Are you looking for extra tax deductions and a way to supercharge your finances? You may want to add a Health Savings Account to your toolbelt. But first, you need to know “How does an HSA work?”

A Health Savings Account (otherwise known as an HSA) is an account allowing the holder to contribute funds, get a tax deduction on the amount contributed, and withdraw the funds tax-free for qualified medical expenses. On top of that, the funds will grow tax-deferred while they’re in the plan!

HSA’s are absolutely wonderful savings vehicles for many reasons, not the least of which is their tax-advantaged nature.

In this post, I’m going to cover everything you need to know about HSAs and why they are such amazing tools for personal finance.

But first, in order to qualify for an HSA, you must meet certain criteria:

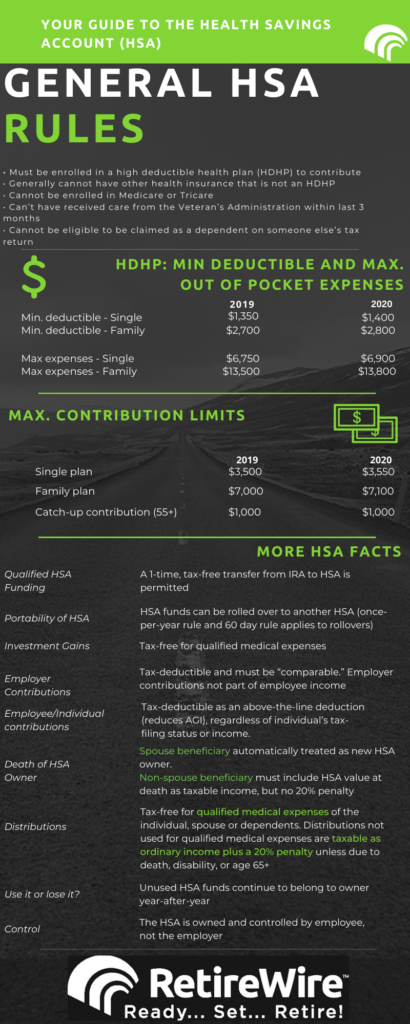

- You must be enrolled in a High Deductible Health Plan (HDHP)

- You cannot have any other health insurance that isn’t an HDHP

- You cannot be enrolled in Medicare or Tricare

- Healthcare sharing plans like Medi-Share typically don’t qualify either

- You can’t have received care from the Veteran’s Administration within the last 3 months

- You can’t be eligible to be claimed as a dependent on someone else’s tax return

Now that we’ve covered the basics, here’s how the HSA works.

An HSA is TRIPLE TAX-FREE

The cool thing that most people don’t realize is an HSA is your only TRIPLE TAX-FREE savings account!

Here’s why…

- When you contribute to an HSA, you get a tax deduction

- HSA money then grows tax-deferred over the years

- HSA money is distributed tax-free if used for qualified medical expenses

And another cool thing about an HSA is that if you wait until after age 65, you can withdraw the HSA funds for any reason and simply pay your ordinary income tax rate on the distribution just like an IRA distribution after age 59 1/2.

In other words, you do not have to use the HSA for medically-related expenses after age 65. However, in general, you’re far better off using the HSA funds for medical expenses to reap the full benefits of triple tax-free!

If you pay taxes on distributions for non-medical expenses, you’re losing a big chunk of the Health Savings Account advantages.

For high-income taxpayers, the HSA becomes even more of a “no-brainer!” The higher your income tax goes, the more the triple tax-free benefits of the Health Savings Accounts benefit you.

Can I contribution to an HSA and a 401(k)?

Absolutely! Since the tax benefits of an HSA plan are so great (better than a ROTH, an IRA, or your 401k at work), not only should you plan to contribute money, but you should maximize your HSA whenever possible, and allow the funds to grow as long as possible.

This means, even though you have funds in your HSA account, if you can fund your current year medical costs out of other taxable accounts you’re best off doing that than eating into your best long term tax-advantaged account–the HSA.

Is there a catch with HSAs?

Sounds good so far right? But, there are a couple of drawbacks to Health Savings Accounts.

- Don’t plan on passing it along to your children

- HSA funds are not shielded from creditors

- High Deductible Health Plans may not be the right health insurance type for you

HSAs are not good assets to get caught dead with because their distribution can be a little tricky. First, you need to decide who you want to name as the beneficiary

- Spousal beneficiaries inherit the HSA tax-free

- Non-spousal beneficiaries inherit the HSA fully taxable!

If your spouse is the beneficiary, he/she will inherit the HSA. Your spouse can use distributions tax-free for qualified medical expenses.

