No doubt by now you’ve heard of the Roth IRA and it’s amazing tax-free benefits. Roth IRA’s truly are one of the best retirement planning tools available, second only to Health Savings Accounts.

You may even be aware that you can strategically convert your IRA to Roth IRA using a multi-bucket strategy. Roth conversions using a multi-bucket strategy hinge on strategic Roth recharacterization.

Recharacterization is the process of undoing a Roth conversion. It’s effectively a “do-over” which allows you to replace the converted Roth account into an IRA. For tax purposes it’s as if the Roth conversion never happened.

There are some rules you must follow to do a legal recharacterization. Failure to follow the rules can lead to the recharacterization being disallowed.

Converting IRA to Roth IRA

The process of doing a Roth conversion is fairly straightforward. You simply instruct your IRA custodian to transfer funds from your IRA to Roth IRA.

Converted funds can be in the form of investment shares or cash, either is acceptable. You can convert 100 shares of XYZ mutual fund from IRA to Roth IRA, or simply transfer cash.

If you’re transferring shares, make sure you divide the dollar amount you intend to convert by the share price to transfer the correct value. It’s the value transferred that determines the tax implications.

The earliest date you can effectively convert all or a portion of IRA to Roth IRA for the current tax year is the first business day of the year. For example, in 2017 the earliest date you can convert would be Monday, January 2nd.

You have until the last business day of the year to convert IRA to Roth IRA as well. For 2017 that’s December 29th. That gives you 52 weeks to get the job done!

What is recharacterization?

Recharacterization is the process of reversing your IRA to Roth IRA conversion. It essentially makes the conversion like it never even happened.

Why would you want to recharacterize? Let’s say you convert $30,000 of IRA to Roth IRA on January 2nd, 2017. With that amount, you expect to remain under the 25% tax bracket for the year.

During the year however, you end up with a promotion and bonus pushing you into a higher tax bracket. If you keep the $30,000 conversion you’ll end up paying more in taxes than you had expected.

The IRS allows you the opportunity to undo it through recharacterization. Rather than keep the Roth conversion, you decide to recharacterize it. This allows you to keep your taxable income lower for 2017.

Another reason you may want to recharacterize your Roth conversion is if the investments you put into it lost value. Let’s say for example you convert $30,000 and invest it all in ABC stock. ABC has a rough year and it drops in half.

Your $30,000 becomes $15,000 thanks to poor investment performance, yet you still owe taxes on the $30,000 conversion. Assuming you converted at 15% tax rate, you would owe $4,500 in taxes. Taxes owed on the new value would only be $2,250 ($15,000 * .15%).

Why would you want to pay $4,500 in taxes when you could only pay $2,250 in taxes? You wouldn’t of course. For this reason, you would recharacterize your Roth conversion.

Roth recharacterization rules

To do this effectively you’ve got to play by the IRS recharacterization rules.

- The deadline. The deadline to recharacterize is October 15th of the year after the original conversion. In the example above you must recharacterize by October 15th, 2018. The means you can effectively use up to 21 months (January 2nd, 2017 to October 15th, 2018) to decide whether to keep the conversion or not. It doesn’t matter if you file a tax return extension or not. If you’ve already filed you simply must file an amended return.

- The account. You cannot recharacterize part of a Roth IRA. You can only recharacterize an entire account. If your goal is to convert $30,000, you may want to put $30,000 each into two or three separate Roth IRA’s (totaling $90,000). Fill one with stocks, one with bonds, and one with commodities (for example). If the commodities and stocks do horribly, you can recharacterize just the commodity and stock filled accounts. The goal would be to recharacterize 2 of the 3 accounts, leaving you with the best performing Roth conversion account. If you do the conversion into one Roth IRA you cannot cherry pick just the commodities or stocks to recharacterize. Rather, you must recharacterize the entire account. This makes the strategic multi-bucket Roth conversion strategy so powerful!

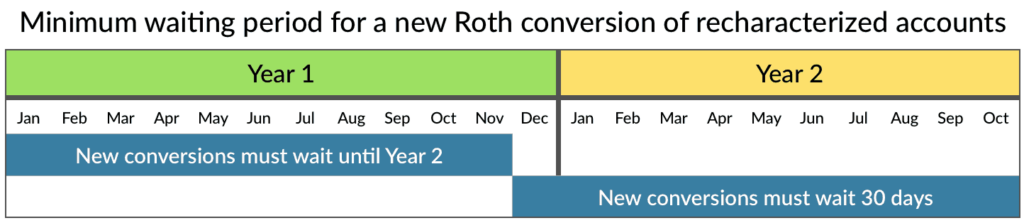

- Reconverting after recharacterizing. Let’s say the Roth conversion wasn’t right for you in 2017 and you recharacterized it. In 2018 however, you’re retired and have little to no income. Roth conversion makes a great deal of sense now, so you want to do another Roth conversion. You must wait at least 30 days OR the year following the tax year for the conversion, whichever is longer. It looks like this:

Roth recharacterization and reconversion rules apply per account

On point #3 above, only a new Roth conversion of a recharacterized Roth must wait the time period noted. If you have multiple IRA’s however, you can convert a different IRA at any time.

Let’s say you have IRA1 and IRA2. You convert IRA1 to Roth1, but do nothing with IRA2. If you recharacterize Roth1 back into IRA1, IRA1 is subject to the minimum time requirements for another conversion as noted in point #3. IRA2 however can be converted to a Roth at any time since it was never converted nor recharacterized.

How to recharacterize a Roth conversion

So the Roth conversion isn’t right for you. No problem, it’s fairly painless to recharacterize. Notify the custodian that you want to recharacterize your converted Roth IRA and they’ll have their own set of paperwork to execute the transaction.

Again, it’s important to remember that you should separate your Roth IRA conversions into distinctly different accounts. You cannot recharacterize part of a Roth IRA conversion account, you must recharacterize the entire account. Essentially the IRS doesn’t allow you to cherry pick losing investments in a Roth account. You can recharacterize all or none, it’s that simple.

If you have one Roth IRA which will go on indefinitely, make that your main Roth account. Use it as a landing account for Roth conversion accounts you will keep.

Let’s say you have a Roth that’s been established as your main Roth. After you’re 100% positive you will not recharacterize a separate recent Roth IRA conversion, you can combine it with your main Roth. Also if the time limit has passed to recharacterize a Roth, combine it with your main Roth IRA since you have no option to recharacterize.

Labeling your IRA’s and Roth IRA’s becomes critical. Keep detailed records on each account, opening date, funding date, conversion date, and recharacterization date. Especially note which IRA was converted into which Roth and when.

Roth IRA recharacterizations summarized

Recharacterizing a Roth IRA is a powerful tool. Best of all, it’s completely legal (and underutilized)!

Consider using a multiple bucket strategy with your Roth conversions. You can juice up your Roth IRA conversions with a little bit of extra work and recordkeeping.

Always keep detailed records. Especially track and label your IRA’s and Roth IRA’s properly. You’ll need this information if you’re ever audited. Or consider having an excellent fee only fiduciary financial advisor assist you. The fees they charge may well be worth their weight in gold in time, effort, and tax savings.