people just mindlessly . . . they think they have to rollover the 401k into an IRA. They quit, they got to roll over and my whole point here is that it totally depends.

Greg: So those are the four “biggies”.

Okay, I want to ask you a quick question because this came up the other day and I’ve seen it before, but a lot of times I have incurred or encountered a client and they’ve got a 401k and it’s from a small employer. Maybe you’ve got 20 or 50 employees, but you know, the plan may be a few million bucks and they look at that and they say “Well, I’ve got Vanguard! I’ve got really good funds! And granted, some of them actually do!

But then you’ll see oh, but the fund is put out by an insurance company, and the insurance company wraps fees around the fund. So it is actually it looks like you’ve got these great funds that are super low cost when in reality you do but you’re still paying additional fees to the insurance company.

John: Yeah, and that’s why I see that disclosure that we sometimes it’s referred to as408(b)(2). Sometimes. It’s referred to as an annual disclosure. Sometimes I make up some other name for it, but there is a form that they have to give you now by law since 2012 once a year.

Greg: And in the table where it lists the fees they have to roll all those extra fees into the total, right?

If the 401k advisor’s got a fee that they tacked on if there’s some sort of—they call it—AMC’s or account maintenance charge, they make up all these terms and you’re absolutely right Greg! If you’re in a smaller employer plan—and by small—I mean anything under a hundred million you know what, you’re more subject to those types of fees than if you’re with a Fortune 500 companies 401k plan.

So thank you for bringing that up! That’s important!

Greg: And just to kind of dive a little bit deeper. I think what you’re referring to—just for clarity—is when you are in a plan—a 401k or 403b or whatever—when you’ve got a lot of buying power or economies of scale. So you’ve got like you said a hundred million dollars?

John: Well, the 401k can manage that much, much, much cheaper than a smaller plan with 5 million dollars in it because of just the economies of scale. So if you’re were at a big employer the chances are you might have a pretty decent plan there.

If you’re in a small employer, chances are you really need to consider these options carefully because you might be paying!

Greg: Yeah, I think that’s exactly right! But it’s a very general statement. There are more and more employers becoming aware of the fees, and they’re negotiating harder, and fees are just flat-out coming down across the board! And so even if you’re in a five million dollar 401k plan (or even smaller sometimes) that can be a very efficient plan.

That plan can be very efficient, inexpensive, and then you know, if it’s not you don’t think it’s that cheap, but if you get in professional management and you just factored in what am I going to pay if you know how much is professional management of the cost me outside of this plan and you’re honest about that.

It could be the 401k is still, you know a much better deal than you could ever get on your own even with a small 401k plan.

Greg: Okay. All right. All really good stuff! So let’s kind of move on to some secondary decision factors. These things aren’t quite as important as the 401k fees and the professional management and so forth. Go ahead and elaborate a little bit on that.

Other 401k Rollover To IRA Factors

John: Yeah, yeah, so, you know one of the things with the 401k rollover, the decision is that (I think I mentioned this earlier) people will come into my office and they’re you know, maybe a little later in their career. They’ve been with numerous employers and they’ve collected a number of 401ks and they’ve opened up a few IRAs and I think it’s really important that you consider consolidation.

Consolidation of Investment Accounts

So if you decide that your current employers 401k is the option out there, I would very seriously consider not only role in my old 401ks into my current employers 401k, I would roll my IRA’s if my employer will let me. I would roll them into that 401k plan.

I would get everything in one place, and the reason is it’s so much easier for you than to manage that. Then hopefully build a diversified portfolio.

If you’re trying to build a diversified portfolio and you’ve got six accounts and you know, they all allow for different investments, it’s hard. I’ve (we’ve) been doing this short of 30 years. I haven’t met the person that can really do that! Well, yet they’re probably out there.

Greg: But yeah, we have to use the technology, we use the software, we can do it but we pay a lot of money for software to do that. So, yeah, the solution is to consolidate.