It’s completely fine if your spouse isn’t eligible for their own HSA as they can still access the HSA funds. If they are eligible for an HSA, they can also make contributions to the newly inherited HSA funds.

Your children probably don’t want your HSA, and here’s why. When your children inherit your HSA, the account is closed, and the funds are distributed.

Your kids will have to include those funds as part of their taxable income. Unlike current laws for ROTH IRAs, IRAs, and even workplace retirement plans (where assets can be distributed over several years or even the beneficiary’s lifetime), there is no ‘stretch’ option for HSA accounts.

The next disappointing aspect of HSAs is that HSA dollars are not protected from creditors. IRAs have some creditor protection, and your 401k plan at work is creditor protected. Health Savings Accounts are not protected from creditors generally speaking.

The third drawback is they’re hard to qualify for! Health insurance programs are making great strides in creating options that are considered High Deductible Health Plans, but most people don’t have an HDHP. So not everyone can have an HSA, which is very unfortunate.

Also, definitely make sure that an HDHP is right for you, here’s an article that will help you decide if you’re on the fence.

How much can I contribute to my HSA in 2020?

The contribution amounts for individuals and families with HDHPs and an HSA will be slightly increased compared to 2019.

For 2020, individuals can contribute $3,550 (plus $1,000 if over age 55).

If you have a family plan, the contribution limit will be $7,100 (add an extra $1,000 if you are over age 55).

You should be able to contribute to your HSA via:

- Payroll deductions

- Automatic bank transfers and

- Checks or money orders

What’s the best way to grow my HSA contributions?

If you’re able to cover your medical costs out-of-pocket, then that allows you to preserve your HSA and invest those dollars for growth.

NOTE: Be smart about the balance between paying for medical costs out-of-pocket and paying with your HSA. If you can cover expenses without taking a distribution, great! But don’t go into debt due to a large medical expense just to grow your HSA funds for future use.

Also, keep in mind you should always try and max out your 401k contributions at least up to the point your company matches BEFORE funding other accounts like a Roth, an IRA, or an HSA. After you get the max employer matching contribution, then start working on the HSA first, and the IRA or Roth IRA second.

As far as investment options, this will be determined by where you set up an account. Generally, HSA users will have the option to invest in a range of mutual funds and ETFs.

You can also decide to leave your HSA funds within a savings account vehicle (not invested) and accrue interest. However, you probably won’t earn anything more than a nominal interest rate.

My HSA gives my family the option to invest in index funds – such as the Vanguard S&P 500 index fund. That’s a pretty neat deal because not only is this a great tax-free investment vehicle when used properly, but it can grow with the stock market over long periods of time!

At the end of the day, it’s great to invest your HSA for long term growth (assuming that fits with your retirement plan), because even though it’s only one aspect of retirement costs, healthcare expenses in retirement will likely be overwhelming due to their much higher inflationary pressure.

Always save your receipts for HSA reimbursement

Under current law, even if I front my family’s current medical expenses with taxable dollars, provided I save my receipts I can go back to my HSA plan several years later and withdraw the funds completely tax free after they’ve had time to grow (though it’s entirely possible if not likely the government will take away this provision).

The downside of this is you’re spending “today’s dollars” and only withdrawing “today’s dollars” later when you tap the HSA account for reimbursement.

Here’s what I mean by that. Let’s say your family has $5,000 of qualified medical expenses in 2020. In 2040 when you may retire those same medical expenses would be more like $13,266 at 5% (medical expense inflation rate) per year times 20 years.

So it’s always good to defer claiming those qualified healthcare expenses until when you really need the money, but there are diminishing returns due to healthcare expense inflation.

Who can contribute to my HSA?

Almost anyone can make a contribution on your behalf. In addition to yourself, your employer, spouse, or another family member can contribute (that sounds like a nice deal!).

Regardless, the contribution limit remains the same and the tax deduction would be filed under the eligible individual’s tax return, not the person making the contribution (for example, if a non-spouse family member was making the contribution).

What happens when I enroll in Medicare?

Keep in mind that most Americans enroll in Medicare at age 65. If you also enroll, this will make you ineligible to make further contributions to your HSA. Regardless of eligibility for contributions, those funds are yours to use in the future.

If you enroll in Medicare, consider spending down your HSA funds, especially if you don’t have a spouse and the named beneficiaries are your children. Perhaps you want to start tapping your HSA account for current medical expenses, your long-term care insurance premiums, or even Medicare premiums.

How do I open an HSA account?

In order to open an HSA, you will need to initiate an account with an HSA administrator.

