This blog post is from the Wealth Summit I did previously where I interviewed 30 professional financial planners, authors, and industry experts. In this post and video, I interviewed Don Graves who is a foremost expert on the subject of the reverse mortgage i.e. the home equity conversion mortgage.

Don was a great interview and a LOT of fun! Enjoy!

Greg: Hello Wealth Masters, my name is Greg Phelps and I am your host of The Wealth Summit. Our mission at the Summit is simple, we want to educate and empower you with actionable tools tips and tactics to help you grow, protect, and maximize your personal wealth. Today I have Don Graves with us and he’s going to explain the five ways that reverse mortgages—home equity conversion mortgages—have changed retirement income planning forever.

Don, are you ready to help us master our wealth?

Don: Greg, I’m ready and willing and able so thanks for having me!

Greg: All right! So for the Wealth Masters out there a little bit about Don. Don Graves is the president and founder of the HECM or HECM Institute for Housing Wealth Studies, and an adjunct professor of retirement income at the American College of financial services.

He’s considered one of the nation’s leading educators on HECM reverse mortgages for use in retirement income planning. He has nearly two decades of experience which has led to more than 14,000 advisers enrolled in his teaching classes, and his personal practice has generated more than 12,000 HECM consultations leading to over 3,000 or roughly 3,000 clients.

Don has been quoted in Forbes Reverse Review Magazine, the American College Magazine, and has been featured on PBS sponsored shows as well as other venues and programming.

He’s a sought after as a professional speaker regarding the changing face of reverse mortgages and how they can seamlessly integrate with a comprehensive retirement income plan.

He holds an undergrad degree in finance from Temple University, as well as Graduate Studies in economics at Eastern University. Don resides in the Greater Philadelphia area, is married, and has three children.

Don that’s quite an impressive bio! Why don’t you take a second and fill in any blanks that I might have missed and then we’ll dig right in.

Don: Well, there are not too many blanks to fill in here Greg! I’m proud to say that my family is from Kentucky. And so those who are listening today, you may see some of my Kentucky sensibilities come out. I tend to simplify, summarize, and synthesize!

I asked my daddy, where does milk come from? He said the store!

That may be a little too simple, but I like the brown cow, eat green grass, or produce white milk. And so we’re going to keep it right on that level talking about reverse mortgages today.

What is a Reverse Mortgage?

Greg: That’s perfect. And I’m going to come clean here for the viewers out there, up until a few years ago at a conference, I really didn’t have a whole lot of reverse mortgage knowledge or education, and all I can say is thank goodness I spent the time to get educated because I am really a big proponent of these for the right client.

So Don, let’s go ahead and get started and talk about what exactly is a reverse mortgage?

Don: Fantastic, thank you so much, Greg. A reverse mortgage and times past was a good way to destroy a good barbecue if you weren’t careful! Let me answer that question about what is a reverse mortgage and combine it with the second thought was why were they created? This is a very important idea because it fits into the concept of retirement.

Retirement has always been in two phases for those who are listening, you all may know this. There’s climbing up the mountain, think of Mount Everest, and that’s kind of getting to the mountain that your accumulation side and hopefully you work long enough.

You weather the storms and trials, you make it to the top and the prevailing ideas you plant your flag. You hit your number. You said I made it!

Well, that’s only one part of retirement. The other side, which is coming down Everest, and two-thirds of the people who died on Everest died on the way down. That’s far more dangerous! That’s after you’ve retired.

Now you’re living off of what you saved, and there the risks can get pretty heavy, Greg as you know. And so for retirement concerns that we’re seeing for retirees, and this will lead into having the reverse mortgage came about and what it is in.

And so they all begin with the fact that retirees have a concern about longevity. You’ve seen those commercials. How long will my money last? Will I run out of savings? Longevity.

Number two is a lifestyle. Will I be able to live life on my own terms? Will I have to cut back my lifestyle so drastically that I no longer enjoy retirement?

Number three was Legacy. How will I be financially remembered?

And number four was liquidity. Will I have money and access to take advantage of money when I need it?

So those are the four retirement concerns coming down the mountain, and advisors traditionally have had to work with 3 buckets of money. Your income, that’s Social Security or pension if you had it. Your investments, and then the third bucket I call insurances, that includes annuities and insurance, a business you’re going to sell, a second home, something that you can rely upon.

Now, here’s the question. The day we are living in, people are living longer, and they have not saved enough, and they’re highly indebted to those three buckets. Just the income, investments, and insurances, and the answer was no, we needed something more.

So in 1961 in America, the first reverse mortgage came about. Its intent was to help people prepare for a very long retirement, and that we’re going to live longer than 50, 60, 70, 80. It’s not uncommon to live 90, 100, 110 years of age. And so we needed something more.

Why were reverse mortgages created?

So reverse mortgages were designed to help retirees prepare for a very long retirement and allowing them to use an asset that most retirees have, 87 percent of retirees live in an older home. How do you get money out of that house?

Why you could sell and move, or you could take out a home equity loan or mortgage to make a monthly payment.

But if there were a way to use that asset to sustain and supplement what would be a long retirement, that would be a winner. So that was why reverse mortgages were created.

The question, “what is a reverse mortgage” and Greg I’m going to give your listeners four words, and if you can understand these next four words, folks, it’ll save your heartache at the barbecue for whatever you make out there. It’s going to save you a lot of heartache.

Here’s what a reverse mortgage is, four words:

It’s just a mortgage.

It’s just a mortgage. Now. Some folks say they don’t believe it, and that is not true, it’s more than that. No, it’s just a mortgage.

See underneath the hood, it’s just a mortgage. What’s the difference? A reverse mortgage is started 30 years ago as part of the Federal Government, 1961 is a private program. It’s simply a home equity loan for those aged 62 years older, that allows them to convert a portion of their home’s equity and turn it into tax-free money without requiring them to move or to give up ownership of the home, to transfer the asset away, or to make monthly loan payments.

That’s it! It’s just a way to access the equity in your home without the burden of making a monthly mortgage payment. That’s it in a wide definition.

Now as we go forth today, I’ll unpack that a little more will cover a few more things. But that’s it in a nutshell. It’s just a mortgage. It’s just a mortgage!

Greg: I have a question for you, and I’m curious because I may very well mistake this when I discuss with people, friends, family, and clients. Is there a difference, technically, between a reverse mortgage and the HECM or home equity conversion mortgage?

Don: The common term for home equity conversion mortgage is a reverse mortgage.

So the legal name in 1988 is the home equity conversion mortgage—or HECM. The common name has been a “reverse mortgage.”

Now, we’re moving back to the HECM—home equity conversion mortgage—terminology because it’s really dynamic.

I would say this to the listeners. I got my first cell phone in 1997. That was 20 years ago.

And I thought I was somebody yeah, I thought I was the man! And I would sometimes pretend I was calling somebody, and it only did two things folks it made calls and receive calls. That’s all it did. It didn’t tweet, text, or anything like that.

Now, my son who just graduated from high school, he got his phone four years ago. Now I’ve seen him do a lot of things on that phone, killed Angry Birds, and watch videos,

But it wasn’t until three days ago that I actually saw him make a phone call. He pulled it out in the car. And I looked over and said, hey, what are you doing making a call?

