Investing in gold is always a hot topic for investors. I have a burning question for you:

If investing in gold is so great, why is it marketed like ShamWow?

If you haven’t seen the ShamWow commercials, they’re pretty funny:

I’ll start with this: Gold (and other commodities) should play some role in any well-balanced investment portfolio. But the hype surrounding gold really does feel a little slimy to me.

Since this is one of the most common questions I’ve answered in over 25 years of advising clients, I figured I’d dig a bit deeper. Should you be investing in gold? If so, how much?

Investors Buy Gold For Different Reasons

Let’s start by dissecting why anyone would want to invest in gold. It doesn’t produce a profit, it doesn’t make the world a better place, it’s just a lump of metal. So why invest in gold?

- Many investors buy gold for performance. They anticipate it will grow in value. Remember, gold doesn’t pay a dividend or create profits of any kind. It’s just a piece of metal, so any gains must be capital in nature and come in the form of buying low and selling higher.

- Others invest in gold as an inflation hedge. One of the biggest fears for an investor – especially a retired investor – is inflation. After all, if the real cost of goods and services you need to live rises substantially you’ve only got so many dollars to purchase those things with. Your dollars run out faster! For this reason, some investors buy gold as an inflation hedge.

- Some invest in gold as a diversifier. We all know the old adage “don’t put all of your eggs in one basket!” Just like we diversify our stocks into mutual funds with hundreds or thousands of stocks, gold can be added to an investment portfolio as a diversifier. Gold—and other commodities—are quite non-correlative after all. They don’t go up and down in value along with most other assets. Rather, gold and other commodities fluctuate in value quite independently of the major asset classes (stocks, bonds, and cash).

One final reason is fear. Some investors fear the dollar will collapse and the Zombie Apocalypse is around the corner. They think if the dollar is worthless, all trade will be done with chunks of gold. The value of gold would then rise, and you could trade for goods and services with it.

For those worried about Armageddon, I recommend forgetting the gold and invest in bullets and guns. After all, you’re going to need to protect your gold stash somehow, and if you don’t have bullets and guns someone will take your gold with their bullets and guns.

Additionally, there’s a new “sheriff” in town – Cryptocurrencies. Things like Bitcoin are quickly becoming a way to diversify your dollar holdings into a (currently) unregulated digital currency.

For the first group of the bunch, let’s take a look at gold’s investment performance.

#1 Investing In Gold For Performance

The “gold buggers” claim it’s a good investment because it grows over time. But does it really?

This claim is based entirely on 2 of the last 5 decades, the 70’s and 2000’s. Indeed, if you were to look only at those two time periods, gold performed amazingly well!

How Did Gold Fare During The 2000’s?

Let’s see, in the 2000’s our economy dealt with:

- Tech bubble bursting

- 9/11 terrorist attack

- 2008 real estate meltdown

- Record oil prices (and recent collapse)

- Numerous natural disasters

- Wall Street scandals

Gold became a “safe haven” so to speak. It was the place to be invested because nothing else felt safe or good.

