Fall is approaching, and the “boys of summer” are winding down their seasons. I’m a Minnesota Twins fan, so the season’s end is more than welcome. Thankfully, the football season is just heating up!

If you follow baseball at all, you realize the saying, “baseball is a game of inches” is accurate. Other people argue, “football is the game of inches”, and I think that’s accurate as well.

So many sports claim to be a game of inches, and rightfully so. In the investment world, returns are a game of “basis points“.

A basis point is 1/100th of one percent. Seems simple enough, it’s just a tiny fraction of one percent. Every basis point is valuable to you however. Every fraction of one percent is crucial to your long term financial goals.

Since investing is a game of basis points, you need to be squeezing every last one! .05%, .10%, .20% – the more basis points you squeeze from your planning the better! They all add dollars and cents to your retirement after all.

Asset location is one way to squeeze some extra basis points from your portfolio. To the novice, .23% seems trivial. When you add .23% to every other “basis point squeezing strategy” we use – it’s powerful!

Asset class investing

In my book The Portfolio Architect, I explain that investing should be broken down by asset class. An asset class is a group of securities with very similar characteristics.

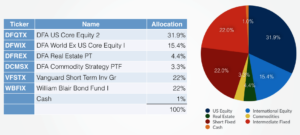

Those asset classes should be blended together to create an investment portfolio. This process is called asset allocation. For example, a moderate client may have an asset allocation like this:

Once you understand the basics of asset allocation, you need to understand how asset location works.

What is asset location?

While it sounds similar, asset location is quite different from asset allocation. “Asset allocation” is the process of blending asset classes together in certain percentages. The goal is to reduce risk and increase returns.

Asset location is the process of putting those asset classes in different types of investment accounts. Not every investment asset class is taxed the same way after all. The results of asset location should be a high level of tax efficiency.

By putting your higher tax asset classes into tax-deferred accounts and your lower tax asset classes into taxable accounts, you can effectively lower your tax burden. Saving money in taxes is a guaranteed investment return after all! Just like paying off interest bearing debt, you’re saving money that must be paid to someone else.

The concept is simple enough. It’s much harder to implement in real life however. First, you’ve got to determine which asset classes are “tax bad” versus which asset classes are “tax less-bad”.

Types of accounts & tax implications

There are four main types of investment accounts. Assuming all applicable tax laws and rules are followed, they break out as follows:

- Taxable – Investments in these accounts are fully taxable each year. All dividends, capital gains, and interest payments are taxable each and every year they’re incurred.

- Pre-tax IRA’s & 401k’s – Traditional or rollover IRA’s and 401k’s grow tax-deferred, but are fully taxable as ordinary income upon distribution.

- Tax deferred annuities – Annuity investments grow tax deferred and have a cost basis. Distributions are taxed pro-rated between the two. Part is a return of cost basis, part is a return of growth. Cost basis is distributed tax-free, but growth is distributed as ordinary income.

- No-tax Roth IRA’s & Roth 401k’s – Roth IRA and Rot 401k assets are completely tax free when distributed.

Additionally, perhaps the most tax-efficienct account possible is the health savings account, or “medical IRA” as I call them. They’re the only account which qualifies for triple tax free treatment. When handled properly, you get a tax deduction for contributions, they grow tax deferred, and withdrawals can be taken tax free for medical expenses.

Depending on your investments and accounts you hold them in, your tax implications may vary widely. The entire purpose of asset location is to minimize your overall tax burden.

Asset location, when done properly, uses your least tax efficient accounts to hold your most tax efficient assets. Conversely, it uses your most tax efficient accounts to hold your least tax efficient assets.

Tax brackets and capital gains rates

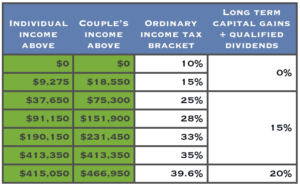

Asset location is only as relevant as your tax obligations. Retired investors in very low tax brackets don’t realize as much value as those in their peak earning years. They do save money in taxes, but the amount they save isn’t as much as it is for those in high tax brackets.

The further down this quick tax spreadsheet you are, the more value you’ll gain from proper asset location:

Again, while every investor – retired or not – can take advantage of asset location strategies, the value you may get depends on your tax bracket for income and capital gains.

High tax burden asset classes

Just as certain types of accounts have different tax implications, different types of investments do as well. An asset class is a group of similar securities. Asset classes can be broken down into very broad or very narrow target groups.

The main asset classes we use for planning are:

- Stocks

- US

- International

- Bonds

- Taxable

- Municipal (tax free)

- Real Estate Investment Trusts (REIT’s)

- Commodities, and

- Cash or Money Markets

While each asset class has varying levels of risk and tax efficiency, generally speaking, their efficiency relative to each other looks like this:

The point is simple. Investments which cost a lot in taxes should be placed in accounts which are most tax advantaged.

