Among other things (like risk and volatility, tax efficiency etc.), a key component to your investment success is the returns – or interest rates – you receive. Stocks generate growth from capital appreciation and income from dividends. Bonds generate interest income (and also experience principal fluctuations).

Each investment you hold should work in concert. The goal being to generate a total return commensurate with your risk profile and financial plan.

But when we’re talking about the returns and rates on these holdings, what is the difference between “nominal” and “real” interest rates. It’s fairly simple, with the main difference being the actual inflation rates.

Real Interest Rates Explained

Real interest rates are nothing more than nominal rates adjusted for inflation. For example, if a CD pays you 2% per year, its nominal rate would be 2%. If inflation was calculated as 1%, you’d have a real interest rate return of 1% (2% – 1%).

The real interest can also be a negative number. If in the above example, the inflation rate was 3%, we’d have a real interest rate return of -1% (even though technically our investment states a return of 2%).

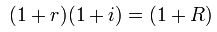

The formula for calculating real interest rates is:

r is the real interest rate, i is the expected inflation rate, and R is the nominal interest rate. The real interest rate is equal to the nominal interest rate minus expected inflation. Inflation isn’t a concrete number however. It’s constantly adjusting and changing over time based on economic factors.

In the long run, if your real interest rate returns are consistently negative, you’ve got to change your investment strategy to keep up inflation. If your returns can’t outpace inflation, you’re far more likely to outlive your money!