Note to readers/viewers: The following healthcare costs in retirement/Medicare video was originally filmed on 7/21/17 as part of my Wealth Summit series of interviews. This particular video explains the critical parts of—and steps to—lowering your retirement healthcare costs.

Click the play button to watch, and enjoy!

Managing healthcare costs: quick summary:

If you’ve ever had family members or extended relatives that struggled with health issues later in life, you’re aware of how costly medical expenses can be during retirement. Whether it’s medication, surgeries, or extended care, there are so many unknowns. David Armes, President of Dover Healthcare Planning, LLC, specializes in helping retirees manage their costs and understand their options. David joins the Wealth Summit to discuss how you can properly prepare for medical expenses that will occur during retirement.

KEY POINTS

- Healthcare costs are different

- How to control healthcare spending

- Types of supplemental coverage

Healthcare costs are typically much higher for retirees than other expenses they’ll incur during retirement. Inflation rates for healthcare related expenses have grown about 1.5% more per year on average than normal inflation prices.

Due to the large variety of options, Healthcare costs are also way more complicated than say buying a house or planning vacations. Additionally, they’re completely unpredictable. Expenses are totally based on your health, which changes in old age. Finally, costs are tilted towards later years as retirees require increased medical services.

One of the biggest threats to your financial portfolio and happy retirement is late Medicare enrollment penalties. They are simple but strictly enforced, and missing the initial enrollment can result in a lifetime of penalties.

Secondly, choose initial coverage very carefully. We’ll discuss varying policies in the next paragraph, so it’ll be important to carefully understand the differences.

Finally, review your coverage yearly. 90% of retirees never change their plans, and 90% of those retirees are paying several hundred dollars per year too much. Don’t suffer financially if it’s avoidable.

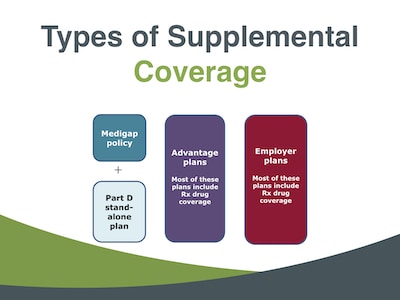

There are 3 main types of supplemental coverage: Medigap policies, Medicare Advantage Plans, and employer plans.

If your employer offers a health care plan, take it. Only about a third of people have this option, and it’s almost always the best choice.

Medigap policies cover the 20% difference not included in Medicare. While the premiums are more expensive, choose your Medigap plan based on the lowest drug cost, not the premiums. Advantage or “managed care” plans have zero premiums, which make them much less expensive than Medigap. However, the out-of-pocket risk is fairly high.

The further and more thorough you plan ahead for healthcare expenses, the better off you’ll be once they hit. Don’t miss your initial enrollment opportunity, otherwise, you’ll incur heavy lifetime penalties.

Review your policy each year, and choose the employer-sponsored plan if eligible. Preparation and planning can prevent your loved ones from being forced to bear the financial burden of your healthcare costs.

Managing healthcare costs in retirement: Interviewing David Armes

Greg: Hello Wealth Masters. My name is Greg Phelps and I am your host to the Wealth Summit. Our mission here at the Summit of simple—we want to educate, and empower you with actionable tools, tips, and tactics to help you grow, protect, and maximize your wealth!

I can’t think of any better topic today to be discussing than managing healthcare costs and retirement. We’ve got a very special guest, David Armes. David are you ready to help us master our wealth?

David: I am . . . I am ready! Put me in coach.

Greg: All right, we’re going to put you right in! Here’s a little bit about David.

David Armes, CFP®

David is the president of Dover Healthcare Planning LLC. He’s a CERTIFIED FINANCIAL PLANNER™ with 10 years of experience in Medicare counseling.

He’s been quoted in articles about retirement healthcare costs in the New York Times, The Dow Jones Financial Advisor, Bloomberg, Businessweek Online, and Financial Planning Magazine. He’s also written articles about Medicare and related health insurance topics for several financial publications, including Financial Advisor Magazine, and The Journal of Financial Planning.

David, you’ve got quite the reputation there! So why don’t you go ahead and take a second and fill in any blanks that I might have missed in your quick intro?

David: Sure, Greg first I appreciate the opportunity to be here. I retired several years ago from a corporate job looking for something to do at the time.

I decided to become a volunteer Medicare counselor for the County of Los Angeles. I did that for four years really came to understand Medicare fairly well. It’s a very complicated area of course, but I understood much of it.

Frequently, we’re not thinking in financial terms. People typically are trying to get their enrollment and eligibility questions answered, right? Which is which is important, but they were not really looking at the longer-term implications of various types of coverage.

If I choose this type of coverage, what’s my cost likely going to be in five or ten years? And so at that time I decided to start a little business.

