You probably hear it all the time from your financial advisor . . . “You need a financial plan!” Financial advisors ramble on and on about it, but why is financial planning important? And what is financial planning anyway?

You’re not alone in your curiosity. Most people wonder what financial planning or retirement planning actually is. They also wonder:

- Do I even need a financial plan?

- Is a financial plan different from a retirement plan?

- How will a financial plan help me and what does it cost?

Most people are trained to think your investments or insurance products are your “financial plan”. This couldn’t be further from the truth, as real comprehensive financial planning is so much more complex . . . and infinitely more valuable!

In this article, I’ll explain exactly what a financial plan is, the step by step process of what goes into the plan, and why you need to have one (or run the risk of dying broke).

What is financial planning?

The strict definition of a financial plan is that which identifies, organizes, and prioritizes your financial goals and then outlines the steps you need to take in order to accomplish those goals. A financial plan encompasses several areas of things that take both money—and planning— to achieve such as investments, taxes, estate, insurance, retirement, mortgage planning, etc.

The first question you should ask yourself is “What am I trying to accomplish?” You have money goals and dreams, and you have certain resources to achieve them. But what is it that you’re really trying to accomplish?

Do you only care about the return your investments earn? Perhaps you’re only focused on paying off your mortgage? Maybe you just want to enjoy a wonderful stress-free retirement and not worry about running out of money?

A financial plan is a roadmap to help you accomplish your goals. Forget about how well “this stock” or “that mutual fund” performs. If you take the time to create a truly comprehensive financial plan the pieces will fall into place over time.

Having been a “financial planner” for 25 years I’ve seen a lot of financial planning software and tools. They run the gamut from very simplistic, to product-oriented, to thorough and comprehensive. The two most widely used software tools for professional financial planners are MoneyGuidePro and eMoney. We prefer MoneyGuidePro, so I’ll answer the question “What is financial planning?” by creating an actual financial plan.

PRO TIP: I created a simple retirement planning spreadsheet calculator that isn’t nearly as robust as MoneyGuidePro, but can still help you answer some retirement planning questions. You can download my Retirement Planning Spreadsheet Calculator as part of my Retirement Mastery Toolkit here.

For most people, a “dream retirement” is on their list of important financial goals. Let’s walk through what financial planning is relative to your retirement goals.

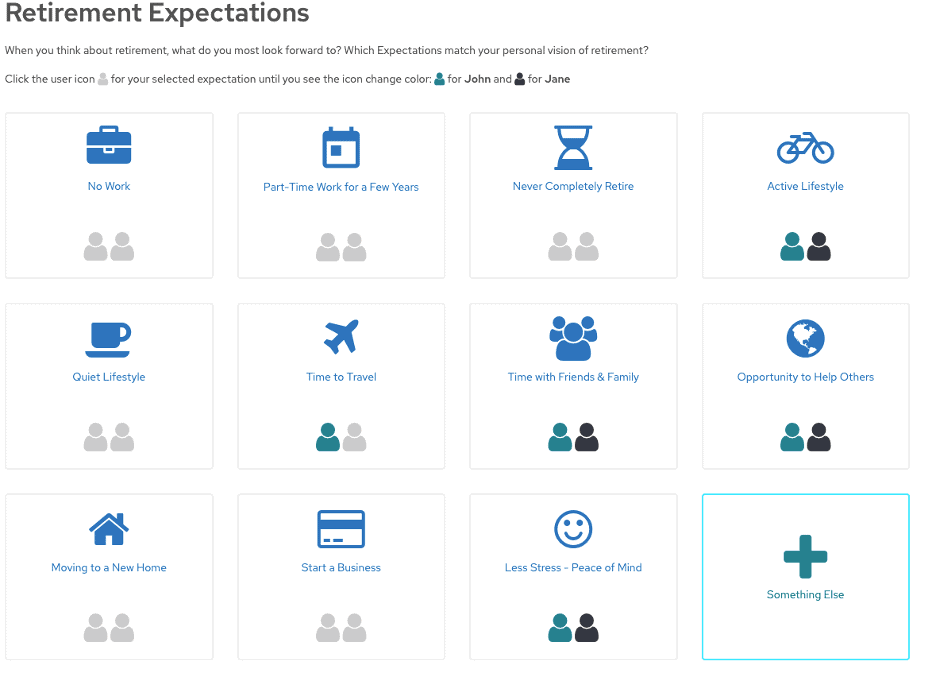

Retirement expectations are built into your financial plan

When we create a financial plan for retirement we start with your vision of what retirement looks like:

- Do you expect to work part-time or not at all?

- Do you plan on traveling extensively?

- Will you volunteer your time or start a business?

- And on and on . . .

What’s your vision of a dream retirement?

the financial planning process will help you enjoy retirement with less stress and more peace of mind! Isn’t that what really matters?

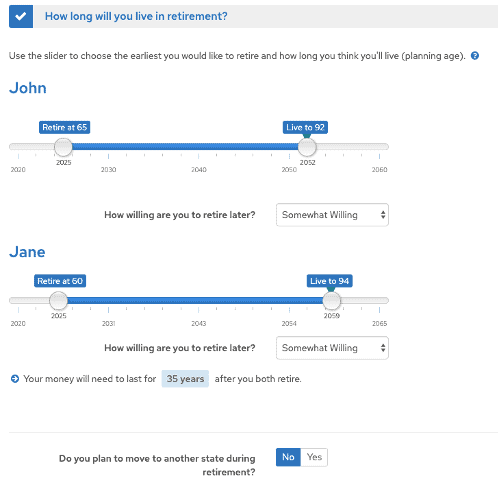

Financial planning for retirement hinges on when you plan to retire

When you’d “like” to retire is a critical question to answer . . . and one you may not be able to answer right away. Once your financial plan is complete we often find you can retire sooner than you’d expected, and unfortunately sometimes later than you’d expected.

What is financial planning? Well, this one question says it all! Without a financial plan, how would you know if you can retire when you want and actually enjoy living the life you want?

Financial planning is all about trade-offs. Without the financial planning process, you can’t possibly weigh the costs and benefits of your financial and life decisions.

You may be willing to sacrifice some retirement travel or buying cars as often as you’d like in order to retire earlier. Then again, you may be desperate to retire sooner rather than later and you’re willing to forego the 50th-anniversary party you’d dreamed of.

Most people plan on retiring somewhere between ages 60 and 65. But again, it doesn’t matter what the average answer is, the only answer that matters is yours!

To create a financial plan you need to estimate how long you’ll live in retirement

If you knew exactly how long you (and your spouse) would live, you could create the PERFECT financial plan for retirement! You could ensure the legacy you want to leave is left to your loved ones or a charity. You could possibly bounce the check for your funeral if you so desired. You could take the trips and life the retirement of your dreams accordingly along the way.

But—like the stock market—we simply can’t predict the future OR when we’ll die. So we estimate our life expectancy based on things like how healthy you are, do you smoke, how long does your family typically live etc.

For most of our clients, we typically plan on them living to at least 90-92 years old. You may live much longer than that, you may not live anywhere near that, but for us that’s a fairly good place to start. When it comes to your retirement planning, we’d rather be safe than sorry.

Your life expectancy is very important! If you retire at 65 and plan on living till 95, that’s 30 years your money will need to last!

Another important aspect is if you plan on moving to another state another during retirement. This is important for a few reasons. Cost of living and taxes vary from state to state.

One of our long time clients really wanted to move out of Las Vegas. We ran several scenarios of western states and frankly told them they didn’t have the resources to move to a state with an income tax. That took Idaho, Utah, and certainly California off the list. Washington however, was a HIT!

They still live in Washington today. In fact, they travel and enjoy the outdoors a lot, and make us a calendar each year with beautiful scenery they’ve visited and live near. I’m always excited to get that Christmas gift from them!

If you plan on living in a tax-friendly, low-cost state like Nevada, then your money will go much further than retiring in a state like California or New York where state taxes and cost of living will be more of a financial burden on your retirement.