And here’s the point. To compare my son’s 2017 mobile device with 3.9 million applications, to my 1997 cell phone would be no comparison at all.

The reverse mortgage that most people have in mind is like my 1997 cell phone. Today’s home equity conversion mortgage is like today’s mobile device.

It’s usages and its strategies are really dynamic. So it is essentially the same, we’re kind of reverting back to the original terminology I suppose.

Greg: But most people just generically think of them as just a reverse mortgage?

Don: Sure, that’s fair to say.

Who can get a reverse mortgage?

Greg: Okay, great. So tell me a little bit about how do I know if I qualify, who can actually get a reverse mortgage?

Don: Sure. So the reverse mortgage there are really only two programs that the Federal Government supports and underwrites for retirees.

One is Social Security, and the other is the reverse mortgage program that started in 1988 . . . so coming up on 30 years. It was designed to help those in retirement to sustain what would be a long retirement.

So it’s for those who are aged 62 years and over now. Only one person has to be 62 so you can be 65 and your spouse can be 25.

The other person only has to be of legal age, 18. So for those 62 and over one of them on your primary residence, and it allows you to convert a portion of that into tax-free money.

And so that’s who’s eligible.

Now since two years ago, there have been some improvements in the program in the sense that now we want to make sure that the people who get a reverse mortgage have the wherewithal to maintain their home and have residual income. So there’s a financial assessment test to make sure that you have enough money left over at the end of the month to cover your property-related expenses taxes insurance.

Things of that nature, and we want to make sure over the last two to three years you’ve been a good credit citizen. You paid your mortgage, on-time with your property taxes and things of that nature.

So those are the two most important qualifications and based off of that your age and value of the home, a certain amount of money is going to be made available to.

How much money can you get through a reverse mortgage?

Greg: Okay. Well, that’s a great transitional topic there because right now I’m really curious, and I know this is a very vague question and it depends on probably age and interest rates and value, and how much I might owe on the home. Tell me just a little bit about how much money could I actually get from a home equity conversion mortgage?

Don: Sure, so think of it as a triangle. So, I want you all who are listening to think of the amount of money that a reverse mortgage makes available is based on these strengths, three points on the triangle.

Number one, the age of the youngest borrow. That’s the pinnacle of the triangle.

Number 2, the value of the home, and number three the current interest rate.

So those three things make up the criteria by which our FHA determines the amount of money that is going to be made available. So for a typical 62-year-old today, at the time of this taping, they’re eligible for about 50% of the value of the home.

And so if you have a $200,000 home, and you’re 65 years of age. You’re eligible for $100,000. If you’ve got a $400,000 home you’re eligible for $200,000.

Now there’s a lending limit. The lending limit says here’s the maximum amount of money. We’re going to say the value of your home today is at $636,150.

So if you have an $800,000 home and you’re 65 years of age you’ll be able to receive about 50% of $636,150.

So it’s about $317,000. So those are the three criteria to the reverse mortgage. The three building blocks, age of the youngest borrower, value of the home, and the current interest rate associated with the program.

Greg: Okay, and when you say the current interest rate, can you explain a little bit?

Let’s just say that interest rates were more normal—if there is anything normal with interest rates in the marketplace—and let’s just assume that government bonds are paying five or six percent.

So the rates are higher than they are today. Can you get more out of your HECM or less?

Don: Sure, because the reverse mortgage is just a mortgage if someone’s listening, and if I said to you how much house could you buy with the regular mortgage if the interest rates are 3% versus 10%, they would say well Don I wouldn’t be able to buy as much or get as much house at 10% interest rates.

I said that’s right. And I said, with the reverse mortgages now, we’re in a low-interest-rate environment you get more money with the reverse mortgage.

If interest rates begin to creep up, and you get less money with a reverse mortgage. So now for a lot of folks, it’s proven to be an optimal time these last several years.

Greg: Okay, because rates are really low so you can actually get more out of it.

Don: That’s right. Absolutely.

Greg: So it’s based on interest rates, it’s based on the age of the youngest borrower, and it’s based on the value of the home.

Now, let’s just say Don . . . let me throw you a little wrinkle here.

Let’s say I’ve got a $400,000 house, but I owe $200,000 on it. What are my options now?

Don: Very important. Thank you, Greg, for asking that.

A reverse mortgage must be a first mortgage. So any existing lines, loans, home equity loans, second mortgages must be paid off first from the proceeds of the reverse mortgage.

So in that example, if a person had a $400,000 home, and they’re 65 years of age, a reverse mortgage makes around $200,000 available. Their mortgage, if it’s less than $200,000, that’s great. The reverse mortgage makes enough to pay that off.

Now, some people have more.

I’ve had a mortgage in that past that was $240,000, but the reverse mortgage only made $40,000 available. So it didn’t make enough to pay off the mortgage. But when we get to the five strategies, I’ll tell you what that client can do that many others have done. So if you’re listening you want to stay tuned to the retirement income strategy.

How do I get the money out of a reverse mortgage?

Greg: Alright, absolutely stay tuned. So my follow-up to that is so now that I know that I’m eligible and roughly how much money I could get off of my reverse mortgage or my HECM how do I actually get the money?

Don: Sure. So there are five ways that a reverse mortgage can be distributed to a client.

Number one, we can back up a dump truck that you just saved for the money and drop singles in the front yard. We don’t do that in the Philadelphia area, but maybe in Vegas, they’ll do that.

So you can receive the money in a lump sum. You can’t have it anymore all in one year, but it’s over two years to be receiving a lump sum.

Number two, you can receive it in a line of credit. We’re going to talk about that more as we move through this broadcast, what exactly a line of credit is.

Number three, you can receive it as a monthly tenure payment. Tenure means, Don I’d like to receive a certain amount of money every month for as long as I’m living in this home and have this mortgage open. That’s called a 10-year payment.

Number four is a term payment. Don, I don’t need the money for as long as I live. I just really need it for the next six or eight years or whatever. I just want a certain amount of money to last this long. That’s a term payment.

Finally, it’s a hybrid. The hybrid just simply means, Don, I want some in a lump sum, some in a term payment and some in the credit.

So that’s just a combination of those five ways you can have the benefits of the reverse mortgage or five distribution strategies.

Greg: So I’ve got two really important takeaways already. Number one is it’s just a mortgage. Number two, there’s a variety of ways you can actually get your cash out.

Don: Sure. Absolutely. Now those are great takeaways. And something that often times you don’t have time to explain all of that in 60 seconds or 90 seconds or 30 seconds.

And so it’s important. I think the people listening with you will have a financial advisor, or be connected with someone who’s a professional in this, that you understand the breadth and width of the tool.

Reverse mortgages—or the home equity conversion mortgage—is not a product. They’re a strategy that must be implemented and used in conjunction with your insurance and your annuity, your retirement income and your total retirement income plan.

Greg: Okay. So let’s just say Don, I love this concept, I need it built into my plan and I go ahead I decide I’m going to get a HECM—home equity conversion mortgage. And what I would like to know is: what are my responsibilities after we go ahead and get that HECM?

Don: Sure, one of the questions that come up all the time is that things get a little spooky with people.

