Portfolio rebalancing is the process of buying and selling portions of your investment portfolio in order to bring the overall investment plan back to it’s originally intended state. It reduces your investment risk and can even improve your investment returns by methodically forcing you to buy low and sell high.

Portfolio rebalancing also gives you the best chance of reaching your financial goals. It’s a critical part of any well-managed investment plan.

In this article, I’ll explain the concept of portfolio rebalancing and teach you how you can rebalance your portfolio on your own!

Portfolio rebalancing starts with an asset allocation plan

Asset allocation is one of the 12 strategies I explained both Morningstar and Vanguard agree can add a LOT of value to your investment planning. In fact, Vanguard places a .35% value on rebalancing alone! This means if you rebalance your investment portfolio you can boost your investment performance (and control your risk) to the tune of an extra .35% per year!

The asset allocation plan dictates how much of your investment portfolio you’ll invest in various asset classes. In its most simple version, these “asset classes” are stocks, bonds, cash, and maybe even alternatives like real estate or commodities.

Asset classes go far deeper, however. There are subsets of stocks like large companies or small ones, value companies or growth ones, international or emerging markets.

There are subsets of bonds as well. Maybe you prefer municipal bonds because you’re in a high tax-bracket? Maybe you like short term treasuries because you don’t want the interest rate risk? Or perhaps you’re most concerned with inflation, and want some Treasury Inflation Protected Securities in your portfolio. As you can see, there are several asset classes which need to be considered when building an asset allocation plan.

Asset allocation can really get into the weeds, but for our purposes we’ll focus on the major asset classes.

The purpose of asset allocation is to reduce your overall portfolio volatility and balance your investments to your needs and desires for risk and return. The process ensures you’re not placing all of your eggs in one basket. If you break a few eggs you’ve still got most of your basket left. If some investments get hammered, you’ve still got other investments that are likely holding up or even appreciating!

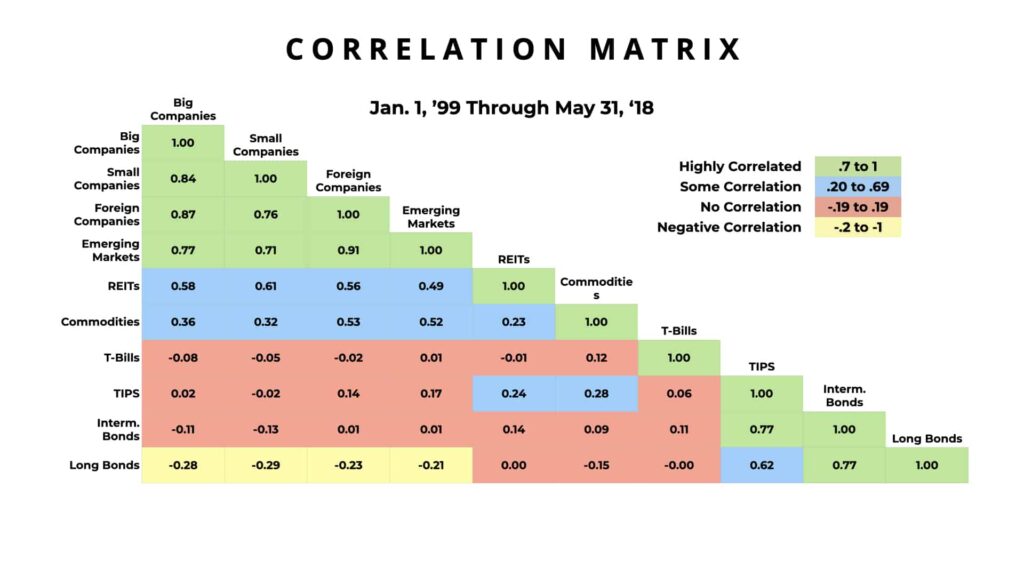

Asset allocation works because asset classes can be “non-correlative”, meaning they typically fluctuate with speed and magnitude notably different than other asset classes. For example, stocks may sink when bonds rise and alternative investments like commodities move randomly.

While some asset classes are highly non-correlative like stocks versus bonds (while one goes up the other typically goes down), other asset classes are highly correlative, like large-cap growth stocks and large-cap value stocks. Large-cap growth and large-cap value stocks may have historically performed slightly differently, but they’re very similar in reality.

Asset allocation is a critical part of your investment planning. It helps you maintain a balanced risk approach and smooth out the market bumps over long periods of time. By combining investment assets with different volatility, risk, and reward characteristics you can achieve your investment goals with a smoother ride and less risk along the way.

