Asset-Liability Matching as a Retirement Income Planning Strategy

Note to readers: The following retirement income planning video was originally filmed on 9/6/17 as part of my Wealth Summit series of interviews. This particular video explains asset-liability matching for retirement income planning.

Click the play button to watch, and enjoy!

Greg: Hello Wealth Masters! This is Greg Phelps, your host to the Wealth Summit. Thank you so much for joining us on a Tuesday afternoon, hopefully, the start of the new work week isn’t too cumbersome on you yet.

Today, we have a very special guest and a topic that I don’t really know a whole lot about! I’m really excited to learn a little bit about this specific retirement income planning strategy with Dana Anspach.

Dana is a friend of mine going back several years, and I am thrilled to have you on Dana. Are you ready to help us master our wealth?

Dana: I’m ready Greg! Excited and looking forward to it.

About Dana Anspach

Greg: Alright, so a little bit about Dana. Dana Anspach is the founder and CEO of Sensible Money LLC. She has been practicing in financial services since 1995.

In addition, she has been writing as an expert on retirement-related topics since 2008 as about.com‘s Money Over 55 expert, which has now evolved into the topic of retirement decisions. She is also a contributor to MarketWatch, and the author of Control Your Retirement Destiny second edition, and Social Security Sense.

Dana is actively involved in the financial industry, participating in conferences for retirement income students with the Retirement Income Industry Association, and working toward expanding the reach of the Retirement Management Analyst designation.

All Sensible Money financial planners use a planning process designed around the principles and concepts learned in the Retirement Management Analyst coursework. The process enables each retirement planner to consistently identify the decisions clients can make that will have the most impact on their level of financial success. And today Dana is going to teach us all about asset liability matching.

So again, I am excited and ready to learn Dana! Why don’t you go ahead and just fill in any blanks that I might have missed in your bio and we can get started.

Dana: Well, that was a lot! I don’t know what blanks to fill in there.

I think you mentioned I’ve been practicing since 1995, and my career really evolved into focusing on what we call the decumulation side of planning starting in about 2003. Then real deep dive in 2009/2010 when I got the Retirement Management Analyst designation.

So this is what I love. I love helping people plan for a transition into retirement and structuring portfolios to accomplish regular retirement paychecks, and that’s what we’re going to talk about today.

Greg: All right, that sounds good Dana! So why don’t you go ahead and kick us off. Let’s get started.

What is asset-liability matching as a retirement income strategy?

Dana: So what I want to talk about today is asset-liability matching. When Greg and I were discussing this topic, he said “That sounds great. I don’t know a lot about that!”

Hopefully, by the end of this presentation, you will! And I hope you ask all of the questions that you want to ask. I know you will ask great questions so the audience will be filled in.

Greg: Yes. And by the way for the viewers out there go ahead and type questions into the chat box. I’ll relay those to Dana throughout the interview and presentation.

Dana: Great. So where I’d like to start is to take a step back and think about the perfect investment. This is what everyone comes in initially when they talk to me—when they talk to Greg—when they talk to any professional. . . and it seems to be what they’re looking for in our mind. The perfect investment would be completely safe.

We wouldn’t have to worry about market downturns. It would provide us growth to keep pace with inflation and for our retirement income to keep growing into the future.

The perfect investment would provide consistent income, not income that might be two times as much one month and a half as much the next, but consistent. Unfortunately, this doesn’t exist, and the sooner as an investor that you realize this the better off you will be in preparing for retirement.

What you have to realize is that as you move toward one corner of the triangle, let’s take the safety part of the triangle:

You move away from the other two corners at the same time. Anything that’s going to be safer is going to have less growth. Anything that’s oriented to growth isn’t going to be a safe investment and won’t produce much retirement income.

One of the biggest questions we get right now is “If I keep my money in the safe investment, I know I need to spend it next year, but it’s only going to earn one maybe two percent.” We say “Yeah, the price of safety today is a low investment return.”

You have to understand that and figure out how you put all of the portfolio pieces together to create a mix—and the right mix—while you’re in the accumulation phase and still working.

Safe money for retirement may not be the right investment mix that will best meet your goals.

As you enter the decumulation phase of retirement, you’re starting to withdraw money in retirement. That’s really the purpose behind asset-liability matching for retirement income.

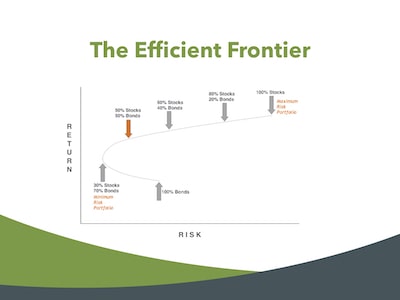

So when I think about the accumulation phase—let’s start there—many people have heard of the efficient frontier. Many people in the financial industry—maybe not consumers. It’s the basis for how most investment portfolios are built.

The efficient frontier – asset allocation for retirement planning

What you have on the vertical axis are your investment returns. What’s the potential rate of return you’re going to have?

What you have on the horizontal axis is the investment risk. The risk is typically measured by volatility, something called standard deviation. This means if the average return is 10% one year, you could have a 20% return on the positive side or maybe a 20% decline on the negative side. Roughly speaking, the difference between those highs and lows is what’s called standard deviation.

The typical portfolio plots a line that says as we begin to add stocks to a portfolio, our potential for return goes up, but also our potential for risk (or volatility) goes up. So investment portfolios are typically structured to maximize return while minimizing investment risk.

Greg: How do I get the most potential upside for the least potential downside Dana?

Dana: So when you talk about adding stocks in the portfolio, are you talking about picking Amazon or Google? Or are you talking about maybe an index fund? Let’s just elaborate on that . . . but great question!

Greg: I’m talking about index funds. When I think of stocks or equities as an asset class, I think of a globally diversified equity portfolio with exposure to almost every publicly traded stock on the market.

Dana: Perfect. Okay, thank you.

Greg: Unless you want to bet? Then you could come to Vegas! Or you could bet it all on what you think the next Apple is going to be.

Dana: No, thank you. No, thank you.

Greg: Not for me either!

Dana: So when you look at this efficient frontier, this is the basis for how most portfolios are constructed with the idea being to minimize some of the behavioral risks that we have.