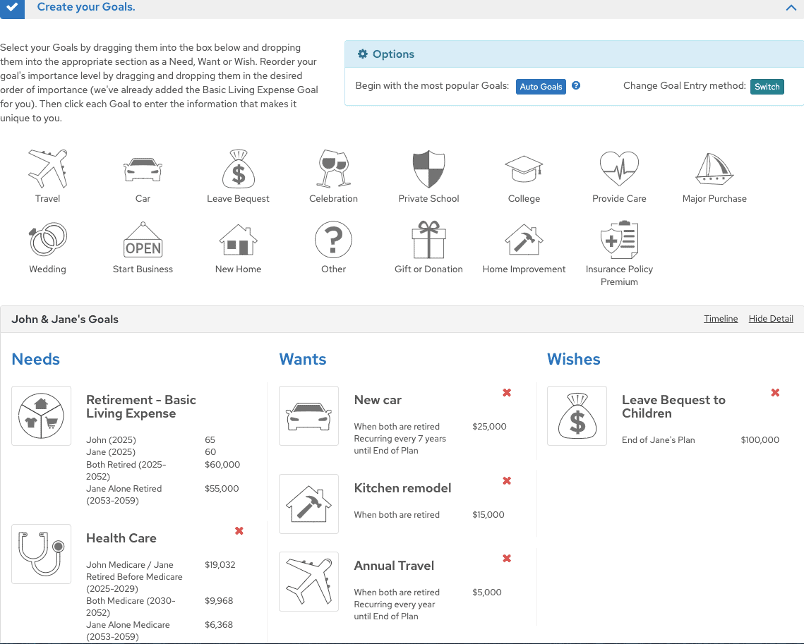

Financial planning starts with your dreams and goals for retirement

This where we start to think about what goals you have and how much they will cost. Some goals are recurring, like a car purchase every 6 years or so. Other goals are one-offs like a trip to Australia.

How and when you enjoy these life goals is critical! That trip to Australia may cost $20,000 today, but in 10 years when you want to actually go, it will likely cost closer to $30,000!

Not every retirement goal is equal though. You may LOVE dining out at fancy restaurants, but don’t care about new cars as much. You may need to help your grandkids through private school, but don’t care as much about a vacation home.

So we break your retirement goals into needs, wants, and wishes. That way we can rank them against each other, adjusting along the way. This also allows you to have a plan that’s flexible! You can include your retirement wishes knowing that you may be stretching things thin and might have to forego some of those financial desires.

Your retirement “needs” are the critical things you can’t live without. Housing costs, utilities, clothes and food for example.

Your retirement “wants” are still important, but not critical. This may include travel expenses, gifts for the family, and expensive new cars.

Finally, your retirement “wishes” are lowest in priority. for example, you may want to leave your kids $250,000, but it’s not a priority over your travel, cars, clothing and housing expenses.

In the financial planning case study I’m building, we plan for John and Jane Doe to live off $55,000 per year until John’s death (which we plan to occur in 2052 when he is 92). Given that expenses for John will end once he passes away, we can safely assume that Jane will live off a bit less than that one she is by herself, so we’ll drop her expenses to $50,000 per year until the end of her life 5 years later.

One retirement expense that cannot be overlooked is healthcare expenses. In this example, we have Jane retiring at the same time as John but she is only 60, still 5 years away from Medicare and lower health insurance costs. We must plan for her health insurance costs to be much higher than when they are both on Medicare, so we add in private insurance expenses prior to her Medicare eligibility.

Again, your goals are uniquely your own. They may share similarities with John and Jane in the example, but they will not be the same.

Maybe you don’t want the kitchen remodeled. Maybe you want to start your own business or pay for a child’s wedding. You may want to live on much more than $55,000 per year. It’s your retirement which is why the financial planning process is not only critical . . . but fun! You get to shape it as you go along and tweak it every year!

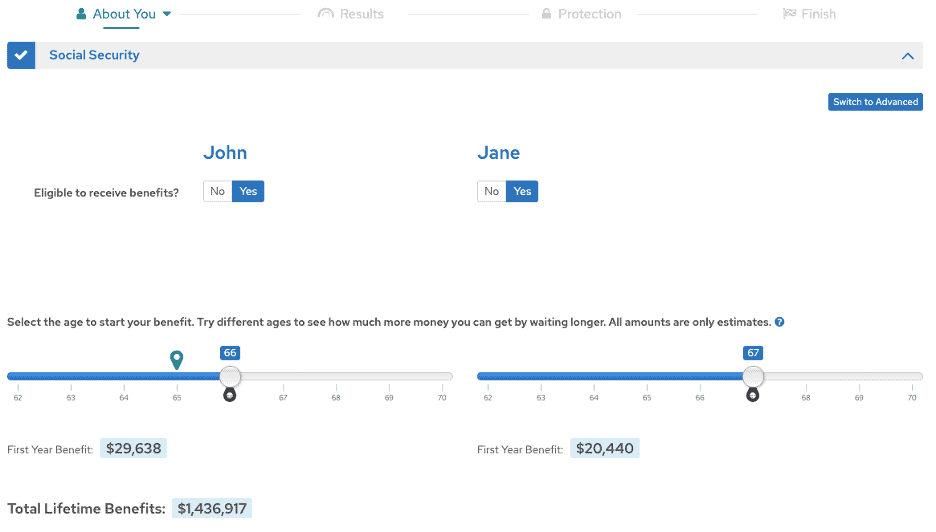

Social Security claiming is a huge part of financial planning!

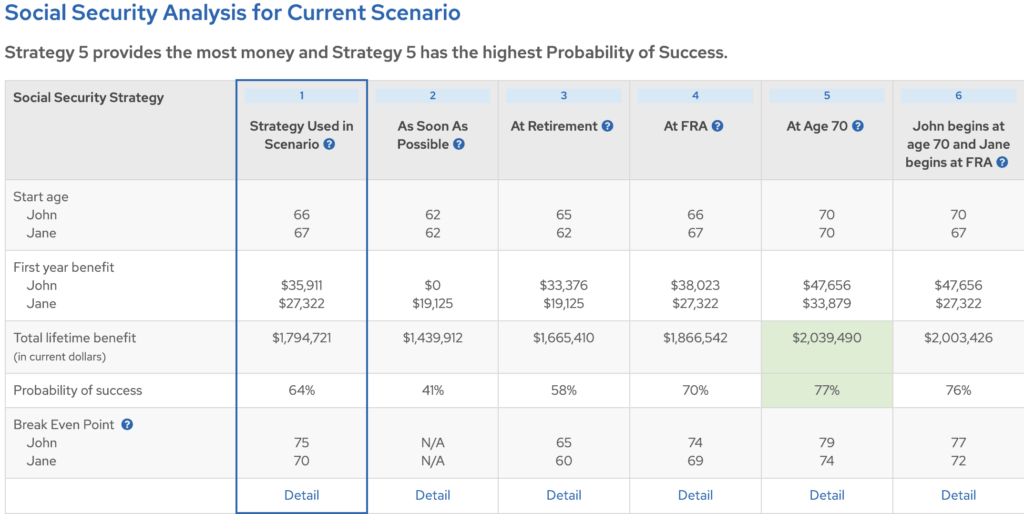

In this preliminary analysis, I’ll have John and Jane each filing for Social Security at their Full Retirement Age (FRA). Unfortunately, only 4% of all Social Security recipients actually get the most money out of Social Security! The vast majority of SS recipients file for Social Security too early and leave most of their benefits on the table.

One of the most important ways you can improve your financial plan for retirement is to get the most money from your Social Security. There are several variables in Social Security claiming strategies that can make or break your retirement success!

In addition to several situation-specific Social Security calculators, one of the best tools we use to help clients maximize their Social Security income is right within MoneyGuidePro. This helps ensure our clients get every penny they deserve.

More on this and how it affects John and Jane’s plan later.

Financial planning accounts for your income, assets & liabilities

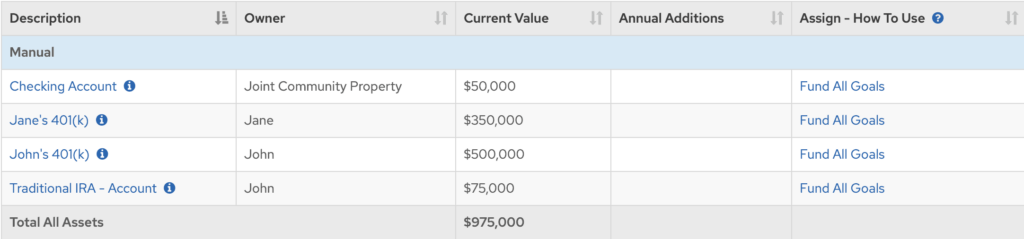

Next, we get to the actual data entry of your assets. As you can see there is a wide variety of different assets a client may have. Stocks, bonds, annuities, real estate, collectibles, businesses, and more! They must all be accounted for because over retirement they may need to be used to accomplish your retirement goals and dreams.

