It’s so easy to get caught up in financial news. They’re constantly finding analysts and commentators to decipher what’s going on with the stock market. For every bear, there’s a bull. For every reason to buy there’s an opposing reason to sell.

The problem is it’s so easy to get wrapped up in what “the stock market” is doing. And what are you getting wrapped up in? Usually it’s one of the big three stock market indexes: The Dow Jones Industrial Average, the S&P 500, and the Nasdaq composite.

While these stock market indexes are a general representation of what’s going on with your investments, they’re not the most important thing to watch. There are 3 things you should understand about these indices which track the stock market.

What is a stock market index?

There are a number of stock market indexes frequently mentioned on television and cited in financial media. They measure various slices of the stock market and can be used as performance benchmarks for both investment vehicles (such as mutual funds) and one’s own portfolio returns.

A stock market index by definition is simply a group of stocks which represent some section of the overall stock market. They can be classified or segmented in many ways.

Some indexes are very broad in nature for example the S&P 500 index. It’s a broad index of 500 of the largest stocks traded in the United States. Other indexes are very narrow in nature, for example the Russell 2000 value index. The Russell 2000 value index is only small companies which classify as “value stocks”.

#1 Stock market indexes don’t include fees

Regardless of what index is being tracked, an index is just an index. It’s not actually a managed portfolio, it’s just a hypothetical chunk of stocks representing some section of the market.

You cannot invest in an index per se. To access the performance of any stock market index you’d need to A) buy all of the stocks in the proper amounts which make up the index or B) buy a managed product which does A.

A managed portfolio would incur management fees, transaction costs, and generate tax implications. Since a stock market index is “hypothetical” it does not include fees.

Anytime you compare something with no fees and something with fees, the one with fees will have a lower return. Any managed investment (think mutual fund) should automatically underperform it’s benchmark index by the amount of fees. It’s up to the investment manager to boost performance enough to compensate for their fees.

So the next time you’re looking at the performance of the S&P 500 index just remember it’s hypothetical. You’ll naturally underperform that index by whatever fees your investment incurs in trying to mimic – or beat – the S&P 500.

#2 Stock market indexes aren’t stagnant

Any index you follow will maintain it’s composition for a certain period of time. At that point in time they’ll be adjusted or updated to whatever securities meet the current index criteria. That process is called “reconstitution”.

Reconstitution is simply the process of removing stocks which don’t meet the index parameters and replacing them with stocks that do. It’s a rebalancing process of sorts, as it brings the index back in line with it’s intended composition target.

For example, the S&P 500 index reconstitutes when needed. It’s not uncommon to happen quarterly or so. When this happens index mutual funds must reconstitute as well. This creates a great deal of buying pressure for securities which will be added to the index, and selling pressure for stocks which are being kicked out.

Since the S&P 500 committee tells the world what it’s going to do, it creates an arbitrage opportunity. Investors can buy up shares which the worlds largest index fund (the Vanguard 500 index) will be buying, and they can sell shares of what they’ll be selling.

This arbitrage means if you own the Vanguard 500 index fund you’ll pay more for the shares being brought into the index, and you’ll get less of for the shares being removed! This is a well known negative to owning any index fund.

Other passive mutual fund managers (like Dimensional Fund Advisors) mimic indexes but dont mirror them exactly. Since they don’t mirror, they don’t telegraph their buys and sells. While their performance doesn’t perfectly track the index, results are better because arbitrage can’t take place.

#3 Stock market indexes outperform the vast majority of active managers

Since all actively managed mutual funds have fees they’re automatically at a disadvantage to their benchmark index. Remember, the benchmark index doesn’t include fees. If your active mutual fund has a fee of 1% the manager must earn 1% just to tie its benchmark index. This is a big hurdle to overcome!

Data also suggests that indexes outperform actively managed investments by a wide margin on average. An active manager is generally buying a small portion of their benchmark index. If they buy the wrong securities their performance will suffer since the index is far more diversified. Take a look at the following graph:

Why don’t indexes outperform 100% of actively managed funds? It’s statistically impossible. With thousands and thousands of mutual funds out there sheer statistics will show you that 25% or so of active managers will “get lucky” and beat the index once in a while. It’s highly unlikely however that the luck is sustainable.

3 of the most popular stock market indexes

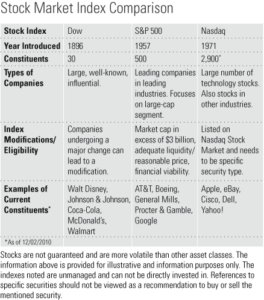

Dow Jones Industrial Average: The Dow Jones Industrial Average was first unveiled by Charles H. Dow on May 26, 1896. It consisted of 12 stocks.

In 1916, the industrial average expanded to 20 stocks. In 1928 was subsequently bumped to 30 where it currently stands.

The index constituents are 30 of the world’s largest, most influential and well-known companies. Whenever you hear someone referring to what “the market” did in any given day, they are most likely referring to the Dow.

Changes to the index are rare. According to Dow Jones Indexes “when a current component is going through a major change, such as a shift in its main line of business, acquisition by another company, or bankruptcy. There is no review schedule.”

Standard & Poor’s 500 Stock Index: When you hear that a portfolio has “beaten the market” it is most likely being compared with the S&P 500. The S&P 500 was first published in 1957. It’s composed of 500 leading companies in leading industries of the U.S. economy, focusing on the large-cap segment of the market but also serving as a proxy for the total market covering approximately 75% of the entire U.S. stock market.

The S&P Index Committee follows a set of published guidelines for maintaining the index (complete details of these guidelines are available at www.indices.standardandpoors.com). Some of the criteria for addition include:

- market capitalization (share price multiplied by shares outstanding) in excess of $3 billion,

- adequate liquidity (how easy it is to buy and sell shares),

- reasonable price, and

- financial viability.

Those that substantially violate the criteria are dropped.

Nasdaq Composite Index: Launched in 1971, the Nasdaq Composite Index measures all Nasdaq domestic – and international – based common type stocks listed on the Nasdaq Stock Market. The index includes nearly 3,000 securities.

The Nasdaq is best known for its large portion of technology stocks, but also has stocks in other industries. To be eligible for inclusion in this index securities must be listed on the Nasdaq Stock Market and they need to be of a specific type. For more information, visit www.nasdaq.com.

Please keep in mind that a company can be a member of more than one of the three indexes described above. Microsoft is an example of a company that has a place in all three.

How stock market indexes affect you and your investments

Most investors have reasonably diversified portfolios. They own stocks, bonds, and commodities. In owning those diversified investments it’s important to be aware of how your portfolio relates to these popular indexes.

When you see “the market was this or that today” on the news, just remember it likely only correlates to a portion of your investment portfolio. Remember you have bonds, commodities, and even foreign stocks which may perform better or worse! So don’t get too wrapped up in the major stock market indexes you see on the news everyday.