Trouble funding your HSA (health savings account)? Why not do an IRA to HSA conversion? Remember, the health savings account (HSA) allows you to use the funds for medical expenses TAX-FREE AND withdraw them for any reason after age 65 with only ordinary income tax due – not a bad deal right?

The kicker is you need to have an HDHP (a high deductible health plan – cheat sheet is here) to have a health savings account (HSA).

Let’s briefly review HDHPs and HSAs.

What is a high deductible health plan?

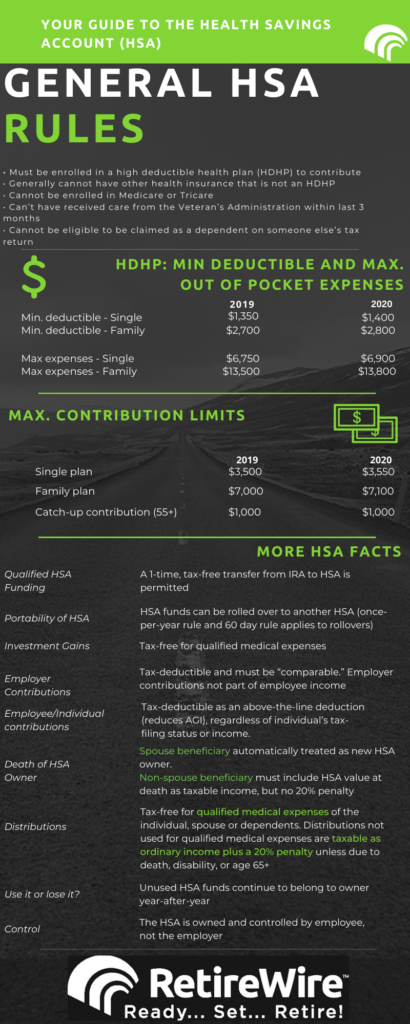

A High Deductible Health Plan is a health insurance plan that comes with an annual (for 2020) deductible of at least:

- $1,400 for individuals

- $2,800 for families

An HDHP typically comes with lower monthly premiums compared to a more “standard” health insurance and are best for individuals or families that do not typically need much healthcare beyond basic checkups and primary care.

This doesn’t mean that HDHPs are the cheapest nor does exclude those that have illnesses – check this article out to help decide if an HDHP is right for you.

A key advantage of HDHPs is that they can be coupled with a Health Savings Account, which comes with some great tax and retirement benefits.

HSA rules

HSAs have several unique and attractive benefits, and can effectively be used as a retirement account in addition to being used to pay for certain medical expenses.

HSA funds can be triple tax-advantaged as contributions are tax-deductible, the money grows tax-deferred, and withdrawals can also be made tax free (as long as you follow a couple of rules).

The first rule is that you use the money in your HSA for qualified medical expenses.

The other option is that you wait until you are 65 to withdraw your HSA funds. Once you reach age 65, all remaining funds in the HSA can be withdrawn tax-free for any reason, not just for medical expenses.

Plus, with an HSA, you are not required to make Required Minimum Distributions, like you are with other tax-deferred accounts (IRAs, 401ks, etc.).

Compare those benefits to an IRA and you can see why the HSA is an amazing financial vehicle!

2019-2020, annual HSA contribution limits are:

- $3,500 (for 2019), which will be increased to $3,550 (for 2020) for individuals. If age 55 or older, you can contribute an additional $1,000

- $7,000 (for 2019), and $7,100 (for 2020) for families, plus the catch-up allowance of $1,000.

Why do an IRA rollover to HSA?

The reason you may think about making an IRA to HSA rollover would be if you are unable to fund the HSA.

Maybe you find yourself financially strapped, but you want to take advantage of the benefits of an HSA?

Yet between a 401(k), IRA, and paying the bills, you may not have enough to also contribute to an HSA. You could, therefore, do an IRA rollover into an HSA.

Upon completing the rollover, you would have a funded HSA and be able to benefit in both the short term (by paying medical expenses with tax benefits) and in the long term (again with tax benefits and possible retirement income supplementation).

By the way, the fancy term for this rollover–or conversion–is a ‘Qualified HSA Funding Distribution,’ or QHFD.

There are a few caveats, however.

