This lottery winner has cracked the code!

Now I’ve seen everything – this may be your ticket to a great financial plan! You can find it all here at http://www.winninglotterymethod.com. Richard Lustig has won a bunch of money in various lotteries. He’s been on Fox, the Today Show, and Rachel Ray, and even has some Guiness world record or something like that.

He’s gained so much notoriety he’s also written a book on winning the lottery. He claims he’s won over 1 million dollars in various lotteries, and guess what – I BELIEVE HIM!

You probably expect me to dispel his claims. It’s not really worth my time, and in fact I’m thinking it’s probable he’s won a bunch of money. So why am I writing about this?

Investors don’t understand statistics

I’ve been advising clients for over 20 years, and I’ve seen a lot of stuff. I get a lot of things sent to me on this strategy or that method of beating the market. I even get plenty of stuff on how you can “make money when the market goes up but never loose!”

One client recently brought me a website where you type in a magical code they’ll put money in your account! Yes, for real, that was the pitch!

What the investor didn’t realize was the money was coming from selling out of the money put options on stocks. All in all selling out of the money puts isn’t rocket science, but can be VERY risky!

I’m covering Richard’s luck because there’s a very valuable lesson here – it’s all in the statistics! If I believe Richard has won a bunch of lottery money. Does his success also mean he’s “cracked the lottery code” as he claims?

The logic defies me

If he’s cracked it, why doesn’t he just pony up a bunch of his winnings and parlay it hundreds of millions in winnings? Why is he wasting his time on tv trying to sucker people into buying his lottery code? But I digress.

I mention in my book, there were a few people who went on record as predicting the downfall of the markets in 2008. I also mention that statistically I’m shocked there weren’t hundreds or thousands of prognosticators who predicted the market collapse.

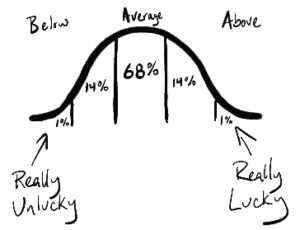

It’s simple math. In order for there to be average people there must be below average people and above average people. Take a look at a bell curve of performance:

By simple math there must be some very fortunate people out there like Richard Lustig… OR like Peter Schiff who predicted the 2008 collapse. By simple math there’s also some people out there who are very very unlucky.

Take Ann Hodges for example. She’s the only person to ever be hit by a meteorite! That’s pretty unlucky if I do say so myself. Or there’s Roy Sullivan, who was struck by lightning on 7 different occasions. It’s unfortunate but it’s a fact of life, he’s one of these statistically unlucky people!

For every one of these really unlucky people, it’s only logical you’ll find some really lucky people. That’s just statistics!

Don’t mistake luck for skill

The disconnect most normal people have is they see these really high performers like Richard Lustig or Peter Schiff and mistake luck for skill. Just because they’re really lucky right now doesn’t mean that luck will continue into the future. In fact, if anything they’re likely to slide back down the bell curve.

Not only are they likely to slide back the other way on the bell curve, they may possibly slide all the way to the unlucky column. That’s called a reversion to the mean.

I’m a big believer in the reversion to the mean. Because I’m a big believer, we’re constantly rebalancing when things get really out of whack! I believe those super out-performing asset classes will eventually return to normal. Those super under-performing asset classes will eventually find success back to their long term patterns.

Statistics relate directly to your investments

The same statistics hold true for active investment managers who “happen” to outperform the stock market over some period of time. They are the very high performers. Don’t mistake that luck for skill!

Now, if you believe statistics lie and Richard isn’t just statistically lucky I have a great financial plan for you! Pony up $49 now and $49 per month for his lottery beating formula!

Or

You may want to enter a code and have money magically deposited into your brokerage account. Just google Lee Lowell Magical Money Codes (please take note of my sarcasm and DO NOT do this!).

My friends, there is NO FREE LUNCH! Statistics don’t lie, they just don’t. So why am I writing about Richard’s lottery beating formula? Entertainment value, because that’s all it’s worth.