It’s scary when your portfolio is down 30%! So the goal is to say “If I can minimize that downside, people are more likely to stick with the portfolio in the long run and get to participate in the upside and the positive returns!” And it works. It’s a great way to construct portfolios, particularly when you’re in the accumulation phase.

Retirement investing: The decumulation phase of life

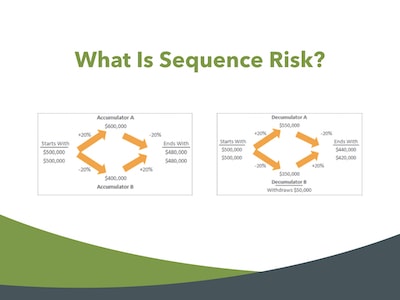

What happens in the decumulation phase is something we call sequence risk. Actually, sequence risk does impact you in the accumulation phase too, it really has to do with you know, do you get a period of time with great returns or do you get a period of time with poor returns? And how many years in a row do you get those poor returns?

The challenge is when you are taking money out. It can have a much bigger impact than you might think.

So in this example, we have accumulator A on the left-hand side. They start with a half a million and the market goes up 20 percent. They have 600,000. The next year the market goes down 20% and they have 480,000.

Now let’s say those returns happen in exactly the opposite order. They start with a half a million investment portfolio and it goes down 20%. They have 400,000. Then the portfolio goes up 20% and they have 480,000.

With that volatility, they ended it with the same dollar amount—480,000. Regardless of what order those returns happened in—and that’s an accumulator—that’s somebody who is not retired.

Greg: They’re still saving—maybe putting money into their 401k?

Dana: Yes. Now, this isn’t taking into account the impact of money they might contribute. Obviously, the person that was able to put money in when the market was down 20% is going to have a little bit more. So it’s not factoring that. It’s just showing you—illustrating—how this works.

Now take that same person. They retire. We have half a million and they need to withdraw 50,000 in their first year of retirement.

Particularly, let’s say they’re delaying Social Security. They might have a few years before Social Security starts where they’re going to draw down a little bit more on their portfolio.

That’s a common strategy that works quite well for many people. You start with this half a million, and now they get a great return their first year of retirement. They’re excited because it goes up to 550,000.

They take out their 50k and the portfolio goes up too! Then they take out their 50,000 and their 550,000 portfolio goes down 20%, and here they are with 440,000 at the end of the year.

Let’s say the exact opposite scenario materializes the first year of retirement the portfolio goes down 20%—pretty scary! I had clients as I’m sure you did—that retired right at the end of 2007. We experienced declines even more substantial than that—and it was scary!

So now the portfolio goes down. They take out their 50,000 and they have 350,000 left. Next year the market recovers and they have 420,000. So the real-life impact of the sequence is they are left with fewer dollars in the decumulation phase. In the accumulation phase, they have the same dollar amount.

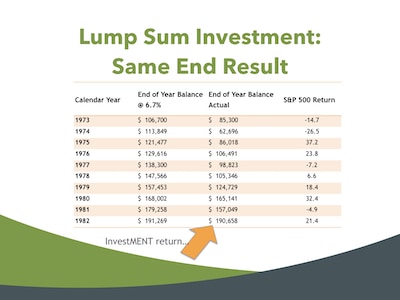

Real world investment returns for savers: S&P 500

If we look at this in a little more depth, this is a period of time and with the S&P 500 where the average return was 6.7%. You see the calendar years 1973 through 1982, and here you’re seeing the year-end balance.

Assuming what we do if you use any online retirement calculators—or you plug a rate of return into a financial planning program—your often using a six/seven/eight percent rate of return.

And it assumes that (rate of investment return) happens like clockwork. Like it was a savings account paying that kind of interest rate. Here you see however, you’re in the accumulation phase and you invest a lump sum.

One hundred thousand invested. It grows nice and easy like a staircase a little bit. The reality was the first two years the S&P 500 was down substantially. Down 14%, then down 26.5%.

Here were your year-end balances. But if you left it alone, you get out 10 years later and you have about the same amount left. So that volatility—or this sequence—didn’t really impact you. It didn’t kill you because you’re an accumulator, you’re not retired and you’re not pulling money out.

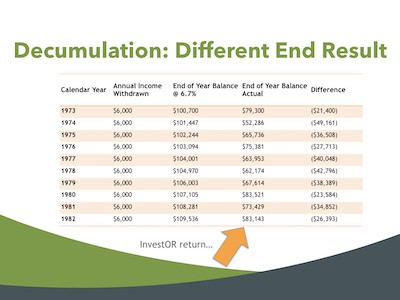

Real world investment returns for those retired: S&P 500

So now you’re in the decumulation phase, and same time period from 1973, same 100,000. You’re going to take $6,000 a year out.

Here we show the annual retirement income or cash flow. I should say the amount that’s withdrawn. You’re going to take that money out regardless of what the portfolio does—regardless of the dividends or the interest—you need six thousand dollars a year.

Greg: You still need to pay the rent and put food in the fridge.

Dana: Right you do. So, here’s the end of your balance. You plug this scenario into many of the free retirement calculators that are out there and you go “Okay, end of the year this works great at an average return of about six to seven percent. I should 10 years later still have all my principal and have the cash flow I needed along the way.”

But in reality, this is what the S&P had actually done. You watched your principal value get cut almost in half.

In order to see even a decent scenario materialize, you need to be able to stick with that portfolio to stick with the investment plan.

Now, if you got out ten years later you’d have 83,000.

There’s a real dollar amount difference in what you might expect you would have if you had just used a very simple online tool to project how this was going to work.

Greg: Right, I think you’re right. And I think most people, they do their own retirement income plans. A lot of people come to us with their spreadsheets, and they just assume 5% a year, 7% a year. They just don’t think about anything else. The sequence of returns risk to a retiree is huge!

Dana: It is huge! And even if you think mentally or behaviorally or emotionally you’re going to be able to stick with it, I can tell you it is scary when you watch that volatility in real life and something happens as you transition into retirement.

Greg: It’s scary. It gets scarier than you may think it when suddenly you realize “I have to live off this money for the rest of my life” and you worked so hard to save it.

I think it’s even harder to stick with the portfolio when those downturns happen—and they will happen—and particularly if you’re going for a 6 or 7% percent rate of return! You are not going to be able to achieve that rate of return unless you are willing to take some volatility risk with your investment portfolio.