You just ask someone, just mention a reverse mortgage at the family reunions and see what happens. Oh my God, and folks will jump and people leave the chicken wings, and the potato salad gets cold, everything goes wrong!

Greg: It’s worse than telling them that you just got a job selling life insurance!

Don: Yea! So their reason for that is that a lot of times people have heard this story. You look over in the corner and there’s Uncle Harry, and he’s living in your cousins spare bedroom.

People whisper and ask what happened to Uncle Harry? And someone says, oh he got that reverse mortgage and he lost his house and he’s in Tracy’s spare bedroom! And that’s the story that you most commonly hear.

I once did a workshop and there were some legislators from Philadelphia and they heard me say this. I said no one’s lost a home or been foreclosed on because of a reverse mortgage, here in Greater Philadelphia. And the man stood up and said now Don that’s not true.

What is the borrower responsible for in a reverse mortgage?

Don: I said no one has lost the home sir, or have been foreclosed on because of the reverse mortgage. And he said no the people come to City Hall all the time! And I want to explain the four responsibilities.

Number one is when you get a reverse mortgage it has to remain your principal residence. You can’t move to Florida and put your cousin Larry in there because that would be a fraud. So it has to remain your principal residence.

Number two, you’ve got to take care of the property. You can’t let a tree fall through the roof and not fix it.

Number three, you have to maintain homeowners insurance or hazard insurance.

And finally, number four, you have to pay your property-related taxes.

Greg: Okay, so all normal stuff that you’re going to do anyways as a homeowner?

Don: Well, it’s not spooky but it doesn’t come up in the story about reverse mortgages. So let’s go back to Uncle Larry who’s living in Tracy’s spare bedroom, and they said, oh he got that reverse mortgage and he lost his house.

Both of those things are true. He did get a reverse mortgage and he did lose his house, but they’re not correlated!

The reason he lost his house is that he didn’t pay his property taxes for three or four years, and the municipality of the city took action. Well, that’s not a good story.

You don’t want to share that with the family. You want to say it was because of all that doggone reverse mortgage. I’m sorry I ever did it! And the majority of people, and this was confirmed by the folks here in Philadelphia because they called me and they went back and said, Don you’re right, we discovered that the people came in with complaints, a hundred percent of them had a foreclosure that was authorized by the city of Philadelphia because they hadn’t paid their taxes.

Greg: There’s nothing to do with the HECM or a reverse mortgage?

Don: Nothing at all. But that doesn’t make a good story, that doesn’t sell newspapers! And you need something spooky or salacious to make a good story, and once you find someone who tells you the truth and be reasonable you understand it’s just a mortgage.

You’re in Las Vegas. I don’t know what happens if, in Las Vegas, you don’t pay your property taxes for two or three years. I imagine they do something and you won’t be able to stay there too long.

All right so there are your responsibilities.

How do I repay the loan?

Greg: Ok. So let’s just say Don that I go ahead and I decide to get a HECM and I stopped making my mortgage payments. Everything is rosy and then I decide in 10 years that I want to move, this isn’t my forever home. I thought it was.

How do I repay the loan? I assume I have to repay it, right?

Don: Sure, so I would say this question came up before. I was in Burlington Iowa at a workshop. And the person said Don should I get a reverse mortgage when I’m absolutely certain this is my last home? And I would say; how would you be absolutely certain of that? Is your last name Nostradamus!

Are you some sort of Biblical prophet right? I said how in the world would you know that?

A reverse mortgage is a strategy, not a product. It’s a strategy or tool which you buy homeowners insurance on your home. If you knew you were only going to be there five years and most people say, yeah I would do that.

I said why? What if you had plenty of money to insure your house, and they said Don, it’s good risk management. It makes sense.

And I said, so if part of your strategy for using your housing wealth is to provide a type of insurance that we will cover in a moment, then you would want to have that in place from day one.

I said now if that wasn’t your strategy, maybe you weren’t drawing from your portfolio or some of the things we talked about have no bearing on you, then maybe you don’t want to have a HECM in place.

So it’s not so much how long you’re going to be in the property, but it’s what strategy and tools are incorporated in your current retirement income plan and does housing wealth fit into that.

Greg: Right, and I love how you describe that. Is this part of your overall strategy?

So you’ve got clients and they’ve got the annuity that they may live off of, and then pitch in the Social Security, and the assets, and the IRAs, and the Roth IRAs and the HSAs.

You’ve got all these different buckets of money, and everybody wants to overlook one of the biggest buckets of money, which they live in! And they don’t incorporate that into their plan.

I think it’s a great strategy because I love to do what I call front-loading my clients retirement. I love to have them enjoy it while they’re 60 and 70 versus hanging on to it until they’re 85 and they don’t want to travel anymore.

Don: Right. That’s right.

5 Reverse mortgage strategies for retirement income

Greg: Yeah, so Don, let’s go ahead and dig right into it, you’ve got five simple strategies that HECM can be incorporated into retirement income?

Let me go back because I didn’t fully answer that question. I got excited in my own storytelling and got carried away. It’s a hazard of growing up in Kentucky and you just get carried away.

When does the loan get repaid is the question. And because this ties into a very common misconception, but the reverse mortgage becomes due and payable when the last survivor was permanently to leave the home. That is when they move or when they decease.

Now what gets repaid is whatever money we advance to you plus any accrued interest if you had made a payment gets repaid and listen a hundred percent of the remaining equity passes on to your heirs or your estate.

Let me explain it this way. Let’s say you have a client that lived in a $200,000 house and she took out a reverse mortgage of $100,000.

So from day one, she owes me $100,000. Well, she goes on and she doesn’t make a payment and it’s years later. And now she owes me $200,000 and she dies or she moves and it’s 15 years later perhaps.

So assuming her home has appreciated, her home could be worth $300,000 at that point and she owes me $200,000. Her heirs or her estate sell the house for $300,000 and then pays back the $200,000, and now there is a $100,000 remaining.

Now that passes on to the heirs or the estate. That’s typically what happens in a reverse mortgage. Well, someone says Donald what happens when Mama died and our house is only worth $200,000 and she owed you $200,000. That’s it, well, that’s a break-even, right? No harm. No foul.

Well, Don what happens if when Mama died she owed you $200,000 but her house is only worth $100,000. She now owes you more than the home is worth and I said, because this is a federally insured loan since 1988, the only recourse the lender has are the net proceeds from the sale of the house, which means the lender only gets $100,000, even though she owed $200,000 because it’s federally insured.

There’s no judgment. There’s no obligation on part of the heirs or the estate and they walk away scot-free.

And that’s how the reverse mortgages are repaid. So typically children sell the house. Pay what’s old and they pocket the difference and the children can refinance the homes.

Maybe they don’t want to sell the home, great. Go and refinance the home, pay back the reverse mortgage company, and retain the home.

Or maybe mom had insurance or other investments. The lender just wants their money, when the loan becomes due and payable they don’t want the hassle the lender does it take the home.

So I want to say that and we’ll cover that and the common misconceptions as we end but I wanted to make sure the listeners understood this. A reverse mortgage folks, is just a mortgage.

Greg: You make an excellent point, and I knew we would kind of get to this topic at some point is a real quick story I love to share with clients.

