Bitcoin took the world by storm from 2016-2018 as its price skyrocketed. Investors that purchased Bitcoin prior to 2016, especially those that purchased prior to 2013, saw their initial investments increase astronomically as we approached December 2017. Some investors even believed Bitcoin could help them retire early!

Stories of teenage millionaires fueled a media and investor frenzy. But, can Bitcoin or other cryptocurrencies help you retire early and is it a wise investment?

Let’s find out.

1. Bitcoin Is a Currency

What is a currency anyway? Currency is any system that is used as money in a particular place and between people.

We’re familiar with the flat pieces of metal and paper that are in circulation today and whose value is derived from the demand for goods and services obtained in exchange for money. The history of currency is fascinating.

Thousands of years ago, goods such as food, clothes, and weapons were used as currency. It wasn’t until around the 11th century that paper money was introduced as currency in China. Barterers in Asia and the Middle East also used precious metals, which eventually evolved into the use of standardized coins.

More recently, we have seen the transition of money from paper and metal to digital cash and transactions. Modern-day currency, whether tangible money or digital numbers, is still valuable because of the demand for it.

Enter Bitcoin, the unintentional invention of the mysterious Satoshi Nakamoto, the pseudonym used by the individual(s) that created it.

What are cryptocurrencies?

Bitcoin was the first and is probably still the most widely talked about cryptocurrency among the more than 2000 coins that now exist and can be traded today.

Bitcoin, as well as other cryptocurrencies, are:

- A digital currency secured with cryptographic technology

- A decentralized currency system with no regulating authority

- A database of limited entries that no one can change and backed by mathematical protocols

Cryptocurrencies use blockchain technology which makes transactions easier. The first forms of digital cash were DigiCash and CyberCash. One problem with these payment systems, however, was the issue of double spending, which is when one system with a central server spends the same amount twice. Double spending essentially led to the failure of these digital payment systems.

Bitcoin solved the problem of double spending by forming a decentralized system and introduced blockchain technology to have a perfect record of all Bitcoin transactions.

“When a transaction is confirmed, it is set in stone. It is no longer forgeable, it can‘t be reversed, it is part of an immutable record of historical transactions of the so-called blockchain.”

What’s a blockchain anyway?

Let’s briefly explain what blockchain technology is, albeit in an over-simplified manner. Blockchain is one of the reasons that people are so excited about the future of cryptocurrency, even though blockchains aren’t new, they have simply evolved. Nor is a blockchain exclusive to cryptocurrency, as you’ll see.

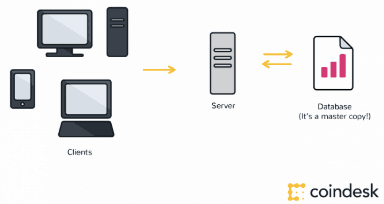

Blockchain technology has grown in hand with the internet. Think about a news website. Every day, the journalists write pieces and the different managers post those articles onto a single page, visible to you on your computer. Editors may make some corrections and unscramble words, and every time you access the page, you see the latest and most up to date version, or the ‘master copy’ (courtesy to Nolan Bauerle for the idea).

Image: Maria Kuznetsov, coindesk

All those uploads, edits, and changes are stored on a server, which constantly is updating the new inputs. The writers and editors have access to that server, surely via a password and a username.

The chain of information from computer to a server to master copy that is visible to all is a blockchain—more precisely it is a centralized (due to the server) blockchain.

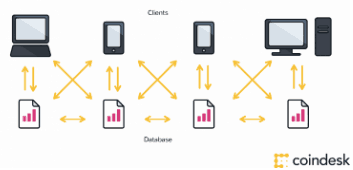

Satoshi Nakamoto’s blockchain is largely decentralized because there is no ‘single’ central server that stores data – although, experts in this arena are quick to clarify that cryptocurrency blockchain is still logically centralized (the system acts as a whole) but politically and structurally decentralized.

For our purposes, the benefit of a mostly decentralized blockchain is an alleged improvement in privacy and security. The safety comes from the cryptography, which essentially translates into the need for less personal information in order to make a transaction (not exclusively a monetary transaction, but any digital change, which could include moving money, changing a name, and so on).