Unfortunately, once you create your asset allocation plan and put it to work, the markets move! Stocks may go up, bonds down, alternatives like real estate sideways, or any combination thereof. Now your asset allocation plan isn’t on target, in fact it’s something other than what you’d intended with your diligent work of creating it.

In comes portfolio rebalancing to “save the day” and fix the problem of an asset allocation that’s “out-of-whack!”.

How does portfolio rebalancing work?

The rebalancing process is every bit as important as the asset allocation process. Portfolio rebalancing helps you maintain your target asset allocation which helps you achieve your financial planning goals and objectives.

It also forces you to “buy low” and “sell high!”

Einstein said “Compound interest is the eighth wonder of the world. He who understands it, earns it!”

If compounding interest is the eight wonder, portfolio rebalancing may be the 9th wonder!

Greg Phelps

Let’s assume your investment portfolio (a very simplistic portfolio) is 60% stocks and 40% bonds. How much are you willing to let your asset classes fluctuate before they move too far from the target? That amount would be your “drift tolerance” or “drift target”.

A drift tolerance or drift target may be 10%, 15%, or even 25% of your allocation. There’s no right or wrong answer, but generally speaking 15% seems to work well without generating too many trades for portfolios above $500,000 which will typically have from 6 to 8 positions (more for those over 1 million).

Like your financial or retirement plan, your drift targets may change over time. For example, in a prolonged boring market period with low volatility, you may tighten your drift target to capture more rebalancing trades. You may loosen your drift targets in a highly volatile period to “let your winners run”. Finally, you may have wider drift targets for smaller accounts to avoid making excessive portfolio rebalancing trades, yet tighter drift targets for a large portfolio when the trade costs don’t matter as much.

Let’s assume your stock investments appreciate above the drift target. Now you sell a portion of them to bring them back into compliance with your asset allocation by buying bonds that have dropped below your target allocation.

It’s pretty simple with two asset classes like stocks and bonds. It gets more complex when you add in other asset classes like international stocks, real estate, and commodities. Finally, rebalancing gets far more difficult when you’re working with large value stocks and small growth stocks, international large companies and international small companies, and on . . . and on.

So this is all great so far, but I’m sure you’re wondering how often you need to run these calculations and execute these trades. The answer is “it depends”.

When should I rebalance my portfolio?

Most financial advisors rebalance their portfolios annually. I don’t believe annually cuts it and I’ll explain why.

Consider a hypothetical index for stocks and another for bonds. What if the stock market starts at 1,000 on January 1st, appreciates to 1,500 mid-year while bonds drop from 1,000 to 800. At years end both asset classes return to their starting point of 1,000. You’ve missed your chances to harvest stock market gains and buy bonds cheap.

Rather, I believe monitoring a portfolio monthly for the opportunities makes much more sense. It’s a more pro-active approach to keeping your asset allocation in line with your financial and retirement planning objectives.

Frequent portfolio rebalancing also forces you to take profits quicker and buy depressed investments sooner. Pundits will say you can rebalance too often, and I can see their argument. You cut your winners short and buy your losers as they keep falling. But if you’re retired—or nearly retired—the risk control effects are more valuable than hoping the winners keep running!

Every investor is unique. Perhaps monthly portfolio rebalancing reviews with higher drift targets makes sense! Or maybe annual reviews with tighter drift targets make sense. Either way, you’re rebalancing and that’s a good thing compared to not rebalancing at all.

What if I don’t rebalance my portfolio?

If you don’t rebalance your investments your portfolio will end up completely “out-of-whack” as the market gyrations take some assets higher and others lower over time. Your risk level will likely be more than you’d prefer, and you’ve missed opportunities to buy low and sell high!

The short answer is you’ll miss out on the hypothetical .35% Vanguard claims rebalancing adds to your retirement and financial planning.