We’ve been in business for a decade. And you know, we’re trying to help people just manage their costs and understand their options.

We don’t sell insurance or recommend insurance. We just explain the process to them. Right?

Greg: Well, I personally have knowledge of your expertise because I actually do send my clients to David for their Medicare reviews and so forth. He’s done an excellent job over the years. So thank you so much for that.

So let’s go ahead and set a foundation Wealth Masters . . . and just kind of “talk about the basics” to get us all on the same page.

The very first topic on that is that healthcare costs are actually different than other expenses. So David, why don’t you go ahead and kind of elaborate on that.

The basics of managing healthcare costs in retirement

David: Sure, and I think most people know this intuitively. If not, maybe academically. Number one is healthcare costs tend to increase at a faster rate than other costs.

Healthcare inflation has grown faster over the last 30 years. According to the government CPI index, healthcare inflation has grown about one and a half percent more each year on average than other kinds of spending.

So as people look at healthcare costs and retirement, they need to be aware that their costs for healthcare likely going to increase at a more rapid rate than their housing costs, their food costs, and other costs.

Also, healthcare is more complex there are just a lot of options! Medicare—as I mentioned a moment ago—can be complicated.

Parts of it are simple—parts of it involve a lot of detail—and people aren’t sure how to manage that.

They say, “I don’t understand it! I get confused!”

So healthcare costs are different than housing costs. They’re a large category of retirement spending.

They all know how to manage housing costs. They’ve been doing it their whole lives.

They can—you know—many retirees downsize (almost 40 percent) their homes. Some take out reverse mortgages.

They know the tactics they can use to manage those expenses. When it comes to healthcare they’re not so sure.

I don’t understand this. It’s confusing. What are all these—you know—deductibles, co-payments, cost sharing, secondary deductibles that apply to certain services?

So they just give up and stay in the same plan.

Costs are unpredictable in healthcare! They’re based on your health—basically. I had a client last year during open enrollment who really had monitored her costs carefully. She was in her early 70’s at the time, and her costs were pretty much on track.

She was trying, she knew it could be a big liability! So she was trying to stay on top of it.

Her doctor at that moment had just prescribed a new brand name drug for her which she needed to take. She was not seriously ill, but he said: “I think this brand name drug will help your health and maybe prevent future complications.”

She started taking it at the time. She started taking it, Greg. Her healthcare costs were about thirty-four hundred dollars a year. We estimated that included a Part B premiums, plan premiums, and co-payments for the drug she already took—this one drug.

Not an expensive drug, it’s a brand name drugs. It raised her costs by $1,500 to roughly $5,000 dollars overnight!

In one year those costs went up more than 40 percent! So healthcare costs are unpredictable, particularly drug costs. In part D coverage where those fall—it’s good—but it’s not great.

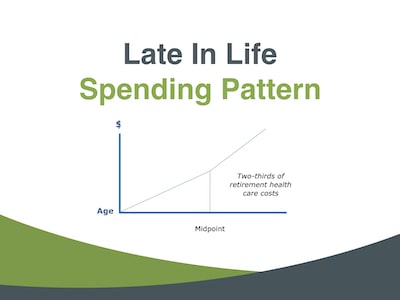

So there’s an unpredictability about what kind of medical services you’re going to need. Many people need medical services that are not covered by Medicare. Then partly because of the health inflation rate being higher you tend to find that healthcare costs tend to be greatest in the last half of retirement—particularly the later years—and so there’s a shift in—as we’ll see—I think on a future slide there’s a shifting of cost to later retirement.

That’s where many people are surprised. They get the later retirement and they say “Wow! I had no idea.”

Age-adjusted healthcare costs in retirement

Greg: Let’s go ahead and talk about shifting healthcare costs towards late-in-life medical expenses.

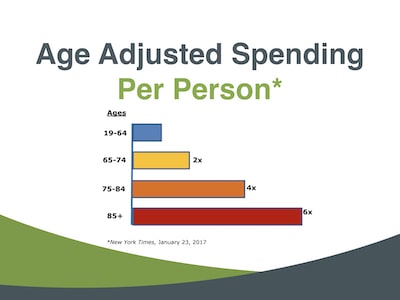

David: This is from a New York Times summary of research that appeared earlier this year. This is spending per person.

We all know that healthcare costs and premiums go up as we get older. You know . . . 30-year-olds pay more in premiums than 20-year-olds. That trend continues throughout—and actually starts to accelerate slightly in the later retirement years.

This shows the total spending per person. This is not out-of-pocket spending. This is what the person spends including out-of-pocket spending.

As you can see, once you get to 75 and older, your expenses are twice or four times as much as they were before you turn 65. They’re six times as much once you reach age 85.