I’ve got a client up in Utah and she’s got this wonderful $250,000 house. She owes nothing on it.

She’s retired. She lives by herself. All of a sudden the city comes in they say hey, by the way, this gigantic boulder that’s behind your house—that’s actually a hazard.

So her property value will likely never go up. I mean anybody who buys this house is going to have to contend with this massive boulder possibly rolling and crushing them on while they’re sleeping.

So the first thing I told her was you need to go get it. Establish this HECM because while your house may never grow in value the home equity conversion mortgage will grow and I know you’re going to cover that real soon.

You could literally write a check to yourself when you’re 80 years old for half a million dollars and the house is only worth 250,000 possibly, right?

Don: That’s right.

Greg: I just love that story because I think there are so many reasons that people need to consider these.

Don: Absolutely that’s a great story. So let’s talk about some of the strategies.

Creating a cash flow cushion using a reverse mortgage

Greg: Okay, let’s dig right in so Don, the very first strategy that we’re going to discuss is actually creating a cushion. So what do you mean by creating a cushion?

Don: So the reverse mortgage one of the ways you can have the money as a lump sum, a monthly payment, or a line of credit. Most people understand the line of credit, even if you’ve never had one on your home, you may want to have one in your wallet.

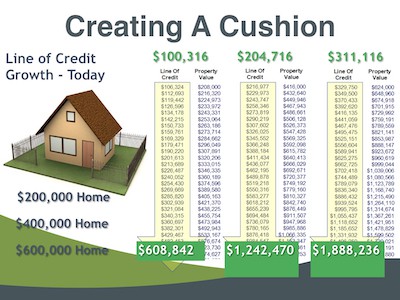

It’s called a credit card! Visa, Mastercard, Discover sends you this line of credit and they say you have access to it, use it as you want up to this limit it has. So the reverse mortgage that you’re seeing on your screen right there has a built-in line of credit.

So if you’ve got a home that’s $200,000 or $400,000 or $600,000 as you see on the screen—and these are numbers from 2016—but interest rates haven’t changed so they still hold true for a 65-year old.

So if you notice a hundred thousand dollar line of credit, if it’s not being used, if it’s not being accessed it grows, it has a built-in contractually guaranteed growth factor. And so over the next 30 or 31 years that hundred thousand dollar line of credit has grown to six hundred eight thousand.

If you had a four hundred thousand dollar home, and you got a two hundred thousand dollar line of credit, it grew to 1.2 million dollars or a three hundred eleven thousand dollar line of credit grows to nearly one point nine million dollars.

That’s at today’s interest rate. If rates go up then that line of credit goes up.

Is that true? I said it’s absolutely true. It’s so true. That the AARP Policy Institute went before HUD and said, you know what we may need to do away with this because people are using this in a way that we never thought it would be done 30 years ago exactly what you said early, so it’s absolutely true.

So creating a cushion. When you say Don, I’ve got my income and you got your investments and you have your insurance that includes annuities and all of this, what difference would it make in your retirement if you were able to create another cushion that’s going to be growing for you.

Not tax-deferred, but tax-free to use for spending shocks that will come up in the future. We’re all going to have spending shocks that commercial life comes at you fast. You don’t know what’s going to happen to you around the corner. Hopefully, you’re well but isn’t it a wise thing to have an accessible bucket of money? A lot of money?

Greg, there’s this term I heard several years ago and most of the people listening on this call who are homeowners . . . you probably have homeowners insurance. You probably had it for 20, 30, 40 years.

And as to people on the phone call are listening here, have you ever had a fire in your house and your house burned to the ground? And most people say no! Did I say a small fire?

No, and I said, but you’ve been paying 500, a thousand, fifteen hundred dollars a year for the last 20, 30 years and you’ve never had a fire?

We should set your kitchen on fire something to get our money! I said why would any reasonable person carry insurance that has cost them tens of thousands of dollars for something that probably will never happen?

Because it’s good financial stewardship, right? That’s a great word that you use. Now that’s homeowners insurance and there’s car insurance.

Well, this financial cushion, this line of credit, is a form of insurance and it’s called equity insurance.

That’s a term that I heard. Dr. Jack at the Wharton School use. What is equity insurance?

This is guaranteed access to the appreciating equity that’s in your home regardless of your home’s value, regardless of your credit, regardless of glitches your assets you have access to, Those figures that you saw on your screen earlier, you have access to that in the future regardless of these other things.

And I can tell you something, your house may not burn to the ground and you may not total your car but the probability that you’re going to need two, three, four, five hundred thousand dollars or something over a long retirement . . . that’s a pretty big probability.

So that’s the first strategic use of the reverse mortgage (home equity line of credit), is creating a cushion for spending shocks.

Greg: You know another thought that popped into my mind on and you—maybe you can comment on this—is you said spending shock and the first thing that I thought of as long-term care medical expenses.

Don: Yes. Sure.

Greg: I imagine this is a great way to plan for those.

Don: Most people don’t plan for that Greg.

I don’t have to tell you that, I’m preaching to the choir there! But one of the things that people have not planned for in their retirement are the two biggest expenses.

Number one out-of-pocket medical costs, which Fidelity have a study that put that at $250,000 for a couple retiring today.

And so that’s not that’s out of pocket. And the second is 70% of retirees who will need some form of long-term care with the average cost looking to be around a hundred and thirty thousand dollars.

So we’re looking at two hundred . . . two, four, or five hundred thousand dollars! And a spending shock that most people will have in some way shape or form.

And they’re not prepared for that and I want to say this to the listeners, that establishing when you buy homeowners insurance, I pay for that every year at $1,200 whatever it is every year and I’ve been doing that ever since I’ve been a homeowner. That’s out of my pocket that’s real money. A reverse mortgage requires the typical borrower to pay about $500, 300 to 500 dollars out of pocket to establish this equity insurance.

Now juxtapose that to the amount of money you’ve been paying out of pocket for your car insurance and your homeowner’s insurance. This is the cheapest insurance I think you’ll ever buy in your life and the one that I know you’re going to need in the future!

Creating a cash flow buffer using a reverse mortgage

Greg: Okay. So let’s move on to the next simple strategy which is near and dear to my heart. It’s creating a buffer. So what do you mean about creating a buffer to what?

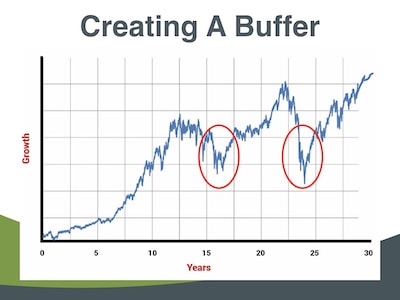

Don: Well, this is for people who really have managed wealth assets (investments) working in the market. If that slide is still up, that’s a picture of the market. The ride that we take here and there up and down. And when you’re younger, I’m 51, so I can sustain that ride because I’m not at the top of the mountain, I’m not taking money out.

But once you get to the place of retirement, this ride they’re not a lot of 80-year-olds on the roller coaster.

Where I grew up there was a place that’s right outside of Cincinnati called Kings Island, and we had roller coaster called The Beast when I was growing up. It was the highest fastest longest all-wooden roller coaster in the world. There’s a lot of teenagers on that thing but very few folks who were 70 and 80!