Before opening an HSA account, take some time to read the fine print:

- Be aware of and minimize administrative fees

- Understand your investment options

- Know the process for making a medical expense claim and accessing funds

- Consider other costs as well as the overall convenience

You can open an HSA account with institutions such as:

- Banks

- Credit Unions

- Insurance companies

Personally, I use OptumBank. They offer a wide selection of investment options and it’s been a very smooth process.

Another important consideration is to think about your needs and long term goals. Are you wanting to treat your HSA more like a retirement account seeking long term growth? Or will you be using these funds in the near future for medical costs?

Opening up an HSA should be relatively quick and can be done in person or online.

What counts as a qualified medical expense for an HSA?

Every year, the IRS publishes a list of qualified medical and dental expenses. These are the items (here is an unofficial list that is easier on the eyes) that you can take HSA distributions to pay for without being penalized.

Always check the list to make sure that your expense is covered, as there are lots of items that are not considered ‘ qualified’ even though intuitively it makes sense to include.

Per the IRS, “Qualified medical expenses are those incurred by the following persons:”

- You and your spouse

- All dependents you claim on your tax return

- Any person you could have claimed as a dependent on your return except that:

- The person filed a joint return,

- The person had a gross income of $4,150 or more, or

- You, or your spouse if filing jointly, could be claimed as a dependent on someone else’s 2019 return

Many people wonder if they can use their HSA funds to help pay for their insurance premiums. Unfortunately, you cannot do this, unless you are paying for:

- Long Term Care insurance premiums

- Health care continuation coverage (such as coverage under COBRA)

- Health care coverage while receiving unemployment compensation under federal or state law

- Medicare and other health care coverage if you were 65 or older

As a general rule, do your homework and make some phone calls if you are unsure about ‘qualified’ expenses.

What are HSA withdrawals for non-qualified expense taxes and penalties?

Despite your best intentions, if you withdraw funds from your HSA to pay for non-qualified medical expenses, there is a tax penalty.

Let’s say you are younger than 65 and you take an HSA distribution to buy a new tablet for $300. You are going to be taxed not once, but twice.

First, you will be taxed a 20% penalty against the $300 for making a non-qualified expense. The $300 will also be reported as income and will, therefore, be counted toward your taxable income for the year.

NOTE: DO NOT USE YOUR HSA FOR NON-QUALIFIED MEDICAL EXPENSES

DO I have to take required minimum distributions from my HSA each year?

No. Even though an HSA, under current law, has the potential to be utilized as a ‘retirement account’ once you reach age 65, you will not be obligated to take minimum distributions like you are with a Traditional IRA or pre-tax 401k, for example.

And remember, after age 65, you can withdraw the HSA funds for anything you please regardless of whether or not it is a medical expense.

DO I lose my HSA if I change jobs?

Luckily, HSAs are portable, meaning that if you ever change jobs, you won’t lose the money you have saved and contributed to the HSA.

You can easily transfer or rollover your HSA from an existing custodian to another for free.

However, HSA rollovers can only occur once per 12 month period. The good thing is that neither transfers nor rollovers will account against your yearly HSA contribution limit.

What if I can’t fund an HSA?

So you’d really like to fund an HSA but you’re tight on cash? I understand completely!

Assuming you can qualify for an HSA and don’t have the money to fund it you may still be able to fund it through alternative means. To do so, you must have an IRA first.

Once you have an IRA you can do a one time IRA to HSA rollover. I realize this may not be ideal but consider for a moment you (most likely) got a tax deduction for funding the IRA. That money has also grown for you tax-deferred over time.

Now you have the first two components of “triple tax-free” (tax-deduction and tax-deferred growth). The only thing that’s missing is the tax-free withdrawal.

If you qualify for an HSA, do an IRA to HSA rollover up to the maximum annual allowable limits. Assuming you have qualified medical expenses later you can do the tax-free withdrawal on the back end.

Worst case scenario, you wait until at least age 65 and simply withdraw the funds paying the typical income taxes you would’ve paid anyway. It’s a good deal if you can execute!

How can an HSA help you?

HDHPs with Health Savings Accounts are a unique tool that you can use to take advantage of some amazing tax savings. It can also help you supercharge future income sources once you retire.

It’s the ONLY triple tax-free account that exists today making it SUPER POWERFUL when it comes to your retirement planning. You will have medical and healthcare expenses in retirement, so why not take advantage of this triple tax-free planning vehicle!

For the drawbacks the HSA has, it’s a great opportunity! All in all, if you can qualify for an HSA – take advantage of it!