To try to get everything to one account—or if you have a traditional IRA or 401k or a Roth—obviously those have to stay separate! But you know through the same type—traditional or Roth—combine them! Then just you can focus on those individual accounts and I think do a better job for yourself.

401k and IRA Creditor Protection

John: So and this . . . this is you know, and I want this as a secondary consideration because hopefully, you’ll never have to worry about IRA creditor protection. But I just want to make you aware of it. 401ks are covered by a different rule than IRA’s are subject to.

They (401ks) have much better creditor protection than IRA’s now. You can roll your 401k out into an IRA as long as it’s a separate IRA. Don’t commingle it and you don’t consolidate it with a different IRA’s. Keep it separate up to 1 million in as long as that IRA is 1 million dollars or less you can protect that $1,000,000 from bankruptcy! It still doesn’t have all the same creditor protections that the 401k has.

So, for example, if you’re sued it depends on the state. In that case, the IRA probably is not going to give you the same level of protection that the 401k will.

So, if you’re somebody that’s more of a target for a creditor, you know, you make a lot of money like a doctor. Somebody might think you have a lot of money and you know, they’re more apt to come after you then. That’s probably a bigger deal!

If you’re not really worried about it, bankruptcy—or you know hiding from creditors—then not a big deal. I’d be remiss if I didn’t mention that.

So it really is like a state-by-state thing in a lot of ways.

Greg: Yeah that 401k is federal so you have to worry about that.

401k Loan Provision

John: The last thing—and you don’t see this very often so that’s why I made it secondary—but sometimes after you leave your employer they’ll still let you take what’s called a loan out of your 401k.

Usually, they won’t want to administer it because you’re gone, you know. But you know sometimes they will! And if they will you want to factor that in (to your 401k rollover decision) because if you roll that 401k into an IRA now you can’t take a loan out of the IRA. There’s no way to do it!

So if you’ve got a situation—and I mean this is a rare situation—but you know, I see it! I bet you Greg see that occasionally! You get somebody that has a lot of money tied up in real estate. They have a lot of money tied up in their IRA’s and 401ks and they don’t have a lot of liquid money! And if an emergency happened they’re in need of money fast!

It may be their last resort is taking a loan out of 401k. And if the month before they took the money out of the 401k and put it in an IRA, that’s no longer an option for them either. So it is something that could happen and you want to factor that in.

Now since we’re on the topic, I’m going to talk about this for a second because I think this is important.

I’m not a big fan of a 401k loan. So just you know, if-if you can avoid a 401k loan . . . if you can access the money another way, I think you should seriously consider it! Just look at it this way, first of all, just because it’s called a loan it’s really not a loan!

Nobody’s lending you money! It’s just that you have the ability to move money from your own money—your own401k—into your own checking account.

Nobody’s made you a loan. You just move money from one place to another place. Then you’ve got to move it back over say a period of five years. Then you might say “Yeah. Well, it’s really easy and there are no questions asked, you don’t have to fill out paperwork, it’s really easy to get the money out!”

But the cost of it is that if the (stock) market is up a lot in those 5 years before you get the money back in you’ve missed out on that appreciation because you had to sell your securities to raise the cash to take the 401k loan out! So factor that into your decision.

The other thing is that people forget this all the time is you need to continue to work at the employer until that loan is repaid. So if you were to quit after two years and you still have a big long balance outstanding they are going to demand the money within 90 days (or even 30 days) and you’re probably not going to have it because you just had to borrow the money in the first place!

So you’re going to say “I don’t have it” and they’re going to say “Fine, we’re going to treat it like you took a distribution and you’re going to have to pay income taxes on that!”

Now you didn’t have the money to pay it back so you probably don’t have the money to pay the income taxes! And if you’re under the age of 59 and a half, there’s going to be a 10% penalty on top of your income taxes!

You know, I tell people about 42% (even 50%) of their money they take as a distribution from the loan if they don’t pay it back it can end up going to taxes. Statistically, about 44 percent of employees who take a 401k loan regret it!