Greg: Yeah, I’ll pass too!

Don: Because the dips and the Beast and that really is the picture of the market for a lot of folks, you want to have some money in there, but you’ve got to be realistic.

Greg: So if you manage wealth, which certainly is as expected, what do you do when the market dips? How do you preserve so one of the strategies that we can’t go deep into but the very simple strategy is this? If you were to not take any money out any distributions in the year following a negative return in the market that next year?

Don: You said I’m not going to take any money out of my savings if you did that every year we hit one of those dips. The preservation of your portfolio would be substantial.

But the challenge is well then how do I live in the years where I’m not taking any money out? Well, you want to find a non-correlated asset, meaning you want to find some money that’s not tied to the ups and downs of the market.

That could be life insurance. That could be something else. But most people have access to housing wealth.

That is if you were to establish that line of credit that we just talked about as strategy number one. Here’s following a negative return in the market instead of pulling it out of that and locking in the losses. You pull it out of your line of credit.

And then you give your account time to recover. And if it recovers well enough you put the money back in and you start over again.

That in and of itself creates a much better retirement experience, a much bigger inheritance, and a much smoother ride for your money. It’s a powerful strategy and I keep saying this, and it’s something you could do for five hundred dollars out of pocket to have this backup insurance plan.

It’s a wonderful way if you’re dealing with managed wealth.

Greg: I was going to say Don I wholeheartedly agree with you and especially and even more important early in retirement. So if you’re dealing with some younger retirees in their 60s, the biggest risk that they face really is that sequence of return risk or it’s you know, the sequence of returns that the market gives them with their portfolio.

So if they suffer through one of these nasty markets, you know drops and they’re still pulling money out of their portfolio, they can’t recover from that.

So this strategy essentially says hey when the market is bad, I am not going to pull money out of my portfolio. In fact, I’m probably going to rebalance and be buying stocks while they’re cheaper instead. I’m going to be living off my home equity conversion mortgage line of credit.

Don: That’s right. A powerful strategy and as a financial advisor and a person that’s retirement income focus mastering wealth, my question is that the consumers who are watching this (there may be some advisers were watching this) you recognize this as a wise and prudent strategy of setting up a HECM to serve as a buffer against this type of volatility.

Why do you think advisors like yourself or consumers may have been maybe a little slow to get on board with this?

The same reason I was a few years ago. I think it’s just a lack of knowledge, lack of education, and lack of really understanding and honestly what sold it for me was when I realized that the line of credit will grow.

Greg: You know for me the deal-breaker was I don’t want to pay money and set this up and it’s just going to you know to be a hassle, and then once I realized that the line of credit grows, in my mind, I’m looking at doing a plan for a 65-year-old couple and I’m thinking hey, you may never touch this. How come you may never touch a dime out of it, but at age 75, you’ll have already enjoyed your younger years in retirement.

You may need to touch a little bit of it then so we’re just going to build it as your what I call it the last arrow in the quiver or the final backstop. It’s insurance just like you said Don, I just I tell them to listen. I don’t care if you know this thing is going to cost you $5,000 to set up or whatever the number is.

I take those five thousand dollars and I divide it over the next 30 years of their life and it’s super cheap insurance.

Don: Right. Absolutely. Well, thank you, Greg, for being proactive.

Creating a cash flow through a reverse mortgage

Greg: So the next one that you’re going to kind of discuss with us is actually going to be creating cash flow. So we talked about maybe taking the money maybe not and all the different ways but explain what we’re looking at here with the cash flows.

Don: These next two of the five strategies are very important.

The typical baby boomer is those born between 1946 and 1964. They’re going to live longer than their predecessors.

They haven’t saved enough and they’re highly indebted which was somewhere between 50% and 68% of baby boomers are carrying some sort of mortgage payment home equity loan, second mortgage payment into retirement and the fellow said to me Don is that true?

I said, yeah the numbers bear it out I said, but next time you’re with a group of folks who born between 1946 and 1964 just ask them, how many of you all have a mortgage or home equity loan or something against your property, nearly every hand will go up. And so they’re coming into retirement having this.

So I want you to think—those who are listening—that about coming into retirement having some savings but having a monthly mortgage payment of 200, 400, 800, 1500. Right.

Maybe you got it when you were 55 and then you’re 65 years thinking gosh I got 20 years left on this and I’m retired and I’ve got a $1,400 a month payment for 20 years.

Here’s the question and I want you to answer this question. Ready?

I’m going to look into the camera . . .

What would life be like for you? What would your retirement look like if you did not have to make that monthly mortgage payment? Think about that, those who are watching. What would your retirement look like?

If you did not have to make that mandatory monthly mortgage payment now, I can’t hear you. Everybody’s going to raise their hand and say it would be tremendously better!

Some of you said that it doesn’t matter. I’ve got something for you in strategy number four. But the truth is if you had an extra twelve hundred dollars a month, what would that mean? That may mean you didn’t have to draw so much out of your managed wealth (investment).

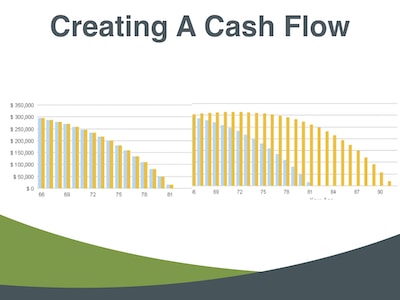

If you simply eliminated a mortgage payment like the picture that was on the screen, but here’s a person and we’re showing this person had $300,000 when they retire. And they were going to draw out two thousand dollars a month beginning at age 65 and that was unsustainable.

And so they were going to run out of money at age 81 with that type of strategy, but they had a monthly mortgage payment.

They were paying $800 a month and they had 20 years left on it. And we said to them if you did a reverse mortgage, and we simply exchange your traditionally amortizing mortgage for a reverse mortgage you wouldn’t have that $800 a month payment.

And if you didn’t have to make that payment then that means you don’t have to draw down as much from your savings. And the waterfall graph that you saw said simply by eliminating a monthly mortgage payment, we extended the life of their portfolio 10 more years!

Now the question is—this may not be your concern—but some of you the number one concern is running out of savings in retirement and you have a monthly mortgage payment. Well, that’s a way to extend the life of that for others who say Don if I didn’t have a monthly mortgage payment I could help my grandchildren with college.

That $1,200 could be used for that. Some of you said if I didn’t have a monthly mortgage payment I play golf three times a week. Now that I’m retired I can play twice a month because it’s more expensive.

Maybe you get more lifestyle. Maybe get more longevity. Maybe you give more legacy. Maybe you have more liquidity. Maybe you just save that money.

But creating cash flow by limiting in a monthly mortgage payment as tremendous benefits to most of the people listening to this call.

Now, let’s talk about those who say well wait a minute, I’ve got a monthly mortgage payment. I’m comfortable. I’m okay with it. I don’t mind it. I’ve got the cash flow to sustain. Well, that’s strategy number four. Let’s look at that now creating a deferred income.

Now think with me for a moment those of you who have a monthly payment and listen, I’ll say this like one politician once said, if you like your payment then keep your payment!