But it’s not that easy…

The fact is the simplistic view chart above doesn’t quite hold water. Due to the limitations placed on funding tax preferenced accounts like Roth’s and IRA’s, generally speaking they’re smaller in amount.

I would never take 100% of a Roth and fill it with commodities. Even though they’re highly tax inefficient, I wouldn’t want the volatility associated with commodities in my most “tax powerful” account (the Roth).

Additionally, commodities are nothing more than an inflation hedge. I don’t expect commodities to earn the rate of return that stocks do over long periods of time. For this reason, I’d prefer putting my most aggressive stock positions into my most tax powerful accounts – Roth IRA’s and Roth 401k’s.

The only caveat is if you’re using a health savings account properly, they are the most powerful account. If you have an HSA and are using it correctly for retirement planning, fund those first with your most aggressive stock mutual funds.

REIT’s are also fairly tax inefficient. They should be placed in your most powerful accounts with the best tax benefits. Again, I would not fill my Roth IRA or Roth 401k with 100% REIT’s. The volatility and inconsistency with REIT’s preclude it from occupying 100% of your most powerful tax accounts.

Commodities and REIT’s would be best served in variable annuities (if you own them, hopefully you don’t), and IRA’s/401k’s.

5 Steps to asset location maximization

The following is a general guide to the asset location process:

- Get an asset allocation plan. Build your investment portfolio’s asset allocation first. Asset allocation trumps asset location, because your asset allocation (in conjunction with a comprehensive financial plan) determines your ultimate financial success or failure.

- Fill your most tax powerful accounts first. Start with your aggressive stock mutual funds, US funds first, international and emerging markets next. The amount you have allocated to these asset classes should be funded first into your most powerful tax preferenced accounts. Fill up your health savings accounts first (if you have one), then your Roth IRA’s and Roth 401k’s. After those accounts are full, set aside any amounts you have left to allocate for the moment.

- Allocate your tax inefficient funds next. Commodities, REIT’s, high yield or junk bonds should fill up your IRA’s and 401k accounts first. Any additional left over amounts should be allocated back to your Roth IRA’s and Roth 401k’s.

- Allocate your moderate tax efficient funds next. Back to any stock fund leftovers you have from #2, fill up your taxable accounts next. Your stock mutual funds, if you’re a wise long term buy and hold investor, are more tax efficient than taxable bonds. Allocating them to your taxable accounts at this point will allow them to grow and eventually be liquidated long term capital gain rates. If you put them in an IRA or 401k at this point, you’re allowing the value to grow when the distributions will be taxed as ordinary income.

- Finish your allocation with taxable bonds, but consider tax free municipals. Every investor is different. Depending on your tax situation and market conditions, tax free municipal bonds may be appropriate for the remainder of your taxable account. If your after-tax yield is better with taxable bonds, fill the remainder of your taxable accounts with taxable bonds.

Depending on your asset allocation, you may have US stock funds or even international and emerging market funds left to allocate. Those would finally go into your IRA’s and 401k’s.

Remember, every investor is unique. This process gets very cumbersome and especially difficult to rebalance your investments. Asset location is however worthwhile, especially if you’re in a higher tax bracket.

Of course, I’m assuming you’re a passive investor

I purposely left out actively managed mutual funds. Passive management dominates active management.

The analysis would change, possibly dramatically, if you’re an actively managed mutual fund investor. Active management has higher turnover, and therefore exposes you to higher tax consequences.

Passively managed mutual funds have much lower turnover. They don’t actively trade securities. Since the turnover is lower, you’re already well on your way to minimizing tax drag on your investment returns.

So actively managed mutual funds are excluded from this example. I’m assuming you’re already ahead of the curve in that respect.

Asset location infographic

We ran a quick analysis with basic assumptions. The infographic to the right explains how a simple balance of stock funds and bond funds outperforms with basic asset location principles.

You’ll notice the lifetime value of this case is about 17K on a $100,000 investment. Granted, this is over 25 years, but combine this strategy with asset location between IRA and Roth IRA and you can boost returns even further!

Asset location in summary

While this strategy is fairly complex to implement, it can yield dynamic results! Anytime you’re saving taxes, it’s a guaranteed return. They say the only certain things in life are death and taxes after all!

As fiduciary financial advisors, we have highly sophisticated software to help us locate our clients assets in the most efficient manner possible. It’s just one more way we add value to our client’s retirement plans. Where this really comes in handy is the rebalancing process. Rebalancing also adds tremendous value, but without the software it would be fairly difficult to execute.

This entire post is meant to give you a general guide to boosting your investment returns by saving money in taxes. Your situation is unique, and it’s far more important you have a financial plan in place before even considering asset location strategies!