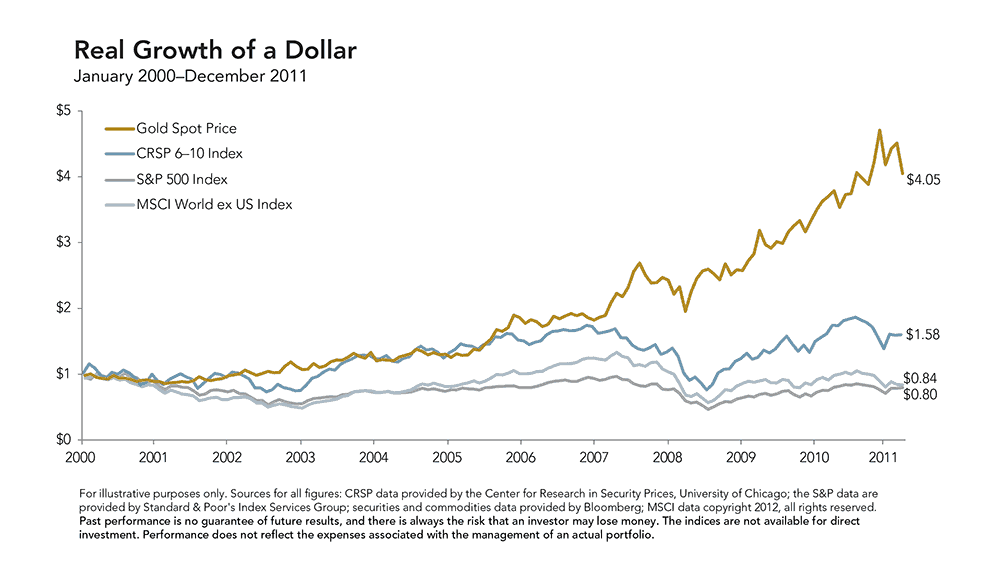

Consequently, gold dominated every major asset class through the first decade of the 2000’s, From 2000 through 2011, adjusted for inflation:

- Gold +12.3%

- S&P 500 -1.88%

- MSCI Non-US Stock Index – 1.4%

- CRSP Small Cap Stock Index 3.9%

Don’t be fooled, however! The stock market (as measured by the Dow Jones) dropped into the 6,000 range in 2008. Now it’s nearing 35,000! Investments are volatile and tend to move in cycles, both up and down.

Gold in 1999 was at a 20 year low! This isn’t entirely different from the Dow Jones being in the 6,000 range in 2008. Gold started the decade at such depressed prices, it was destined for some recovery. Does that alone make it a good investment?

What About The 1970’s? How Did Gold Perform?

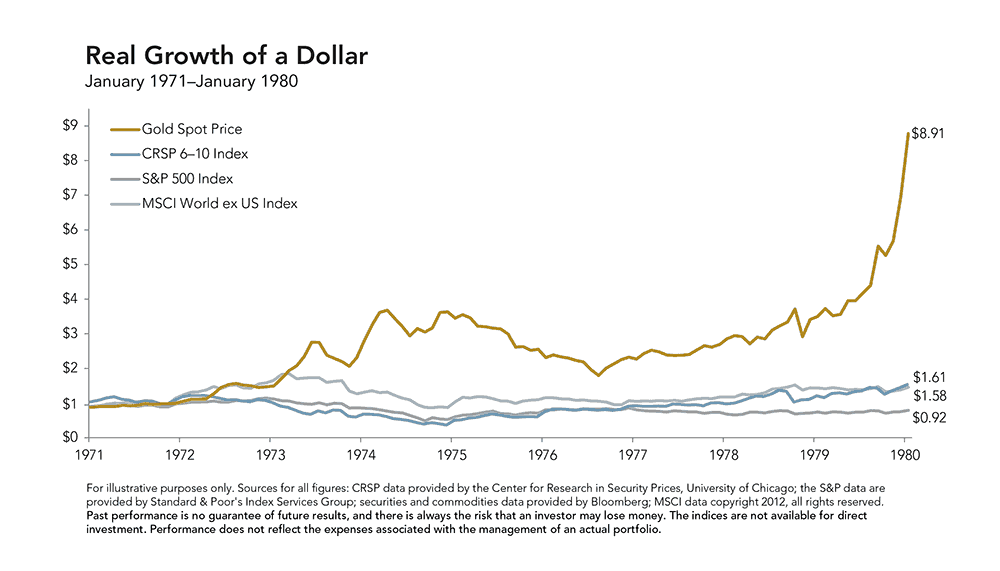

The ’70s were another very strong period for gold’s performance:

Again, an investment in gold during the 1970’s proved to be quite smart! But what happened in 1971?

I wasn’t “quite” born yet, but I was close. While I don’t remember this, the United States went off the gold standard in 1971. The price of gold was reset to $38 per ounce.

Gold and the dollar were no longer tied together in 1973. This finally allowed the value of gold the flexibility to float on its own.

Here’s the rub: investors couldn’t actually buy gold until 1975. You may not remember, but there were restrictions on owning gold put in place in 1933. Investors couldn’t even buy it! This means most people missed a good chunk of gold’s appreciation – the first half of the 1970’s.