Okay, so I’m not going to mess with your payment. You like your payment, you love it every month. I’m not going mess with it.

So let’s say you like your payment and every month you’ve been paying $1,000 a month to such and such bank.

So that’s $12,000 a year. And now you’re 10 years into this. You got it at 55.

Now, you’re 65, you’ve paid them $120,000 and you call them up on the phone. You call them up. And you say listen, I’d like for you to send me a check for $80,000, just overnight that to me.

That’s like I said, you must have the wrong number you said no, no.

Greg: No. I’ve been paying you guys for years. I’d like to get some of that money back.

They say no you have to re-qualify go through xyz. We have checked income and credit.

Don: See folks, they don’t give you the money back. Do they now? What would happen, listen to this?

What would happen if you could take your mortgage and just exchange it for a reverse mortgage?

I don’t want you to stop payments. I want you to switch partners, right? I don’t want you to change payments. I just want you to change partners.

So you’re still going to have payment but we’re going to have instead of you being with the bank of the world right now going to be what the HECM bank. So that $1000 a month payment you had, you’re still going to have it.

Here’s what will happen. Every time you make a payment on the HECM, your loan balance goes down, it goes down until it fades.

Now that happened when you were with the bank of the world? Nothing different? So I’m not going to I’m not asking you to change any behavior.

I’m saying make a payment because you like it. Now let your balance go down, it goes down.

But this shows what happens to a person that had a four hundred thousand dollar home and had $100,000 mortgage payment paying $1000 a month when they got a HECM, we said to them keep making a payment. And so the red line shows that every time they made a payment their loan balance went down.

So 10 or 12 years later. Look what happened to it. It’s done. They have no more loan balance.

But the green line folks, the green line is every time you sent in $1,000 monthly payment we added that to your line of credit. Watch this, the line of credit today at the time recording is growing at around 6 percent.

So your loan balance went down every time you made a payment we added a thousand dollars to your line of credit and that went up. So when you see that on your screen and you see that over time now, ten years down the road the $120,000 calls your balance to go down and you call me up and say Don I’d like $80,000 and I say to you what? That’s all you want?

I said you’ve got a hundred fifty thousand and then you say what are you talking about? We took something you are already doing as a behavior pattern, making a payment, getting a tax deduction, reducing your principal balance.

We took that but instead, we said we’re going to change your partner. And every time you make a payment, we’re going to put that in a line of credit. So down the road, you won’t have a hundred thousand. You could have 200, 300, 400, 500, 600 thousand dollars and on the chart that we had up, it says even the money that you had could even surpass the value of your home itself.

Now, here’s the question. If you’re here and you’re listening to me, you have a monthly payment and you like making that payment why wouldn’t you switch? Why wouldn’t you change partners?

Keep your payment the change partners that down the road you could have access to three, four, five, eight, seven hundred thousand dollars when you need it?

And the truth of the matter is in retirement, you’ve got to have the go years. That’s when you first retired.

And then you have the slow-go years where you said? Well, you know what? I don’t want to do all that traveling and I and then around 80-85 you got the no go years, and that’s when the money starts drying up.

But if you were strategic just for the first 15, 18 years when you have that payment if you kept it. And you end up with a huge pot of money six, seven hundred thousand dollars when you’re 80 years of age.

You’re going to look back on something that cost you nothing. You didn’t have to change your behavior at all and folks will look at you and say why do Bill and Mary have $800,000 in this extra pot of money.

It’s because they did something strategic. And early on, that’s how you create a deferred income without ever having to change your behavior or your economics at all.

Greg: You just keep making your payments to a different bank. Like you said the HECM bank that they get to take the loan out for and eventually at some point in time when you want to draw money it’s there for you to draw or if you just want to stop making payments that could be an option as well.

Don: Right and I should say that the payments are voluntary. And so you say Don I don’t have a thousand dollars this month. I said that’s alright you’re making a voluntary payment that matches what you were making?

Make more than you can, make less you can, make none at all. You’ve got payment flexibility, cash flow, control tax, deductibility guaranteed growth.

And here’s the biggest thing, you’re creating equity insurance because down the road you’re going to need access who own this call could say to me, Don, I don’t think when I’m 80 or 79 or 85, I don’t think I’m going to need an extra $500,000 or $800,000. I’m okay.

Greg: What if you look at the alternative Don in that kind of process that you described where somebody gets the HECM, now it’s set up.

It’s guaranteed. Nobody can take it away from them because it’s federally insured right?

This is the opposite. Let’s say you make your payments, your house is eventually paid off and at age 80 you want to pull money out of your house.

Well, you did not set up the HECM, you were not strategic about this. Now you’ve got to go and try to find a bank to loan you money when you’re 80 years old.

You have no job. You’ve got you to know Social Security maybe is income. It’s a lot harder to try to get a loan later in life than it is to set it up early.

Don: Sure, or some advisors have told the client but listen, let’s not do the HECM right now. Let’s wait until you’re 75 or 80 you’re older your house should be worth more than you probably get more money. And the truth is you will get more money. But as we’ll see in a moment the money you’ll get 20 years or 15 years from now will never catch up.

It will never catch up to the money you could have gotten today because the money today is growing at around six percent. So you’ll get more down the road, but you’re going to lose a lot more when you do that, so let’s go to the fifth one and let’s land the plane here.

Creating a right-sized retirement with a reverse mortgage

Greg: Yep. Let’s land the plane creating a right-sized retirement Don, what exactly is a right-sized retirement?.

Don: A lot of folks and talked about downsizing and many folks don’t like that word downsizing. No one wants to go down. Everybody wants to go up.

And I said, well, it’s not downsizing its right-sizing. What’s the right size? For your final home in retirement how many of your clients Greg have homes and their children are coming back?

You don’t need all those bedrooms and square footage and the taxes. My last child is leaving and a month. I told my wife to change the locks and let’s go! My house is too big. I was just talking to my neighbor.

I said, listen. I don’t want this big house. I don’t want the steps. I don’t want all of that.

So right-sizing, as we put on the screen here, is just an example. And I’ve said to clients I said if there were a way that you could increase your cash flow, reduce your expenses, and add more money back into your retirement savings would that be something you’d like to learn about?

Sounds good right? Okay, no one. No, I don’t want to increase my cash flow. I don’t want to reduce my expenses. Get on out of here. No one says that in their right mind.

Well in 2008 after the Great Recession, there was a new type of HECM called the HECM for purchase. The HECM for purchase was simply a way that allowed you to purchase your next home even before you moved in there using a reverse mortgage.

Here’s how it works on the screen there. There’s a client that had a house,` $535,000 and they had a big mortgage on the property. And so the wife was concerned about longevity that I don’t want to run out of money. The husband was concerned about lifestyle.

I want to play more golf than I’m playing right now. And I said to them listen, let me show you a strategy. This house is big, are you open to moving?

They said yes. Yes, we’re open today. I said if you sold your house for $535,000 house it was on the screen and we paid off the mortgage you’d have about 400,000 dollars leftover and no mortgage payment.

So just right there. We’ve helped the husband because of that thousand dollars a month. I said I don’t know how much golf can play but I had to get you a few rounds in the hot dog after each of them. But the wife says well, what about me? I said so let’s find a there’s a new gated community over here.