This improves privacy because your name, social security, and other identifying pieces aren’t necessary as they are with most centralized government and bank blockchains. These institutions have access to all of our personal information, making privacy a real concern. But cryptography makes it virtually impossible to know the identity of the user.

Image: Maria Kuznetsov, coindesk

A centralized blockchain needs authentication (your password, social security number, etc.) while a largely decentralized blockchain requires authorization via a private cryptography digital key.

So, blockchain is a ledger of information that uses the unique storage methods mentioned above. And the technology doesn’t just store cryptocurrency information. It can be used to store nearly any type of digital info and be used to do things like build games, e-commerce stores, social networks, and any other digital dream someone may have. That’s why people are so excited about it because it seems to have unlimited potential.

So what’s the future for Bitcoin and other cryptocurrencies?

Underneath the technological noise surrounding cryptocurrencies, it still remains just that—a currency. Investing in currency isn’t wise because it’s impossible to time the fluctuations of the value of a given currency.

Furthermore, cryptocurrencies are unlike traditional money. No paper notes or metal coins are involved. No central bank issues the currency, and no regulator or nation-state stands behind it. Instead, cryptocurrencies are a form of code made by computers and stored in a digital wallet. Transactions are recorded on a public ledger called blockchain.

2. Unclear Use And Future Of Bitcoin

Who even uses bitcoin? Is it only used on the dark web?

Bitcoin remains largely unused globally, however paying for goods using Bitcoin and other cryptocurrencies is a practice that has gained some traction. Some of the companies that accept Bitcoin include:

- Microsoft, Overstock, Expedia, and KFC Canada

- Some Starbucks, as well as Nordstrom and Whole Foods via the Flexa app

- Some ATMs offer cash payments and remittances using Bitcoin

- I actually saw a Bitcoin machine in a local restaurant recently here in Las Vegas which was quite surprising!

And yes, Bitcoin can also be used on the dark web. The dark web is part of the internet that is only accessible using special software and allows the user’s activity and identity to remain anonymous. The dark web is not inherently malicious, however, it is often used for illegal activity such as drug dealing, stealing, human trafficking, and terrorism.

The dark web isn’t exactly the place that anyone would want to be making traceable transactions. Since Bitcoin is inherently anonymous it has served as a perfect form of payment to be used for illegal activities. Because of this, a huge fear of the US government has been the funding of terrorist groups using Bitcoin via the dark web, something that proponents of increased cryptocurrency regulation often cite.

Can my money go missing?

Yes, your money can go missing with cryptocurrency investing. Money can be lost due to:

- Decreasing value of a particular coin, as seen in early 2018

- A hacking event

CNBC reported that in 2018 $1.1 billion dollars were stolen from cryptocurrency owners, and it’s apparently very easy to do. As the article points out, cryptocurrencies are not insured by third parties or protected by institutions such as banks—remember Bitcoin is a decentralized currency.

Can you guess which country in the world was the most targeted for crypto-related cybercrimes? None other than the United States of America.

3. Bitcoin Value Is Tied To Supply And Demand

Bitcoin was created with a limited supply, but the number of different cryptocurrencies seems to be unlimited.

Currently, there are only two ways to obtain coins. The first is to buy a portion of—or an entire—Bitcoin. The second is by mining for coins.

Bitcoin mining is complicated, time-consuming, and requires special equipment.

Purchasing coins can be done using fiat currency or by trading coins. You can buy a portion of a coin, so investing in Bitcoin does not require thousands of dollars to get started.

Trading cryptocurrencies can be done with the use of an exchange platform such as Coinbase or Bitstamp. It is also possible to also be paid in cryptomonies which can then be used on an exchange platform or be cashed out.

However, there is not an unlimited supply of Bitcoin since the original protocol capped the number of Bitcoins to 21 million, of which approximately 17 million are currently in circulation. Therefore, the value of Bitcoin is strongly tied to supply and demand.

As I mentioned above, Bitcoin was the first cryptocurrency, but now over 2000 different coins exist and that number will probably keep growing. In addition to Bitcoin, the hot coins in the exchange today are Ripple (XRP), Ethereum (ETH), Bitcoin Cash (BCH), and Litecoin (LTC) among others.

