I’ll be the first to admit I didn’t understand all of the nuances of reverse mortgages until very recently. There are quite a few factors involved in these complex products. A reverse mortgage was also a “bad thing” after all, at least that’s the impression most of our clients had. In fact most of them still put a negative stigma on reverse mortgages today.

Since we’re in a massive national retirement crisis, reverse mortgages in various forms are becoming more and more popular! I’d be remiss in my duties as a fiduciary advisor if I didn’t dig deeper into these intricate products known as a reverse mortgage line of credit (RLOC).

The first thing I’ll note is they’re not actually called a “reverse mortgage line of credit”. These products are technically referred to as a “home equity conversion mortgage line of credit”. I refer to them a lot as an RLOC to reduce my carpal tunnel issues (it’s an awful lot to type over and over).

The second thing I’ll note is we do not sell these products. We have no dog in the fight other than helping our clients squeeze every last dime out of their retirement. We’re a fee only financial advisor firm, and as such we don’t accept any compensation except directly from our clients. We’re also not licensed to sell these products. This article is solely based on my research in an effort to help teach people the value the reverse mortgage line of credit can provide them!

What are the benefits of a reverse mortgage line of credit?

1. Enjoy retirement more now knowing your RLOC is a backstop later. The biggest benefit of taking out a reverse mortgage line of credit is it’s a great backstop for your retirement plan! We’ve run many retirement plans which were OK, but not confidence inspiring. Oftentimes clients will curtail the vacation they’ve always dreamed of, or put off remodeling their home because they fear dying broke.

When you add the potential cash flow from a reverse mortgage line of credit their plan results often skyrocket! This gives them a great confidence in spending a bit more now while they’re young knowing they have a backstop later in retirement if they actually need it.

2. Liquidity for many purposes. There’s no requirement to pull money from your RLOC. It’s there to use only if necessary and provides liquidity. You can use it for retirement income during a bear market – which allows you to stop drawing from your investments and rebalance into stocks while they’re cheap. You can use it to pay taxes on Roth conversions – which will help you reduce your long term taxes.

Another great way to use the RLOC is to smooth your yearly taxes. What I mean by “tax smoothing” is let’s say you have a year with major expenses (that vacation or home remodel) and your income soars from drawing on your IRA’s. It makes sense to consider drawing from your RLOC if your IRA draws will push you over into the next higher tax bracket. Next year you can then pay down the RLOC when your income needs are lower. Or don’t pay it down at all! It’s up to you!

You can use the RLOC for long term care or other unexpected medical expenses. As a matter of fact you can use the funds – which are TAX FREE – for anything! The reverse mortgage line of credit provides the ultimate source of current or future liquidity.

3. You still own your home. Many people think taking a reverse mortgage means they’re kids won’t inherit their home. This isn’t the case at all. You’ll always own your home and your kids will still inherit it even if you draw on it!

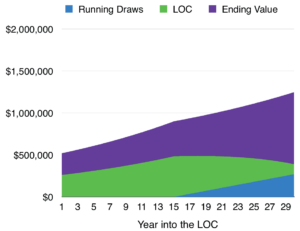

Take a look at the example below in which this 65 year old borrower has a $500,000 home value growing at 4% per year. They have a $250,000 initial reverse mortgage line of credit at a 4.5% growth rate. This borrower used the RLOC in their retirement plan as a backstop and actually needed it.

They drew $1,500 per month ($18,000 per year) at age 80 until they died at age 95. Click the graph to enlarge:

In the above example the borrower dies and the heirs still inherit a home worth 1.6 million. They need to simply pay off the debt he drew out plus interest accrued which is about $375,000. Once they do that by selling the home OR paying cash to buy down the debt they still inherit a value of about $1,250,000.

So your heirs don’t get the entire 1.6 million dollar home free and clear. They do get $1,250,000 in value however. What most people miss is these RLOC draws likely allowed the borrower to leave MORE money in his Roth IRA, his IRA, his investment accounts, and more! So they likely got the bulk of the 1.6 million – just in different forms.