Greg: All right, so just keeping that in mind, be a little bit more thoughtful before you take a loan from your 401k plan!

John, I’m with you! I try to discourage 401k loans if at all possible. If—you know certain situations—it kind of makes sense. You know, long-term employment? Maybe they need to buy a house or something like that?

But I really try to discourage that especially when you see the people that say “I need to buy a couch so they want to take it right?

John: I know yeah drives me nuts!

401k Fees—Who Pays Them?

Greg: So John real quick. I want to . . . I want to get a little bit more into the weeds on fees before we move on and talk about 401k distributions and rollovers.

So riddle me this . . . “If I have a 401k . . . I own this company and I’ve got a 20 million dollar 401k plan. Who pays the expenses for the 401k plan? Are they paid generally by the employer or by the participant?”

John: They’re generally paid by the participant. So what will happen is that there’s a service provider that is required and they are necessary.

You can’t have a 401k without a recordkeeper. The recordkeeper keeps track of whose money is whose and somebody needs to do that. When you log into your website, you see you have X dollars you’re invested a certain way. That’s the recordkeeper.

When you make a deposit from every paycheck it gets invested like magic! Actually, that’s the recordkeeper.

So they want money. There’s so many that the employer—your employer—needs what’s called an administrator. They do some IRS filings and they do create your plan documents and do plan testing.

They want to get paid also!

And then you have a custodian to hold your assets.

So in a 401k plan especially you have to have a custodian and many plans have 401k advisers! You know, the 401k plan advisors are advising and helping them pick the best funds . . . the best quality funds!

So all these folks have to get paid! Now, here’s the thing, a lot of the plans the way they pay these fees are by reducing the performance of the investments.

Okay. So let me give you an example. Let’s say you have a mutual fund in your 401k and maybe it has a hundred stocks. And let’s just say those hundred stocks made 8 percent during the year.

When you get your 401k statement it may say you made 6 and 3/4 percent. All right, and that difference between what they did really make (was 8%) and what they tell you it made (was a 6 and 3/4) is because they took out one and a quarter percent in 401k plan fees!

Greg: Okay, and then they paid all these 401k service providers and I don’t mind that. I mean, you know people have to get paid right?

John: I’m more of an advocate of what’s called transparency. So you actually see these are not reducing your 401k mutual fund performance. You just see them on your statement. There’s a trend towards this what’s called “transparency” ” in the 401K! So does is that it does that answer your question?

I get off track.

Greg: Yeah. No, that was perfect! It was exactly what I was looking for! And I guess where I was going with that, is so John if I leave my employer and I’m—you know—instead of getting 8% I’m getting six and three-quarters percent I’m still paying all of those fees for the 401k and I’m still paying for the 401k plan advisor . . . I’m still paying for the mutual funds. I’m still paying for the recordkeeper and the 401k plan sponsor approves all of those fees!

So if I leave my 401k or 403b alone, I’m still getting tagged with a bunch of retirement plan fees that I’m not even getting the benefits from because I’m not in the plan.?

John: Yeah, yeah, so that’s why you have to be aware what the fees are and the value of those services.

There it is. It can be hard. I will tell you I’m in the field and you know, I look at other what other competition charges I know it usually if you have a good recordkeeper . . . good administrator—those fees are actually can be pretty minuscule though, and they may only be .10, you know, which is nothing.

You know, it’s really you have to worry about so much. So it’s more a lot of times the mutual funds are too expensive is what the problem is! Or like you’re absolutely right. You mentioned the insurance carriers also.

If you’re with an insurance company odds are that they’ve created these special fees they call wrap fees, you know account maintenance charges. Like Fidelity value, and they just charge a fee for that.

It’s you know, it gets frustrating and I wish there was more transparency because I think the employees out there we go their employers say hey, you know, what are these fees for and then have an adult conversation about it and decide if there’s value in. If there’s the value that’s awesome.