So, you see, this shifting of costs is primarily because first of all healthcare inflation, but also the older we get the more we’re using more medical services and taking more drugs as we age.

They’re more likely to take brand-name drugs. They’re more likely to use services that are not covered by Medicare . . . certain forms of in-home-care and things like that.

So there’s this—I mean—it’s one of the key elements in planning for healthcare costs is the realization and preparation for this later phase of retirement.

Greg: Right, as you mentioned, I mean the expenses are just going to ramp-up exponentially as you’re showing here on this chart, and it’s just something that has to be taken into consideration. I know when we do plans for clients, we assume anywhere from six to six and a half and percent inflation on just the medical costs.

David: Yeah, and that’s it’s a little tricky because you can look at out-of-pocket costs typically. People’s out-of-pocket costs don’t grow quite as quickly as healthcare inflation because the insurance company (and in Medicare’s case the government) absorb some of that additional inflation. But they still go up faster than other kinds of inflation.

Out of pocket healthcare spending in retirement

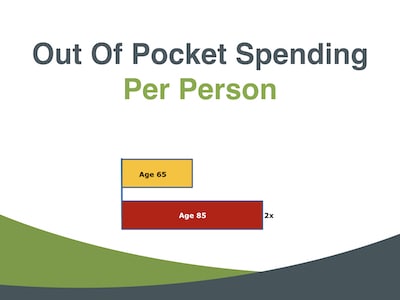

Greg: So, okay . . . so let’s kind of transition to looking at your out-of-pocket spending at different ages as well as a very similar slide.

David: Yeah. The prior slide shows just total spending by the person. This is what people spend out of their pocket and premiums, co-payments, deductibles, cost-sharing, and it’s approximately two times as much at age 85.

Now this chart—as simple as it looks—can be misunderstood.

Some people will see this and perhaps think “Okay, what this means is I’m 65 today and when I’m 85 in 20 years, I’m going to spend two times as much.” That’s really not what this chart is saying.

This chart is saying that this year (2017) the average 85-year-old is going to spend twice as much out-of-pocket.

Okay, that’s the average 65-year-old, and that’s because of higher premiums in individual policies and also greater use of medical services.

Greg: Okay, and that kind of makes the medical spending pattern looks like this chart here where we’ve got this rapid rise towards the end—you know—later in life.

David: There have been so many studies that document this “shifting”, this “back-loading” of healthcare costs. And again, there’s a lot of variation among individuals. Two-thirds of your retirement healthcare spending will come in the second half of your retirement.

And again, there’s variation. That’s not a prediction that’s going to apply to everybody. But people need to be aware as they think about this large expense for retirement that it’s going to get bigger in all likelihood, and can in some cases overwhelm them in late retirement.

Greg: Right, and I suspect and you can elaborate on this. The fact that we’re living longer really back-end loads this whole expense thing.

David: Yes. Yeah, a big factor is longevity in these costs, and we’ll see that in a moment. I think some projections are estimates of cost, and those are.

The primary determinant is going to be longevity. In many cases, the average Medicare beneficiary pays 70% of their costs and premiums.

Even if you never go to the doctor, you’re going to be paying those premiums every year. So if you live five years longer and never go to the doctor during those five years, your premiums are going to be going up five percent a year perhaps.

Greg: 5%! And you’re saying “But I’m healthy!” . . . but you’re also living longer. That’s a perfect segue too!

So I know there’s a lot of studies on exactly what we can expect to spend in retirement on healthcare. I know the numbers are pretty big right?

What will you pay for healthcare in retirement?

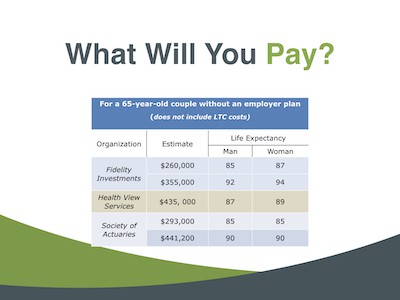

David: Numbers are very big and I wouldn’t put credibility on them. I tell clients and when I write about this none of these is a prediction.

These are estimates made by organizations that have been doing healthcare cost estimating for Medicare. Society of Actuaries has been doing it for like 35 years.

These are estimates of how much 65-year-old married couple will spend if they do not have employer coverage. If they have employer coverage, it will vary depending on how good that coverage is.

It will probably be a little less for most employer plans because the employer is subsidizing that coverage. Two-thirds of people retiring do not have employer coverage.

You can see here in the right two columns the life expectancies that are assumed for these projections. None of these is going to be right.

We don’t know which is going to be right there. Probably they’re all going to be off a little.

There’s a benefit to looking at these I think though—just to give people an idea of the potential magnitude of their costs and that may do a couple of things great.