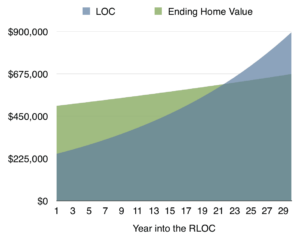

4. It’s government guaranteed. I often wondered how the government could guarantee these loans and why they would ever need too. The fact is your reverse mortgage line of credit grows over time whether your home does or not! While it’s unlikely, let’s assume your house grows at 1% over the next 30 years and your line of credit grows at 5%. Take a look at what your house is worth relative to how much money you can draw from your RLOC:

Now keep in mind you’re paying for that guarantee. 1.25% of your total interest rate goes to the government into a pool to backstop this exact type of situation. If you don’t use the RLOC however you don’t pay it. You only pay interest on what you draw from the RLOC, and that interest includes the 1.25% FHA mortgage insurance.

In the above example I’ve shown a $500,000 home growing at 1% with a $250,000 initial reverse mortgage line of credit and an initial growth rate of 4.5%. You can see that RLOC grows dramatically even at these low interest rates! And we’re looking at this growth at current interest rates which are very low and likely to rise during your retirement lifetime!

Your RLOC will likely grow at a higher rate than what’s illustrated. Your home will likely appreciate more than what’s illustrated as well.

If you took out this RLOC at age 65 (year 1) and the day before you died at nearly 95 (year 30) you could literally write yourself a check for $900,000. Your home by the way is only worth about $675,000. Because this is an FHA insured program the government will eat the $225,000 loss on your line of credit.

Let me repeat that. The government will eat that $225,000 loss! No wonder we’re 19 trillion dollars in debt. Without getting on my soapbox too much, the fact is these RLOC’s are desperately needed for our aging populations quality of life in retirement.

Granted, in this scenario your kids wouldn’t get your house. Rather they’d get the $900,000 in your checking account when your house is only worth $675,000 or so. Not a bad deal, but you’ve got to be alive to write the check!

These lines of credit are structured in such a way that this is very unlikely to happen. If rates rise your home value will likely appreciate as well. This scenario noted would be unusual, but it is accurate in concept!

5. They can’t take it away from you. Remember in 2008 when all of the banks were freezing and closing home equity lines of credit? I do – they froze mine and kept me from using it.

Unlike a traditional line of credit, a reverse mortgage line of credit can never be frozen or taken away. It’s guaranteed to be there for you if and when you need it.

Can I qualify for a reverse mortgage line of credit?

First of all you must meet a few qualifications to consider a reverse mortgage line of credit:

- At least one homeowner must be age 62 or older

- Maintain the property taxes and insurance

- Live in the home (once you leave the home you must pay off the RLOC)

- Pay other necessary home related costs (homeowners association, etc.)

- Have roughly 50% or more in equity in your home

It’s pretty simple you can see. Granted, this is coming from a financial advisor NOT a mortgage advisor. You may have additional qualifying factors that I’m not aware of, but for most purposes it’s fairly simple to qualify for a reverse mortgage line of credit.

How does the reverse mortgage line of credit interest rate work?

There’s a floating rate tied to interest rates in the economy – let’s say your loan uses the Libor (London Interbank Offer Rate). So that’s really low right now, about .25%. That’s one component of your total interest rate.

The next component is the bank margin. That’s what the bank makes if you borrow on the RLOC. This can be anything from 2% to 3% or more. Generally it’s about 3% from what I’ve seen lately. This rate really depends on the exact type of reverse line of credit you take out.

The last component is the 1.25% FHA mortgage insurance premium. That’s standard for all reverse mortgage lines of credit and goes to the government to create a safety pool in case the government has to backstop some of these loans.

Add those three components together and you get the initial growth rate. In this case let’s say it’s .25% plus 3% plus 1.25% or a total rate of 4.5%. That’s the rate you’d pay if you borrowed money from the RLOC. It’s also the rate at which your RLOC will grow over time.

It’s really important to remember the one component of that rate isn’t static. The floating rate tied to prevailing rates in the economy will change. It can easily rise over time, and it possibly has some room to drop but not much. While this rate may rise your total interest rate is capped at some amount.