Everybody understands that. They go back and get value for the employees.

Greg: Right, right. So I guess that that also is possibly another consideration is when you leave your employer, you’re still paying 401k fees! Don’t think that you’re not paying them, and you know, you’ve got to weigh the fees that you’re paying their versus the fees that you’d be paying in a self-directed IRA, and that goes back to that whole insurance wrapper thing.

I mean you look at your statement and just you could go to Google or Yahoo Finance and type in Vanguard, you know S&P 500. You think “I’ve got this amazing fund why would I ever get rid of it?”

And then you don’t realize that the insurance company is tagging on 1% or 2% or whatever that number is.

John: Yeah, you know Greg just coincidentally I saw this late last night.

I got an email directly from a participant and he thought his fees were exact. It was an exact scenario. You just need to type this long email back explaining. No, that’s unfortunately not doesn’t work that way. It’s not the case.

Greg: So that’s what I mean Wealth Masters. It makes these decisions so ultra-critical because if you think about fees or even a half a point over the next 15, 20 years of your life, you know, you’ve got to weigh the dollars and cents behind that and you’re talking about compounding and growth also.

There’s just a lot of things to consider. So, John, I’m going to kind of transition is now into you know, distributions versus rollovers. Let’s talk just real briefly about the tax implications of that and then we’ll kind of bring it home.

401k Distribution or 401k to IRA Rollover?

John: Yeah, and I start talking about this earlier, you know, there’s something in our industry that we call them.

This is not an eloquent term at all, but it’s called “leakage” and what it means is that—you know—assets are leaving the 401k prior to retirement, not because people are retiring and they saved up and “I hit retirement” and then they started taking the money out.

You know in retirement, which is the whole point and purpose . . . but instead, you know, they move from employer to employer and they build up what they consider the not be a large balance, maybe $5,000 or $10,000.

And so because they don’t consider to be a large balance they don’t roll it into an IRA. They don’t roll it into the next 401k or leave it where it is.

They take it out the cash it out. So here’s the problem with that. It’s going to go on your 1040 and you’re going to be taxed at the federal level your highest federal level (whatever that is).

And if you have state taxes, you’re going to get the pay state taxes on top of that! This makes the 401k rollover to IRA highly beneficial from a tax standpoint.

Now a lot of times when people are doing this they’re under the age of 59 and a half. I mentioned earlier the federal government tries to dissuade you from doing this and will tack on another 10%. I can tell you from experience.

Greg: This is a conversation. I think I had this week with a family where my clients the father—he’s telling me the story of his daughter and his son-in-law and they made the mistake—they took money out of the 401k and they’re in their 30’s. They got to the end of the year and they didn’t put the distribution on their tax return.

So who caught them, of course, it was the IRS!

Now by the time the IRS caught them obviously, they’re late in paying their taxes. They’re late in paying their penalty. So they had to pay their taxes. They got to pay the penalty, now they get to pay a penalty and interest on the taxes and the penalty. So, you know, it was just they just didn’t know any better!

It was just a really bad experience for them, which is why I was hearing about it. So, you know, the best thing to do is just avoid the distribution taxes and a penalty for a second.

John: Really Greg the best thing to do is that! Remember what the money is for . . . it’s for your retirement and you got to have that long-term vision . . . you have to have discipline!

Those are the successful investors!

So what if you changed? Employers take the money from that old 401k plan and do something smart with it? Either roll it into the new 401k or an IRA, but do not cash it! Leave it where it is if that’s the best!

Greg: You know the options you have. Do not cash it in you will someday be patting yourself on the back when you’re doing what you want in your retirement. You’re traveling because you want to travel you can pay for your hobbies or whatever . . . and you can even retire!

John: I mean, you know, right, you know! It’s not a matter of you have to keep working because you squandered away, you know, you’re savings as well as tax and penalties.