Dana: Right. So considering all of this. What do you do? How do—you know—how do you invest to help protect against that? To help mentally make sure you stick with your investment portfolio during those times?

The efficient frontier of retirement income planning

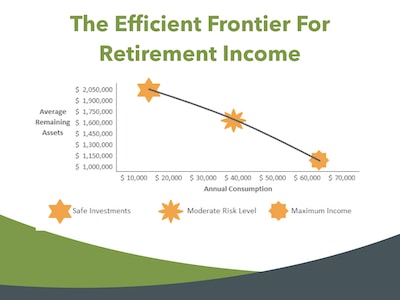

Well, the first thing is understanding that you’re solving for a different math problem in retirement. So the efficient frontier we looked at with risk on the horizontal axis and returned on the vertical axis—well, there’s a different type of frontier for retirement-oriented investors.

What we’re looking at here is we’ve got annual consumption on the horizontal access, and we’ve got remaining average assets on the vertical axis. We are solving for a retirement. You don’t know how long you’re going to live.

You likely want to leave some assets to heirs to the family. Even if you don’t you want to, leave enough that should you live longer than average you’re still Okay!

So what you’re solving for here is (if you think about), let’s say I want to know I can leave at least 2 million over somewhere between a 20 and a 40 year time horizon. You likely are only going to be able to draw about 10 or 20 thousand a year out of the portfolio to have a reasonable assumption of leaving that much as you move up on the consumption.

Let’s say you want to be able to take out 40,000 a year. Well, reasonably, you can expect to leave maybe one and a half to 1.7 million.

If you want to say “Wait, but I want to spend 60 to 70,000 a year” then you have to be able to realize you’re potentially going to spend down some principle, and not have as much remaining at the end.

And so there’s a balancing act between your remaining investment assets at the end of each year and the amount that you can take out when you start solving for that math problem. That leads to a different way of constructing the portfolio, and a different way of measuring your progress along the way. If you think about it, this is a problem that pension plans have had for years!

Pension plans use the asset-liability matching strategy

I want to call it a problem, but it is the goal of a pension. They have to deliver cash flows to their retirees, and they have to be able to do it like clockwork. They also have the constraint where if the balance of the pension plan assets at year’s end is too low, then they’re going to have to (the company’s going to have to) put more money into the plan.

The CFO doesn’t like that! It impacts earnings, and so they have to create a certain way of managing that portfolio so they can deliver cash flow while also trying to minimize the volatility of the portfolio as a whole. Asset-liability matching is how they do it.

It’s a concept (asset-liability matching). I actually went motorcycle riding in Connecticut a few weeks ago with a man who’s in charge of one of the Fortune 500 pension plans.

We had some interesting conversations, and I mentioned asset-liability matching. It was an easy conversation. He knew exactly what it was because they use it, of course, it with their pension plan.

They make sure they have the cash to meet the retirement income they need to deliver at the point in time they need to deliver it.

Greg: Okay, so taking a step back, where does asset-liability matching fall within the different strategies you can use for retirement?

Retirement income strategies

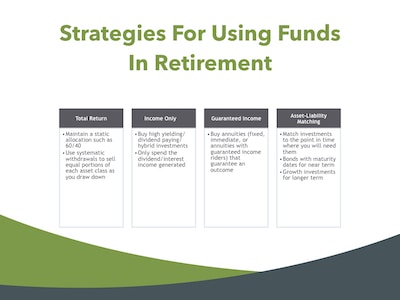

Dana: Here on the left-hand side we have What’s called the total return process. So if I think about that efficient frontier that we used, we looked at initially their traditional way of managing retirement portfolios.

It works great. You have a 60% stock allocation into globally diversified index funds, 40% in bond funds, and you just withdraw income systematically. That works well in up markets, it’s very scary in the down markets. But it’s not necessarily matching your investments to the point in time where you need the income.

Chasing yield strategy

You have an income only approach where some people like to buy all dividend-paying stocks, high-yield investments, closed-end funds, and use the interest or investment income that’s generated. That works great until 2008/2009 comes along and dividends get slashed and payouts are reduced.

Retired people living on that strategy experienced income volatility! Suddenly the cash flows they were receiving dropped substantially.

Greg: All right, I think a lot of times you’ll see the principal drop as well in those at the same time.

Dana: Yes. Yeah, and when clients ask me about that strategy I say “Know what? It’s not that it wouldn’t work, it’s that if I’m responsible for the outcome, I don’t want to be that person that has to call my clients to say, you know, “I’m sorry, you have to take a 50% pay cut this year because these stocks reduce their dividend” and so I don’t want that.

Guaranteed retirement income strategy

I want a strategy that allows consistency. You also have the guaranteed income approach where you buy annuities, and that could be expensive. But for some people, it is the right way to do it, particularly people who are what we call “constrained”. They need as much income as possible and they need to know it’s going to last for a potentially long time.

Asset-liability matching strategy

And then you have the asset-liability matching strategy that we’re going to talk about, which is really where you match investments to the point in time where you will need to use them for income. And so you structure a globally diversified index fund portfolio with individual bonds.

There are also Guggenheim bullet shares. Those are a package of bonds that all mature at the at a similar date. It’s a diversified package of bonds, but yet the maturity is all going to come due around the same time.

Greg: And so if you have a large enough portfolio then the bond portion can be fulfilled with individual bonds or an individual bond ladder?

Dana: I think that’s great. And if you have a smaller portfolio, I think Guggenheim bullet shares are a wonderful alternative.

Asset-liability matching over time: Cash, stocks and bond ladders

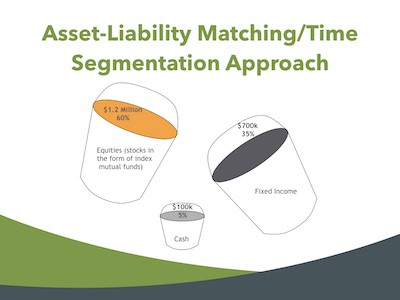

Greg: All right. So in simple terms, think about it a two-million dollar portfolio. Let’s assume we know you’re retiring next year and you need a hundred-thousand a year in retirement income.

Dana: So this first hundred-thousand is going to stay in cash for safety. That’s your first chunk of retirement income. You are going to send it out normally in terms of monthly direct deposits. And it’s not going to earn very much, because we talked about the price of safety is a lower investment return.