The cap on your loan rate may be 5% above your initial growth rate. It may be more or less as well, it all depends on the loan. But in our example, if the loan had a cap of 5% above the initial rate it would be capped at 9.5%. This means your interest charges can never exceed this maximum rate.

Why you need to set up a reverse mortgage line of credit now!

The amount you can borrow is based off several factors including your age and your home value. It’s also based on current interest rates. The higher interest rates are the more the RLOC grows, so to mitigate the risk the ratio of what you can borrow drops.

Right now with ultra low interest rates a 62 year old borrower with a $600,000 house (free and clear) could borrow about half the value, or $300,000. That’s based on a current initial growth rate for the RLOC at roughly 4% or so. If rates were 3% higher the amount you could borrow would literally be cut in half to about $150,000.

With higher interest rates comes more reverse line of credit growth. The more the RLOC can grow, the more the risk that the government will need to backstop the loan. Since the risk is higher the ratio of the amount you can borrow relative to the home value drops substantially.

Another benefit of setting up the reverse mortgage line of credit now is that you’re assuming a very low RLOC growth rate! Chances are very high that your RLOC growth rate will increase over your retirement lifetime, meaning you’ll have a higher amount of money you COULD borrow if necessary in the future.

Keep in mind there are variations on the reverse mortgage line of credit. Some provide a higher loan amount with higher fees. Others have a lower loan amount with lower fees. Generally speaking if you think it’s remotely a good financial backstop, you should set up an RLOC now versus waiting for rates to rise 5, 10, or 15 years from now.

Can I wait to establish the reverse mortgage line of credit?

Of course you can! Because the amount (or the ratio) of what you can borrow versus your home value will grow by roughly 1% per year you’ll possibly get a larger line of credit. But think about the math behind this, does it really work?

Let’s say the RLOC amount you can borrow grows by 1% per year because you’re getting older. Let’s also assume your house value is going to appreciate by 4% per year. This means the amount of your RLOC may rise by a total of 5% per year.

In our (very rough) current scenario where your initial growth rate is 4.5% you’re virtually guaranteed that if you take out the RLOC now your line will grow by that 4.5% per year. Should you wait and hope the amount you can borrow will grow by roughly 5% per year? Should you set it up now and almost assure your reverse mortgage line of credit will grow by that amount per year?

It think the choice is clear. Rates are low, they’re likely to go higher. Home appreciation isn’t what it was in the mid 2000’s. You’re likely better off to take out your RLOC now and sit on it, using it to smooth your taxes, enjoy retirement more while you’re young, and ultimately have a great retirement plan backstop!

What if my home isn’t paid off yet?

If you still owe on your home you’ll need to pay off your current mortgage OR just use the RLOC to pay it off. This works a little different than the fluctuating interest rates I mentioned above however. It’s actually better!

Let’s say you owe $250,000 on your home worth $500,000. Your mortgage advisor has told you the ratio of what you can borrow is 60%, or $300,000.

In this situation you’d take out the reverse mortgage line of credit for $300,000. $250,000 of that line would be used to pay off your current mortgage debt. The other $50,000 would be deposited to your checking or savings account typically.

The interest rate on the $300,000 would then be fixed for the rest of your life. This is a pretty good deal at these ultra low interest rates! The best part is you’d never have to make a house payment again!

Are you considering a reverse mortgage line of credit?

As I mentioned the biggest benefit of an RLOC is how impactful it is on your retirement plan. Whether you use the cash or not, just having it available as the ultimate retirement plan backstop allows our younger clients to really enjoy their retirement more now while they’re young.

These loans aren’t right for everyone however. They’re complex, and I’ve painted some very broad strokes. It’s important to find the right advisor to help you through the process, and make sure it fits with your retirement plan. Give us a call if you’d like to learn more about how a reverse mortgage line of credit can fit in with your retirement plan!

*We do not sell mortgages in any form and are not licensed to sell them. We can connect you with other professionals who are however.

[review]