Did the stock market just die?

This is the front page of Business Week magazine 36 years ago on August 13, 1979. Given the fact that we’re 36 years past – and the markets are oh so scary right now – I thought it would be a good time to share my thoughts.

If you happened to have read this magazine cover and took your marbles and went home, you would have missed out on an average annual return of 11.78%. Put another way, your $10,000 stock market investment would be worth about $550,000 today if you stayed invested!

You have to be invested to reap the benefits

Those are pretty impressive numbers! I can’t imagine having missed out on that type of opportunity.

When the markets turn a little ugly, it’s important to remember why you’re a long term investor. Here’s a few main points to consider:

-

Remember, you don’t “own the stock market”. If you’re diversified, something in your portfolio should be doing well right now! You don’t own the “stock market”. What you probably see on the news is the Dow Jones (30 big stocks). You may even see the S&P 500 (500 of the biggest stocks).

The fact is you own some of those companies – but you likely own much much more! You own (our clients anyway) over 12,000 globally diversified companies, thousands of bond issues, and things the government can’t print like real estate and commodities.

Just because big US stocks are volatile doesn’t mean you don’t own other assets which may even be appreciating in value. Most clients actually have 35% to 50% of their portfolio in shorter term bonds. Short term bonds are definitely NOT the stock market!

-

Stock market investing can be very irrational at times. Markets are irrational, companies are rational. This sounds a bit weird, but it’s reality.

The markets are volatile because it’s humans who own and trade the securities within them. Think about this, with the click of a mouse your neighbor could be dumping tens (or hundreds) of thousands of dollars of stocks right now because they’re scared.

Emotions are why humans are poor investors. We tend to struggle separating the news from our long term financial planning.

On the contrary, companies are rational. The companies that your neighbor may have just sold haven’t changed at all overnight.

Wal-Mart is still Wal Mart, and Apple is still Apple. Their book value hasn’t changed noticeably, yet their stock value bounces around like a pogo stick because humans are prone to irrational and emotional behavior.

- We rebalance. Let’s say your allocation to global stocks is 50%. As the market drops, that 50% may become 47%.At that point in time, your bonds are very likely holding their own, trudging along. They may even appreciating in the normal “flight to quality” that happens in rough stock markets.While your neighbor is clicking away, wiping out his stock positions, we’re actually looking at your account every week to see if there are opportunities to buy a more stock a little cheaper than it was prior.That’s called “contrarian investing”, we don’t run with the herd, we go against them. To that point, the rebalancing process always assures looking to take a little profit on what’s done well, and buy a little of what hasn’t done well at lower prices.

- That 11.78% for the last 36 years was BECAUSE of the volatility, not in spite of it! That’s right, if the stock market was this nice smooth cushy ride it wouldn’t have earned nearly 12% per year for the last 36 years. Investors would have bid up the market so high that the long term yield would be something like that of bonds.You should embrace the volatility, because it’s WHY the returns are higher. To wish away the volatility is to wish away the returns.

-

You can’t be a successful investor, and an emotional investor at the same time. Returns are highest when markets are lowest. The volatility caused by your neighbor (and the big institutions) dumping his stocks pushes prices lower. This creates an opportunity for you to invest in his shares at a cheap price.

When prices are cheap, there is a higher expected return. When prices are highest, there is a lower expected return.

There’s no way to duck dodge and dive your way around the stock market drops because none of us have a crystal ball. Think about it this way – in 2008 should you have been buying more stock investments or selling them?

The returns are higher when values are lowest. As tough as it is to watch, it’s foolish to be selling shares when their value is higher.

-

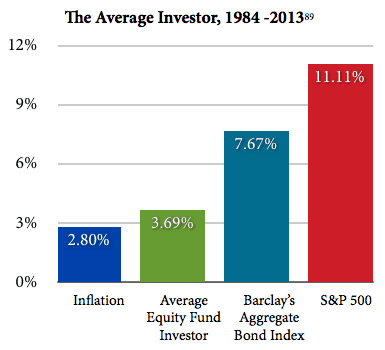

The average investor really messes up compared to the markets on a whole. Your neighbor is messing up his finances! The numbers change slightly, but the margin is always a big one! According to Dalbar, your neighbor (who is invested in the stock market) earned just a little bit more than the rate of inflation and far less than bonds.

They also earned about a quarter of what the stock market did for the last 20 or so years. Why is this? They’re clicking their mouse and freaking out, thinking the world is coming to an end because they heard China devalued the yuan, saw Ron Paul on tv talking about the implosion of the dollar, they don’t think Trump is a good candidate, and they heard there will be a resurgence of ebola mutated into SARS with a touch of the bird flu soon.

Pay no attention to the fear mongers, you can’t control the markets. I can’t either.

All you can do is put yourself in the best possible position to earn a rate of return above that of inflation over the next 5 years (and every 5 year period after that).

-

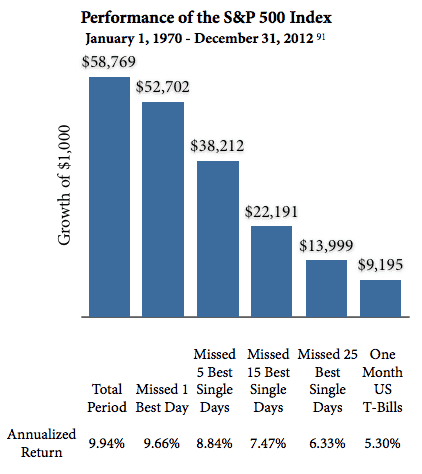

It’s far more likely you’ll miss the best days than the worst days. The ONLY reason to be a seller is if you are certain the market is going lower. But again, you can’t be certain right? Unless you know something I don’t (maybe a fortune teller told you, your uncle has a time machine, or you received some divine inspiration). You simply can’t predict tomorrow.

If you could predict tomorrow, you would have sold yesterday! So by selling, you’re taking a VERY BIG chance that you’ll be wrong.

Not only do you have to be right on when to sell, you have to be right on when to get back in! Missing just the best week in the stock market cost you about a point and a quarter in annualized investment returns.

Sit on the sidelines for the best month and you’ve slashed your returns by 30%. At that point you would have been better off buying treasury bills and sitting in bonds your entire life (saving more and spending less accordingly).

This slide piggybacks off the prior one from Dalbar – THIS is the reason most investors fail! They sell out and get back in higher and higher each time. It’s so unfortunate.

-

Besides, this is actually really normal! Investing isn’t supposed to be easy. This happens every single year! It always seems worse, because today is today! But this type of volatility happens every year.

On average, the market drops about 14% each year at some point. Every year we go through the same thing, over and over. Every year it seems different somehow! The fact is it’s not different, EVER!

The dollar will remain the world’s favorite currency, there will always be an issue in the middle east, there will always be companies missing earnings, there will always be a slow down in something, there’s always going to be some politician or legislation you’re not fond of.

It’s just a lot of the same – but somehow it always feels different!

Investing in bad stock markets summary

The markets are what they are, they’ll do what they’ll do. Anyone who tells you they can “bob and weave” their way to greater riches with little or no risk is lying (or at a minimum bending the truth and hiding something)

As long as your stock to bond ratio is suited to your financial plan, the allocation within stocks and bonds is broadly diversified with non-correlative asset classes, and the individual investments you own are low cost, broadly diversified, and highly efficient – you’re on the right path even if it doesn’t always seem like it.