Greg: Yeah, well yeah, well you took it out you bought the couch or whatever, you bought the boat with it that you really didn’t need you know, so any way that’s a whole different topic but that’s a great soapbox I love it I’m with you . . . I do want to touch on one other thing because I think this is a critical component that we haven’t really touched on yet so we’ve discussed at 55 with your 401k.

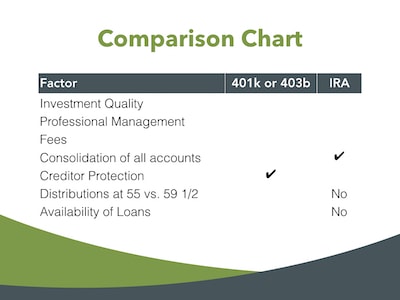

401k Keep or 401k IRA Rollover Comparison Chart

You can take withdrawals and avoid that 10% penalty. So after 59 and a half, this is really the penalties don’t even apply.

The taxes are the same. It’s a non-event.

We just take that off the table before 55 or less for public service workers. You have these taxes and penalties no matter what you pull out of the 401k or IRA, but you’ve got that window between 55 to 59 and.

Greg: So I think one of the critical components—correct me if I’m wrong—is if you’re in that window or under 55 and you’re getting close to needing money at 55 is you know, are there other assets to support you financially during that window, right?

John: Right. Yeah, you know we started with the 401k rollover to IRA but now we’re getting a little bit into retirement planning. . . But I mean see this is all puzzle pieces, right?

Your 401k is just a puzzle piece in your whole retirement plan situation, and then that whole decision on where you get the money to support your retirement.

Greg: If you have a taxable account, should you first be tagging the money from there? Is that more tax-efficient than taking the money out of the IRA or out of the 401k just you know, because uh, they allow you to do it doesn’t necessarily mean that that is the best thing for you to do?

John: So it takes some thought. I mean a lot of times, you know, as you know is somebody retires in their mid-50s, they’re going to have a way to get to age 65 when they qualify for Medicare. So they’re probably paying a hundred. Well, they are there they retired they’re paying on time so their health their medical premiums and you know that’s expensive.

So there’s a lot of thought that goes into trying to retire, you know in your mid 50’s and frankly, most American workers really can’t afford to do that. And the other thing I would throw out there is that you know, if you retiring at age 55, you know, you maybe you’ve been working for 30, 35 years at that point.

You could easily have another 35 or even 40-year retirement. So you seriously would have needed to save a ton of money—a lot of money—you know to get you through four decades over retirement maintaining some sort of meaningful life.

You know how much is your pension is going to be reduced if you retire usually if you retired age 55, not necessarily, I mean, there are some government programs is military, you know as public service and stuff.

Greg: But for most people, there are a lot of factors that go into that decision. There are and it way it’s why really becomes ultra-critical to get the right advice and to make sure because I mean I tell the story of how I sweat soldered a water softener at my house one time because I thought I could do it and I could YouTube it and I got the blowtorch and did it.

It was the ugliest sweat solder job you could ever imagine but it held it held for two years until I came home one day in the garage is full of water. I just thought to myself “Boy if I would have just spent that extra two or three hundred bucks. It would have never broken.”

John: No, I yeah, you get what you pay for it and you end up paying more to fix the problem you cause then you say everyone is saved in the first place.

Greg: Yeah. Thanks. Exactly. So just real quick one final, you know touchpoint on that 55 to 59 and a half window. Let’s say I retire at 55. And or you know 58 or whatever the number is and I cannot pull, you know, I roll the money into an IRA. So now I’ve got potential penalties. So let’s just say I really need the money.

I’ve already rolled it into an IRA. Is there any other way that I can access some of my IRA money without the penalties.

John: Yeah, I mean you do have one limited option and that would be to do a 60-day rollover. So you could take the money out for a 60-day period as long as you put it back in 60 days but you know, then you do avoid the penalty.

Okay. Okay. That’s where you going. Yeah. So Rule 72 T allows you to take equal distributions based on a formula over your life expectancy and avoid the 10% penalty. That’s another way to take a distribution prior to 59 and a half and avoid the penalty, but there are a lot of complicated rules that gets very very tricky.