How did this affect performance? Gold for the entire decade (January 1970 to January 1980) was +27%. Since you couldn’t actually invest in gold until 1975, how do the real results shake out?

From 1975 to 1980 inflation-adjusted annualized returns were:

- Gold +18.4%

- CRSP Small Cap Stock Index 28.9%

- S&P 500 +6.9%

- MSCI Non-US Stock Index 9.4%

Also remember, the first part of the 1970’s the United States dealt with:

- War

- An oil crisis

- A massive bear market (’73 & ’74)

- Worldwide conflict and tension (Middle East and USSR)

In fact, doesn’t the early 1970’s sound a lot like the early 2000’s? From a political and economic unrest viewpoint, I think we can all agree they have remarkable similarities.

Does it make logical sense to invest in gold based on strong performance for 15 years (discounting 1971 to 1975 when you couldn’t invest in gold) out of the 40 year sample period?

Gold’s Real Performance

I’d argue it doesn’t make sense to be bullish on gold based on past performance. 21 out of 49 years sampled isn’t enough to get me excited about gold as an investment.

The stock market, after all, returns positive roughly 3 out of every 4 years. Gold’s 22/50 years is 44% of the time. I’m sure there will be other positive—yet unremarkable—years for gold. Regardless, it doesn’t have the strong long-term results of the stock market.

Gold’s performance relative to other investments throughout the entire sample period is quite bland (putting it nicely):

From the ’70s through mid-2020 (including when you couldn’t own gold from ’71 to ’75), inflation-adjusted annualized returns are:

- Gold +4.03%

- S&P 500 +6.3%

- MSCI Non-US Stock Index +4.67%

- CRSP Small Cap Stock Index +7.24%

In reality, since investors couldn’t own gold until 1975, gold’s allure fizzles sharply. From 1975 through June 2020, inflation-adjusted annualized returns are:

- Gold +1.58%

- S&P 500 +7.78%

- MSCI Non-US Stock Index +4.90%

- CRSP Small Cap Stock Index +9.57%

Gold Plain Stinks In Normal Economic Times

Let me clarify that headline above. You can see similarities in political and economic turbulence in the 1970s and 2000s. In the ’80s, ’90’s, and 2010’s, not so much.

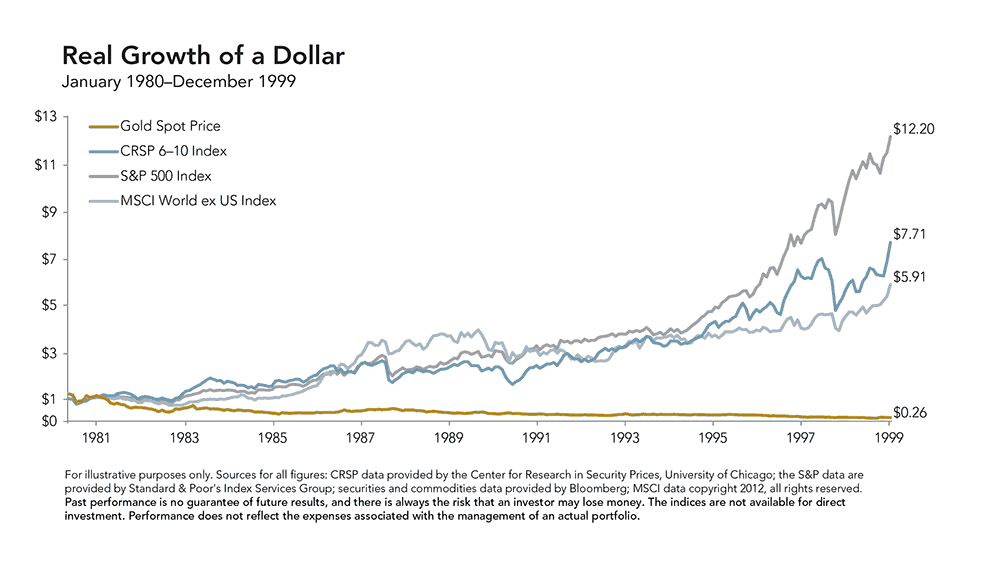

I’m referring to the three decades from 1980 through 1999 and 2011-June 2020 as more “normal” times. During this 30 year period, gold was a complete BUST!