It may encourage them to monitor their coverage as they go throughout retirement. Like I know later my expenses could get very large . . . so I need to pay attention to this.

The other thing is in some cases it will shift them to a different kind of coverage. An early retirement many times is one of the mistakes I saw people make when I was a Medicare volunteer counselor.

They will jump into the most comprehensive plan they can get—which is also the most expensive plan when they’re 65 years old. They’re still—most of them—in very good health!

They don’t go to the doctor much, they do not need comprehensive insurance. They may need that comprehensive insurance in 20 years, but they’re wasting (in some sense) their dollars if they spend it now. . . they’re very affluent.

And if it’s not an issue then that’s fine. I mean, they’ll enjoy that very comprehensive coverage.

To go back to this chart, the costs (while unknown) are substantial! If you look at the life expectancies here, I mean in many cases people are going to live longer than these life expectancies.

Greg: Right and these numbers are fairly shocking. I know when we discuss with people and you say hey, by the way, you know, you’re young and in retirement. You’re 60 . . . the early 60s . . . the mid-60s!

You’re looking at three or four hundred thousand dollars that you’re going to spend over the rest of your life for medical services and healthcare.

David: Yeah, and I think that’s a good ballpark for a couple—for a married couple—you know as approaching retirement? I would say you know, $300,000. In fact, I think the next slide we’ll see talks a little bit about in terms of what you should have set aside theoretically at the start of retirement.

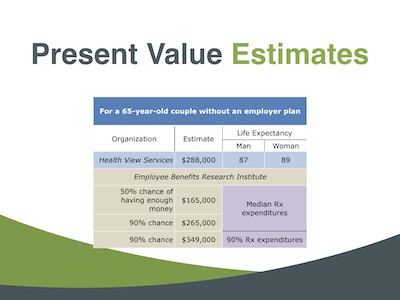

The present value of healthcare costs in retirement

Greg: Yeah, let’s go ahead and tackle that one right now. So if I wanted to pay for all of my healthcare expenses upfront . . . how much money do I need?

David: Well, this let me just preface this Greg by saying this is from the Employee Benefits Research Institute. Most of these are—the first one’s not—this is Money Magazine.

These are what financial planners called present value dollars. This is how much—as you said—you need today to have in the bank.

So I’ll jump down to Employee Benefits Research Institute just to take one example. They’re saying that for a 65-year-old couple (who doesn’t have employer coverage) if they want to have a 50% chance of having enough money to pay for their retirement healthcare they should have about a hundred and sixty-five thousand dollars in the bank now!

They’re assuming that’s going to earn in their modeling. This is a Monte Carlo analysis.

They’re assuming that investments are going to earn an after-tax rate of 7%! That’s TOO optimistic which is a mistake.

EBRI—they probably do the best job in terms of looking at different situations. They look at what happens if you have average drug expenses or median drug expenditures. What if you’re in the 90th percentile range and in the 90 percentile range you can spend twice as much for healthcare if late in life, you need some expensive drugs!

Greg: Right. Wow! So $165,000 in my investment account right now that grows at that seven percent number . . . that’ll cover my medical expenses throughout retirement with a 50 percent possibility there’s also a chance I’m gonna run out of money!

David: Exactly. Exactly now, I guess the one thing that I would just say here and it’s an optimistic note, is all of these projections use a Medigap policy because it is the most predictable expense.

And they’re modeling. It’s very hard to model Advantage Plan costs far out, and Medigap policies as I think we’ll talk about are typically or the most expensive choice. So they are assuming very good coverage here.

And I think many people—as we were saying earlier—don’t need that comprehensive coverage when they start. But yeah, these are these are numbers! The Employee Benefit Research Institute has been doing this for 25 years.

They testify before Congress on these numbers when Medicare legislation is up so they know what they are.

Greg: Yeah, EBRI is very good. I have seen a lot of their reports in their analysis. So, so let’s kind of transition a little bit David and let’s kind of jump into how do we control some of these healthcare costs?

Controlling healthcare costs in retirement

David: Okay, there are really three key things.

Avoid the Medicare late enrollment penalty

The first is to avoid the Medicare late enrollment penalty. That’s a one-time deal when you first enroll in Medicare. Whether at age 65, or some people continue working, or their spouse continues working and they enroll.

There are some very simple but strictly enforced rules, and there about 750,000 people today that are paying lifetime late enrollment penalty because they didn’t understand those rules or thought they could get away with ignoring them. Social Security handles the initial Medicare eligibility and enrollment process, but it’s important.

Greg: For people first to get through this first hurdle—which is to make sure they enroll on time again—what are the Medicare enrollment rules on that?

David: Well, they’re complex Greg. Depending on a lot of things when they retire, there are different rules for people who retire at 65 or older than 65, or disabled people who apply younger than 65.