You don’t want to do this on your own. Don’t do this. Yeah. Don’t try this at home. Don’t try this at home. You know, you definitely need to enlist a good CPA and a good wealth advisor, hopefully as well.

Greg: So John, why don’t we just bring it on home here? We’ve covered a lot of interesting things and you’ve actually created this kind of neat little chart now clearly everybody’s different because you can’t fill in all the blanks.

401k Rollover To IRA (or not) Key Action Items

You just don’t know what their specific situation is, but some of them are already filled in. So why don’t you spend just a couple minutes and kind of touch on some of the comparison stuff and the chart here.

John: Sure so, you know the first one again if you know, this is the base was repeated what we just talked about.

So it’s just, you know, let’s just run through a really quick. We’ve got investment quality.

401k Investment Quality

You know, there’s I mentioned some of the ways that you can determine if the investment quality inside the 401k is good enough because if it’s not I think that settles it . . . you really need to roll your 401k into an IRA where you have access to certainly better investments.

Greg: And John, I think we all really, for example, if you’ve got really expensive funds or if you’ve got all active managers and they’re just not that good and you really wanted some passive or index type of investments. These are some critical decision points, right?

John: Yeah, you brought up active versus passive. So now I’m going to talk about it because I’m a big, yeah, I mean, yeah, I think.

Active Mutual Funds vs. Passive Mutual Funds

Yeah, alright, so, you know, basically, you know, you’ve got active managers. What they’re trying to do is they’re trying to—through stock selection—is they’re trying to outsmart the other guy in there that eventually you know buy undervalued stocks, you know before their you know, fully valued and outperform the market that way.

Here’s a challenge with that is I mean, even if they’re good at it it’s expensive to be able to do that.

You have to be paying for research. You need to have a team of Chartered Financial Analyst’s working for you. You may have to fly across the country to meet with the CEO of the company really good under the hood and understand so you can incur some costs and those costs are going to get passed on to the investor and you know, so that’s going to hurt the performance from the beginning.

The second thing is if you’re an investor in an active fund, sometimes they do very well for a period of time and that might indicate to you that you know, that’s going to keep going in the future and that’s because that manager is very skillful, you know, and it wasn’t just a period of. Just you know the run of luck, right?

If you flip a coin, you know lineup a thousand people and you tell him to flip a coin 10 times each. Somebody statistically is going to flip 10 heads, but does that mean that I’m the 11th flip is guaranteed to flip heads or is it really still 50/50? So, you know just so many active money managers out there.

Somebody’s going to have a run, you know statistically speaking that doesn’t necessarily mean they’re skillful know. Maybe they are maybe they aren’t that’s your problem. How do you figure out that that skillful manager that that manager’s skill or not?

On the passive side. It’s easier it’s cheaper, you know, the money manager is basically passive so they’re not trying to outsmart the market.

They’re simply trying to capture the performance of the market. Whatever. Have you defined that S&P 500 big company stocks or you can slice and dice it to blend and blend growth and value large and small foreign, you know, and you can just buy all the stocks and that asset class and then you know, you’re going to get the performance of that asset class and effectively what you’re capturing is the average performance of all these active managers try and outsmart each other, you know, and but it’s so much cheaper.

You know, I’ll support the market that the fees are so much lower that it’s really hard for those active managers to outperform those passive managers. So yeah, you brought it up. So I want to talk about it, you know, we’re advocates of passive as well and frankly, you know, the term passive sounds like well, you’re very passive.

You just ladies get up. Yeah. Yeah. Yeah, but really it’s very. Evidence-based it’s very science-based and you know the academics and those are all the folks that are doing this the style of investment and sometimes they think the active managers are really just trying to sell their performance and that’s how they attract people is not necessarily that.