You may also have debt on your balance sheet. This is also a critical part of the financial planning process, because debt may need to be eliminated or managed differently in retirement.

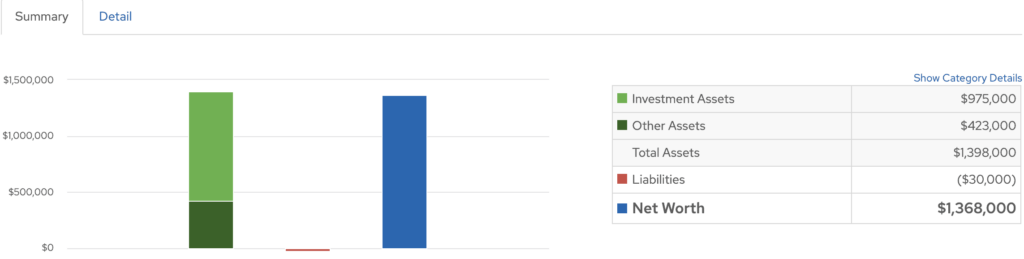

In this case, the Doe’s have $975k in investment assets and other assets (real estate) worth $423k. they also have a liability (mortgage) that still has $30k left on it for a Net Worth of $1,368,000.

Not all of your assets are the same however. Some of them may be taxed as income when you withdraw them to spend. Others are tax-free, and yet others are tax-deferred. Taxes are a critical component of your financial planning for retirement because ever tax dollar you can save is a dollar earned! And most importantly, it takes planning to save those tax dollars!

Knowing your assets and liabilities we can create a net worth statement for you! Just like any successful company, you need a tally of your assets and debt to understand how to fund your expenses when your current retirement income may fall short!

Your ability to live the retirement you’ve always dreamed of hinges on your assets, income, expenses, and liabilities. Without a thorough accounting of these things, you’ll never know if you’re risking dying broke . . . or sacrificing the retirement lifestyle you should be enjoying!

The financial planning process helps determine how much investment risk you should take

You’ve scrimped and saved . . . and probably invested along the way. But once you retire you can’t earn it again!

Just because you stop working for your money doesn’t mean your money should stop working for you!

Greg Phelps

Your retirement savings and investment assets needs to work hard for you. But the harder that money works, the riskier it gets!

There are three different aspects of how your should invest for retirement:

- Your risk tolerance – This is gauged with a “risk tolerance” questionnaire where you’ll answer some questions to help determine what level of volatility you’re comfortable with.

- Your risk required – This is determined through the financial planning process. Without creating a plan for retirement you’ll never know how much risk you NEED to take in order to realize the retirement of your dreams.

- Your risk capacity – Again, this is determined through the financial planning process. You need a financial plan for retirement so you can figure out if major volatility will derail your retirement (or if you’ll be fine!)

What is financial planning? How much risk you should take with your assets is a huge—and critical—part of financial planning. While two of the three determinants MUST be gauged from the actual financial plan, the first one is determined with a risk questionnaire.

We use a scientifically proven tool called Riskalyze that helps us learn about your comfort level with investment risk and volatility. I also laid out a simple set of questions to help you figure out your own risk tolerance in my book The Portfolio Architect: 5 Keys to Design, Build, and Manage Your Ultimate Investment Plan. You can get a FREE copy of my book here in my Retirement Planning Toolkit.

Discovering your risk score is critical because it will guide you to the best investment portfolio for YOUR situation. if you’d like to get your personal Risk Score click here.

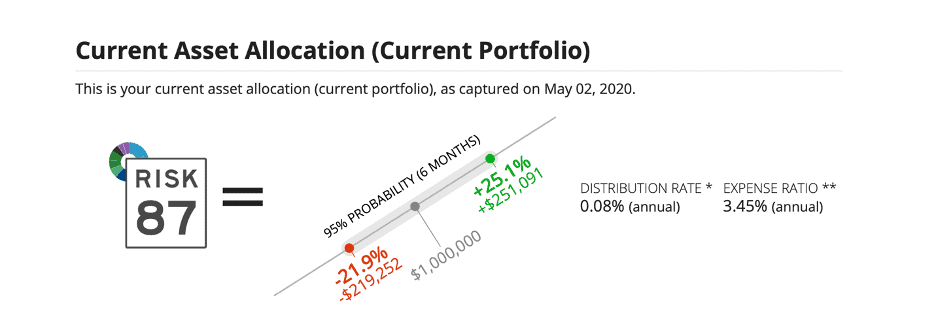

Riskalyze not only helps us determine your risk score and your investment asset allocation but other things as well. For example, we can show you the investment fees you’re currently paying (Hint: they’re probably much higher than you think), and how to eliminate unnecessary investment risk.

We can also show you the risk-efficiency of your investments. Are you paying $10 for a $5 burger? That may sound silly, but everyday we find investment portfolios that are incredibly expensive for lackluster retirement and outrageously high risk and volatility.

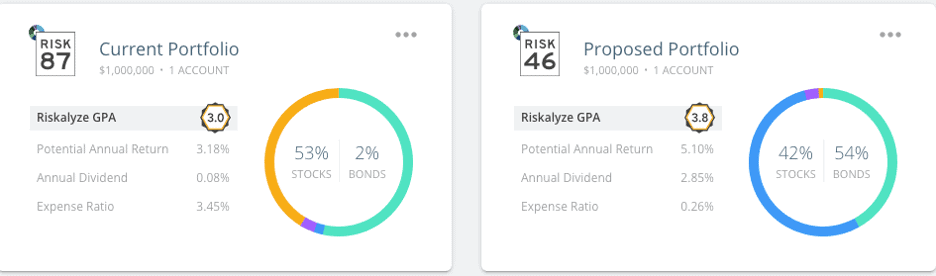

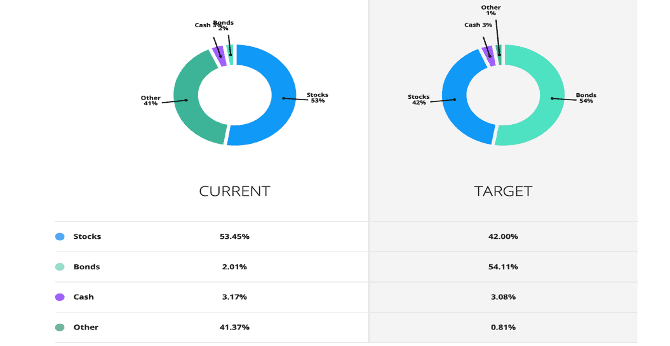

In the example above, John and Jane are invested in an 87 Risk portfolio. Their investment portfolio is invested very aggressively! This may be fine, but does it match their risk tolerance?

They’re also paying 3.45% in the expense ratios. If their investment return is 7% they’re only seeing 3.55% of it (7%-3.45%). That’s HIGHWAY ROBBERY for an investment portfolio!

Are you being ripped off? Find out here.

I’m sure you’ve thought to yourself before, “My broker said I had a 10% return, but when I actually crunched the numbers it was more like 6%!” Sadly, this is something we hear all the time.

This happens because most “financial advisors” (who are merely brokers) are incentivized to sell you a fund or an annuity that they get a commission or kickback from. The more money in their pocket, the less in yours.

That’s why it is imperative to hire a fee-only fiduciary advisor. Under this compensation model, the only way your financial advisor gets paid is from fees you pay them directly and not commissions or kickbacks from some Wall Street insurance or investment company.

