Living Trusts – common problem solved! Please fund your trust

I want to thank Greg Phelps for inviting me to discuss Living Trusts and a critical, but all too often overlooked, area of estate planning. That aspect is the failure to actually fund a living trust you’ve created.

Creating a Living Trust – but failing to properly fund it – would be similar to:

- Running a marathon and stopping 3 feet short of the finish line.

- Neglecting to file the paperwork to get your diploma after completing the required college coursework.

- Leaving your brand new car on the dealership lot after buying and paying for it.

Far too often people do the difficult work in making decisions for their living trust, then fail at actually funding their trust. This article explains how assets are passed at death, and how and why it’s important to fund your trust.

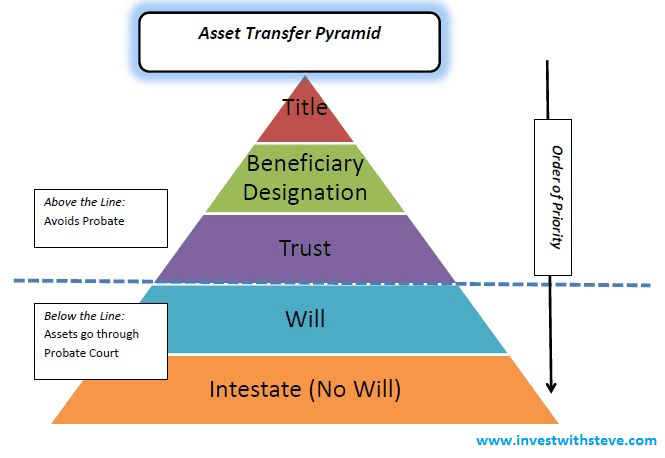

Asset Transfer Pyramid – How assets are transferred at death

Below is what I like to call the Asset Transfer Pyramid. It’s a visual tool I use to help clients understand how assets are passed at death.

Your assets can pass via any of these means on the pyramid. The biggest surprise to most people, is that assets which pass via will are still subject to probate and the costs associated with probate.

In order to avoid probate, the asset will need to pass via title (for example joint with rights of survivorship), beneficiary designation, or trust. Technically, assets held in trust are passed via title. For purposes of understanding the pyramid, I place the trust BELOW title and beneficiary designation.

If an asset is not titled in the name of your trust – or the beneficiary designation is not named in your trust – the trust will be ignored. In this case, the asset will pass according to title or beneficiary designation.

I also wrote another article Asset Transfer Pyramid – Estate Planning Explained. In that article I go into greater detail about asset transfers and other estate planning issues.

Common examples of NOT funding your living trust

The most common example is often the primary residence. The home was owned in joint tenancy when purchased. After the trust was established, title to the home was never changed to the trust. This happens far too often!

In the event of death with join tenancy, the home would go to probate court if both parties were to pass. This is the case even if they had a living trust, because the house was never titled into it.

The probate court would then read the will. If the will said the home should pass according to the trust document, the wishes of the deceased in their trust would be followed.

The result is identical for any bank accounts, brokerage accounts, and other assets where the title is not held in the name of the trust. If you don’t fund your trust, you’re missing out on the benefits of all the hard work you did to create it.

What about my retirement plan and IRA’s?

This topic should be discussed with a financial advisor who is knowledgable in the pros and cons of naming a trust as a beneficiary of an IRA. The first point about these retirement plans, is that you cannot title the assets in the name of your trust.

While you can’t put these accounts in trust name, you can name the trust as an IRA or 401k beneficiary. Before you do that, you should discuss with your advisor if it makes sense for you to name the trust as a beneficiary.

The options available to you are beyond the scope of this article. The key point is if the trust is NOT named a beneficiary, it will have no control over how the asset is passed. Beneficiary designation is a higher level on the asset transfer pyramid, and therefore trumps whatever is stated in the living trust itself.

The take away

Having a well-crafted estate plan which includes a living trust accomplishes little for your estate plan if it’s not funded. I highly recommend working with an expert to craft an estate plan that uses your trust, title, and beneficiaries designations properly. This helps ensure your wishes and estate plan is implemented.

Stephen Reh CFA, MBA, CFP® is a financial planner in Southern California. Steve founded www.investwithsteve.com and Reh Wealth Advisors LLC in 2010, to provide fee only asset management and financial planning. If you are in the Southern California area looking for financial planning or investment advisory services, give Steve a call.

Disclaimer: Information above is for information purposes and should be reviewed with your advisor and attorney to make sure it’s accurate and applicable to you. I am not an attorney and I do not provide legal advice.