IRA to HSA Rollover Rules

- You can only make and IRA to HSA rollover once in your lifetime

- You must participate in an HDHP

- You must remain eligible for your HSA for a 12 month period

- You must make the conversion in the calendar month you are in (unlike funding an HSA where you have until your tax filing due date)

- The maximum amount of money that you can convert from your IRA to an HSA is the same as the HSA annual limit

An IRA to HSA conversion is a once-in-a-lifetime event, not an annual one. Good ole Uncle Sam doesn’t want you doing this every year because that would mean a lot less in terms of tax revenue for him!

But, since it’s a one time deal, it’s best to be certain it’s the right move for you and that you are aware of the rules.

It’s really not a “rollover”

It is technically not a rollover (even though we all call it a rollover), or at least the treatment is different than a rollover from, let’s say, a 401(k) to an IRA.

In the case of a rollover, the money that you rollover from the 401(k) doesn’t count toward your annual contribution IRA limit. For example, you can rollover, let’s say $35,000 into your pre-tax IRA. In the same year, you can still contribute $6,000 to the IRA.

The IRA to HSA rollover (ok . . . it’s a conversion), however, does count toward the annual HSA contribution limit. That’s fine because one of the reasons for doing this conversion is when you find it difficult to fund your HSA.

Should I use funds from my Roth IRA or Traditional IRA to fund my HSA?

Using funds from a traditional IRA is more advantageous compared to a Roth.

Remember that if you have a Roth IRA, you can withdraw your contributions (not gains) at any time tax and penalty-free.

Additionally, rolling IRA funds to an HSA escapes the pro-rata rule, which is beneficial if you have an IRA with both pre-tax and after-tax funds. You can roll the pre-tax funds into the HSA.

This leaves a larger amount of after-tax funds in the IRA and would mean that in the future, more withdrawals would be tax-free and/or the required minimum distributions could be less. Remember, HSAs have no RMDs.

What if I don’t have an IRA?

If you don’t have an IRA, but you do have another retirement account, such as a 401(k) or something similar, you could roll over these funds into an IRA (assuming your plan allows for it). Once you have an IRA, you can open an HSA (assuming you have the HDHP) and make the qualified HSA distribution.

How to fund your HSA after the conversion?

Once you complete the QHFD (IRA to HSA rollover), you may be wondering how you will continue to fund the HSA, especially if nothing changes in your financial situation.

So how can you fund your 401(k), IRA, and HSA?

- Consider contributing to your 401(k), up to your employer match

- Contribute to your HSA

- Additional funds could be used to then fund an IRA (either partially or fully), and/or be used to increase your 401(k) contributions

What happens to my HSA funds when I die?

Remember, under current law (which could possibly change in the near future), your non-spousal IRA beneficiaries can stretch their distributions out over their lifetime. This isn’t the case with HSA’s.

You’ll want to spend your health savings accounts down before you die because these accounts must be distributed after death. An IRA or Roth IRA, however, is a great way to stretch the tax advantages out for a generation or more!

Are you looking for ways to fund your Health Savings Account?

Now you know about some different methods to fund your HSA, whether or not you are financially stretched. The HSA is a great financial tool that can benefit you in both the short and long term.

If you have any questions about HSAs, IRAs, or anything related to planning for retirement, please feel free to contact me and I will be happy to assist you.

I learned something today from this article I should have known. After I turn 65, I can take HSA funds and use them for whatever I want and the funds will not be taxed. I am 63 and four months now so I will only be able to take 4600 from my IRA this year and maybe figure out a way to fund another $4600.00 next year before the 12 months before I turn 65 in May of 2023.

I would like to ask a question. I will most likely find this out from my financial advisor, but he hasn’t gotten back to me yet. Golfing. Can my transfer from my IRA to my HSA be in a form of stock shares. I have two IRA’s with Edward Jones, and one in multiple funds and the other IRA is stock shares from the company I retired from. Please let me know if you know. Thanks and thanks for teaching this old dog a new lesson.

Hey James I’m glad you found the information helpful! Before I answer, also please check out how to find the best financial advisor article here. You should make sure the financial advisor you’re entrusting your financial wellbeing to is acting in your best interests (fiduciary) as well as has the skills and knowledge to squeeze every last dime out of your retirement planning and make sure you’re “money confident” in retirement!

Just like your IRA or Roth IRA, you can only contribute DOLLARS to your HSA. It would be nice to have flexibility to contribute stock to your HSA but sadly that doesn’t exist.

Best wishes James!!!