Then you have laddered bonds or CDs or bullet shares maturing a hundred-thousand per year for the next seven years. So this cash covers year one, and the next 700,000 covers your subsequent seven years of retirement income.

The equity portfolio is where the remainder is. I want to think of this as . . . let’s say we’re a year in and you spent this hundred-thousand, and this bond matured and it poured into cash.

So now you have six more years of laddered bonds out here, and one year of cash.

What about stocks for growth?

Greg: And so what do you do with the equity side of the portfolio?

Dana: Well, if the investment returns were good, I think of this bucket as literally overflowing. So you measure that—and you take the overflow—and you invest in a bond that’s going to be out there maturing in year seven (because we spent the first year).

The second year the bond matured and poured into cash. So we have six more years worth of bonds maturing.

We buy year 7 almost like laying a railroad track as you’re driving down it.

Greg: So when you say “If you had a good experience in the markets for that period of time, is that like—let’s just say—the projections for larger us companies are 7% percent, so you’re saying that you got your seven percent or more? That type of approach?”

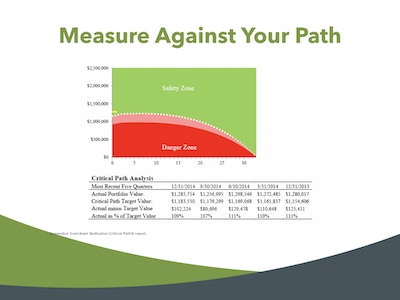

Dana: You could measure it that way, we have a different way of measuring it that I will show you. It’s called a critical path.

The “critical path” of retirement income

The critical path is a trademarked term through an investment partner that we work with called Asset Dedication. So they run this portfolio strategy for us, and they produce the critical path reports. What I like about it is it’s measured against your retirement goals, not some random benchmark. “You” being the client.

So these arbitrary benchmarks—you know measuring my progress against the S&P 500—well, that doesn’t make as much sense to me personally as measuring against my personal retirement path.

What do I need to have remaining each year to know my retirement plan is going to work through MY life expectancy and beyond? I’ll show you how that works.

Greg: And then how do you make those decisions?

Dana: When you’re ahead of the path we think of it like this (which is usually when the stock market is up): the portfolio is overflowing and you are adding into your bond ladder.

This bond ladder can get out as long as 12 to 15 years. If you have many years where the stock market is good early in retirement, you may end up with a bond ladder that covers 20 years!

The rest of your portfolio and growth is just for the extras. You know, it literally becomes that you don’t need it.

Now you could also have 2008.

What happens when the stock market is down?

Where are you if you retire into a really poor stock market? The returns are low, and so you may say “Well I’m willing to let these bonds mature.”

I might get down to a point where I only have three years worth of cash flow left covered by safe guaranteed bonds maturing. If I get down to that point, then I will begin to liquidate some of my equity portfolio.

Most of the time—actually all of the time in history—in those interim years there would have been years where the equity portfolio overflowed, where you would be able to have harvested some of it, and added it to your bond ladder.

But you have this flexible approach rather than saying “I’m going to rebalance every year to 60% stocks 40% bonds.”

You say “You know what? There’s some wiggle room here when I’m ahead of the path. I’m not going to sell stocks when I’m behind path. I’m just going to let my bonds mature and my bond allocation may actually go down.”

Greg: You’ve got a structure in place though. I guess that’s what I’m picking up. You have a methodical process of “This is what happens if this happens,” So at least it takes some of the chance and the volatility (or randomness) out of the equation.

Dana: Yeah. Well, there’s always randomness and well.

Greg: Right, but it’s your decision-making process.

Asset-liability matching puts a structure in place

Dana: Yes in terms—exactly in terms of the decision-making process you know—what you’re going to do when this happens and instead of being afraid of the volatility that we know is going to always be there and probably you too Greg!

Greg: It always makes me laugh when people say “Oh my God, what do I do if the market goes down? What if this happens?” I’m like, “Okay, it’s a natural occurrence for the market to drop.”

Dana: Yeah, if you’re invested in stocks, you should expect it. It’s going to happen.

Greg: You should know ahead of time. What’s your plan? How are you going to handle it? And as long as you have that in your mind.

Dana: I was just reading a book on habits—the power of habits. If you read this book it’s amazing. It has over 4000 reviews on Amazon.

They were talking about the power of habits, and people who wrote out a plan were likely to stick with this habit.

They had formed it in their mind what they were going to do, and it was related to people recovering from physical therapy from—you know—surgeries and how well they recovered, and those with a plan recovered. Well, so the stock market is the same way if you have a plan a financial plan a retirement plan.

You know as you put it, Greg, what your decision-making process is going to be when the inevitable volatility occurs, you just go to the plan. Just like recovering from physical therapy or from a surgery or from anything else.

You’re going to recover and you’re going to be just fine. As long as you stick with that plan.

What’s a bond ladder?

Greg: Okay Dana. Real quick just to circle back for the viewers out there who don’t understand the terminology. Can you just real quickly explain a bond ladder?

Dana: Yeah, so think of it, let’s say I know I need to spend fifty-thousand dollars a year for the first four years of retirement. And perhaps the subsequent four years I only need 40,000 a year because pensions are going to start or my Social Security is going to kick in.

So I have bonds that are going to mature year one for fifty-thousand. Year two 50 thousand. Year three . . . and so on.

I know that when I get to year four for example—if that’s the year that the equity market is down 30%, I don’t have to stress about it.

I’m not going to have to sell any of those stock investments because that bond is going to mature I know what my cash flow is going to be. I know how much and I know when I’m going to get it and so it helps that behavioral aspect.

It helps relieve the stress of thinking “What do I do if the market’s down 30%?”. You don’t have to worry about that!

So, essentially, it’s just dividing up your fixed income into chunks that mature when you’re going to need the income. Then staggering them out along the timeline.

What about the interest income from the bonds?

You’re not living off the interest that the bonds are producing. When that bond matures you’re going to spend the principal value, and the interest from the other bonds that you’ve bought is also helping to cover your retirement cash flow needs.

You actually need a lesser amount of bonds in the first few years because the interest from the bonds maturing later help meet those cash flow needs. So when it’s built correctly, it’s nice! You don’t have to hold as much money in the shorter term bonds which pay less. Rather you get to hold a little more money in the longer-term bonds, which pay more cash flows and help offset your retirement income requirements.