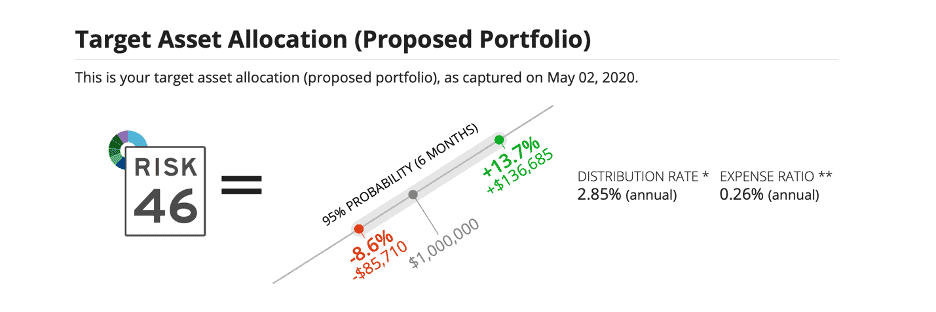

After having John and Jane go through the risk tolerance questionnaire we settled on a joint risk score of 46.

They were invested as a Risk Score of 87, and their real Risk Score is a 46! See a problem here?

John and Janes’s portfolio should be approximately 45% stocks and 55% bonds with a 0.26% expense ratio. This will save them tens of thousands of dollars once they’re invested in a globally diversified, low-cost index strategy.

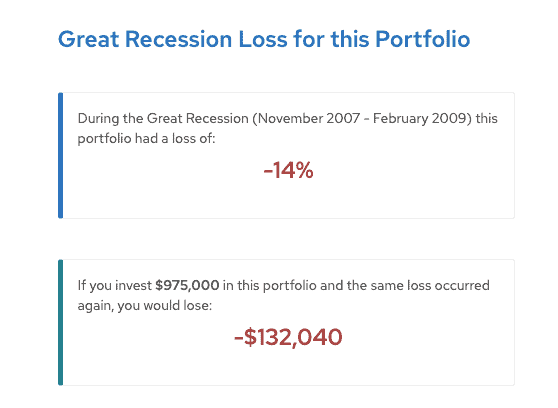

Another way we can gauge how comfortable the Doe’s are with this portfolio is to stress-test the portfolio to see how well it would have held up during the Great Recession (from November 2007-February 2009). Given that the global markets lost around 50% of their value during this timeframe, a 14% loss, in comparison, isn’t all that bad.

In this case, we’re actually able to earn more return with less risk because of the risk-efficiency of the portfolio! This is another reason having your investments lined up with your risk tolerance is so critical. You can actually boost your investment performance while also reducing risk!

Some clients are comfortable with more risk than others, but financial planning is unique to you! Your financial plan must deliver the life results you need.

How does your financial plan for retirement stack up?

Here’s where the rubber meets the road! At this point, your life goals and dreams for the future are mapped out with your current and future assets, income, expenses, and liabilities. But will it work?

It’s somewhat easy to assume a fixed rate of investment return and determine if your plan will work or not. It’s a lot of calculations, but it can work. The problem is investment returns aren’t linear!

Interest rates rise and fall. The stock market rises and falls. There is a great degree of variability in how much—and when—your investments will deliver returns.

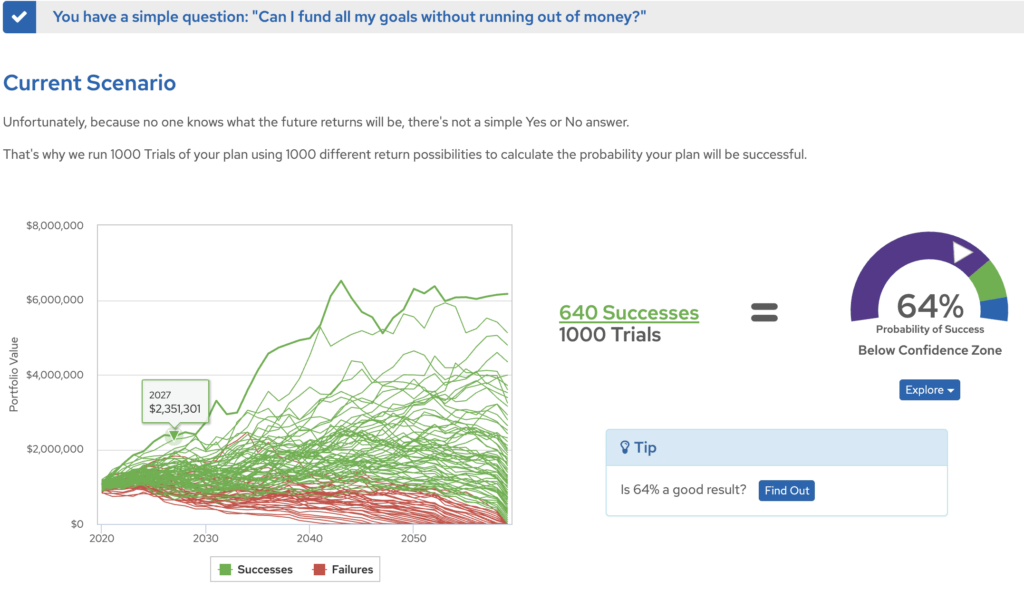

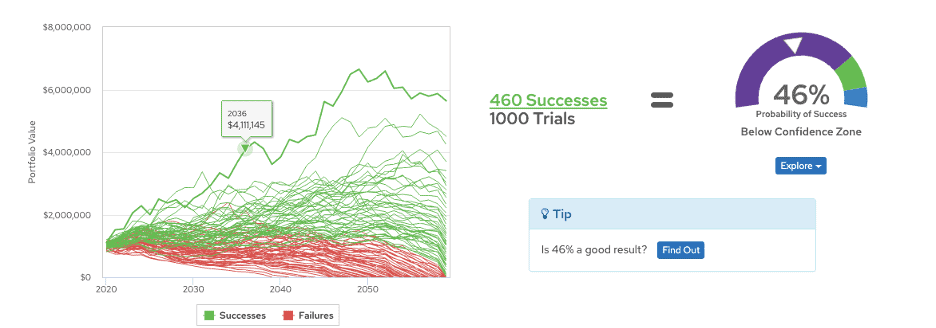

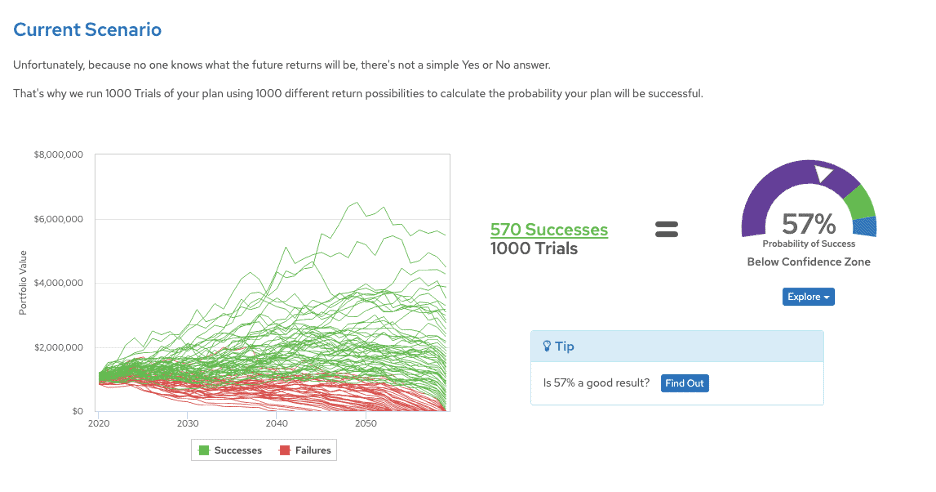

For this reason you need to run several simulations across your entire financial plan timeframe. Not just 5 or 10 simulations, but to be statistically significant a thousand simulations. We call this a Monte Carlo simulation.

A Monte Carlo analysis runs a thousand different simulations of your various financial planning scenarios with randomized investment returns each year. Ultimately, it tells you how many times your plan succeeded or failed.

As you can see below, the Doe’s were able to accomplish their financial goals only 64% of the time. Well, that’s not exactly encouraging news.

You wondered what is financial planning, and this is where financial planning really gets important. Just because your current financial situation isn’t that great doesn’t mean it can’t be improved without massive changes.