They’re slightly different rules, but basically, let’s say take somebody at 65. You have a seven-month period that begins three months before the month you turn 65.

During that period you have to make your choice. If you don’t make it—particularly for the supplement for Part B—if you don’t enroll in Part B or have Part D coverage by the end of that period—you’re at risk at least for facing a lifetime enrollment penalty.

The rule for Part B is you if you go a year without it you’re going to pay 10% a year for the rest of your life on premiums—and those premiums will go up with Part D! It’s 1% a month for every month late, but then you’re locked out of enrolling. Once you pass that initial enrollment period you can’t get back in.

You can’t do it the next month and say “Oh I missed it by a month”. You’re locked out until the next general enrollment period.

Greg: In that case that seems like a pretty critical upfront move that you’ve got to get right?

David: Yeah, and most people do! I mean one and a half percent of all 59 million Medicare beneficiaries don’t get this right. But it’s it’s an important element, and it’s fairly easy to handle if you’re paying attention.

Choose initial healthcare coverage carefully

Second thing is to make that initial choice of your supplemental coverage. You need some thought about how much it’s going to cost in the future. It’s hard to predict because of the unpredictability of healthcare costs, but you can still do some ballparking.

As I said earlier, Medigap policies can be very expensive and we always caution all of our clients just be aware. If you want a Medigap policy from day one there are some things you can do to save money, but this is still going to be the most expensive type of insurance—it is great insurance!

But you know, listen, you’re going to pay a hundred thousand dollars in premiums by the time you reach 90 if you use the typical comprehensive plan.

Greg: Do a real quick—just to refresh—on the Medigap policy. That’s going to cover what Medicare doesn’t?

David: Yes. Okay. Yeah, and actually yeah, and I’m sorry for jumping into terminology here.

We have a chart coming up that’ll explain the different kinds of supplemental coverage. The only point I was really trying to cover is that Medigap policies are very expensive and that people should be aware when they first enroll in Medicare. They should give some thought and they should understand what those costs may be, and then if they can afford it or if it’s “maybe.”

If you’re having health problems already at 65 they say “I want this really good coverage right?”

Other people may not.

Review healthcare coverage yearly

The third bullet on here is to review your coverage yearly. Medicare—like most employer plans—has an annual enrollment period October 15th through December 7th. Plans change dramatically from one year to the next, so people who do not do this are at risk (and we may talk a little about that later.)

Coverage changes very quickly—particularly prescription drug coverage. You can be in the lowest cost plan this year for the drugs you’re taking, and next year it can be several hundred too expensive even though you’re taking the same drugs.

Greg: Wow. Okay, so it is pretty critical that you not only get into the right plan, but you constantly review and update where your health is, what your finances are, and match that with the actual supplemental coverages and your Medicare plan, I guess?

David: Yeah, that’s well said! That’s exactly the dilemma. Unfortunately, as people grow older and their healthcare costs are increasing they are less likely to do this.

They—some of them—just don’t have the intellectual capacity that they had when they were younger to go in and review their coverage. They don’t know where to go to get somebody else to review it.

So you see among the older population, Medicare statistics point this out. Less and less frequency of changing plans or reviewing coverage.

Greg: So at the same time that financial stakes are highest, people are least likely to be monitoring their coverage? I don’t know this for a fact David, but I would guess just anecdotally—you know—having worked with people over the last couple of decades—I would guess that 90% plus don’t even bother to review it.

David: Yeah, and that’s a good number because there are a number of studies. We don’t know how many. There’s no way to know how many people, there’s no precise way to know how many people don’t redo it.

You can tell real precisely how many people change plans, and you can also tell very precisely with drug costs how many are in the wrong plans. And 90%—some studies—they never change plans and like 90% of that 90% are paying several hundred dollars a year too much!

So there’s a high percentage of people that never change plans.

Greg: Right, right. So it is important that because as you mentioned several hundred dollars a year should be money that you’re enjoying on your trips in your retirement and spending time with the grandkids! It shouldn’t be wasted on unnecessary medical costs that you really don’t need.

David: Yeah, and one year’s gone but what we sometimes see are people that just . . . you’re talking about year after year after year real costs go up they’re not reviewing the plan. And we get several clients every October who come in and say “My drug costs are killing me.!

These are typically people in their late 70’s or early 80’s, not always, however. Sometimes they’re younger people but they’re saying “Help,” you know, “is there something I can do here?”

We just do a very simple search and say “Here’s the lowest-cost plan for the drugs you are now taking.” Next year you can switch if you want to call this toll-free number and your prescriptions will probably be transferred over to the new plan—and they can do that by calling 800 medicare. At no cost, Medicare will do that for them.

