In recent years donor-advised funds have exploded onto the wealth management scene due to their incredible flexibility, tax advantages, and the ability to do something great for your favorite charity! In fact, in 2015 the Fidelity Charitable Gift Fund overtook United Way to become the single largest recipient of charitable funds in the United States.

Given this popularity, it has become common for many of our clients to reap the benefits of a donor-advised fund (while doing something great for the world at large)!

What are donor-advised funds?

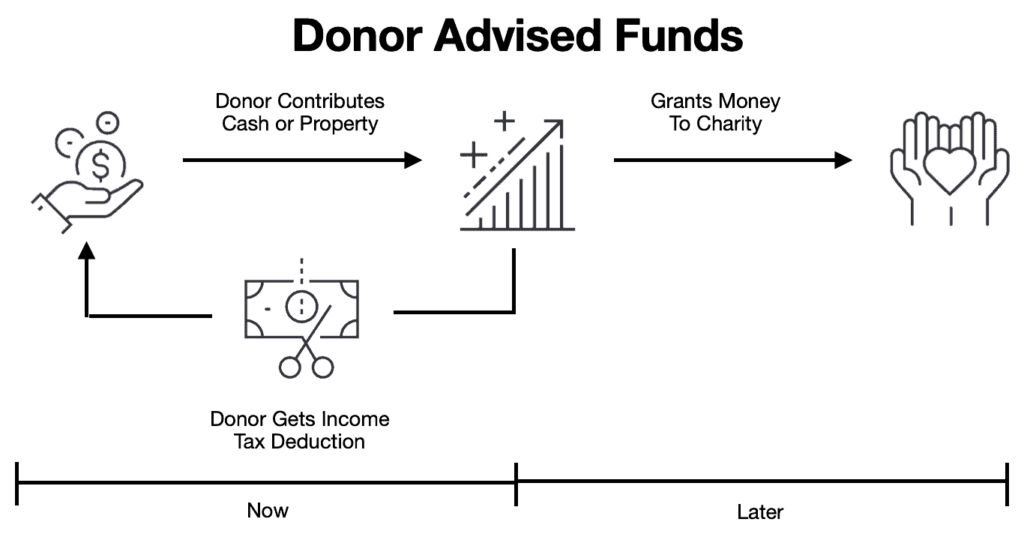

A donor-advised fund (DAF) is a private fund run by a third party and created in order to manage and facilitate charitable donations for individuals, families, and organizations. Donor-advised funds are 501(c)3 charitable organizations which can be funded with cash, securities, or even tangible assets (like art).

Because of their tax-preferred status, donations made to donor-advised funds are eligible for tax deductions. In the case of donated securities or other valuable assets, they can continue to grow in value after the donation is made.

Donor-advised funds are especially useful for those who are charitably inclined and looking for ways to minimize their current tax burden. So, if you’re looking for a way to reduce your tax hit and want to help out a qualified charity of your choice in the process, a donor-advised fund may be the way to go!

How do donor-advised fund tax deductions work?

A donor-advised fund can offer significant tax benefits to those who can use them. If you’re donating cash you’ll enjoy an income tax deduction of up to 60% of your adjusted gross income (AGI). Any remaining non-deductible amounts can be “carried forward” for up to 5 years for additional tax benefits.

If you’re donating appreciated securities to a donor-advised fund you’ll enjoy a tax deduction up to 30% of your adjusted gross income! You’ll also avoid paying capital gains tax on securities you contribute to a donor-advised fund.

Another huge benefit of contributing to a donor-advised fund is that you can take a current tax deduction for donations to the fund and decide what charity gets the benefit at a later time. For example, if you set up a DAF and make a $100,000 cash contribution (assuming your AGI is $100,000), you’ll get up to a $60,000 tax deduction now, but you can wait years to ultimately decide which charity the donation is made to. Again, the unused $40,000 can still be “carried forward” for up to 5 years.