Financial advisors typically feel somewhat comfortable with a Monte Carlo score above 75%. That’s the “green zone” you see on the meter.

You need to boost that percentage to feel more confident in your financial plan. Who wants to go through retirement knowing a toss of a coin could leave them destitue after all?

Let’s take a look at some of the financial planning strategies that can improve your retirement and help make your golden years a bit more “stress-free”.

Maximize your Social Security planning first

We’ll start with the “low-hanging fruit” which is squeezing every last dime from your Social Security benefits. Remember I mentioned only 4% of all Social Security recipients are getting the most from their benefits?

What most retirees fail to realize is poor Social Security claiming strategies could cost you about half of your entitled benefits AND leave your spouse in a bad spot. For most (but not all) retirees, delaying Social Security as long as possible will help them realize their goals.

The difference in lifetime benefits by waiting until age 70, in this case, was several hundreds of thousands of dollars in extra money. That goes a long way in making sure you’re getting the most out of your retirement.

As you can see with the Doe’s, by waiting until age 70 to claim Social Security their probability of success was boosted from 64% (at retirement) to 77% (claiming at age 70).

Your situation is unique, but it’s important to find out which Social Security maximization strategy works best for your situation.

Now their financial plan is that confidence range at 76%, but there’s a lot more we can do improve that probability of success. Financial planning is a lifelong process!

Financial planning will expose your insurance needs

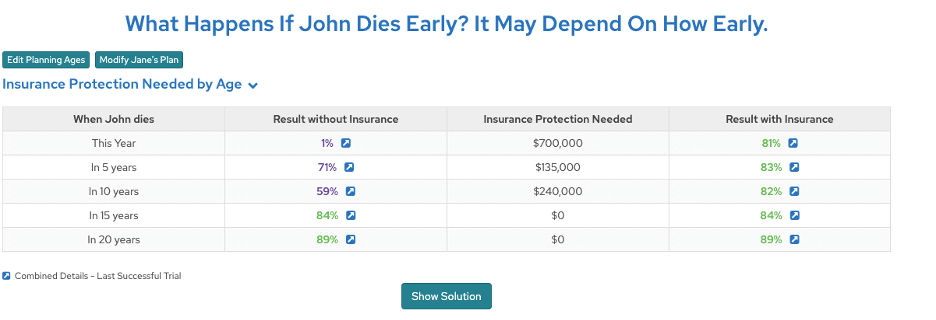

Given that a substantial portion of the family income is being generated by John, we don’t want to leave Jane in the dark in the event that he passes away. In fact, with a simple insurance analysis, we discover that if John were to die this year, Jane’s probability of success plummets to just 1%.

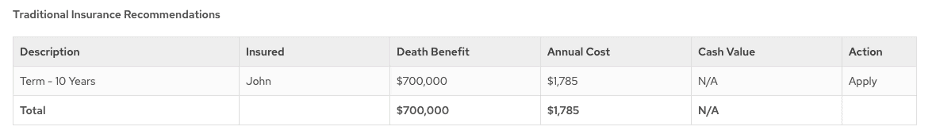

For the record, we do not sell insurance of any kind. We simply explain your financial results under certain life events. Typically, we recommend term insurance. Term insurance is inexpensive, and you will get the most “bang for your buck”.

In Jane’s case, it would be prudent to purchase a 10-year term life insurance policy on John with a $700,000 benefit, which increases probability of success to 81%. This will cost approximately $1,785 per year, but as you can see, it must be done to protect Jane and her future if John passes away.

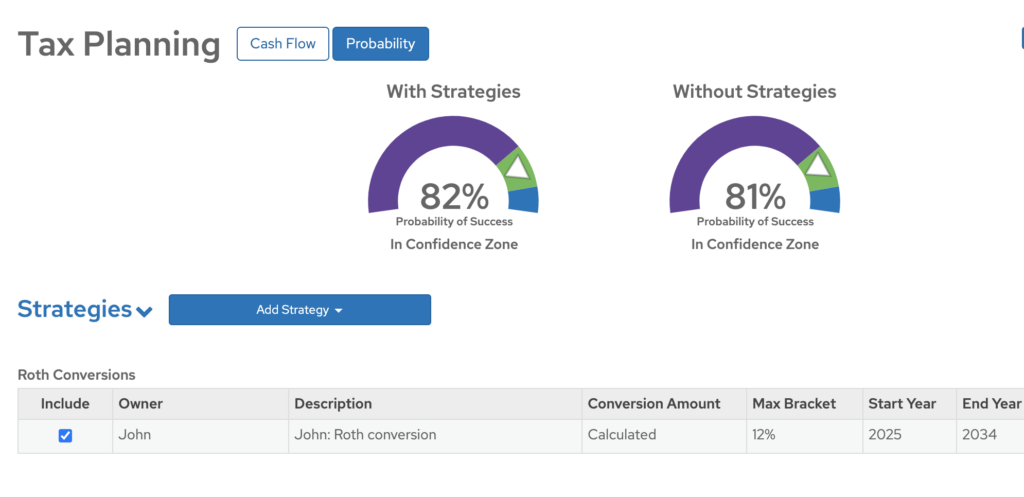

Roth conversions are part of the financial planning process and can slash your lifetime taxes!

A Roth conversion is simply distributing money from your pre-tax IRA and putting it into a Roth IRA. This triggers income tax on the conversion, but the Roth account is tax-free forever!

Why would you want to pay taxes now when you can delay paying them until later you ask?

- You can control the amount of tax you pay by converting the amount you’re comfortable with

- Tax rates are historically low and likely to be higher in the future

- There are no required minimum distributions from a Roth IRA

- It reduces the widow tax (when one spouse dies the other pays tax at the higher single filer rates)

So how do Roth conversions help?

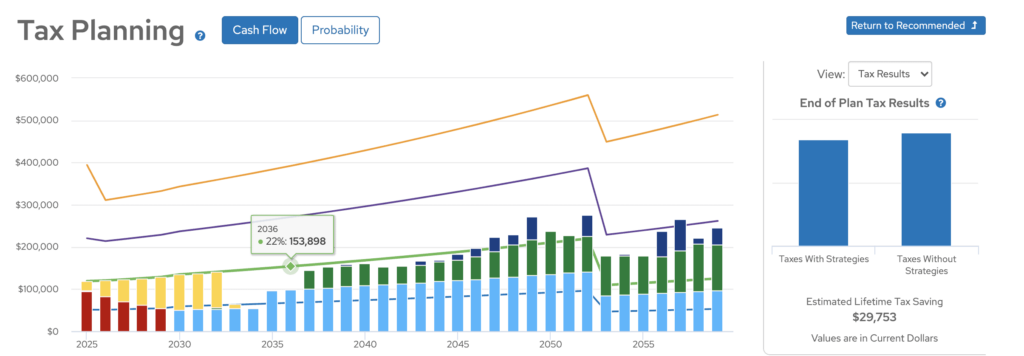

When we implement the strategy for the Doe’s you can see their probability of success goes up by 1%. It may not seem like much, but there are tax savings in implementing this strategy and it provides greater tax flexibility in your retirement income planning later on.

So what is financial planning? Well, as you can see below, the Doe’s save nearly $30,000 dollars in taxes over their lifetime! Now THAT’S financial planning!

Financial planning compares multiple paths to reach the end goals

As mentioned earlier, if they decide to do nothing, they’ll have a 64% probability of success. While a 64% chance of success may be palatable to some investors, the financial planning process can almost always improve that!

So we reviewed maximizing Social Security, taking the insurance recommendation, and executing strategic Roth conversions. Altogether the probability of success bumped up to 81% and saves nearly $30,000 in lifetime taxes!

Financial planning includes estate planning

Estate Planning is an essential component to your overall financial plan. It allows you to gain more control over aspects of your life both during your lifetime and after your death.

Creating a trust allows you to avoid the costly process of probate. A lot of people think that when you die your assets automatically transfer to your beneficiaries, but with the exception of retirement accounts where you have to name a beneficiary, this is not the case.

For some, the probate process can take months—if not years—to sort itself out. To make things worse, the government is in control of how your assets are allocated, not you!

For those with larger estates, estate planning can help avoid the estate tax, which applies to assets exceeding $11.4 million per person. The estate tax rate can be up to 40%

There are five major decisions that go into each estate plan. Those decisions are described below, along with examples and a description of people in your life that may be up to the task.