They (longer-term bonds) help cover your spending needs. That’s what Asset Dedication does. They have the software that kind of projects these things. It’s really a more efficient way to generate retirement income than just buying a bond-ladder.

They (Asset Dedication) actually call it an income-ladder to distinguish it from the traditional term bond-ladder. It’s truly a laddering of securities to match an income need. It’s the same process that pension plan funds use.

Technology made it cost prohibitive to do it at an individual account level until really the last 10 or 15 years. With improvements in technology now, you can do that in at the individual account level—and I just couldn’t do it before.

Greg: Great! Alright, thanks for thanks for clearing that up.

The two most important questions when investing for retirement income

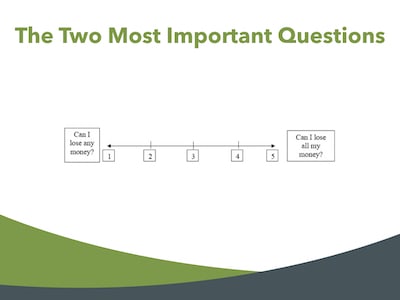

Dana: So to put this in perspective, I think of it as the two most important questions. You can ask number one, “Can I lose all my money?” For the amount you want to spend actually, you always want the answer to be “No,” right?

I mean, can I lose all my money? You want the answer to be no, and I started over here on the right side to the left side: can I lose any money?

So if I think about you know, I’ll get clients who say “I’m going to buy a house or a second home in a year or two.” You know, “What do I do with that money?”

Actually, my brother is saving up to buy a house in New York city. So should I be putting him in a money market? In the stock market?

And if you’re going to buy a house in the next year or two, this question “Can I lose any money?” You want the answer to be “No” right?

You need that in a safe investment. You’re not going to earn a lot, but let’s say you put it in the stock market and next year you find the ideal house. Then suddenly your down payment is down 30% and your portfolio is worth 30% less. You don’t want that!

With retirement, you can lay out your plan and exactly what you’re going to need to withdraw each year.

Income needs are more predictable in retirement

Not exactly . . . I mean obviously life happens, and some years we need a little more or a little less. But, you kind of know “I’m going to take this trip to year” and “I’m going to fund this goal there” or the extra house or whatever it is.

Even building car purchases into a retirement plan. Clients will say “Should I go get one?” And we’ll say “You know, you don’t have to buy it this year, but the cash is available now. If you want to write a check go ahead!”

When you lay all of that out—when you look at the first 5 to 10 years of cash flows that you’re going to need, the question “Can I lose any money on that portion?”

You want the answer to be “No.” You don’t want to be worried about that piece of your portfolio down 30 or 40%.

Now you have to segment that retirement plan down to the individual account level. How much is going to come out of the IRA versus the Roth IRA versus the non-retirement brokerage-type investments? So you can actually match the bonds up in each individual account with where you’re going to be taking your withdrawals from.

You think “Okay, great. I can sleep at night as I transition into retirement. I know that part of the portfolio—I’m not going to lose any money on it.”

The next question is “Can I lose all my money?” Again, you want the answer to be “No.” I don’t know if you probably have the same conversation with your clients Greg.

Greg: It’s (you know) can you lose all your money in the S&P 500? No, absolutely, not.

Are your investment fears warranted?

Dana: You and I are comfortable saying “No.” Theoretically, every company—every Fortune 500 company—would have to go bankrupt for that to happen. I tell people you know, if that happens we have a lot bigger problems on our hands, you know aliens have invaded or something apocalypse-like.

Greg: Yes I like that one. Yeah. I tell my clients “If you think that’s going to happen you might as well just go buy bullets and guns.”

Dana: Yeah. I said the same thing. That’s a whole other conversation. I say “You know, if you’re really concerned, go buy land somewhere, some chickens and cows. Yeah, the whole thing.”

So this “Can I lose all my money?” is where (back to your question earlier) investing in index funds versus “Do I try to pick the next Amazon or Microsoft or Apple?” comes into play.

Investing risk levels: stocks to bonds to cash

So I think of any investment where you could lose all your money—I call that a “Risk level 5.” Any individual stock is a risk level 5.

We may think it can’t happen, but in history, it has happened. You can see it drop 50% and never recover. You can see it drop to zero and never recover.

To shift that to a risk level 4 is to shift from owning individual stocks to index funds. Index funds you can own around 14 to 15 thousand publicly traded stocks all across the globe.

You can have a little piece of all of them and that shifts that risk level from a 5 to a 4 where yeah, you’re going to experience volatility, but you can’t lose all your money.

There’s no guarantee this approach is going to deliver higher returns over time. I will assure you it helps people sleep better at night, right?

The cash flows are going to be there because they’re in that safe Guggenheim bullet or short-term bonds or intermediate-term bonds. When that volatility does come along, people are relaxed thinking “Okay, I get it! This bond’s going to mature and I won’t have to sell any of those stock market investments that are down right now. It just brings a sense of peace—a sense of confidence—to how the whole process works.

Greg: So what’s a risk level 3?

Dana: Yeah, so I think of a 3 as a balanced fund. For example, if you know you use the target date retirement funds that are in a 401k plan—something that’s putting together stocks and bonds for you—you’re not going to see as much volatility as a pure equity fund. You’re going to see more volatility than you would just in bonds.

Greg: And the difference between a 1 and a 2?

Dana: Agency bonds, CDs with truly guaranteed items, you know at a risk level 1. That versus municipal bonds or lower rated corporate bonds at a risk level 2. I think of it as a risk level to where there’s a tiny bit more risk.

They’re not a hundred percent guaranteed like a like a government bond would be or a CD.

Greg: Okay. Alright.

Asset-Liability matching historical performance

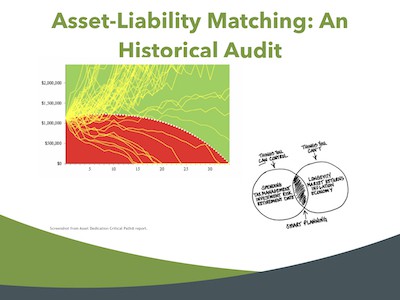

Dana: So your question earlier, how do you measure this process, you know? And first, how do you test if it would work?

Well, the first thing you do is lay out your retirement income and cash flow needs. Just like a pension plan, I have to know how much I’m going to have to deliver. What amount of retirement income each year . . .

