How TIPS (Treasury Inflation Protected Securities) Work

Treasury Inflation Protected Securities (known as TIPS), are inflation indexed bonds issued by the US Government. But what do TIPS really offer you as an investor and how exactly do they work?

There’s a lot of investor angst regarding future inflationary expectations. It’s a normal concern after all with the government deficit exploding to unfathomable proportions. Couple our massive debt with historically low interest rates and it just feels at some point inflation will rear it’s ugly head again.

TIPS sound great by their name. Who wouldn’t want inflation protected investments? So should you invest in TIPS? Not without knowing how they work first!

How do you buy TIPS?

Treasury inflation protected securities come in 5, 10, and 30 year maturities and are bought in increments of $100. They can be purchased direct from the US government through the treasury, a bank, broker or dealer. You can also buy TIPS through a low cost index fund such as DFA Inflation Protected Securities (DIPSX).

Individual TIPS securities (not a mutual fund) are purchased through an auction process. During the auction you can either accept whatever yield is set at the auction, or set a minimum acceptable yield. If your requested yield target isn’t met your purchase won’t execute.

How do TIPS work?

The underlying TIPS value fluctuates based on changes in inflation. The index for measuring the inflation rate is the non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (CPI-U). That’s a mouthful for sure, but just remember inflation is measured by the consumer price index. The actual index is published monthly by the Bureau of Labor Statistics (BLS).

The coupon rate is determined when the security is originally issued or bought. That coupon payment always stays the same in percentage terms. Since the value of TIPS fluctuates with inflation the actual yield for each payment floats. This is because it’s a fixed percentage coupon payment divided by a fluctuating par value.

Because the TIPS value changes with inflation, the investor is protected from inflationary pressures. If inflation rises the value of your TIPS will rise. This is why they’re called “treasure inflation protected securities”.

Now let’s look at the opposite of inflation – deflationary pressures. Should deflation occur your principal value would drop. TIPS do have a backstop for deflation however. The TIPS maturity value payment is the greater of $100 per TIPS unit or the adjusted current value at that time.

Like most government bonds TIPS pay their coupon semi-annually. If you own individual TIPS securities you’ll get your same coupon payment every six months until the security matures.

A treasury inflation protected security example

Let’s say in January you invest $1,000 in a 10 year long TIP with a real interest rate coupon payment of 1%. If inflation is 1% for the first 6 months the new TIP value would be:

$1,000 X (1.01) = $1,010

Your payment in June would be $5.05:

$1,010 X .01 = $10.10 divided by 2 (for the semi-annual payment) = $5.05

No if inflation really spikes the last half of the year to 3%. Your new TIP value is:

$1,000 X (1.03) = $1,030

and your payment in January would be:

$1,030 X .01 = $10.30 divided by 2 (for the semi-annual payment) = $5.15

So as you can see your interest rate stays the same but your payment changes based on the fluctuation in inflation. If inflation rises so does your income. If it drops, so does your income.

Keep in mind

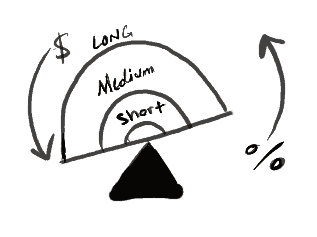

Treasury inflation protected securities are still bonds. While they fluctuate in value relative to inflation for purposes of the semi-annual payment, they also fluctuate in value relative to interest rates in the economy. What I mean by this is they have principal risk relative to interest rate fluctuations.

As you can see from my very crude drawing, as rates rise bond values drop. This is true for all types of bonds including treasury inflation protection securities. The longer to maturity you have, the more the bond will drop. The shorter to maturity you have, the less current interest rates will affect your TIPS. This works in reverse as well. If interest rates drop your bonds will rise in value by some degree.

This principal risk due to normal interest rate fluctuations lessens as time moves the bond closer to maturity. Once the bond matures at it’s par value or more after inflation adjustment the principal risk is nullified.

The bad side of TIPS

There are some downsides to TIPS, the biggest being taxes. Should the principal value rise with inflation in a given year you’re taxed on the growth as if it were income. The growth you’re taxed on is NOT distributed, it’s only on paper. This creates somewhat of a phantom income tax. While you don’t actually receive the money you’re taxed as if you did!

The upside of paying this “phantom tax” on the undistributed growth is you establish a new basis in the security. You won’t be taxed on the appreciation again. If deflation occurs after you may even have a loss to put on your tax return. Please consult your tax advisor for tax implications more specific to your situation.

There’s also political risk because TIPS are government issued securities. It wouldn’t be the first time the government changed the rules. The government also controls the CPI calculations. Who’s to say they’ve got their calculations right? Are they manipulating inflation for other political or economic reasons?

TIPS in conclusion

Considering inflation is at incredibly low levels however treasury inflation protected securities may be a great option for your portfolio. A great way to use them is to assign cash flow requirements to certain TIPS allocations. Let’s say you’re buying a sailboat in 5 years for $50,000. By allocating $50,000 to TIPS you’ll virtually ensure you can afford the sailboat even if inflation soars! You can do the same with your retirement income requirements.

While TIPS are great for some investors they’re not right for everyone. They’re also not right for an entire portfolio. Remember they’re still bonds and they share some of the same interest rate risks normal coupon paying bonds do. You should always have a comprehensive financial plan dictate your asset allocation, because any quality financial plan will ensure you’re diversifying your assets prudently.