- Beneficiaries – This is WHO will get your assets when you pass away. Generally, if you have children, we see to it that things go to your children in equal shares. However, there are also opportunities to leave things to charity (via a specific dollar amount after a death), or to other loved ones.

- Method of Distribution – This is HOW your beneficiaries will get everything when you pass away. Depending on the age and financial capabilities of your beneficiaries, you may wish to delay distributions to a beneficiary. For example, for young beneficiaries, we often see clients give it in stages (1/3 at 25, 1/3 at 30, and 1/3 at 35). Please keep in mind that those young beneficiaries will have immediate access to funds for health care, education, and support. If you have a beneficiary with special health needs, you can leave assets for them through a special needs trust.

- Successor Trustee/Executor/Financial Power of Attorney – This is the person (or people) who will make financial decisions for you in the event you cannot. The type of person who makes a good trustee is someone who is financially responsible, would handle finances similar to you, and is generally a good decision maker. If you don’t have a family member or friend who fits the bill, you can consider a professional trustee. Generally, there are 2-3 successors named (in order of preference).

- Health Care Power of Attorney – This is the person (or people) who will make health care decisions for you in the event you cannot. The type of person you name here would need to be able to make decisions during a difficult, emotional time. You will have the ability to state your end of life and organ donation wishes in this document as well. Generally, there are 2-3 successors named (in order of preference).

- Guardian (if necessary) – This is the person (or people) who will have legal custody of any minor children should you pass away. The guardian will work with the trustee to access funds for any minor children. We often see your parents, siblings, or dear friends named here. We also see other children you have that are over the age of 18 named here. Generally, there are 2-3 successors named (in order of preference).

Financial planning includes those “what if” scenarios

What if inflation spikes?

The government has been printing a lot of fake money lately. Hyperinflation is a very real fear!

Inflation is perhaps the #1 destroyer of your returns over a long period of time. You’ll never see inflation, but you’ll certainly feel it’s effects on your portfolio.

So, what is inflation?

Inflation is the general increase in prices over time and has the effect of eroding the value of your purchasing power. All of us have felt this. 30 years ago, the price of gasoline in the US was barely over a dollar per gallon. Today, if gas is under three dollars per gallon we feel like we’re getting a deal!

A quick example of the power of inflation: Let’s say that the price of an apple is $1, and the inflation rate is 3%. In one year, that same apple will now cost $1.03. Ok, doesn’t seem so bad at the moment. Now, let’s take this out 10 years. 10 years later, assuming inflation remains the same, that same apple costs $1.34, a 34% increase to the same product!

This means that your income will have had to go up by 34% over that 10-year period, just to buy the same apple and not lose purchasing power. This is also the case with your investments.

The only tried and true way to beat inflation is to invest in equities which over the last 90 years have outpaced inflation by over 7%. In comparison, the 10-year T-Bill has only outpaced inflation by 2% over the same time period.

Let’s say that the return on your investments over a 1-year period was 6%. This would make sense for a diversified portfolio invested in a combination of stocks and bonds. Let’s also assume that inflation was 2.25%, which is historically what we can expect over a long period of time.

This means that your “real” return was only 3.5%, a far cry from 6%.

For the Doe financial plan, we assumed inflation to be 2.25%. What effect will it have on the plan if inflation increases to 3%? A dramatic difference! The probability of success from the original 64% scenario decreased to 46%!

What if your investment returns are less or more than expected?

I mentioned earlier that the only long-term way of beating inflation is to invest in equities (stocks, mutual funds, ETFs, etc.) in order to have a higher investment return.

Although, let’s test this plan for the event that returns are lower and higher than expected.

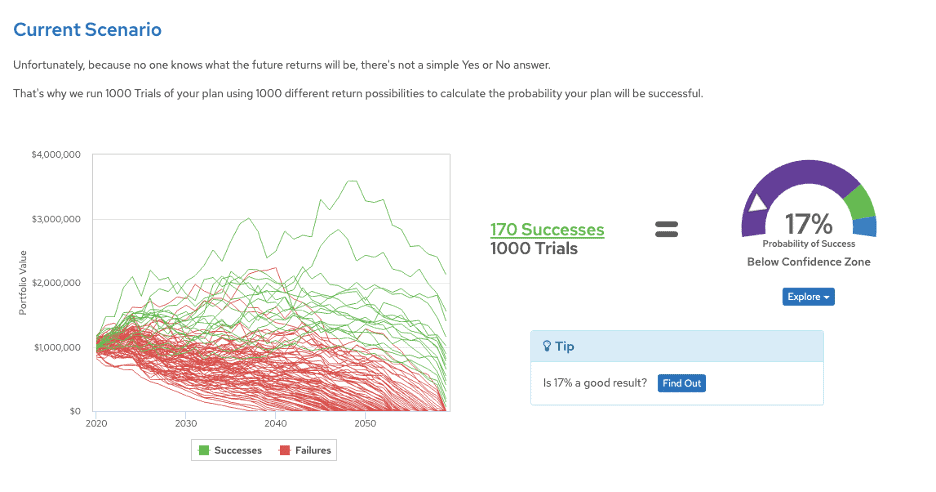

First, we test for lower returns on the base scenario. Let’s assume that returns are lowered by 2% annually pre and post retirement for an average annual return of 2.77 rather than 4.77.

A 2.77% return would be someone who is invested in an approximately 15/85 stocks to bonds portfolio (i.e. a hyper conservative investor).

The probability of success to the base case decreased from 64% to 17%… a MASSIVE DECLINE! The decreased risk not only lowered their investment return by 2%, but it ravaged the probability of success of the plan, lowering by a whopping 47%.

This plan can still work, but it will require some combination of spending less, saving more, retiring later (or dying earlier).

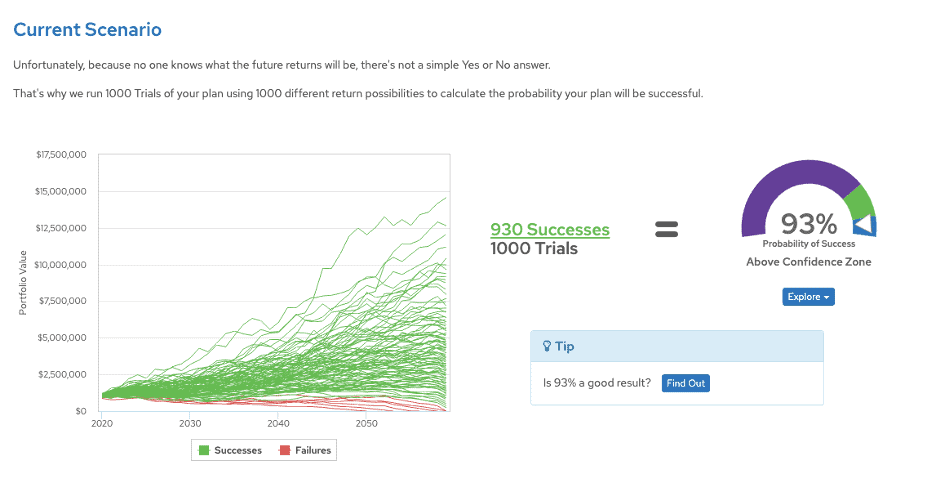

Next, let’s see what happens if investment returns increase 2%, from 4.77% annually to 6.77% annually both before and after retirement.

The effects of additional returns—which can be achieved from investing in a more aggressive portfolio—were dramatic! For example, 75/25 stocks to bonds rather than 45/55 stocks to bonds increased the probability of success for the base case from 64% to 93%.

Over a long period of time, the additional risk taken increased the probability of success by 29%. While it took an increase in investment risk, the results allowed the Doe’s to live the retirement life they’d dreamed of.

Fine tuning your risk tolerance over time is part of the financial planning process over time. You may be well ahead of your goals and decide to reduce your investment risk. Conversely, in the middle of a bear market you may decide to increase your investment risk. That’s why financial planning is a process, and it happens over the rest of your life!

Are you retiring to a different state?

We see it all the time. You retire and want a nice change of scenery. Perhaps you want to retire to the beach . . . or maybe the desert and dry air are what you’re looking for. But what effect does that have on your retirement plan?