So you lay that out on this crazy chart I call it the “spaghetti chart.” It’s one of my favorite—actually it is my favorite chart—that I use in my process.

So each yellow line represents an actual path that your financial accounts would have taken. And when I say yours—this was a sample that was done—but each client gets their own path.

The dotted white lines represent the minimum amount that you must have remaining at each year end for your plan to work through your retirement time horizon. So this was about a zero to about a 35-year lifetime path.

It’s hard to read the numbers, but this is about a little over a million dollar portfolio. And so what happens is we dedicate the income—the cash flows—needed to enjoy your retirement.

Here’s the starting balance. Here’s the amount of withdrawals I’m going to need to take each year. Then they calculate out the minimum remaining assets. It usually gets . . . well it always comes with a minimum return.

What type of investment returns do I need for this to work?

We ask “What’s the minimum required return that it would take for this to work?” Is that return required too high/unreasonable?

Is it 7% or 8%? If so, I’m going to come back first and say “You know, this is not realistic.” And so, you know only in the very best times in history this would work.

We really need to come back and readjust your (Mrs. Client) spending. Maybe work a year or two longer? Because we need to make some kind of adjustment.

Assuming the return is realistic—5% or less, it will likely work. I like to see them come back around 3% or 4%.

We’ve had clients come back with negative required returns and you know, meaning they have more money than they need. And we’re trying to say “It’s actually not, it’s usually that they’re very conservative.”

They are frugal. It’s not that they have so much, it’s that they spend very little. So they can spend more!

Greg: Yeah. Tell her you can’t take it with you! Take the family on a trip to Disney or you know, an Alaska cruise or something that’s going to create memories that you will all have.

Dana: Yeah. So each one of these yellow spaghetti lines is a random return.

It’s not random, however. It is the actual path the investment accounts would have taken starting in 1927.

What if you don’t get the required returns?

So some of these lines finished down here in the red, right? From a historical audit perspective, it’s saying we’re going to go back in time and look at if you had retired a 1927, 1928, 1929, and each year.

Moving forward each year—where we had a 30-plus year time period to test—and see “What actually would have happened?”

We would have invested this way. We would have used, you know, a bond or income ladder. We would have used index funds, we would have taken out the exact amounts we said.

You see most of these lines yellow lines finish up here far off the top of the chart with a lot more money than what the person retired with. A few of the lines skim or follow closely along the path.

Then you have this handful down here which were primarily Great Depression era—where the yellow line essentially says “Okay, your plan wouldn’t have worked if we got that particular scenario now and we assumed that you just kept right on spending.

So Great Depression comes along. You just keep buying your automobiles. Take your vacations, etc.

Greg: You don’t know. I know in 2008-2009 even those clients who had the means cut back their retirement spending.

Asset-liability matching against your retirement income path and plan

Dana: Yeah, in reality, you’re going to have those does tough discussions with clients. Also, there are some smaller changes that can be made. So as you’re measuring along the way—and you do measure along the way—so this is a client about one year into their path and you start to see that yellow line.

You only get one yellow line. So you have the historical performance audit right? It shows you all of the things that would have happened in history.

In real life, we have one yellow line because it’s OUR OWN retirement plan, not a randomization of return sequences. So here we’re measuring against their (the client’s) path. They are 102,000 had ahead of the path!

So, in that case, we—as you described it—their equity bucket was overflowing! So we decided to sell stocks and add on to their income ladder now.

If they end up in the pink and we’ve had that—what we call the (you know)—not quite the danger zone. We recommend first forgo any inflation raise.

What if we’re behind the critical retirement path?

So what I typically do if someone’s in the green, you know, we go “Great, we’re going to sell some stocks and we’re going to add your income ladder—your bond ladder!”

In addition, do you need a retirement income raise? If we want to increase your withdrawals by 3% now, honestly, most people say no, I’m really comfortable.

The lower income clients feel the constraint of inflation a little more. Increases in gas, health care, and those things have a bigger impact on someone with less to spend. And so often if we can even increase their withdrawal by two or three hundred dollars a month they go “Yeah, that would be great!”

So in these years, we’re ahead of the path. We know the investment portfolio has room to support that no problem. Let’s give you a raise!

In the years we’re in the danger zone we say “No raises.”

You know, keep the same retirement income you took out last year. Let’s leave it the same and not do any extras. We’re going to wait till we’re back in the green, and every client we’ve had—even those that retired at one of the worst times in recent history (2007)—are fine. They are fine!

As long as they follow this process and stick with the plan—and it’s really amazing—it brings it that decision-making framework. You know what to do, you know when to do it, you know when you can take an inflation raise when you need more income in retirement.

If we really ended up here in the danger zone—and I have had a few—and the reason they ended up there was because they spent a lot more in retirement than what we had initially projected.

Are you spending too much?

Greg: That’s the number one problem! We see the people over spend versus their budget when they come in.

Dana: Yep. Yep, and so and often times it was to support or help adult children. So adult children are going through a divorce or through a period of unemployment and naturally, someone’s going to say”You know what? I’ll figure it out. I need to help my children!”

In those cases, we did have to say “Okay great. You’re going to have to make some adjustments to your retirement spending. How do we cut “X” dollars a month (for example) out of the budget at least until we’re back into the green.”

So I had a client we did that with and we just did their annual review. They’re back in the green, and this is the second year in a row now they get inflation raises. More retirement income is a good thing, right?

So, you know, it works! And they did their part and cutting expenses—and now we’re back on the path—and they’re starting to relax a little more!

So the retiree has to be willing to embrace the process that they have to be willing to cut back or not—take that inflation raise for example—otherwise, it doesn’t work! Retirement income planning only works if the client is willing to embrace the process.

With one exception in my 20 plus year career now, I’ve had people who did embrace the process. I had one who I sent her warning letters for seven years that she was going to run out of money. Eventually, she did!

She just took withdrawals, you know, the house needs new flooring, etc. My son needs this and I want to pay for grad school.

I did everything I could. Sometimes I think we’re all going to encounter those people who—you know—her answer was that you know, God would take care of her. That was her response. She just felt like it would all work out and, and maybe she has a plan (other investments) I wasn’t aware of.

Greg: Yeah, I’ve had those same situations and I’m always wondering “there’s got to be other investment assets that you’re not telling me about because clearly, you’re going to run out of spending money.

