Mutual Fund Investing: Survivorship Bias

Comparing mutual funds is tricky due to a phenomena called survivorship bias. Survivorship bias refers to the death of a mutual fund(s), which distorts the pool of surviving funds and changes how they rank against one another.

When companies need to drop mutual funds with poor performance, they typically close the fund, or more likely merge it into a strong and similar active fund. This leads to an overestimation of active mutual funds past returns and performance. Confused? Here’s an example…

Not every mutual fund is a winner

Let’s say there’s 1,000 US large cap growth stock funds today. Some will do well, others poorly. The worst performers will wither, because no one will want to invest in them. Let’s say 50 of them are so bad that new contributions dry up. The remaining shareholders in those 50 funds get absorbed into a larger, better performing fund.

All the while there’s an index (passive) fund which isn’t shooting the lights out, but is doing better than most. Let’s say it’s performance puts it at 350 out of 1,000, so it’s in the top 35% this year. Next year, there are only 950 of our original funds in that category, but our index fund keeps humming along with similar performance. It’s now 350 out of 950 or the top 37%, hence it’s performance stayed the same, but it’s relative performance to it’s peer group dropped.

In five years, our index fund is still grinding out reasonable returns, but over that 5 years 300 of the original funds have died and gone to mutual fund heaven. Now our fund has performance ranked 350/700, or the top 50%. Our solid and consistent performing index fund went from good to average in five years not because it lost performance, but because it’s peer group around it either had good (lucky) performance, or they were removed from the peer group.

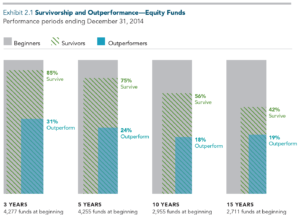

This happens everyday, take a look at stock fund attrition here:

There are about 2,700 funds alive after 15 years from the 4,200 or so funds the category started with. Index (passive) mutual funds are left to compete against the best (luckiest) actively managed funds, because really crummy mutual funds just went away. This creates a completely inaccurate comparison of active versus passive investing.

About a third of mutual funds disappeared

A study was done by Professor Mark Carhart which showed that 1/3 of all stock funds disappeared from the years of 1962 to 1993. Even in a shorter period, the same trend remains. From 1988 to 1992, 100 of the original 686 funds disappeared. Thats nearly 15%! And more recently from 1993 to 1998, an astonishing 600 equity funds disappeared!

Mutual fund companies are manipulating numbers for their benefit. They claim they shouldn’t be required to include “dead funds” in their return calculations because they’ve been transferred to different managers. I disagree.

The CFA institute has tried to monitor how past performances are recorded, but disclosure of these instances isn’t a requirement for mutual fund companies. There are loopholes to the point where even if the company does comply, all they have to do is report it in the fine print of the prospectus to hide it.

I’ve run studies on basic index fund performance (such as Dimensional Fund Advisor mutual funds) versus the average actively managed mutual fund manager. Depending on the time-frame and specific asset class, index funds (or DFA Funds in many of my studies) outperform anywhere from 60% to 90% of their actively managed counterparts. These studies use various timeframes and compare each passive mutual fund to the entire universe of it’s true benchmark peers. If you’d like copies of my research, simply contact me through this website.

60% to 90% outperformance – seems crazy anyone would try to pick and choose active fund managers!

The outperformance isn’t even accurate, it’s understated

Unfortunately, due to survivorship bias, these numbers aren’t accurate. I’m comparing index funds and DFA mutual funds to the currently active peer group. What I should be doing (if the data were actually available), is measuring index funds and DFA mutual funds agains ALL mutual fund peers (both in existence and closed or merged) for any given time period.

Measuring index funds and DFA funds against a complete group of ALL peers (both closed AND open) would mean DFA funds and index fund alternatives would outperform EVEN MORE than the current estimates of 60% to 90%! This would make doing anything BUT passive investing seem downright foolish (as if it’s not already foolish enough)!