What’s more important to you? What you can spend or what percent rate of return you earn?

Rates of return are arbitrary in reality. The simple fact is you can’t spend a rate of return. What you spend rather, is the underlying dollars in your portfolio. You spend those dollars throughout your retirement, and those dollars lose real value over long periods of time due to inflation. Let’s look at a stamp 30 years ago:

Now look at a stamp today:

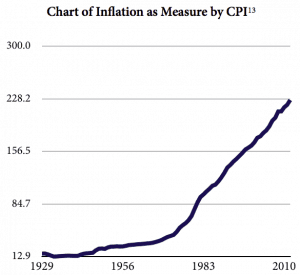

Inflation has never had a 5 year period when it was negative. Just take a look at inflation as measured by the Consumer Price Index (CPI) over your lifetime:

So the question is what really matters in life? Investors fall into the trap of trying to beat the markets, or beat their neighbors investment return. But in the end, it’s what you can spend, and the offset for inflation throughout your retirement lifetime that really matters!

Taking this discussion one step further, it’s your REAL investment return that matters. For example, if you averaged an 8% return over the last five years it seems pretty “OK” but nothing special. The fact is it’s really is pretty special!

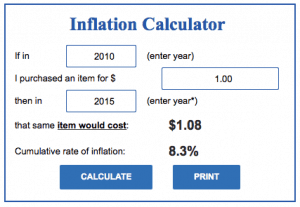

Using the inflation calculator here, we can easily compute that an item purchased for $1 in 2010 would cost $1.08 today. That’s an 8.3% total inflation rate. Dividing that inflation rate by 5 years you get an average annual inflation rate of 1.66%.

Your REAL investment return was 8% – 1.66% or a net return of 6.34%. That’s a lot better than OK, it’s pretty darn great!

Most retirement plans are built on real rates of return that are in the range of 3-4% pear year. That’s for an average retired couple with a moderate risk tolerance. For those investors, they about doubled their required real rate of return for the past 5 years.

So when you’re thinking about your investments, and the rate of return you earned, consider for a moment what it is in life you’re really after. I propose it’s not the investment return over time, it’s actually what you can spend over time after inflation has deflated the value of your dollars.