Let’s assume that the Doe’s are debating on whether or not to move once John retires from Nevada, a low-cost state, to California, a high cost state. Preferably, they would like to live just a few miles away from their grandkids which is motivating them to move to sunny California.

Unfortunately, it’s going to cost them. All other things being equal to the base case, their probability of success decreases from 64% to 57%.

Perhaps the 4-hour drive from Las Vegas to Los Angeles wasn’t as bad as they thought!

There are a variety of financial considerations to think about when moving in retirement.

- Cost of living – Will the state/city you move to be more or less expensive and how much housing can you afford?

- Taxes – Does the state you move to have a state income tax?

- Quality of healthcare and assisted living facilities

- Cost of health insurance – If you retire before becoming eligible for Medicare at age 65, you will need to purchase health insurance on the open market which varies from state to state.

What if the stock market crashes?

Sequence of returns risk is a very real thing. If you retire at the top of a bull market, you may need to be liquidating investment assets at lower prices during the bear market bottoms. This means you’re selling more shares at lower prices, something you can’t recover from once you retire.

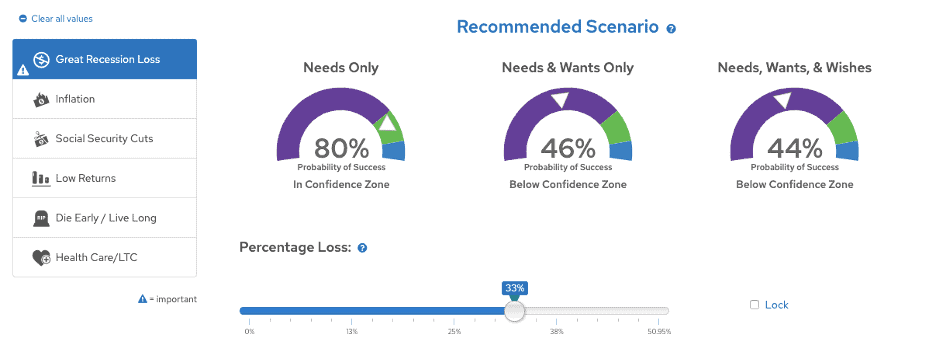

Let’s assume the Doe’s put into place the “Recommended Scenario”, which was maximizing their Social Security benefits and executing strategic Roth conversions.

If their portfolio loses 33% of its value tomorrow (which their portfolio would have lost during the Great Recession), then they would still have an 80% probability of having all of their needs met and close to a 50% chance of accomplishing all of their Needs, Wants and Wishes also.

Not great, but their basic living expenses and healthcare are still safe. They may have to rethink leaving money for their children and grandchildren, or putting on hold those annual travel trips or that car purchase, but their needs will be met.

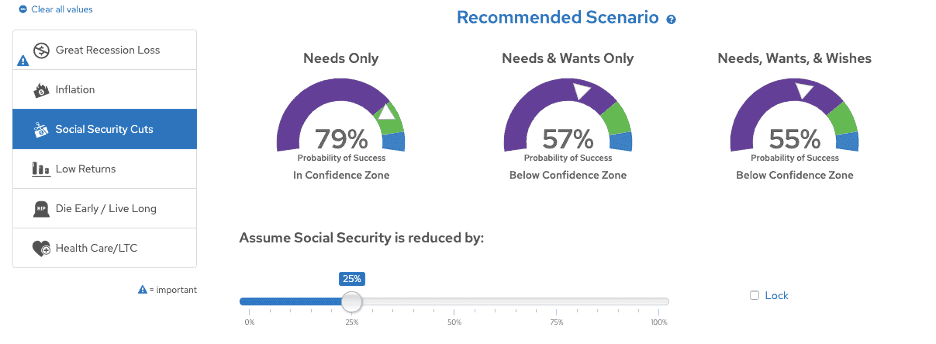

Will my Social Security be reduced?

This is a big topic for today’s retirees. Some even believe that social security will run out of money soon.

Even though this isn’t something that needs to be addressed for retirees today, unless something is done about it future benefits may be reduced for those in their 20s and 30s.

Nonetheless, let’s say that John and Jane’s Social Security benefits are reduced by 25% tomorrow. What effect does that have on their plan?

Needs are still being met, but accomplishing all of their Needs, Wants and Wishes will be trickier. For the Doe’s, we do not believe that major SS cuts like this will be an issue, although it is still important to see the effects of such cuts if they happen the moment they retire.

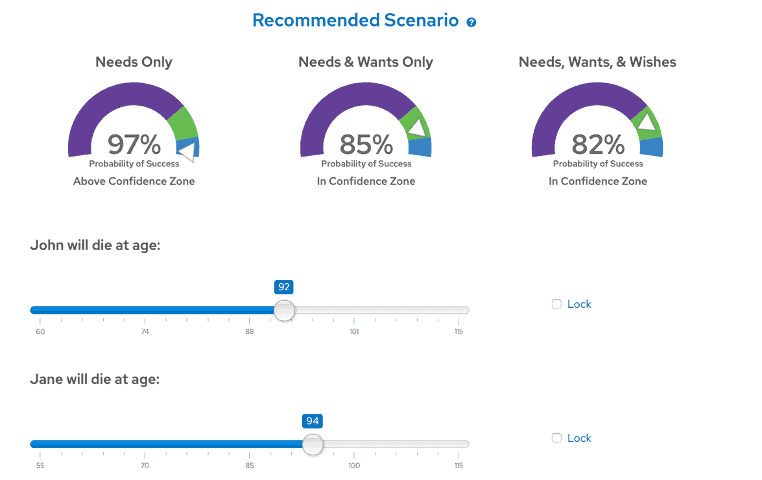

What if you live too long?

Given the advances in modern medicine, there’s a good chance that many of us will live longer than we expect. It’s entirely possible that living to be 100 will be common occurrence in the not too distant future.

Living longer can also have a detrimental effect on your retirement plan from the standpoint that your money will have to last longer. Financial planning must account for longevity risk among the other things we’ve already tackled.

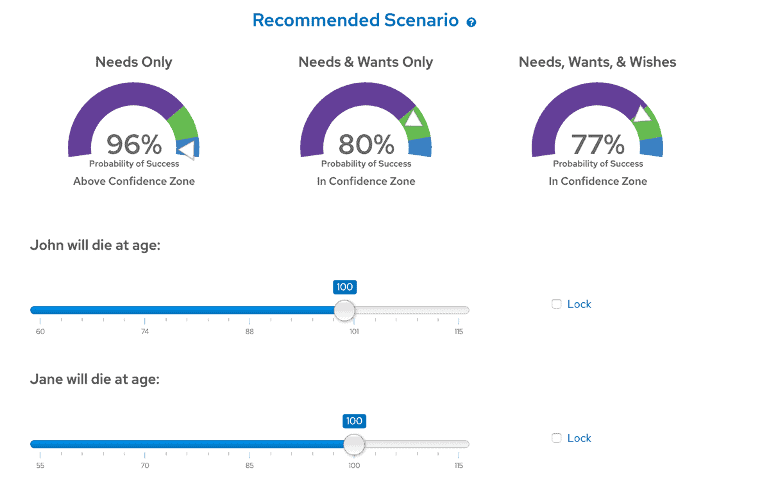

Currently, we’ve planned for John and Jane to live to 92 and 94. Assuming they implement the Social Security maximization and Roth conversion strategies (Recommended Scenario), they have a very high probability of accomplishing all of the Needs, Wants & Wishes

But what happens if each of them lives to be 100? Because we’ve already implemented planning techniques to make their money last longer, living an additional 8 years only decreases probability of accomplishing Needs by 1% and Wants and Wishes by 5% each.

Financial planning helps alleviate your worries over long-term care needs

Thinking about health care expenses and long-term care is never easy. Unfortunately, most retirees will need long-term care at some point towards the end of their financial plan.

The cost of nursing care is astronomical with annual stays often costing 6-figures or more! Needless to stay, an expense this big can derail your retirement plan, potentially leaving your spouse destitute.