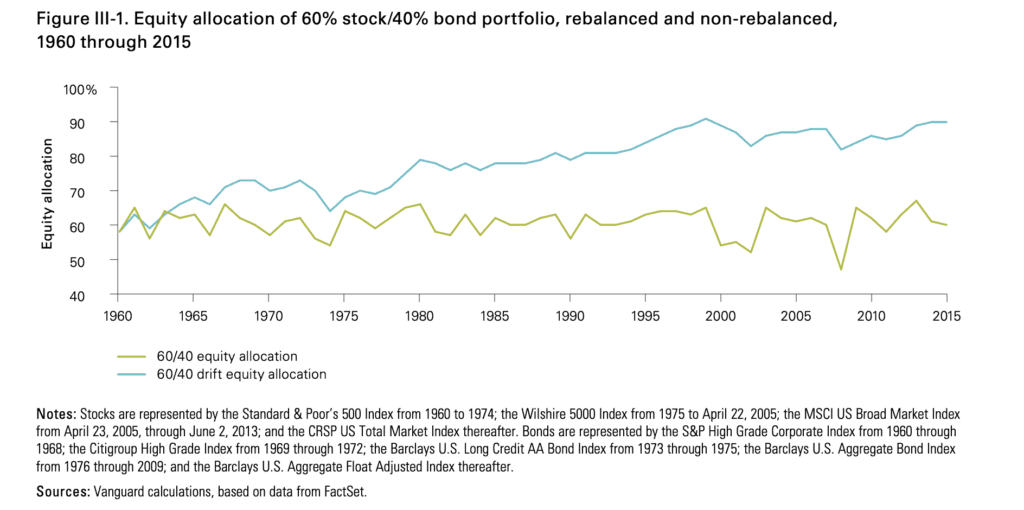

Vanguard illustrates in as little as 5 years your portfolio would be way out of tolerance with your intended plan. Your 60-40 portfolio could easily jump to nearly a 70-30 portfolio as you can see from 1960 to 1965 on the chart:

It only gets worse the longer your portfolio gets neglected!

Within a few short years, your asset allocation was completely out of whack from your original investment plan. That quick 5 year period pushed your stock allocation up by about 9% higher than the 60% you started with.

Did you intend on having that much risk? This becomes critically important if you’re retired or nearly retired. A 70-30 allocation is relatively aggressive, and I’m guessing you probably want less risk in retirement.

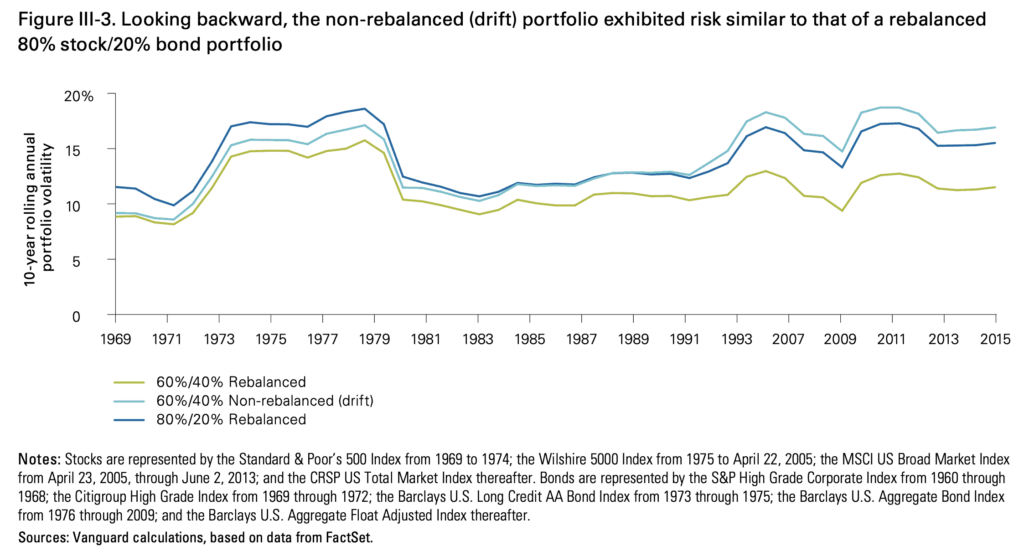

Vanguard also illustrates that over the 45 year period from 1969 to 2015, a 60/40 portfolio with NO rebalancing exhibited the same risk as an 80/20 portfolio which was rebalanced.

If you’re going to take the risk of an aggressive 80/20 portfolio with your 60/40 allocation, you might as well get the higher returns of an 80/20 portfolio and have someone rebalance it for you!

As I’ve said several times portfolio rebalancing reduces your investment risk by keeping your asset allocation close to target over long periods of time. You’re probably wondering “Can I actually make money by rebalancing?”

Can portfolio rebalancing actually actually make me more money?

Portfolio rebalancing simply and consistently forces you to buy more shares when they’re cheap relative to the rest of your portfolio using the money you sold from shares that were expensive relative to the rest of your portfolio.