But people don’t do this, and over the course of retirement, I’ve seen people that I’m convinced have left tens of thousands of dollars on the table because they are taking expensive plans that they never monitor. They look at their bill and I say “Wow!”

Greg: Well, I guess all these articles about drug costs being higher are right! But they don’t do anything to see if they can control it!

In some cases they can’t—there’s nothing—but in many cases there is! So I love the word control because I always say at the end—and I’ll say it again in a few minutes here—either you control your money or it will control you!

And this is just a perfect example of something that you can do if you put in some time—some effort—some thought and hire a qualified Medicare advisor . . . somebody like David. You can actually reduce your healthcare costs over your lifetime, and that’s tens of thousands of dollars that you just mentioned you potentially could have given to your kids or grandkids. Yeah, yeah that’s very true. . . very true David.

Let’s kind of transition and talk about some of these supplemental coverages that are available.

Medicare supplemental coverage

David: Okay, Greg we touched on this a moment ago when we talked about Medigap policies. This is where many people get confused. What are all the different kinds of supplemental coverage?

Medicare is called primary coverage. It’s going to pay first there and it has a lot of gaps as people know. There are four different ways to supplement those gaps or to cover them. I’ve only listed three here. The fourth is Medicaid and I’ve assumed that most people who listen to this or not going to be on Medicaid. Using Medicaid, rules also vary a little bit by state.

A Medigap policy

The first of these which we discussed is a Medigap policy, and that’s basically called a traditional Medicare supplement. Medicare pays 80% of the bill the Medigap policy pays the 20% balance. These are very nice policies as we said they tend to be expensive.

They do not include drug coverage. So people who choose a Medigap policy will also need to enroll in a standalone drug plan called Part D stand-alone plan.

They choose those plans not based on premiums, but on the lowest cost for their drugs (unless they don’t take any drugs). Frequently a low premium drug plan will not be the lowest cost plan once you take into account the deductible and co-pays.

Many, many seniors, many retirees just say “I don’t understand all this stuff, I’m going to choose a low premium plan. But that may not be a good solution.

A Managed care plan

The second type of coverage is a managed care plan. These are much less expensive.

They involve more risk—more out-of-pocket risk—if someone got seriously ill. Half of those in the country are zero premium plans, meaning you have no premium at all for either prescription drug or medical coverage.

Well, the out-of-pocket risk is fairly high! It can be—you know—four/five/six/even in some cases $6,700!

Greg: And that’s the Advantage Plan that’s on your chart here, right?

David: Yeah. These are Medicare. They’re called Medicare Advantage Plans Greg, and they are managed care plans.

Basically, most of them—60% of them—are HMO’s. Another 30% are PPO’s, and then there are a few—depending on the state—there are few other smaller, private, fee-for-service plans and cost-sharing plans.

Greg: How do how do they afford to send out the money for all these claims?

David: Once you join an Advantage Plan, Medicare pays that plan every month say a thousand dollars, and that it’s going to vary by person—by their age, by their health status.

But Medicare says “Okay, we’re no longer taking care of this person. They have decided to enroll in an Advantage Plan. We’re going to pay that Advantage Plan a set fee based on those factors (that I mentioned).”

It varies depending also on part of the country you’re in, what the medical costs are, but I’ll just use a thousand dollars.

Greg: So they’ll pay a plan twelve thousand dollars a year for an enrollee, and if that person doesn’t go to the doctor much that year, the plans going to make a lot of money, right?

David: If that person goes in the hospital and skilled nursing facilities for (you know) long periods of time they may lose money on that particular patient. Overall they come out ahead.

They make a slight profit on average, and they get their money from the government. So they can afford to entice you with a zero premium plan.

Greg: Is that catastrophic coverage or something?

David: Well, it’s pretty good coverage. There is an out-of-pocket limit in it. It varies a great deal by the plan in urban areas.

We see a lot of this in Southern California. There are some exceptional plans with zero premium/zero deductibles/zero cost sharing/zero payments for doctor’s office visits or a specialist office.

If you get out into rural areas—or less urban areas where they have a lower population base—you’ll find that. There tend to be weaker and their networks are smaller. It’s less likely you’re going to find your doctor in a plan.

So they’re really good in urban areas and can be good in remote areas . . . rural areas

Employer plans

Okay, and then there’s the third kind—or employer plans—and those come in all shapes and sizes depending on your employer.

I have an employer plan. I retired from a large company. Someone will get that phone. I apologize.

Greg: That’s fine.

David: And there’s a lot of variation here depending on the plan. These are usually the best options for people who have them.

Typically these are going to be offered by very large companies—Fortune 500 companies, government agencies, some cases schools. Federal employees, some unions, but they’re subsidized and they’re also group plans which give them some pricing advantages, and most of these plans include drug coverage.

