Diversification means you’ll always be a loser…

Our philosophy has always been to have a healthy dose of international and emerging market stocks in our investment portfolios. We don’t time when or how, we just have it and hold it – making very minor adjustments and tweaks along the way each year at the end of the year.

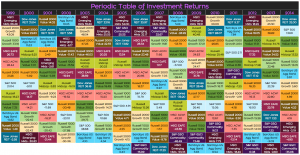

Last year international stocks suffered miserably, so did emerging stocks. But no one knew that was going to happen in advance of it happening. Just take a look how investment returns are random (click to enlarge unless you have owl-vision):

Can you spot the trend in the chart? The highest asset class returns are on the top, the lowest on the bottom.

There’s no consistency, there’s no pattern.

The only thing I DID notice is the S&P 500 is in the BOTTOM HALF of all investment returns about 2/3 of the time.

If you were going to buy an asset class and the only information you have is historical performance from last year, which one would you buy?

Don’t chase investment performance

So many investors leap to the best performing asset class (real estate and US large stocks). It seems so simple right? They have the best performance.

Vanguard thinks the opposite (so do I actually). They prefer increasing allocation to the WORST performing asset classes. In this case, international stocks.

Take a look at their press release, noting an increase of 10% in international stocks and bonds.

Rather than chase hot performance, they’re adding poor performers. Why? To further diversify their already diversified mutual funds, and at an opportune time (when international stocks lagged).

This is a wise move. The saying doesn’t go “sell low and buy high”! The saying goes “buy low and sell high”.

The question is “are you adding international stocks or selling them?”