Portfolio diversification loses it’s luster

I preach in my book The Portfolio Architect about portfolio diversification to capture the benefits of “non-correlative” asset classes. Over the long haul, this practice works out in your favor. In some markets, correlation factors merge towards 1 and there is little benefit to diversifying.

Last year non-correlation surely worked, and worked well! Unfortunately it actually worked against your investment portfolio.

The S&P 500 soared 13%+ last year, with non-US markets trailing far behind. We would have been better off investing in US markets than overseas. But that’s not the whole story…

Did international stocks perform poorly? Or was it the dollar exchange rate?

Part of the reason foreign markets didn’t keep up with the US markets is currency fluctuations. When you own foreign securities, you own them in foreign currencies. When the dollar is strong and foreign currencies are weak, it reduces your investment returns.

Ironically in 2006, this worked out in your favor. In 2006 a weak dollar really benefited foreign investments. In 2006 clients wanted MORE foreign diversification, not less.

Last year, foreign diversification hurt overall performance

Here’s the performance numbers:

- S&P 500 +13.69%

- MSCI Ex US World Stocks -4.32%

While your US stocks were soaring, your foreign stocks were sinking. This was due in large part due to a strong dollar.

If you look at the MSCI Ex US World Stock index in LOCAL currency (as if you lived overseas in the countries you were investing in), your return was +6.3%. Not nearly what the S&P 500 did, but a decent return no less.

So should we move more towards US markets and reduce foreign exposure? No. Absolutely not.

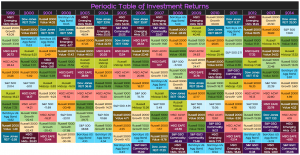

Take a look at the major market indices and notice specifically the light blue (S&P 500) click to enlarge:

The fact is there’s no way to tell which markets will outperform from year to year. The S&P 500 however, is in the bottom half of asset class returns the overwhelming majority of years.

So we diversify, and diversify, and keep diversifying. We’re assured to have the best performing AND the worst performing asset classes over time.

Fortunately, the asset classes we own all have a positive long term return. Even if they’re the laggards in a given year, they’re making money in the long term!

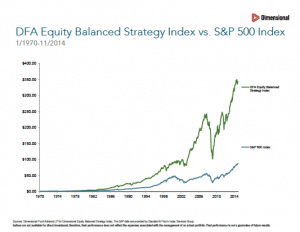

And here’s why we diversify religiously (click to enlarge):

The global markets on average (when blended together and rebalanced) far surpass the S&P 500 in returns. To only hold the S&P 500 would be a mistake of epic proportions!

Diversification in summary

Who knows if or when we’ll see another year like 2014. It was quite odd to say the least.

Non-correlation was in full effect, and as we consistently re-balanced into weak currencies and weaker foreign markets. We will hopefully reap the rewards as markets revert back to the mean.