Outside of professional athletes kneeling during our national anthem, the upcoming elections are dominating our media attention. More and more I’m fielding questions like “What will happen if Trump wins the election?” and “Will Hillary’s tax increases crush our fragile economy?”

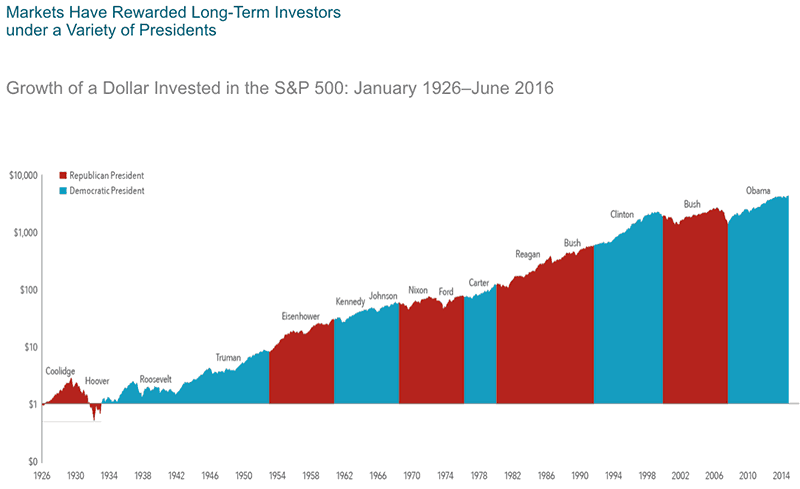

No one knows the answers to these questions. What I do know is this: the stock market has rewarded long term investors no matter who wins the elections.

Stock market investing throughout Presidential cycles

The best indicator of a securities future price, is it’s current price. We call this “swarm intelligence“. The simplest way to sum it up is “the collective wisdom of masses of investors always fairly prices securities”.

My expectations on earnings, economic growth, and the elections, affects security prices through my buying and selling pressure. So does yours. So does the collective buying and selling pressure of the entire population of investors.

Rather than focus on any knee-jerk reactions to which candidate wins the election, we should focus on the long term. The markets have always rewarded stable long term investor behavior, even though short term reactions really can shake your confidence.

Don’t change your investment plan

The biggest mistake investors are making right now is changing their investment plan. Just because election night is a few weeks away doesn’t mean you should go to cash, or get aggressive. You cannot predict the outcome (even though it seems predictable at the moment).

Even if you could predict the outcome, it doesn’t mean what you suspect will happen will actually happen. For example, for investors who think Trump will cause perilous financial harm, there are investors on the other side who feel Clinton will do the same or worse.

Who’s right? You, them, your experts, my experts?

Don’t change your investment plan, don’t change your financial plan. You cannot outsmart the market! Rather, ride the wave. Stay grounded in your long term fundamentals. You’ll be much happier and much better off financially for it!