Stock market investing isn’t easy!

You know very well the financial media is all about readership and viewership. They need the revenue from ad’s of course!

Consequently they’re all about the FLASHY stuff! The hot stocks, or best fund managers always grab the headlines. They prey on your fear, and your greed! They must keep you coming back and buying into their hype!

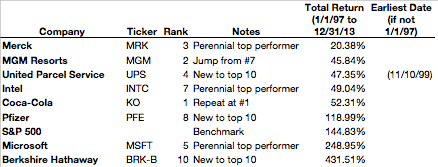

In 1997 Fortune released a list of “America’s Most Admired Companies“. While they’re not screaming buy buy buy, the article does lead one to think strongly about investing in these bulwarks of capitalism.

The fact is, individual stock investing just isn’t smart – even if you own America’s most admired companies.

Take a look at the results from America’s Most Admired Companies:

To be sure, there are some “great” companies on that list. Who doesn’t love a Coke now and then? What wonders that little blue pill from Pfizer did for an aging male population.

Just because they’re great companies doesn’t mean they’re great investments.

Underperforming a simple index investment

The S&P 500 index performance walloped 7 out of 9 of these companies (we couldn’t find #9 in the article from their top 10 list).

If you were lucky enough to have picked Microsoft or Berkshire – awesome! But I doubt you would have gone “all in” on those two alone.

You likely would have spread your money over multiple companies. This would have put your personal returns well below that of the S&P 500.

This data is RIGHT on par with the fact that about 70% to 80% of active managers can’t beat their benchmark index, just take a look at the data below:

Investing in stocks – summary

Trading stocks just doesn’t make sense from a risk/reward standpoint. It matters not whether you buy and sell, or you pay some overpriced portfolio manager to buy and sell for you.

The fact is owning stocks through broadly diversified investment portfolios is the one consistent path towards long term higher returns with less risk, stress, hassle, taxes and headaches!