So these are the three options really. If somebody has the employer plan, in 90% of the cases it’s going to be their best case.

That’s the best one that if they have that option—about a third of people do. If they don’t, the other two-thirds of people, they’ll have to choose between a Medigap policy and Advantage Plan. And that’s where we—you know—try to evaluate the costs and risks of each of those.

One thing we do on the Medigap policies, we continue to say they’re expensive but there are different Medigap plans. So we frequently advise people to at least consider a less expensive Medigap plan that is still pretty comprehensive.

Most insurance agents like to sell the most comprehensive plans because they get the most commissions.

Greg: Right

David: People in Medigap policies have a plan with zero deductible, and it just. . . I mean I can go on and on! It’s crazy how people overpay! They pay more in premiums than they save in the deductible if they go compare it to a plan that’s the same coverage but does not cover the deductibles.

So, you know, and we’ve seen people pay seven or $800 a year too much just when they could change one plan and do the whole thing a lot cheaper and get better coverage really.

So those are the options. People can choose from those.

Medicaid

The fourth is Medicaid. 17% of people in Medicare are also on Medicaid, Medicaid supplements. Medicare still pays first in all of these scenarios.

Greg: Okay, before we kind of wrap up and bring this home, real quickly can we just hit the four Medicare parts (ABCD), and just a real quick overview of those for the viewers?

Medicare parts A, B, C, D

David: Yeah, and this is confusing to many people particularly. It’s basically hospital insurance and services related. It does not have a premium.

If you’ve worked your 40 units (and 99% of people have) part a has a zero premium. You should enroll in it at age 65 even if you continue working.

The exception is if you have a health savings account at work. Enrolling in part A will disqualify you for that health savings account.

Part B supplement covers the outpatient services, doctor services primarily, and that’s it.

There’s some variation here, but typically Medicare is going to cover 80% of a doctor’s bill. The supplemental insurance would pay the remaining 20%—or some portion thereof—depending on the type of insurance.

And so if you enroll in part C, it includes your drug coverage and most cases it always includes your medical coverage. So that’s called part C.

People say “I want to enroll in part C.” They’re enrolling in an Advantage Plan.

And then Part D is, of course, drug coverage that was added in. Many kinds of coverage include drug coverage with them.

We said that Advantage Plans usually do—not all of them. Employer plans usually include prescription drug coverage.

Medigap policies do not. You have to have drug coverage that Medicare says is good enough to avoid a penalty. So all of the plans here will certify this.

Medicare has said their plans are good enough to avoid a late enrollment.

Greg: Okay, and and I guess two more questions. One would be how many different types of Advantage Plans or Medigap policies out there would I have to choose from? How broad is this Market?

David: It’s going to vary a little bit depending on whether you’re in an urban area or not, but I’ll just use Los Angeles County where I am. There 10 Medigap plans to choose from here. We narrow that down to two or three that we think are good options.

There are 30 insurance companies. They all have different premiums. Premiums can vary by 50% for the same plan benefits . . . It’s amazing!

So, so you not only have to choose the right plan that’s going to meet your needs. You have to find the low premium—one of the lower premiums—or you can choose an Advantage Plan in Los Angeles County right now.

I think the 32 Advantage Plans . . . all of them are HMO’s! So your only choice here if you live in Los Angeles County is if you want to enroll in an Advantage Plan.

Managing healthcare costs in retirement summary

Greg: Okay, and final question before we wrap up, I like to give the Wealth Masters out there some specific actionable things—or key takeaways—and so just envision for a moment that you’re talking to your brother and he’s turning 65 and he needs to figure this out. What are the most important things that he needs to know both in selecting that initial coverage and planning for the future.

Get initial Medicare enrollment right!

David: Okay. Well, I would say first and be sure you get enrollment right. It’s a one-time deal.

Social Security will help you with that. If you work for a company or retired from a company, they should help you if it’s a fairly sizable company.

There a lot of Medicare counseling agencies out there that will help you through that at no cost. Get that right!

Your initial Medicare coverage options are incredibly important!

Then give some thought (a lot of thought actually) to your initial coverage choices when you first get in and try to make sure you’re choosing the best plan that meets your needs. That makes it less likely you’re going to need to change plans in the future if you do your homework up front.

Monitor your healthcare coverage

The third point—as we discussed—is to monitor the coverage each year. It’s going to depend on the type of coverage you have (what you monitor), but you know you can you can learn!

You look for drug costs always for people who take prescription drugs. Even one brand name drug! That that’s almost always going to be your most volatile type of coverage from one year to the next.

So we tell people who take drugs, you know, look at this every year! And there are free resources out there.

I mentioned 1 800 Medicare—the Medicare Help Center. We do it for a fee, but there are people who stay on top of their costs. Particularly if they take any expensive drugs they will save a lot of money by doing that.