I’ve done the same thing with the letters. I’m clearly telling you-you’re going to be out of money here in a minute. You know, five or seven years, and it doesn’t matter, it doesn’t change anything.

So this is kind of an interesting framework. If you can get a retiree to buy into the retirement income and investing process, and as long as they understand the dynamics of it (if they stick with it) it looks to me like the success rate is very very high!

Dana: It is it’s amazing. I love it. I was doing something like this on my own.

Can you create your own bond ladder for retirement income?

I met Asset Dedication at a conference in February of 2012. It was the T3 the technology conference in Miami. I said, where have you guys been? You’re doing what I’m doing—but better.

So we outsource our portfolio construction to them. We design the plan, and we control the process.

It’s like they’re an employee actually. It’s like hiring a portfolio manager where say “Here are the parameters. Go build me a retirement income strategy that works!”

You think of it as an architect where we are the designer and they are the builders. We lay everything out. We asked them to construct the retirement income portfolio.

How often do you re-evaluate your income strategy?

Greg: And Dana, do you do this? For example, you do it just once a year maybe and then queue it up for the next year? How often do you do this?

Dana: So the critical path is measured once a year. I remember I had a client who—after about six months—says “When do I get that green and red graph?”

He remembered it! I said, “Whoa, whoa, you know, we have another six months before we can see it!”

So we did end up using it to make mid-year retirement income/portfolio decisions with the dividends and interest.

Sometimes we have what we call “excess cash” that accumulates in the portfolio. That is more cash than what the client needs for their current spending needs.

If they’re ahead of path, we typically pull that and add it to the bond income ladder. If they’re behind path we add it to growth side of the portfolio.

We do use it in the interim—when we get cash alerts—but for the most part, we like to measure once a year. It’s one of three what we call “Retirement readiness tests” that we use—this being the primary one once someone’s already retired.

Greg: Okay, interesting. You do it once a year and that kind of sets you up for the next 12 months. Then you just repeat the cycle.

Dana: Yeah. Yeah, then you just, you know every year you’re measuring and you have a sense of what direction you’re headed. So, we capture this what we call funded level.

What if investment returns are great?

If we have several years in a row where the equity portion of the portfolio is strong and spending stays in line, we end up more and more in the green.

When we’re planning for retirement income, here is a point where we start talking about extras. So, as you saw on the previous slide, this is the majority of the scenarios. So if we look at history as any indication of what the future might look like, the majority of the time someone’s path is going to look like one of these yellow lines up here in the green.

As we get five or six years into the plan, we have clients now sitting way up here where we get to have some really fun discussions about, you know, I have clients say “I have everything I need” and so we get to see.

We’ll start to think about “Are there some areas where you’ve really wanted to make a difference in the world?” Whether it be charitable, you know, you can contribute to organizations that really matter to you. Or whether it be with your family. Maybe some things that you’d like to be able to see them do while you’re here to enjoy what they get out of the process.

So those are great conversations to have. This tool allows us to have that conversation in a very objective fashion. Right?

Greg: Well, I can imagine as a retiree sitting there and looking at this yellow line thinking. Hey, I’m pretty high above this white dotted line—or the danger zone—yeah, let’s spend a little bit more and enjoy.

Dana: Yeah, and if they’re just skimming the line we might say “Well it’s not quite there yet. Let’s take the inflation raise and see how things go.” But once they get up here, it’s “Let’s figure out, you know, a higher monthly amount?”

Greg: Gotcha, and I think the key is the ongoing process is just a continual cycle. I think a lot of people come in and say “Hey, I got a retirement income plan. I’m good.”

But everything changes when they walk out the door. The market does this, tax law changes there. And again, if you’ve got better or worse investment returns than you might have planned for.

Dana: You plan for 6.7% every year. It doesn’t work like that. So here you’ve got to make some adjustments.

Greg: Yeah—I’ve heard the analogy before—it’s like flying a plane across the country. You know you’re going from LA to New York, right? How often is a plane actually on course?

Not very often, you know, it’s maybe five percent of the time that it’s dead on course. It’s a constant series of course corrections. Now, obviously that all happens by software and automation today, but still it’s no different with your retirement income plan. We don’t know what healthcare is going to do. We don’t know the exact amount that your premiums might go up next year.

Dana: I just got a call from a client earlier today whose long-term care premiums went up 30%. We had some discussions, and his number one question was “Can I afford it?”

If I want to keep the policy as it is, well, they are far ahead of the path. The answer was easy.

Absolutely. You’re not even going to notice it. If that is going to bring peace of mind, just keep the policy as it is.

It brings us this process on how you make those decisions.

Summary of retirement income planning strategies

Greg: Okay, so in summary, I think of it as you know, we talked about different strategies that you could construct retirement portfolios for income.

Total return is one. You could have asset-liability matching. You can have guaranteed income through annuities. You can live off the interest from a bond ladder.

Dana: There’s not a right or wrong answer. As a professional, if we’re going to be responsible for the retirement paycheck (and that’s how we look at our clients), we are responsible for delivering the retirement income strategy that is laid out in the plan.

There’s only one way we’re going to do it because all of our research and testing shows it’s the most reliable and economical way to do so. That’s the asset-liability matching strategy!

I think of it as you have the fancy sports car over here. You know, those are the people who like to pick the individual stocks. They want the fancy retirement income strategy. Things like private equity investments—flashy! Something that’s gonna get me the best returns (they think)!

That’s not the process I want in retirement. I don’t want to try to beat the stock market or time the market. It’s too much risk, and if you think about the maintenance of these cars it’s hefty!

I think of that as risk, yet high-speed, but you get risk with your Jeep also.

So these are some of what I call like the special retirement income strategies. Do they work in reality, you know, rough terrain, right? But that’s not most of the time either.

It’s not very economical. So there are certain hedging strategies, and an annuity is—for —a hedging strategy. There’s an extra cost to that.

A Jeep can weather any kind of terrain, but from a gas mileage standpoint, it’s not the most economical choice. It’s not the smoothest type of vehicle to drive on the highway or just around a ride.

Greg: Yeah, so you have your nice four-door sedan economical type. Maybe it’s a Toyota (no advertising here). It could be whatever you want. Maybe it’s a Prius?

Dana: It works, it’s reliable, it’s economical, it’s low maintenance. You know what to expect!