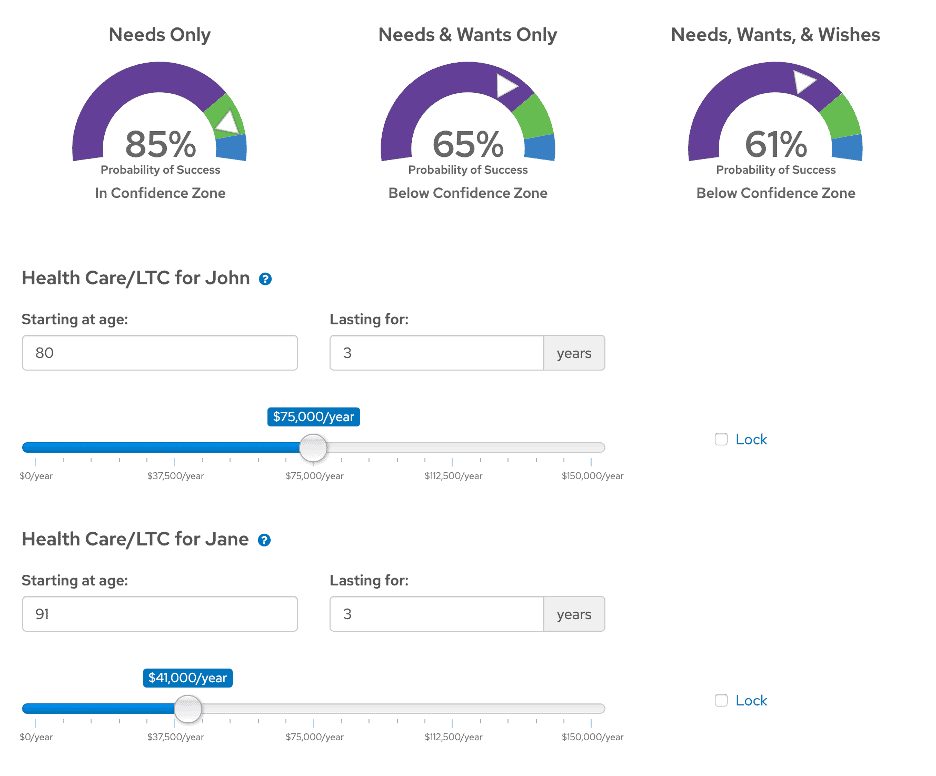

For the Doe’s financial plan I assumed that John will need some sort of long-term care when he is 80 years old. The average stay is about 3 years and the cost of this is $75,000/year.

For Jane, the last 3 years of her life we assume that she will need some assisted living, which costs $41,000.

The combined effect of these long-term care expense assumptions puts some parts of their retirement plan in murky water. Their Needs are still being met, but their Wants and Wishes fall out of the confidence zone.

Assuming you’re not comfortable with these results, this is where LTC (Long-Term Care) insurance comes into play.

According to Morningstar, the average annual premium for a long-term care policy purchased by a person age 55 or younger is approx. $1,831. This is roughly what we’ve seen when clients get their quotes.

The average annual premium for long-term care policy purchased by a person age 70-74 is $3,421. Obviously, the longer you wait to purchase it the more expensive it will be!

Planning ahead while you’re young and healthy can prevent devastation to your retirement plan later in life. Many people can “self-insure” and simply run the risk they’ll have to pay for these expenses, while others really should consider a long-term care insurance policy.

Financial planning always gives you options

Your financial plan is really a living, breathing thing. The second you finish it, it will change based on a wide variety of factors like investment returns and maybe you got a raise or had an unexpected expense.

One of the most important things you can do is monitor your progress towards your overall financial and retirement goals. As you monitor your plan versus your goals you may find you’re doing better than expected after a long bull market run! You may also find you’re doing worse than expected in a nasty bear market.

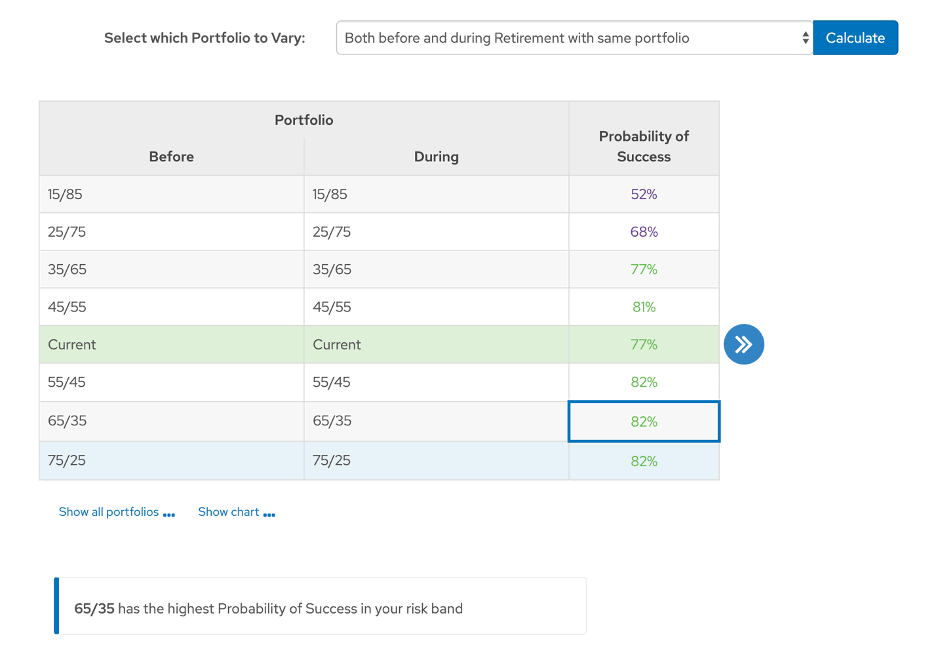

One of the best financial planning tools is the portfolio probability matrix. It allows us to make small adjustments in your risk over time based off your progress towards your goals. It also may allow you to accomplish your goals while taking less risk simply by moving to a more balanced and diversified investment plan.

When I mentioned your investment portfolio should be based on not only your risk tolerance but your risk required and risk capacity, this is what I was referring to. You may find you need to take more risk to get a higher probability of success. You may also find you can take less risk for better results.

What is financial planning in conclusion

You were wondering “What is financial planning?” and that’s a great question! The OVERWHELMING majority of investors have no clue what real financial planning is!

As you can see, financial planning is a long and arduous process that goes so much deeper than the returns on your stocks or bonds. The reality is that just about everyone needs a financial plan. The problem is most people “think” their financial advisor is giving them a financial plan when in reality most people are getting a watered-down sales pitch for some insurance or investment product.

You need blueprints to build a house, you need direction to drive across the country, and you need a professional financial planner—a CERTIFIED FINANCIAL PLANNER™—to build you a financial plan. If you need help getting started, learn how to find the best financial advisor for your situation here, check out our online financial advisor services, or drop me a note here.

What is financial planning frequently asked questions

Financial planning is the process of identifying, organizing, and prioritizing your life dreams and goals which take both money and planning to achieve, then creating a comprehensive plan to reach them using strategies and tactics in the areas of investments, taxes, estate, insurance, debt & credit, etc. Financial planning is an ongoing process of monitoring your progress towards your goals, maintaining your plan, and making adjustments as time passes.

Financial planning for retirement—also known as retirement planning— is the process of envisioning the retirement lifestyle you want then matching that vision with your financial ability to achieve it. Your current and future assets, income streams, expenses, and liabilities are mapped out over your retirement lifetime and adjustments are made to balance your financial goals with your finances.

Having a financial plan is critical to your success in accomplishing life goals which take both money and planning to achieve. A goal without a plan is merely a wish, and without a financial plan to illustrate how your financial decisions affect you over time, you’re simply guessing and hoping. A financial plan incorporates your assets, income, expenses, and liabilities and allows you to make cost/benefit decisions regarding how and when you achieve your financial goals.

Only 4% of all Social Security recipients maximize their benefits and every individual’s optimal claiming strategy is unique to their situation. You can begin claiming benefits as early as 62 with a 25% reduction from your Full Retirement Age benefit or delay all the way until age 70 earning an 8% per year benefit over your Full Retirement Age. Making the wrong decision can cost you tens or hundreds of thousands of dollars over your lifetime.