It’s $300,000 beautiful homes. And I said they’re just smaller, but they’re gorgeous. And they said great Don, we’ve got $400,000 we’ll just pay cash.

I said well do you really want to lock up a hundred percent of your equity in a home given what happened in 2008?

And they said no. No, we don’t want to do that. I said, let me give you a strategy. Let’s use the home equity conversin mortgage for purchase on your new home.

So the new home was $300,000 and the HECM for purchase made about 50% available or a hundred and fifty-four thousand dollars. So three hundred thousand dollars to the new house minus the HECM 154 means the client had a down payment of $146,000.

That’s what they had to bring—$146,000. They had four hundred thousand dollars left over. So out of the four hundred, they put down a down payment of 146.

And they had two hundred fifty-four thousand dollars in cash left over to add back into their retirement savings, both the husband and wife were stunned!

We didn’t know we could do this! And I say yes the HECM for Purchase is the number one way in America that boomers are rehabbing their retirement.

If you’re listening and you’re saying, if I say to you would it make sense to increase your cash flow?

Well, how do we do that? By moving and paying off their mortgage we increase their cash flow number to reduce their expenses.

We went from this big house to a smaller house with newer appliances, less maintenance, and lower taxes. We reduce their expenses and we added a quarter-million dollars back into their net worth and back into their savings.

Everybody won’t do a quarter million dollars. Some people can do more some people can do less.

So the home equity conversion mortgage for purchase is a powerful strategy that I believe every advisor and every person should look at.

If you got a lot of folks saying Don, I love my house. I’m committed to my house. I said that’s great. I said that sometimes the trade-off is you can have more house and less retirement or you can have less house but a bigger retirement.

What do you want? And so those are the five strategies creating a cushion through a line of credit.

I’m creating a buffer to manage market volatility or just withdrawing at the wrong time. That’s creating cash flow by limiting a mortgage, creating a deferred income by making a mortgage payment with switching your mortgage partner.

And here creating the right size retirement that you can add more money back into your savings by super-sized powerful strategies.

Greg: Five great strategies.

Don: There are 31 altogether, but we only going to cover five, but if you just stop there that’s very important. So great. Let’s land the plane here.

Greg: All right, let’s do that. You know, we had talked a little bit, you know so far about when you want to go ahead and get a HECM Mortgage and I think I know the answer it’s probably as early as possible.

But go ahead and explain what this slide on the screen is and you know, what’s the best time to get it?

Don: Sure the slide on the screen emphasize what I said earlier, what’s the best time particularly right now to get ahead?

Well, the Top Line shows a 250 thousand dollar home and it’s going to appreciate over time. That’s the top line and the two bottom lines the blue one and then the gold one shows a client that gets a hundred twenty-five thousand dollar line of credit.

Now the middle line says they got it today. They let it grow and you notice over time it grows even possibly surpassing the home’s value.

The line at the bottom is the person that says, well, I’m not going to do a reverse mortgage line of credit today. I’ll wait. Because I’ll be older and my house will be worth more and I’ll get more money, and indeed you’re right that bottom line says you got more money, but you never catch the top line.

And right now interest rates may begin to creep up. We’ve begun to see that with the new administration. There’s economic uncertainty and if interest rates creep up and you got a line of credit today what that would mean is your line of credit would grow faster at a higher rate. And then the amount of money you would get from a HECM would be lower.

So the gap would be even wider if you did that. So the optimal time really in this type of environment and this has been borne out through the Journal of Financial Planning and Kiplinger’s, Wall Street Journal and most of the academic thought leaders agree that the optimal time to establish a reverse mortgage line of credit is early in retirement.

Greg: All right, and just to reiterate Wealth Masters and kind of drive that point home about the interest rates. If the interest rates are higher, you will not get as much out of the HECM value because just like any other regular mortgage. If you’re paying more in interest to the bank that’s less house that you can afford.

So that’s another reason with interest rates at historic lows that this is something you probably want to consider sooner rather than later. And Don you know, here’s another chart that you created that just kind of reiterates the optimal point to get a HECM again. Can you explain what we’re looking at here?

Don: Well, that was a waterfall graph earlier. And so let’s focus on the chart before that and will disregard that one. But really it’s looking at it sooner than later.

Let me say a word about the world of the HECM sphere that world of providers.

I’m an educator. I have partnerships with other folks, but it’s very important to the consumer who’s listening that if you’re dealing with someone who’s treating a reverse mortgage as a product, they’re selling you a product.

You want to be far away from that person. And I mean that with all my heart what you want to find is a home equity conversion mortgage strategist.

Someone who’s working with retirement income planner or if you don’t have a plan or someone who understands the principles of the HECM strategy so that you can optimize this. So in my nearly two decades of saying this, there has been some folk who guided folk in the wrong way that it would benefit themselves.

And someone saying you need to take that money out in a lump sum and put it in your bank. You want to run from that person you want to run from that because that’s self-serving to them.

And so just a word on make sure you connect with legitimate trained retirement income reverse mortgage professionals that will lead you through a questioning and a coordinated process where you were they’re dealing with your income your investment your insurances and then how housing wealth fits into that, and that it’s a long-term strategy and not a short-term strategy.

So I can just kind of summarize that what I’m hearing from you is this is not just any old mortgage. This has to be carefully considered in the grand scheme of your entire retirement, including your assets, expenses, incomes, liability, your goals and needs and wants for the future.

Greg: This isn’t just a hey go out and get a mortgage and forget about it.

Don: Absolutely. The HECM specialist I think is a rare breed. There’s somewhere between economist, advisors, pastors, and social worker.

It’s a whole world, but it’s a strategy folk. You gotta understand that you can’t get this in a 60-second commercial from a TV star.

This is something that requires really some coordination some questioning and making sure that it’s in your best interest and it’s a coordinated strategy with all of your other assets. And so make sure you deal with the right one. I think some of my contact information will be there. I’m happy to point you but whether you do that or not, make sure the person you deal with is not selling you about a product.

Certainly not telling you to take it out in a lump sum because I don’t think that’s the way you need it unless you’re paying off a big mortgage make sure it’s strategic in its usage.

Greg: So Don, I think you know going back to my original admission that I really didn’t know a whole lot about the reverse mortgage or home equity conversion mortgage.

I think it was mainly because of all of these misperceptions and myths and every time a client walks in the door, I hesitate even mentioning a reverse mortgage because literally, you see them kind of shut down and cower and they don’t want to hear about it.

So can you just kind of go over some of these misperceptions and dispel them? For example, the bank will take my home.

Don: Yes. I hear that often and I got to be careful every now and again someone at church I say that’s the guy that sells reverse mortgages go get him!

That’s a loan with the bank that gives you the money, and when you die they take your house and that’s not true folks!

We’ve covered that because four words what is a reverse mortgage? It’s just a mortgage! The bank didn’t want your house they want their money back.

I’ve got a mortgage and if my wife and I happen to pass away my children are going to sell the house, pay back the bank of the world, and they’re gonna pocket that whatever is leftover. And in a reverse mortgage that’s all that happens.