It’s not the flashiest, but that’s how I think of asset-liability matching. It’s a steady approach to retirement planning.

Asset-liability matching is designed to deliver cash flows at the point in time when you need them (from the bond ladder) and to take the stress off what might happen when things are rough.

It might not be the number one “go-to” approach for a lot of people. In retirement for us, it’s the only type of approach that we’ll use because of that reliability factor. As you put it that process you’ll know where you’re going to go and how much it’s going to cost. Without much deviation from that.

Greg: Right! Peace of mind!

Dana: Yeah. Yeah. It is. So what other questions do you have for me?

The final arguments for asset-liability matching

Greg: Well if any wealth masters out there have any questions, please feel free to drop them in the question box. Dana’s happy to answer those. And in the meantime, I will let you know if anybody does!

So one of the things that we always like to do—and this is my 30th interview for the whole Wealth Summit—I always like to ask the speakers “Can you give us some action items or some key takeaways?” Here you’ve got yours all laid out.

So why don’t you kind of walk through those?

Dana: Yeah, so I tell people my number one rule actually for life as well as in retirement, is what got you here won’t get you there! I’ve learned that running a business evolving from having almost no employees to currently six employees.

It’s a different skill set. And so as you transition from the accumulation phase to the decumulation phase, I think of it as you are solving for a different math problem!

Understanding that it might take a different investment strategy in retirement—or a different way of looking at things—that’s the number one key! Just be willing to shift your mindset, and be willing to be open. That reliability might be a more important factor than what could potentially give me the highest rate of return.

Number two, you can’t control the outcome, but you can manage risk. Making a clear delineation between “what you can control and what you can’t.” Much of the media that we see—the financial media—is focused on the stock market like it’s a sporting event.

It’s crazy. It’s you know, completely outside of our control! So understanding and being able to take a step back, that’s why I like that historical audit—that long-term perspective—and saying “Okay, wait a second. All of those ups and downs. That’s normal. Nothing Sensational!”

It doesn’t need to be reported on that way. I don’t need to look at it that way. I know my decision-making ahead of time. I know the risks that are going to come along, and I know how to manage them.

Okay, number two and number three deciding which risks you want to hedge. They are different. So many people look at things like delaying Social Security or buying an annuity as well.

How does that compare rate of return wise? Well, it’s it’s not all about rate of return. Delaying Social Security and buying an annuity hedges a particular risk of living longer than average. And so the rate of return on that decision actually gets quite high if you are one of those people who lives longer than average.

You can make those decisions not because of the rate of return though, but because you’re hedging that risk of living long. So using an asset-liability matching process for retirement income hedges the risk that the markets down 30 or 40 percent the first year or two of retirement, and you make a horrible decision because you’re scared and you cash out.

It helps to lay out a plan—or a retirement income strategy—to follow! So understanding you have that perfect investment triangle, you have to decide which of those risks you’re going to manage. Then your portfolio can be structured around that, but you can’t have it all! You do have to decide! There isn’t this perfect solution out there!

When should you start matching assets with liabilities?

Greg: So Dana, would you say that this is the type of strategy that is most important—or more important—early on in retirement? Or maybe even—I suppose—you would probably start this seven years before retirement, right?

Dana: My ideal time to start is about 10 years prior to retirement. Where most people start is a year or two. So the common inquiry we get is “I’m retiring next year” in many cases.

You know, I read your book a few years ago. But people wait! They don’t feel comfortable for some reason, you know, starting that planning process farther out.

Any time is better than never and you know, follow this all the way through death. Now there could be a time where someone is so overfunded where it’s not necessary to follow that process anymore. It’s been effective so why would you would you change it?

Greg: Okay. So Dana, can you please share with everybody out there watching how they can reach out to you if they have more questions? If they need some more insights? That would be great.

Get in touch with Dana Anspach

Dana: Yeah, and we are going to laugh at this but I forgot to put my email and number. So I’m going to tell you what it is.

Greg: Let’s see if I can edit the PDF on the fly. I mean, I think that’s my fault, but I will tell you this it will be posted on your speaker page. So don’t worry about it.

We’ve yeah, we’ve got all of your information up there and we can add in Social Links as well. No problem. Yeah, my editing skills. Probably aren’t going to work on the fly.

Dana: But the email is Dana (at) Sensible Money.com. So pretty easy! And check out my website SensibleMoney.com – that is the most effective way to reach me.

I am in meetings and things like this webinar on retirement income strategies. So it’s challenging!

Our main office numbers 480-719-7290. As I mentioned our website has a lot of information!

I also have a book “Control Your Retirement Destiny.” It’s on Amazon. You can look up my name—Dana Anspach—on Amazon.com and you’ll find it. That can be a great way just to learn more about what we do and our process.

Greg: Okay, and Dana do you work I guess with just people in the Phoenix greater area? I suppose do you work with people mostly there—or do you also do kind of a virtual thing?

Dana: We work with people all over the country. I have three planners that work for me, one is in Massachusetts, ones here in Phoenix, one is in California and I have another employee in Oregon. The rest of us are here in Arizona.

We have retirement income planning clients across the country that we have actually never met face-to-face. It’s all done virtually like we’re doing this webinar, and they’re seeking a certain type of expertise which I think is why they’re comfortable working with us that way.

Greg: Okay. Well Wealth Masters, thank you so much for joining Dana Anspach and myself as we discussed retirement income planning. As she mentioned check out SensibleMoney.com, and her book on Amazon as well.

I have followed you for years on everything that you put out to your social media and you’re writing for about.com and so on. I’ve been very impressed with what you do there.

If you have any questions reach out to Dana directly.

I always say “Either you control your money or it will control you.” And again, this is just another process for you to put into place that will help protect you in the bad markets. I think that probably the biggest thing, you know, because we kind of specialize in that retirement decumulation genre as well . . . I think probably the biggest thing that clients—retirees—would get from this as well is that peace of mind that you sleep at night thinking “I don’t have to worry. Go ahead market . . . do what you’re going to do. I can’t control you! I know that I have my retirement income strategy set up—and my cash flows—and I don’t have to worry about it!”

Dana: Yeah, absolutely. Yeah.

Greg: All right Dana. Thank you so much!

Dana: Thank you Greg. It’s been wonderful. I appreciate you putting this together!

Greg: All right, this is Greg Phelps your host of the Wealth Summit signing off!