The 20 year time period from 1980-1999 had massive global economic expansion and far less political anxiety. The stock market went on a tear, giving investors dynamically positive returns!

In inflation-adjusted annualized returns:

- Gold -6.5%

- S&P 500 +13.3%

- MSCI Non-US Stock Index +9.2%

- CRSP Small Cap Stock Index +10.7%

In real terms, a dollar’s worth of gold dropped to 26 cents over that 20 year period! Yet your stock investments—even your bond investments—had substantial and positive returns.

In the last 10 years, the story remains the same. In inflation-adjusted annualized returns:

- Gold +0.64%

- S&P 500 +10.85%

- MSCI Non-US Stock Index +1.65%

- CRSP Small Cap Stock Index +6.74%

In real terms, a dollar’s worth of gold increased ONLY 6 cents over that 10 year period! Yet your stock investments—particularly your US stocks—had substantial positive returns.

#2 Investing In Gold As A Hedge

Some people buy gold as an inflation hedge. Inflation is a nasty fact of life. It erodes our purchasing power over time as consumer prices march higher and higher.

But is gold a good inflation hedge?

From 1980 to June 2020, gold’s price rose quite a bit. The problem is the rise is in nominal dollars. After you adjust gold’s price for inflation, the returns aren’t so great.

For the roughly 40 year period ending June 2020, gold rose from $1 to $3.46, in nominal dollar terms. Inflation during the same timeframe grew at an annualized rate of about 3.1%.

Once you account for inflation, gold grew from $1 to $1.03, which translated to an inflation-adjusted annualized return of ONLY 0.074%. Gold, therefore, barely kept pace with inflation. Does that make it a “hedge”? Or would you be better off allocating your gold investment to T-bills?

T-bills grew roughly 4.3% annualized in nominal terms or about 1.2% in inflation-adjusted terms. The math is simple, you would have been better off buying T-bills.

Keep in mind, we’re comparing and contrasting gold to inflation. Inflation isn’t very volatile, rather it’s quite consistent over time.

From 1970 through ’05, the Consumer Price Index’s standard deviation (a measure of volatility) was 1.2%. Gold’s standard deviation was 19%. This makes the price of gold 15 times more volatile than the consumer price index.

In some periods, gold has indeed served as an inflation hedge. In others, it’s failed miserably. It’s substantially more volatile as well!

Gold as an inflation hedge is true “hit or miss”! You can “swing for the fences”, just be prepared for a lot of strike-outs!

#3 Using Gold To Diversify Your Investment Portfolio

Finally, some investors choose to invest in gold to diversify their other investments. Gold, after all, is fairly non-correlative to most other asset classes.

Gold doesn’t fluctuate up and down with the stock or bond markets per se. Rather, it does its own thing! Stocks going up? It’s a hunk of metal, it doesn’t care about stocks, it may even drop. Bond’s going down? Gold doesn’t care, it marches to the beat of its own drummer.

Since gold doesn’t perform along with any other asset classes, it can be viewed as a good diversifier. The problem is gold is so much more volatile than most asset classes.

Above I mentioned the standard deviation of gold at around 19%. A 19% standard deviation rivals that of small-cap stocks on the exchange. In other words, gold’s price is HIGHLY VOLATILE!

While diversification is generally good, and gold can prove to diversify a well-constructed portfolio, keep in mind how gold produces its returns.

Investments Should Generate Economic Returns

For an investment to be “worthy”, it should generate some investment return, right? That is after all what investors want… more money coming out than they put in! But gold on its own doesn’t produce any real profits or growth.

Here’s what I mean by this. Gold is a shiny metal. It’s not a business. It doesn’t promise to pay interest or dividends. Gold doesn’t have the capacity to produce profits in a free market.

Gold—that simple shiny piece of metal—is nothing more than an opportunity to gain or lose investment capital based on future supply and demand constraints. Should the demand rise for gold, the price will rise as well. Conversely, as demand drops, the price drops as well.

What About Gold Versus Stocks And Bonds?