Even Venezuelan president Nicolas Maduro created, in 2018, the Petro crypto-coin as a way to sell oil and at the same time avoid the use of the dollar in an attempt to sidestep certain US economic sanctions.

Despite Bitcoin being accepted at some major retail companies, it is still largely an unused currency. The limited supply of Bitcoin could spike its value, but then again the flooding of the crypto-market with thousands of other coins may dilute that value. The future is very unpredictable and is just another reason Bitcoin is a highly speculative investment.

4 . Investing In Bitcoin Is Unlike Investing In Global Stock Market

Investing in cryptocurrency is fundamentally different than investing in the stock market.

The Global Stock Market

Let’s take the global stock exchanges for example. What are investors actually investing in with the stock market?

Well, investors, in the case of stocks, are buying shares of ownership in a public company. Companies issue stocks to raise funds for the purpose of growing the business. The market (which is now largely an online market) allows for a method of negotiation where buyers and sellers negotiate prices.

As an owner of stock shares in these public companies, your investment will participate with the ups and downs of the company profits, growth prospects, dividend payouts, economic and stock market environments. Perhaps the most important thing to remember is owning shares of a company means you expect the company to grow.

That growth comes from increased profits, profit margins, new technologies, growth prospects and more. The easiest way to understand this is to consider a big company like Coca Cola. Coca Cola is expected to growth profits over time as they sell more Coke and other food and beverage products.

Compare and contrast that to Bitcoin and other cryptocurrencies. A currency in any form does not drive or produce or grow profits—it’s simply a method of exchanging value for goods and services. It will not increase market share, solve the world’s problems, make our lives better, or sell more beverages! It’s just a currency, as is gold is just a lump of metal!

The Bond Market

When an investor buys bonds, he or she is buying a debt obligation which the borrowing party has to pay back (the principal and the interest). Government bonds often provide a more certain repayment of promised cash flows than corporate bonds.

Besides the potential for providing positive expected returns, another reason to hold government bonds is to reduce the uncertainty of future wealth. Bond investors have an expectation of a return of principal AND interest payments because they’ve loaned the government or company their money and expect an investment return for that risk.

Compare and contrast that again with Bitcoin and cryptocurrencies. At least with an investment in bonds, you have a high expectation of a return on your investment! Not so much with cryptocurrencies . . .

There are many factors that affect stock prices such as news, company reports, and supply and demand. The same is true with bonds—they fluctuate based on the credit of the issuer and current rates in the economy.

The price of a stock or bond reflects the return investors demand to exchange their cash today for an uncertain but greater amount of expected cash in the future. It’s just more transparent than something like a cryptocurrency which doesn’t promise to repay anything and doesn’t have a business to produce and grow profits.

When you invest in Bitcoin you are investing in a currency. It’s impossible to time fluctuations in the price of the currency. It’s a fundamentally different form of investment compared to stocks or bonds and therefore does not provide a clear picture of future wealth. There is no reasonable expectation that holding one Bitcoin today is going to translate into additional Bitcoins being gained over time.

High Volatility of Bitcoin

The argument could be made that stocks, bonds, commodities, and real estate also see volatility and are common investment vehicles for many people. So why not also invest in Bitcoin?

To date, cryptocurrency behavior has been unpredictable and we don’t have a large body of data on the crypto-market since it’s still in its early stages.

Over the last couple of years, Bitcoin has provided investors with something akin to a joyride in a muscle car that then turned into a nightmarish nosedive off a cliff. The media clung to the Hollywood-like stories of newly minted Bitcoin millionaires that fueled an uptick in investments as the price of Bitcoin peaked to around $20,000 USD (up from its original price of just pennies a few years earlier) on December 17, 2017.

Unfortunately, what followed were stories of investors gone bust as the price subsequently fell, like a bird nose-diving to catch its prey.

The volatility of Bitcoin is fueled by various factors, including:

- Market Size

- Pump and dump rumors

- Regulation attempts

- News

The market size of Bitcoin affects its price because it’s a relatively small market compared to the global stock market. The former has a market cap of around $800 million dollars and the latter has a cap of over $76 trillion. Smaller markets tend to have greater volatility when compared to larger ones.