Greg: So David, you mentioned: “We do it for a fee.” I have to follow up final questions on that, and one of them is do you work with clients just in LA county or do you work virtually with people all over the country?

David: We work anywhere in the United States. Medicare, of course, is national, and probably 60% of our clients are on the east coast.

Medicare itself is standardized throughout all 50 states. The types of supplemental coverage and Medigap pricing and rules will vary from state to state but we understand those because we worked with them a lot.

And then the second question was what I believe “virtually.” I think I was kind of alluding to the fact that just like we’re doing this conversation through GoTo Meeting.

Greg: I’m sorry. That was it.

David: Yeah. Yeah, I know that we work with anybody and our service is really fee only. We do not recommend anything specific. We just look for plans that we think meet the client’s needs.

These will allow him or her to continue seeing the current doctors. They fill out a questionnaire list—their doctors and drugs and other things—they want us to be aware of.

We say “Okay, these plans tend to be the ones that seem to fit your needs.”

“This is the most expensive . . . It has almost no risk! This is the least expensive. If you’re in good health. you’re probably going to save money there, but it has more risk!”

And then we never know Greg. I won’t say never but. . . rarely! We give them the numbers to call—to enroll in those plans and the deadlines for enrolling to start their coverage on time.

So it’s really a fee-only service where we just say “Here’s an evaluation. Take it. Use it. If you have follow-up questions, let us know!”

Greg: Okay and David, I apologize because I do remember what that second question was virtual. You did address that.

I’m just curious. So if I’m watching this interview and I say “Hey, I really need somebody to look at this! I want to call David!

What (roughly speaking, you don’t have to get too specific because I know everybody is unique), but what “roughly” is the fee for doing that?

David: We just have three—we only do three types of evaluations—for someone who’s enrolling in Medicare. The first time we do $125 for evaluation then we send them an electronic file with the comparisons.

I mentioned for people who just say “I want to look at my drug coverage every year”, we will charge. And they just may want to do it one year, we charge $50 for drug coverage.

We look at some things Medicare probably doesn’t look at like it. Is there a preferred Pharmacy? You can save money and you save money with mail order versus retail, you know?

We try to really understand the least cost healthcare option for them, then see if their benefits work. We charge $50 for that.

Occasionally somebody will say “You know, I have an employer plan and I’m not sure if it’s any good and I would like for you to compare my employer plan to your Medicare options in my area.”

We charge $200 for that because it takes us a lot more time. We have to come up-to-speed on the employer plan they’ve got so I understand its rules and you know, raise questions if there are questions to be raised. So we charge more for those, they are flat fees. They’ve been in place for a couple of years.

We are going to raise them sometime next year (2018) on our website.

Greg: So get your review done now? Well, you know, I you know, I kind of had a rough idea what your fees were because we have worked together in the past.

That is a very small barrier to entry so-to-speak, where all the person has to do really is fill out kind of a quick questionnaire, pay that hundred and twenty-five bucks. Or, you know, fifty dollars, or in that range. Then they get a professional analysis from an expert that could possibly save them hundreds—or even thousands of dollars—a year.

David: Yeah, we like to think we can save people money, but we don’t always. We don’t guide them toward a plan if they keep saying “We’ll just stay here.”

It is “Be aware of this with this type of coverage. Here’s the risk! Here’s a different type of coverage. Its strong points in risks”.

Greg: I think there’s an incredible value there and that’s why we’ve been working together for a few years.

So David if I’m home on the on the couch watching this interview on my iPad and I want to reach out to you directly, why don’t you go ahead and share with us: What’s the best way to reach out to?

David: I think the best way is the website that you just showed. Our website, it’s www.DoverHealthcarePlanning.com

You can go to see our services. There’s a tab on that page where it says “Our Services”

You can download a questionnaire there. There’s an email link. You can send us an email with questions.

There’s a phone number you can call us with questions. So there are different ways to contact us, but that site should explain or answer at least the basic questions about what we do.

Greg: www.DoverHealthcarePlanning.com, right? Excellent David!

Thank you so much for your time today! I really really appreciate it.

This is . . . it’s a topic that I don’t know much about and I’m still learning. And again, that’s why we’ve been working together! Because if I can’t be an expert in it I want to send my clients to the expert . . . and that’s you.

David: Thanks. Thank you so much.

Greg: Wealth Masters, either you control your money or it will control you! Again, we already hit on that word “control”, and you can control your healthcare costs and expenses in retirement just by taking a few simple steps and putting a little bit of time, a little bit of effort!

David, thank you so much for your time today!

David” You’re very welcome. I enjoyed it.

Greg: This is Greg Phelps for the Wealth Summit . . . signing off.