Greg: Yeah, you’re going to have a good experience at the end of the day. That’s a whole other discussion Wealth Masters. That could be another hour on its own and I didn’t mean to open up the topic, but I think it’s important to consider. I know personally that if I was in a 401k with a big company, and they had no passive and real quick again, the delineation they’re really for active and passive is active.

You’ve got a manager or a team of managers that are going to be buying and selling and picking and choosing in time and trading. They’re just trying to outsmart everybody else in the market in—the benchmark. They’re trying to beat the benchmark.

It’s really expensive versus the compare and contrast that with passive and a lot of people think of it like indexes and for simplicity sake in this purpose . . . you can think of it like an index but where you just buy all stocks or all securities in a certain group.

So it’s very low maintenance low cost and a lot more tax efficient not that it matters in a 401k but so real quickly to me personally if there were not enough passive options, that would be a really big point for me to start looking at rolling it into an IRA.

That’s just me personally.

John: Hey, I know I agree a hundred percent agree. I’m glad you brought that up. Here’s something you can actually do as a retail investor because I share this with employers and a lot of times they don’t they’re not aware of this is if you’re trying to determine whether a fund is active versus passive, look at what’s called the turnover rate of that fund with the turnover rate is it’s simply a matter of what percentage of the portfolio was bought and sold or sold during the year.

So if you’re seeing turnover rates of 50% or 80% I mean just think about that managers buying and selling buying and selling and buying and selling and what do you what’s that generating transactions. If nothing—else all things being equal—generating transaction costs bid-ask spread commission’s that are hurting the performance of the fund a passive fund.

You probably depends on the asset class, you know, but for the most part, you’d probably expect less than ten percent turnover much lower. These dimensional fund advisor funds that I talked about you they’ll be down but two percent turnover. So this very little cost being generated because they’re not trying to you know, make moves, you know that are you know test designed to you know outsmart everybody else out there.

Another Pro-tip is just because you have an index fund in your stable of investment options in your 401k, it doesn’t mean it’s a cheap one. There are a lot of index funds amazing that cost three-quarters of a point or a point. So even if you have a Vanguard S&P 500, it doesn’t mean that your paying, you know, ten basis points or ten 100’s of one percent or whatever that that fund charge it somewhere.

There you could easily be paying a hundred and ten basis points. So just keep that in mind Wealth Masters. Don’t get fooled by. Oh, I’ve got these great index funds because they may be charging you just as much as the active. So anyway, John I didn’t mean to deviate too much go ahead and bring it all home with your chart and let’s a let’s go back here real quick so we can kind of refresh our memory and then we’ll kind of talk about the action items.

John: Yeah, yeah, so the chart basically we did this chart for you so that you could what you could do is you could just remember what all the important factors are and you could just do a little checklist in each of the columns and you know, hopefully, it’ll clearly help you decide whether you should roll into an IRA or state in the 401k, right?

And so the quality access to professional investment management. Again, it’s fairly rare these days, but it’s growing fairly quickly as well as low fees.

We’ve been talking about low 401k fees the whole time. So I won’t go there again fees are obviously always important.

The ability to consolidate, you know accounts and you can probably do that in the 401k or the IRA creditor protection if that’s important to you.

You’re probably better off, you know, all things being equal you’re better off in the 401k, you know, if you think you’re going to be needing to take the money out or you know just retired and you’re between that 55 to 59 and 1/2 window, you know, the 401k may get the get the nod at that point if you have low liquidity situation.

Whatever reason and your 401k() after you leave your 401k they still allow you to take they call it a loan. I don’t you know, it’s not really what it is. But they let you take your money out then pay it back if that’s really your the only way you’re going to get any money.

If you have an emergency, you don’t have an emergency fund build-up, it what I tell people is leaving the 401k and work really hard to get your emergency fund built up.

And once you got to the point you have sufficient liquidity outside of IRA’s and real estate and everything else your house. Then if that 401k isn’t so good, let’s now let’s get it out and get it into an IRA where we can do a better job for you.