Contrast gold with a bond. A bond is a promise by the issuer to repay your principal investment along with interest payments over time. The issuer makes the money to pay you principal and interest through their business, municipal, or federal activities. There are real economic principles at work here!

Contrast gold with a company’s stock. The company issues shares on the open market in order to finance growth.

Let’s say it’s an ice cream truck business. The company sells you some shares so they can buy more trucks and hire more drivers.

The ice cream company expands, they grow profits by selling more ice cream to more kids. As a shareholder in the ice cream company, you’re a fractional owner in those profits. There are real economic principles at work here!

Gold, on the other hand, is just gold. It doesn’t produce anything. You can’t buy a Slurpee at 7/11 with it, and you can’t force it to grow and expand like a business. It’s just a hunk of metal.

What’s The Real Value Of Gold?

Years ago, I found this interesting quote from Warren Buffet. Mr. Buffet is considered by many one of the greatest investors of all time. In the February 2012 issue of Fortune Magazine, he said:

Today, the world’s gold stock is about 170,000 metric tons. If it were all melded together, it would form a cube of about 68 feet per side (fitting within a baseball infield). At $1,750 per ounce, it would be worth $9.6 trillion.

With the same amount of money, you could buy all US cropland (400 million acres with output of $200 billion annually) plus 16 Exxon Mobil’s (one of the world’s most profitable companies, earning more than $40 billion annually), and still have about $1 trillion in cash.

So what would you buy? All of the farmland in the US, 16 Exxon Mobil’s, and pocket a trillion dollars? Or would you buy all of the gold in the world? It is a pretty shiny metal after all!

So How Much Gold Should You Invest In?

Using gold as an investment hedge, or a diversifier, or even for what you expect may be good performance are all reasons to own gold. They may be faulty for the many reasons mentioned above, but they’re reasons nonetheless.

So if any of these arguments to invest in gold are valid, how much should you own anyway? I’d argue that since the reasons to invest in gold are shaky at best, not a lot!

Gold as a diversifier, gold for performance, gold as an inflation hedge – they’re all reasons to own gold in small amounts! Gold is certainly not an asset class you want to invest a large portion of your assets in.

Small amounts, such as 1% to 5% of a diversified, rebalanced portfolio, are reasonable to invest in gold. I’d never put 10% or more into gold, simply because it doesn’t produce any economic return (like a business or a company stock).

As part of a larger commodity allocation, gold makes some sense. Commodities, in a broader sense, also prove to be an inflation hedge and a diversifier throughout certain periods of time.

Nonetheless, as part of an overall asset allocation plan, 10% allocated to commodities is approaching the “discomfort zone” for me.

So where should you locate your gold? Definitely not under the couch!

Gold and other commodities are nothing more than an inflation hedge. I don’t expect commodities to earn the rate of return that stocks do over long periods of time.

For this reason, consider placing your commodities in your pre-tax IRA or 401k. Since the returns are expected to be much lower your taxes on withdrawal will be less as well! Or, put them in a taxable account! Since they don’t earn much they’re pretty tax-efficient! Put them wherever, just don’t own too much of them.

Investing In Gold Summary

While investing in gold has had brief periods of great returns relative to other asset classes, those periods have been short-lived. Over long periods of time, gold has failed to deliver any substantive value to an investment portfolio.

Consider keeping your allocation to gold—and all commodities—minimized. Use it for what it is, a non-producing investment asset that may provide some returns, may provide an inflation hedge, and may prove to be a good diversifier as part of an overall well-balanced investment plan.

FAQ’s

Possibly. Gold and other commodities can play an important role in your portfolio. Because they are non-correlative to stocks and bonds, they can be a strong diversifier of assets. Although, the amount of gold and other commodities should represent 5% or less of your total portfolio.

Frankly, not well! As a barometer, the S&P 500 returns positive roughly 75% of all years. Gold is only positive 44% of the time going back to 1971.

Sometimes. Over the last 40 years, gold has nearly a flat inflation-adjusted return and is extremely volatile. T-Bills have

shown to be a far greater inflation hedge, returning more than gold on an inflation-adjusted basis, but with exponentially less volatility.