It’s a mortgage. At some point, you’re going to owe money at the end. The children are going to settle the estate, sell the house, get the insurance, whatever pay back what owed and they pocket the difference.

The bank doesn’t take the house. They don’t want the house.

Close on the heels of that is Uncle Larry’s story. Oh that reverse mortgage, you got to be careful because you could lose your house. And I said who do you know lost their house?

Last time I was with my cousin, Uncle Larry’s in her spare bedroom because you’ve got to pay your taxes, keeping it kept up, live in the house. And I said did Uncle Larry do all of those things?

Oh, yeah. I’m certain he did.

Ask him if he paid his taxes? See, he may not tell you the truth. If he looks down at his eyes go down, you know, he didn’t pay it.

But that’s another misconception that we get often.

Another one is when you can’t get a reverse mortgage if you if you’ve got a mortgage already on your property. Not true.

That’s really been the number two reason that people got a reverse mortgage was to eliminate an existing monthly mortgage payment and get rid of that.

A common prevailing theme oftentimes for some of your clients are those who have some means—the mass affluent—is that oh reverse mortgage is only for those who are house rich and cash poor. It’s only for poor people, right?

And I’d say well, let me ask you a question. I want you to be honest with me. Are you a hundred percent certain you’re going to have a great retirement? Now, those who are listening to this call, I want you to answer this question.

Are you a hundred percent certain that you’re going to have a great retirement?

No, no, most of your not. Now listen to this last question. If there were a proven resource that allows you to increase your cash flow, reduce your risks, preserve assets, enhance your liquidity, and even add retirement dollars back into your savings. If there was proven research to do all of that, would you want to know about that?

And you well said Don absolutely. I said, okay now you told me you don’t want a reverse mortgage or you’re skeptical of it. But you want the five things a reverse mortgage can do you?

Greg: You can call it a purple cow and they probably go, yeah, I want to get a Purple Cow Mortgage!

Don: Yea! And so if you want to increase cash flow, reduce risk, preserve assets, enhance liquidity, and even add dollars back into your retirement savings.

Look at where the majority of the wealth lies. The US Census Bureau said that 60 to 68 percent of most Americans total wealth is in housing. Well, did you hear me? 60 to 68 percent is in housing wealth.

Now if you don’t know how to leverage that housing wealth to create a sustainable retirement income you may live in a state of uncertainty.

You just told me that you were not a hundred percent certain that you’re going to have a great retirement. A reverse mortgage may not make you a hundred percent certain, but it may get you closer than where you at now.

Don’t you owe it to yourself to get all the answers all the possible proven solutions and strategies that could help you?

I have five friends who have cancer, two of them are no longer with me, and of my five friends and then we talked about this and I use this example with their blessing, and I said two of them went for alternative strategies went to Mexico another one went set such a play. That was fine.

We believe in that. But all of them when they went to their oncologists, imagine going to an oncologist, and they said, I think we’re just going to have to do surgery to amputate. And you say to them? Well, should we wait a little bit to see if it grows? Nope, we’re going to amputate. What about chemo?

What about it? What about radiation? No, we don’t talk about that. We’re just going to amputate. You would sue that oncologist that would be malpractice to say they’re not giving you all the possible strategies whether you like them or not.

You see so housing wealth must be apart of a retirement income strategy, whether you have an advisor, your advisor needs to look into that.

They have to know a minimal amount about this because it has an impact. Or if you’re doing it yourself or you’re just watching this by yourself you owe it to yourself.

To understand how this works and to work with a qualified reverse mortgage retirement income professional. You do that, and I think we’ve covered all the other myths and misconceptions.

Greg: I got to thinking to myself a lot of times, I wish I would just say Purple Cow Mortgage to clients because they probably wouldn’t be so oh I can’t do this. I can’t do a reverse mortgage and then at the end explaining well, it’s actually called a HECM reverse mortgage.

Here’s what I say to folks, to advisors, and to the consumers you’re watching and you’re listening. Don’t tell people you’re doing a reverse mortgage. Say I’m doing a new reverse mortgage, because really that’s what it is. Say, I’m looking into the new reverse mortgage because it is newly restructured or say I’m looking into the home equity conversion mortgage.

We just called it by that name the reverse mortgage. It’s like this. It’s so much different than what you may have imagined that it does a lot more than making receiving phone calls there.

Greg: Well, Don, our job here is to as I said in the opening mission statement is to educate and empower people with all of these tools and tips and tactics and strategies and you’re an expert and this clearly has to be a strategy that’s considered.

Key takeaways from the reverse mortgage

So as we kind of bring this discussion on reverse mortgages home Don, can you just kind of hit on some of these main takeaways that if you’re going to leave the viewers with anything you need to think about these three things.

Don: Sure. The main takeaways. I’ve said it ten times.

It’s just a mortgage. Four words. Okay, but a takeaway. You won’t lose your home. You’re not going to lose your home. You’re required to live in the house pay taxes, keep insurance enforce it, maintain it.

Those are your responsibilities and don’t you already do that? That’s not anything new, is it? The reverse mortgage was designed that you can enjoy a long retirement. It’s designed that you can enjoy a longer stress-free retirement by using all of your assets.

And the third takeaway is the earlier you establish, it’s been proven I should say that’s it’s been proven. That earlier you established a HECM line of credit the more advantageous it will be for you. So those are my key takeaways. I think they’re on the screen as well.

How to reach Don Graves

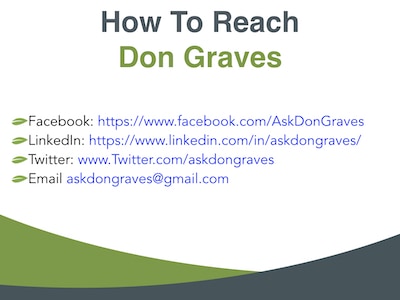

Greg: Yep. Don, that was great! Thank you so much. So for the Wealth Masters out there Don, can you just share a few people want more information on the HECM, the reverse mortgage, the Purple Cow Mortgage, whatever you want to call it, you can you please share with our viewers out to how they can reach you.

Don: Sure. You can always email me and askDonGraves at gmail.com.

That’s an easy way to get to me. Twitter at askDonGraves. Book askDonGraves. LinkedIn askDonGraves.

And all these things will be on your speaker page as well. So they can just point and click.

Or if you want to I write about this every week. I do videos on my education site that is askDonGraves.com. So you’ve got a question ask Don Graves about reverse mortgages!

Greg: Don, you’ve got a great YouTube channel. I did a little bit of research as I was preparing for this and I love your YouTube channel and all the videos you put out. You are definitely an educator. I want to thank you so much for your time today Don.

Don: Thank you, Greg. I appreciate it!

Greg: So for the Wealth Masters out there, thank you for learning a little bit about the HECM reverse mortgage.

I always like to say that either you control your money or it will control you and I can’t think of a much better strategy for you to consider about actually taking control of some of this untapped wealth as you enter retirement.

So consider the HECM Mortgage, do a little bit more research and ask Don Graves. You can probably just go on Google and type in asked on graves you’ll get all of this stuff! They’ll pop up right there. Yeah, don’t thank you very much.

Don: Thank you, Greg!

Greg: All right, it’s Greg Phelps signing off.