Donating appreciated securities to a donor-advised fund can really have some great tax benefits! For example, let’s say your adjusted gross income is $75,000 and you purchased 100 shares of Apple in the 1990s when the stock price was only $1 per share. Assuming a current price of approximately $365 per share, those same shares went from being worth $100 to $36,500 . . . not a bad return on investment!

In this case, you’d be able to receive a tax deduction for up to 30% of your AGI ($22,500). But what happens to the remaining $14,000 ($36,500-$22,500)? Like the previous example, this unused amount can be carried forward for up to 5 years. You’ll also avoid paying capital gains taxes upon the sale of those shares because they were transferred to the 501(c)(3) qualified donor-advised fund.

In the case of donated securities (or other valuable assets), they can continue to grow and appreciate tax-free. Your ultimate charity will truly thank you!

The disadvantages of a donor-advised fund

Even though there are plenty of benefits to using a donor-advised fund, I would be remiss to leave out the disadvantages as well. As we all know, no investment vehicle is perfect.

- Donations Are Irrevocable – Donor-advised fund contributions are made irrevocably. This means once you make the donation you can’t get it back!

- DAFs Are For The Rich – Another criticism is they are often seen as exclusively for the wealthy. Although this is not always the case (and depends on the fund in question), there are often high minimum donation amounts ranging from $5,000 to $25,000 or more.

- Custodial Fees – You’ll also need to take into account the fees associated with DAFs as well. Typically, administrative fees on DAFs are around 0.6% on the account balance, which are paid directly to the custodian.

- Investment Fees – There are also fees on the investments themselves which vary widely depending on the investment plan you choose.

- Advisor Fees – There may be fees from your advisor to orchestrate and manage this entire process, which again, depends entirely on your unique situation and what you’re trying to accomplish.

- Limited Investment Options – Depending on what your donor-advised fund custodian can handle, your investment options may be limited as well, although you’ll typically have a wide range of mutual funds and other securities to choose from.

While they’re not without some downsides, they can still be an excellent way to slash your taxes and make the world a better place! However, it’s important to do your research and due diligence before making any decisions.

Donor-advised fund vs. private foundation

Some investors prefer to create a private foundation over contributing to a donor-advised fund. One major consideration when choosing between a DAF or a private foundation is the cost and time associated with both.

Donor-advised funds really have no startup costs. There are however large costs and administrative/compliance burdens for a private foundation which can take a year or more to set up!

Furthermore, donations made to a donor-advised fund offer a greater immediate tax deduction. The tax deduction to a private foundation works the same as one to a donor-advised fund, although the tax deduction is less. For example, tax deduction limits for donations of cash are capped out to 30% of adjusted gross income (donor-advised fund is 60% deduction), while gifts of stock or other securities are limited to 20% of adjusted gross income (donor-advised fund is 30%).

Private foundations are also subject to a 1%-2% excise tax on investment income and must expend 6% of the net asset value of the foundation every year.

A private foundation has more control over the assets which are donated. Once the contribution to a donor-advised fund is made, the donor is no longer in control of the assets as the donor-advised fund has control.

There are a few benefits to having a private foundation, however. A private foundation can be passed on to your heirs and even be used for succession planning purposes.

Regardless of your choice, you’ll still enjoy some great tax advantages along with the proud feeling you’re doing something great for the world by helping your favorite charities out.

Which donor-advised fund is best for me?

What are the best donor-advised funds? Which is right for you and your financial goals? It really depends. You’ll find some of the larger financial custodians such as Schwab, Fidelity, Vanguard, and Goldman Sachs offer donor-advised funds. They each have their own costs and benefits which must be analyzed.

At Redrock, we take the burden off your shoulders and do the research for you to find the best donor-advised fund possible. Because we are an independent, fee-only financial planning firm we are not obligated to recommend any particular DAF over another, and we do not receive any kind of compensation from the donor-advised fund itself.