It’s the ultimate “buy-low and sell-high” strategy!

Again, rebalancing pundits (dare I say “lazy brokers”) may argue you’ll make more money NOT rebalancing. This entirely depends on market conditions and volatility of asset classes versus each other. It also depends on how aggressive you are.

The two most non-correlative asset classes are stocks and bonds. If you’re really aggressive at 100% stocks, there’s not much to rebalance as stock asset classes are more closely correlated. If you’re really conservative in all bonds, again there’s not much to rebalance.

The closer you get to 50% stocks and 50% bonds the more likely you’ll be able to take advantage of rebalancing trades . . . BUT, your asset allocation is more important than trying to gain an edge with rebalancing. If your asset allocation plan is 70% stock and 30% bond that’s more important than rebalancing your portfolio.

Also, if you’re willing to let your portfolio drift more aggressive than your initial investment plan then they may be right. Most investors have a rebalancing plan because it matches their financial and retirement goals. Drifting far from that plan is certainly not in line with your original intentions.

Rebalancing DOES forces you to sell your winners and DOES force you to buy your losers. Just keep that in mind as you create your rebalancing plan.

All of that being said, it controls risk and it can also improve your returns.

Portfolio rebalancing and asset LOcation

Asset LOcation is very important . . . perhaps one of the most important tax strategies you can use! It’s important because asset classes have different tax consequences. Putting tax-efficient asset classes in tax-deferred accounts doesn’t make sense if you have tax-inefficient asset classes you could put there.

You wanna hear a great story? Early in my career, a new client brought their Primerica Financial Services account statement to me. The Primerica advisor literally put municipal bonds (which are tax-free) in their IRA. Not only was this stupid, but it also made tax-free investments taxable upon distribution! So yes, asset LOcation is very important!

Part of your initial asset allocation plan should have considered some form of asset LOcation. Putting taxable bonds in a taxable account and international stocks in your IRA just doesn’t make sense for most people!

Here is the ordering of asset classes and tax efficiency in a very simple form from most tax efficient to least tax efficient:

- International and Emerging Stock Markets (very tax-efficient due to the foreign tax credit)

- US Stocks (value stocks being less tax-efficient than growth)

- Real estate (REITS typically have a higher dividend)

- Taxable bonds (longer and higher-yielding bonds less tax-efficient than shorter higher grade bonds)

I realize the asset LOcation process is complex if you have multiple accounts and asset classes, but it’s worth it! Especially when your tax bill comes in!

Portfolio rebalancing in summary

Portfolio rebalancing takes a lot of time and energy to do right. You can adjust your drift targets in calm or volatile markets, angle your high-tax assets into tax-preferenced accounts and your highest growth assets into your tax-free accounts (Roth and HSA), and rebalance more or less frequently based on several factors. Portfolio rebalancing is worth it though!

Vanguard says it’s worth .35% as a matter of fact. I believe them . . . RETRACTION! I don’t believe them.

I did a study on a 50/50 portfolio through the “LOST DECADE” from 2000 to 2010. Simply rebalancing annually added over .60% during that period! So .35% is very realistic (if not conservative in my humble opinion).

If you don’t have a portfolio rebalancing plan in place, you should seriously get one! Start with a simple portfolio and give it wide drift targets with annual rebalancing. As you get more and more comfortable, tighten the drift target which will trigger more rebalancing trades until you reach your unique optimal point. You can also review for rebalancing opportunities more often than annually.

Overall, you’ll enjoy less investment risk and volatility, potentially greater returns, and a better investment experience!

Portfolio rebalancing frequently asked questions

Portfolio rebalancing is the process of buying and selling portions of your investment portfolio in order to bring the overall investment plan back to its originally intended state. It reduces your investment risk and can even improve your investment returns by methodically forcing you to buy low and sell high.

Asset allocation is the process of blending multiple investments with differing volatility and return characteristics together in order to reduce overall portfolio risk while achieving your investment goals.

Asset LOcation (different from asset allocation) is the process of locating less tax efficient investment assets in accounts which have greater tax advantages and more tax efficient investments in accounts that don’t enjoy tax advantages. Typically tax-free accounts (Roth, Health Savings Accounts) would be filled with aggressive growth assets first, then highly tax-efficient investments (international and emerging markets funds) would be located in taxable accounts, with the rest of your asset allocation (usually less tax-efficient investments) being located in pre-tax IRA’s or 401(k)’s.