Greg: So okay with the creditor protection again, it’s a state-by-state thing.

John: I mean, you’re not saying that you won’t have creditor protection. You’re saying that it’s a state-by-state thing. So it could be 500,000. It could be a million. It could be depending on what type of purpose you’re being sued for or whatever it is.

John: Yeah. Well, it’s a million.

It’s going to be a million. That’s a federal rule but the but again one way if you take the money out of your 401k and you roll it into an IRA that you already have and this is, an irony that you know a few years ago. You put some money into it your own money, you know, you took a tax write-off hold accumulation, Ira, you lose that creditor protection believe it or not.

So you do have to be careful with that and what I was talking about the creditor protection of the IRS they do exactly right you roll from 401k and IRA and it’s you know, we can call it a rollover IRA just we can keep it separate in our minds. It’s not going to protect you from everything every type of credit or out there like a 401k well, and that’s where you want to look at the state rules.

It will protect you from bankruptcy. Okay, but it might not protect you from knocking a school bus full of children off the cliff, you know, it’s about you know that you know, that’s a different creditor you so yeah.

Greg: All right, John. So if our Wealth Masters out there get nothing else out of this discussion.

Just bring it home with the most important action item takeaways.

John: Well, basically make sure you review all your available options prior to leaving your employer and just go through, I mean seriously just go through, all these factors.

It’s, you know, I really think some of them were a little bit more challenging than the other but this is the money that you’re dealing with and you want to make a very thoughtful decision.

And the reason we’re having this conversation. Greg is in my experience, I don’t know about you but most people are not very thoughtful about their decision. So we’re just trying to you know, raise conscious to little consciousness of you know, what things you should be looking at.

Greg: Okay, excellent. All right. So, John, you’re clearly an expert in 401k, 401k rollover thought processes and planning and strategies and so forth. If the viewers out there if they want to reach out to you directly or perhaps even a 401k plan sponsor who really wants some help getting a low-cost passively managed diversified plan set up, go ahead and why don’t you share with us real quick? How can they reach you?

John: Well all sorts of ways but you know most probably easiest is just emailing us at info at Alliantwealth.com. You can also go to our website alliantwealth.com.

There’s a contact us button and you can you know reaches that way fill out a little bit of information about yourself that will help us and we’ll get right back to you the toll-free number 8 6 6-3 6-4 6-2 6-2, you know in the last thing I want to mention is that you know, I thought it would be helpful.

Went through a lot of information. We went through it very quickly. Is that chart that you know, we just reviewed we’re going to make that available to anybody that views this presentation here. It’s not for the general public and you want to make a note of this because it’s going to be a hidden page on our website, but it’s going to be www.Alliantwealth.com and then forward slash wealth mastery and at on that site, you’ll be able to download a copy of our handout and some comments some you know, little more detail on what you should be.

Keep it in mind.

Greg: Okay, great. So that is alliantwealth.com/wealthmastery so viewers out there go ahead and check that out download the checklist. It’s going to get you started going to give you some good thought-provoking things to consider when you’re leaving employment and what do you roll it into a new plan or leave it at the old one to roll it into an IRA or God forbid you actually distribute it and pay the taxes and possibly penalties.

So go ahead and check it out. John. Thank you so much for your time today. I really enjoyed this. This is honestly one of my favorite because it’s like like it’s such a hot button issue right now. So I love it. So thank you so much for your time Wealth Masters.

I always say either you control your money or it will control you and you know, this is just another great example if you’re not taking the time to put these plans in place and these strategies and thinking about these decisions.

You could be like John’s example, you know a young 30-year-old couple and just wiping out half of your retirement savings without even thinking. It’s and that’s just another way that your money will control you. It’ll drag you around instead of you being in control of it. So either you control your money or you will control you.

I prefer you’re the former. . . not the latter!

John. Thank you so much again for your time.

John: You’re welcome. Great. This is great. This is Greg Phelps with the Wealth Summit signing off.