Rumors add to the volatility of Bitcoin in a peculiar way. Being that Bitcoin, and other coins, are fairly new and confusing (yet at the same time are creating millionaires), many people want in on the game.

One way to find out about these coins is to join an internet forum. Here, you may encounter the effects of a ‘pump and dump;’ a pre-planned practice involving a group of forum users that artificially inflates the price of the coin and is followed by a swift selling-off period that causes the price to drastically fall. Kind of like the “boiler rooms” of Wall Street which prey on unsuspecting investors.

If you are the victim of a pump and dump, you won’t be in on the secret. You will only hear about the buzz that creates the rise in the price, pressuring you to buy in and you’ll invest money, and then you’ll be left hanging during the rapid price drop. It’s those that create the pump and dump that make a profit.

Attempts to regulate Bitcoin, or even rumors of regulation, can create volatility as the regulations cause uncertainty as to the future of cryptocurrencies. The US, China, and South Korea are but a few of the countries that announced planned regulations of the cryptocurrency exchange.

News also contributes to the volatility. News can be positive or negative.

For example, over the last couple of years, South Korea has given the go-ahead for the use of Ripple (XRP) blockchain technology that would improve the speed and safety of certain financial transactions and remittances to other countries. This news helped to drive up the price of XRP. Negative news, such as regulations or government threats to disallow cryptocurrencies and major hacking stories all tend to drive prices down.

All of these factors are out of your control and the lack of regulation essentially eliminates any form of control and oversight—making Bitcoin a risky and highly speculative investment.

5. How To Retire Early—With or Without Bitcoin?

If retiring early (or retiring at all) is one of your goals, you’ll know that in order to successfully do so it takes great planning and lots of discipline. The problem with Bitcoin is that it fuels our modern day human desire to get rich quick.

Yes, some people got very lucky with Bitcoin, but really only those that invested in its early stages and even they couldn’t have guessed how good it was going to turn out for them.

The safest way of retiring early is mastering financial basics such as expense control, maximizing savings, practicing sound investing, and finding ways to increase income. For most people, Bitcoin shouldn’t be part (or at least be a large part) of their overall plan.

But, what if you have financial house squared away and have some extra disposable income and time on your hands? Maybe you’re wondering . . .

Can I Make Money With Bitcoin (And Other Cryptocurrencies)?

You can make money investing in Bitcoin with a short term horizon, but it would not be easy and would be nothing like investing in the stock market. Additionally, it’s effectively the same as coming to Vegas and putting it on black or red – it’s gambling!

Longterm, Bitcoin is not proving to be a wise investment due to several reasons, namely the fact that like any other currency it’s just a form of transferring value and doesn’t have or produce any value itself.

Never forget the driving forces of Bitcoin volatility mentioned above.

Money can, theoretically, be made with cryptocurrencies if you were to approach it as a day trader. Like more conventional stock market day traders, there can be many losers and some winners.

Day trading Bitcoin is based on buy low and sell high principles and requires a high tolerance for risk plus a large time commitment if you are doing it yourself. However, some people use trading bots that can perform 100s of trades per hour and operate 24/7 looking for opportunities to make money.

The bots aren’t free though, they charge monthly subscriptions and take a percentage of any earnings. Not only that, but according to many Bitcoin trading bot review websites, the bots can make poor trading decisions depending on how the bot was programmed.

Personally, I’d never day trade anything let alone Bitcoin or cryptocurrencies. I’d rather enjoy the craps table and I don’t even gamble! it’s foolish and in 24 years of advising clients on retirement strategies, I’ve never seen one client come out ahead by gambling or day trading.

Although Bitcoin recently attracted the eyes of the world, its long-term success is tenuous at best. It remains a highly volatile currency in an unregulated market.

For most people, especially those that want to begin investing today, long after the first miracle run of Bitcoin, investing in BTC shouldn’t be part of their retirement plan. For some, like those that have a strong hold on their finances, Bitcoin may provide some opportunity for speculative earnings, but then again, so do our slot machines! At most, Bitcoin should have a limited role in a well-diversified portfolio.

If you are thinking about how to retire early and see Bitcoin as an opportunity, talk to me first. Together, we can come up with a solid financial plan for your future.