The Morningstar Rating™ for funds was created in 1985. It’s widely accepted by many investors as a great way to find the best mutual funds to invest in. But is the Morningstar star rating all it’s cracked up to be?

The beauty of the Morningstar Rating™ was it’s simplicity. By looking at how many stars a mutual fund had you could quickly and easily tell which funds looked promising for investment.

There are other lesser known mutual fund rating systems. Lipper mutual fund ratings and the fi360 toolkit come to mind. Morningstar continues to dominate the news however, and garners the lions share of credibility in the mutual fund rating game. But does the Morningstar star rating system predict winning mutual funds?

How does the Morningstar Rating™ system work?

The star rating has morphed over the last 30 years. The current version being more robust than the last, and that version more robust than the prior one to that. The system has improved greatly, but how exactly does it work today?

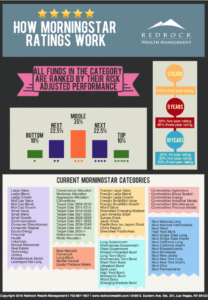

#1 Morningstar star ratings are mathematical. There is no human input on any mutual fund score. This makes the analysis purely quantitative.

#2 Star ratings are assigned based on risk adjusted performance. In 2002 Morningstar improved the risk adjustment. Originally risk was measured as performance relative to the 90 day treasury bill. Morningstar found more volatile funds were being punished under this method because low volatility funds had greater consistency in outperforming the treasury bill.

In todays Morningstar Rating™ model “expected utility theory” is used to measure risk. Utility theory takes into account our human emotional biases towards uncertain negative outcomes. This gives more weight towards negative outcomes and rewards mutual fund consistency.

#3 Morningstar separates mutual funds into groups of similar mutual funds. A US small cap value fund manager has a dynamically different job than an emerging markets fund manager. Rating them against each other doesn’t make sense. Rating them amongst their respective peer groups does. So Morningstar groups funds into highly similar categories.

How does Morningstar assign their Stars?

The Morningstar Rating™ is pretty simple actually. Morningstar takes historical performance and divides is up as follows.

Star ratings are generated as follows based on the age of the mutual fund:

- At least 3 years but less than 5 – 100% 3 year star rating

- At least 5 years but less than 10 – 60% 5 year star rating, 40% 3 year star rating

- Longer than 10 years – 50% 10 year star rating, 30% five year star rating, 20% three year star rating

If you dissect the weighting above you’ll notice the current star rating system is heavily weighted to shorter term performance. For example funds older than 5 years but less than 10 years have 40% attributed to the 3 year star rating and 60% attributed to the 5 year star rating. Remember the 5 year star rating includes performance from 3 years and less. So the 3 year performance is already in the 5 year performance, hence the short term performance is heavily weighted even for funds with a long track record.

What’s wrong with the star rating?

#1 Mutual funds can become unwieldy to manage.

Which mutual funds do you want to invest in? If you’re using the Morningstar Rating™ system you’re naturally going to look at 4 and 5 star rated funds. Why would you settle for a 3 star fund after all?

So if you’re a 4 or 5 star fund manager and you have large fund inflows where do you put the new dollars to work? A fund manager invests in their best stock picks. They may invest in 50 stocks or 250 stocks (though it’s hard to imagine a manager has 250 “best ideas”).

If your mutual fund doubles in size because you garner a 5 star rating do you find more “best stock ideas”? Do you buy more of the same ones you already own? Buying more and more of the same positions can lead to problems. So can digging deeper for more “best ideas” to invest in.

As a fund manager what happens if you just buy more shares of your current portfolio? If the cash flows are large enough you’ll force the price up, paying more and more for each share. What happens if you own so much of a company that selling forces the price down? You can’t sell when and how you want. Large inflows can cause fund management issues.

If the manager expands the portfolio into new “best ideas” they dilute the management style that got them the 5 star rating in the first place. Think about it, the fund manager did well managing a certain size mutual fund. They picked their “best ideas”. When they’re forced to go out of their comfort zone they’re now buying their “second and third best ideas”. This dilutes their management strategy and pushes the fund towards the benchmark index composition.

#2 Past performance is no guarantee of future results.

You’ve heard it a thousand times but it’s true. Looking at mutual fund performance alone is not an indicator of what a fund may do in the future.

The past performance cliche is so true in fact that you really need to consider running the other way! Be leery of 4 and 5 star mutual funds, because they may be poised to fall off the cliff. How you ask? Take a look at some real world results:

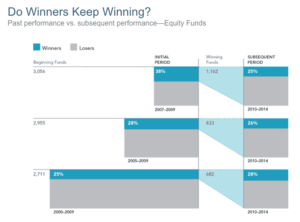

The graph above shows how funds that outperform their benchmarks fail to maintain that performance in subsequent periods. For example, from the period 2007 to 2009 about 38% of mutual funds beat their peer benchmark. That’s actually higher than normal! But the following five years only 25% of those funds maintained their benchmark beating performance.

Or take the period 2000 through 2009 for a longer term perspective. Only 25% of equity mutual funds beat their peer benchmark index. The five years after (starting in 2010) only 28% of those top performers continued to outperform.

So past performance alone really isn’t an indicator of future results. If anything, you’re more likely to underperform in future time periods. The Wall Street Journal noticed this and wrote an article on it here. This makes the Morningstar star rating methodology faulty to begin with – because it’s simply a measure of past performance.

#3 Morningstar itself says don’t use their star ratings.

Don Phillips, the President of Investment Research at Morningstar, was asked about the Morningstar rating’s ability to pick mutual funds at the 2010 Morningstar Investment Conference. He replied:

The star rating is a grade on past performance. It’s an achievement test, not an aptitude test… We never claim that they predict the future.

If the star rating wasn’t meant to predict the future why have it? You can’t go backwards in time and invest or we’d all be rich. Clearly Morningstar creates the rating to be used as an investing guide of some sorts.

Morningstar does however share a secret to picking outperforming mutual funds – scrutinize fees and expenses! In a Morningstar article from August of 2010, Russel Kinnel noted:

Expense ratios are strong predictors of performance.

Hence if you really want a great start at picking the best mutual funds, look at fund fees and expenses first!

Using Morningstar ratings to pick mutual funds in summary

If you’re looking to invest in mutual funds fees are important – past performance isn’t. If anything, historical outperformance means there’s a high likelihood of future underperformance. Since star ratings are past performance oriented there’s little value in using the Morningstar star rating system to pick mutual funds.

Using Lipper ratings, the Forbes Honor Roll, Zacks or Kiplinger fund picks isn’t much better. They’re all similar fund rating systems. None of them can predict the future.

Rather than use historical performance start with mutual fund fees. The lower the fees the better. Lower fund fees present less of a hurdle to simply break even, let alone produce positive investment returns!